How do you profit on a call option?

A call option writer stands to make a profit if the underlying stock stays below the strike price. After writing a put option, the trader profits if the price stays above the strike price. An option writer's profitability is limited to the premium they receive for writing the option (which is the option buyer's cost).

How does a call option WORK example?

For example, if a stock price was sitting at $50 per share and you wanted to buy a call option on it for a $45 strike price at a $5.50 premium (which, for 100 shares, would cost you $550) you could also sell a call option at a $55 strike price for a $3.50 premium (or $350), thereby reducing the risk of your investment ...Jan 7, 2019

Is it better to buy stocks or call options?

For all but advanced investors, stocks are probably the better choice than options at all times, but an easier way to buy them is through stock ETFs. You'll get diversified exposure to a stock portfolio, reduced risk and the potential for nice returns.Apr 13, 2022

What happens when you buy a call option?

When you buy a call, you pay the option premium in exchange for the right to buy shares at a fixed price (strike price) on or before a certain date (expiration date). Investors most often buy calls when they are bullish on a stock or other security because it offers leverage.

How do you trade options for beginners?

How to trade options in four stepsOpen an options trading account. Before you can start trading options, you'll have to prove you know what you're doing. ... Pick which options to buy or sell. ... Predict the option strike price. ... Determine the option time frame.

How do call options work for dummies?

0:002:433 Minutes! Call Option Explained with Call Options Tutorial & Call Options ...YouTubeStart of suggested clipEnd of suggested clipCall options explain in three minutes imagine a stock price is $100. You do not want to buy it yetMoreCall options explain in three minutes imagine a stock price is $100. You do not want to buy it yet right now. But you're thinking that you might want to buy it in the future.

Does Warren Buffett use options?

Put options are just one of the types of derivatives that Buffett deals with, and one that you might want to consider adding to your own investment arsenal.

When should you sell a call option?

If you think the market price of the underlying stock will rise, you can consider buying a call option compared to buying the stock outright. If you think the market price of the underlying stock will stay flat, trade sideways, or go down, you can consider selling or “writing” a call option.Jan 24, 2022

Is options trading just gambling?

There's a common misconception that options trading is like gambling. I would strongly push back on that. In fact, if you know how to trade options or can follow and learn from a trader like me, trading in options is not gambling, but in fact, a way to reduce your risk.Apr 11, 2022

Can you exercise a call option early?

Early exercise is only possible with American-style option contracts, which the holder may exercise at any time up to expiration. With European-style option contracts, the holder may only exercise on the expiration date, making early exercise impossible. Most traders do not use early exercise for options they hold.

Can I sell a call option without owning the stock Robinhood?

To sell a naked call, you don't need to have the underlying stock in your portfolio. However, the funds in your account must be enough to cover the short position if the call is assigned.Jul 6, 2021

Why would you sell a call option?

Selling Calls The purchaser of a call option pays a premium to the writer for the right to buy the underlying at an agreed-upon price in the event that the price of the asset is above the strike price. In this case, the option seller would get to keep the premium if the price closed below the strike price.

Why do banks use call options?

Call options can be bought and used to hedge short stock portfolios, or sold to hedge against a pullback in long stock portfolios.

What is the difference between a call and a put option?

On the contrary, a put option is the right to sell the underlying stock at a predetermined price until a fixed expiry date. While a call option buyer has the right (but not obligation) to buy shares at the strike price before or on the expiry date, a put option buyer has the right to sell shares at the strike price.

Why are call options considered high risk?

Call options allow their holders to potentially gain profits from a price rise in an underlying stock while paying only a fraction of the cost of buying actual stock shares . They are a leveraged investment that offers potentially unlimited profits and limited losses (the price paid for the option). Due to the high degree of leverage, call options are considered high-risk investments.

What is it called when you own stock?

An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company’s residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. or other financial instrument.

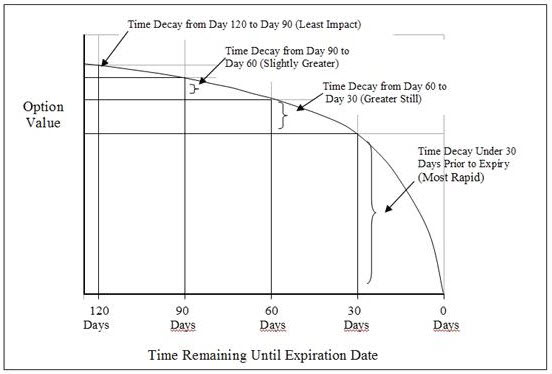

When does an option expire?

