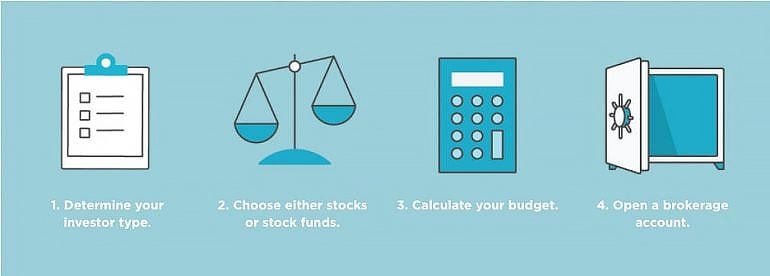

- Decide how you want to invest in the stock market. There are several ways to approach stock investing. ...

- Choose an investing account. Generally speaking, to invest in stocks, you need an investment account. For the hands-on types, this usually means a brokerage account.

- Learn the difference between investing in stocks and funds. Going the DIY route? Don't worry. Stock investing doesn't have to be complicated. Stock mutual funds or exchange-traded funds.

- Set a budget for your stock market investment. How much money do I need to start investing in stocks? ...

- Focus on investing for the long-term. Stock market investments have proven to be one of the best ways to grow long-term wealth. ...

- Manage your stock portfolio. While fretting over daily fluctuations won’t do much for your portfolio’s health — or your own — there will of course be times when you’ll ...

- Decide how you want to invest in the stock market.

- Choose an investing account.

- Learn how to invest in stocks vs. funds.

- Set a budget for your stock market investment.

- Focus on investing for the long-term.

- Manage your stock portfolio.

How to start trading stocks in 5 steps?

How to Start Trading Stocks in 5 Steps

- Choose the Right Time. In order to achieve significant stock market success, you’ll need to have a good amount of freedom, free time and headspace.

- Select Your Strategies. ...

- Find the Best Site, Platform or Broker. ...

- Do Your Research. ...

How to get started in trading stocks?

How to invest in stocks in six steps

- Decide how you want to invest in the stock market. There are several ways to approach stock investing. ...

- Choose an investing account. Generally speaking, to invest in stocks, you need an investment account. ...

- Learn the difference between investing in stocks and funds. ...

- Set a budget for your stock market investment. ...

- Focus on investing for the long-term. ...

What is the best way to trade stocks?

- Simple platform that is easy to master

- CopyTrader feature that allows new traders to copy the same strategies used by professionals

- Virtual dummy account that gives you $100,000 to practice trades

- You can now trade U.S. stocks and ETFs as of January 2022

How to actually learn to trade stocks?

- Don’t dollar cost average

- Don’t buy stocks just because they appear cheap

- Don’t buy and hold

- Don’t over use leverage

- Don’t be affected by the herd mentality

- Use stop losses to protect capital and always manage your risk

- Buy only top quality stocks

- Trade well, not often

- Diversify but not too much

- Lastly and most importantly - educate yourself!

How do beginners invest?

Here are six investments that are well-suited for beginner investors.401(k) or employer retirement plan.A robo-advisor.Target-date mutual fund.Index funds.Exchange-traded funds (ETFs)Investment apps.

How do I trade stocks on my own?

You can buy or sell stock on your own by opening a brokerage account with one of the many brokerage firms. After opening your account, connect it with your bank checking account to make deposits, which are then available for you to invest in.

Can you get rich by trading stock?

Investing in the stock market is one of the world's best ways to generate wealth. One of the major strengths of the stock market is that there are so many ways that you can profit from it. But with great potential reward also comes great risk, especially if you're looking to get rich quick.

Which trading is best for beginners in stock market?

Best Trading Platforms for Beginners 2022Fidelity - Best overall for beginners.TD Ameritrade - Excellent education.E*TRADE - Best for ease of use.Merrill Edge - Best client experience.Webull - Best investor community.

How do beginners learn to trade?

Process of stock trading for beginners1) Open a demat account: ... 2) Understand stock quotes: ... 3) Bids and asks: ... 4) Fundamental and technical knowledge of stock: ... 5) Learn to stop the loss: ... 6) Ask an expert: ... 7) Start with safer stocks: ... Read More:

How do beginners trade online?

Four steps to start online trading in IndiaFind a stockbroker. The first step will be to find an online stockbroker. ... Open demat and trading account. ... Login to your demat and trading account and add money. ... View stock details and start trading.

How do you earn monthly income from stocks?

Investors who are comfortable putting their money directly into stocks, rather than investing in mutual funds, can develop a regular income stream by investing in dividend-paying stocks. Larger, well-established companies traded on the New York Stock Exchange often pay quarterly dividends.

What stocks Will Make Me rich?

With that in mind, these 10 stocks could make you a millionaire in 2022:Microsoft (NASDAQ:MSFT)Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL)Berkshire Hathaway (NYSE:BRK-A, NYSE:BRK-B)Nvidia (NASDAQ:NVDA)Nike (NYSE:NKE)Innoviva (NASDAQ:INVA)BrightSpere Investment Group (NYSE:BSIG)The Aaron's Company (NYSE:AAN)More items...•

How can I invest 100 dollars to make money?

If you can spare $100 a month for your future, here are some ways in which you can invest that money.Build a Portfolio: Fractional Shares, EFTs and Bonds.Just Trade Fractional Shares.Earn Interest With a High-Yield Savings Account.Start an Emergency Fund.Save for a Child's Education.Start a Brokerage Account.More items...•

How much money can you make from stocks in a month?