The expiration date may be three months, six months, or even one year in the future.

What is financial asset?

Financial Assets Financial assets refer to assets that arise from contractual agreements on future cash flows or from owning equity instruments of another entity. A key. at a specific price – the strike price of the option – within a specified time frame.

What happens if the strike price of a call option rises?

Alternatively, if the price of the underlying security rises above the option strike price, the buyer can profitably exercise the option. For example, assume you bought an option on 100 shares of a stock, with an option strike price of $30.

How do investors close out call positions?

Investors may close out their call positions by selling them back to the market or by having them exercised, in which case they must deliver cash to the counterparties who sold them.

Why do we use trading calls?

Trading calls can be an effective way of increasing exposure to stocks or other securities, without tying up a lot of funds. Such calls are used extensively by funds and large investors, allowing both to control large amounts of shares with relatively little capital.

Why do you buy calls?

Investors often buy calls when they are bullish on a stock or other security because it affords them leverage.

Who is Alan Farley?

Alan Farley is a writer and contributor for The Street and the editor of Hard Right Edge, one of the first stock trading websites. He is an expert in trading and technical analysis with more than 25 years of experience in the markets.

What is call option?

What are call options? A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration date. The buyer of a call has the right, not the obligation, to exercise the call and purchase the stocks.

What is a long call?

A long call can be used for speculation. For example, take companies that have product launches occurring around the same time every year. You could speculate by purchasing a call if you think the stock price will appreciate after the launch. A long call can also help you plan ahead.

Is it legal to falsely identify yourself in an email?

Important legal information about the e-mail you will be sending. By using this service, you agree to input your real e-mail address and only send it to people you know. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. All information you provide will be used by Fidelity solely for the purpose ...

What is stock option?

Stock Options Definition. Stock optionsare a form of compensation. Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price.

What are the two types of stock options?

For starters, it’s important to note that there are two types of stock options: Non-qualified stock options(NQSOs) are the most common. They do not receive special tax treatment from the federal government. Incentive stock options(ISOs), which are given to executives, do receive special tax treatment.

How long does it take to exercise stock options?

A four-year vesting period means that it will take four years before you have the right to exercise all 20,000 options. The good news is that, because your options vest gradually over the course of this vesting period, you’ll be able to access some of your stock options before those four years are up.

What happens if a company doesn't go public?

If you don’t wait, and your company doesn’t go public, your shares may become worth less than you paid – or even worthless. Second, once your company has its initial public offering(IPO), you’ll want to exercise your options only when the marketprice of the stock rises above your exercise price.

How long do stock options last?

You can find this in your contract. It’s common for options to expire 10 years from the grant date, or 90 days after you leave the company. When You Should Exercise Stock Options. When and how you should exercise your stock options will depend on a number of factors.

How long do you have to hold stock after exercise?

If you hold the stock for at least one year after exercise AND you don’t sell the shares until at least two years after the grant date, the tax rates you pay are the long-term capital gains rates. Bottom Line. Stock options are becoming a more common way for companies to attract and keep employees.

Do you pay less in capital gains tax?

That way, you’ll pay less in capital gains tax and on income tax (see below). Also, if your time period to exercise is about to expire, you may want to exercise your options to lock in your discounted price. But if you’re at all worried about losing money, you should consult an investment professional.

What is covered call option?

Being able to generate a fairly regular income is one of the goal standards of options trading. One of the logical places to start, especially for stock investors or those coming into their own with options trading is covered calls, since it presents a similar scenario that most of them are already used to.

Why do investors use options?

Another main reason investors use options is as an insurance policy . Hedging allows them to protect their portfolio from a market downturn. While insurance policies are seen as necessary, even mandated by the law for depreciated assets such as vehicles, hedging with options has attracted its fair share of critics.

How to trade options?

In a nutshell, these are the things an options investor should do if they want to make successful trades: 1 Don’t hold options for too long; they are time depreciating assets so it is ill-advised to hold them until expiration 2 Ensure you’re option’s strike price is reasonable by understanding the underlying stock’s volatility 3 Based on your expectation of price increase, ask yourself whether purchasing options at the price you intend gives you a fighting chance to make money 4 Since wide markets are difficult to trade, ensure the bid/ask spread isn’t too wide

What is option contract?

Options are contracts that give an investor a right to buy or sell an underlying security at a predetermined price and date, respectively known as the strike price and expiration date. Whenever someone exercises that right, another party is saddled with the obligation to perform.

What is a put buyer?

A put buyer has the opportunity to sell stock at the strike price, while the put writer (to write means to sell) sells the put option to the buyer and obligates herself to buy the shares in the event that the strike price is exercised by the buyer. Option contracts are created on exchanges such as NYSE, or NASDAQ.

Can John Q sleep at night?

With the price above $100, John Q can sleep safely at night since he is happy that the market hasn’t taken away his money. Just like a car owner who purchased vehicle insurance but didn’t get into an accident, John Q paid a $2,000 premium he didn’t ultimately need.

What happens if ABC stock falls below $100?

If ABC’s stock price falls below $100, John Q is covered because he has an insurance policy in the form of his put option contract that guarantees him the right to sell his shares at $100. While the drop in price has decimated the account of other less prescient ABC shareholders, John Q has avoided their fate.

Exercising Versus Selling

So far we've talked about options as the right to buy or sell the underlying. This is true, but in actuality a majority of options are not actually exercised.

Intrinsic Value and Time Value

At this point it is worth explaining more about the pricing of options. In our example the premium (price) of the option went from $3.15 to $8.25. These fluctuations can be explained by intrinsic value and time value.

What is a call buy?

What it is: Buying a call gives the holder of the contract the right to purchase 100 shares of stock at a certain price on or before a certain date.

What does selling a call mean?

What it is: selling a call obligates the writer of the contract to sell 100 shares of stock at a certain price if the holder of the contract exercises their right to buy on or before the expiration date.

When do index options expire?

However, it should be noted that index options usually expire around the same time of the month as stock options; however, each index option has its own set of rules, so be sure to seek clarification from your broker before entering into any index option trades!

What is a put in stock?

What it is: Buying a put gives the holder of the contract the right to sell 100 shares of a stock at a certain price on or before a certain date.

What does "leaps" mean?

LEAPS is an acronym for Long-term Equity AnticiPation Securities, which is just a fancy way to say “longer-term option.”. The life of these contracts is often measured in years rather than months, and they always expire on the third Friday of January in the year specified by the contract.

How Do Call Options Work?

Buying A Call Option

- The buyer of a call option is referred to as a holder. The holder purchases a call option with the hope that the price will rise beyond the strike price and before the expiration date. The profit earned equals the sale proceeds, minus strike price, premium, and any transactional fees associated with the sale. If the price does not increase beyond the strike price, the buyer will not …

Selling A Call Option

- Call option sellers, also known as writers, sell call options with the hope that they become worthless at the expiry date. They make money by pocketing the premiums (price) paid to them. Their profit will be reduced, or may even result in a net loss if the option buyer exercises their option profitably when the underlying security price rises above the option strike price. Call optio…

Call Option vs. Put Option

- A call option and put option are the opposite of each other. A call option is the right to buy an underlying stock at a predetermined price up until a specified expiration date. On the contrary, a put option is the right to sell the underlying stock at a predetermined price until a fixed expiry date. While a call option buyer has the right (but not obligation) to buy shares at the strike price befor…

Related Readings

- Thank you for reading CFI’s guide on Call Options. To continue developing your career as a financial professional, check out the following additional CFI resources: 1. Types of Markets – Dealers, Brokers and ExchangesTypes of Markets - Dealers, Brokers, ExchangesMarkets include brokers, dealers, and exchange markets. Each market operates under different trading mechanis…

Call-Buying Strategy

Closing The Position

- Investors may close out their call positions by selling them back to the market or having them exercised, in which case they must deliver cash to the counterparties who sold them the calls (and receive the shares in exchange). Continuing with our example, let’s assume that the stock was trading at $55 near the one-month expiration. Under this set of circumstances, you co…

Call Option Considerations

- Buying calls entails more decisions compared with buying the underlying stock. Assuming that you have decided on the stock on which to buy calls, here are some factors that need to be taken into consideration: 1. Amount of Premium Outlay: This is the first step in the process. In most cases, an investor would rather buy a call than the underlying stock because of the significantly l…

The Bottom Line

- Trading calls can be an effective way of increasing exposure to stocks or other securities, without tying up a lot of funds. Such calls are used extensively by funds and large investors, allowing both to control large amounts of shares with relatively little capital.