Key Takeaways A reward-to-risk ratio of 1.5 is fairly conservative and reflective of the opportunities that occur each day in the stock market. Making 5% to 15% or more per month is possible, but it isn't easy—even though the numbers can make it look that way.

How do beginners deal with stocks?

Best Share Market Tips for BeginnersUnderstand the Stock Markets.Understand your Risk profile and Investment Goals.Trading or Investing.Shares or Mutual Funds.Choose Stocks of Established Companies.Start Analyzing Yourself.Avoid Derivatives.Don't Make Decisions Emotionally.More items...•

How much do day traders make per day?

You average 5 trades per day, so if you have 20 trading days in a month, you make 100 trades per month. You net $7,500, but you still have commissions and possibly some other fees. While this is likely on the high-end, assume your cost per trade is $20 (total, to get in and out).

How Much Money Do I Need to Start Trading Stocks?

Nowadays, not a lot at all. You can open an account with a stockbroker with as little as $/€/£10 and start trading stocks.

How Much Should I Invest in the Stock Market?

You should never invest more in the stocks than you can afford to lose. If the stock market were to collapse, you risk losing all of the money that...

Is it Possible to Make a Living Trading Stocks?

Yes, many professional stock traders make a living trading the stock markets every day. Now, it takes time to master and to excel in the field, but...

What is the 3 Day Rule in Stock Trading?

The Securities and Exchange Commission (SEC) states that trades must be settled within a three-day period. So, when you buy stocks via your broker’...

Do I Need a Broker to Buy Stocks?

No, but it is tough not to. There are occasions where you can buy stocks directly from a company, but for the majority of companies, you will need...

What is a trade in stocks?

Remember, a trade is an order to purchase or sell shares in one company. If you want to purchase five different stocks at the same time, this is seen as five separate trades, and you will be charged for each one. Now, imagine that you decide to buy the stocks of those five companies with your $1,000.

What is the best way to reduce risk in investing?

Diversify and Reduce Risks. Diversification is considered to be the only free lunch in investing. In a nutshell, by investing in a range of assets, you reduce the risk of one investment's performance severely hurting the return of your overall investment.

What is mutual fund investment?

Mutual funds are professionally managed pools of investor funds that invest in a focused manner , such as large-cap U.S. stocks.

What does investing mean?

Investing is a means to a happier ending. Legendary investor Warren Buffett defines investing as "…the process of laying out money now to receive more money in the future.".

What is an online broker?

Online Brokers. Brokers are either full-service or discount. Full-service brokers, as the name implies, give the full range of traditional brokerage services, including financial advice for retirement, healthcare, and everything related to money.

How much can I invest in mutual funds?

Therefore, as long as you meet the minimum requirement to open an account, you can invest as little as $50 or $100 per month in a mutual fund. The term for this is called dollar cost averaging (DCA), and it can be a great way to start investing.

Is it bad to invest $1,000 in stocks?

As mentioned earlier, the costs of investing in a large number of stocks could be detrimental to the portfolio. With a $1,000 deposit, it is nearly impossible to have a well-diversified portfolio, so be aware that you may need to invest in one or two companies (at the most) to begin with. This will increase your risk.

What type of brokerage account do I need to invest in the stock market?

For most people who are just trying to learn stock market investing, this means choosing between a standard brokerage account and an individual retirement account (IRA). Both account types will allow you to buy stocks, mutual funds, and ETFs.

Can I invest in individual stocks?

Individual stocks: You can invest in individual stocks if -- and only if -- you have the time and desire to thoroughly research and evaluate stocks on an ongoing basis. If this is the case, we 100% encourage you to do so. It is entirely possible for a smart and patient investor to beat the market over time.

Should I invest in stocks as I get older?

Let's start with your age. The general idea is that as you get older, stocks gradually become a less desirable place to keep your money. If you're young, you have decades ahead of you to ride out any ups and downs in the market, but this isn't the case if you're retired and reliant on your investment income.

How to invest in stocks?

Even if you find a talent for trading stocks, allocating more than 10% of your portfolio to individual stocks can expose your savings to too much volatility. But this isn’t the only rule to manage risk. Other do's and don’ts include: 1 Invest only the amount of money you can afford to lose. 2 Don’t use money that’s earmarked for near-term, must-pay expenses like a down payment or tuition. 3 Ratchet down that 10% if you don’t yet have a healthy emergency fund and 10% to 15% of your income funneled into a retirement savings account.

Why do stock traders buy and sell?

Stock traders buy and sell stocks to capitalize on daily price fluctuations. These short-term traders are betting that they can make a few bucks in the next minute, hour, day or month, rather than buying stock in a blue-chip company to hold for years or even decades. There are two main types of stock trading:

What is day trading?

Day trading is the strategy employed by investors who play hot potato with stocks — buying, selling and closing their positions of the same stock in a single trading day, caring little about the inner workings of the underlying businesses. (Position refers to the amount of a particular stock or fund you own.)

What is a market order?

Market order: Buys or sells the stock ASAP at the best available price. Limit order: Buys or sells the stock only at or better than a specific price you set. For a buy order, the limit price will be the most you're willing to pay and the order will go through only if the stock's price falls to or below that amount. 4.

Does NerdWallet offer brokerage?

NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities. Not everyone who buys and sells stocks is a stock trader, at least in the nuanced language of investing terms.

What is the purpose of stock trading?

The goal of stock trading is to, of course , make money by timing the market and capitalising on short term moves in the value of the shares you are trading.

What is stock investment?

A stock is a type of investment/security that represents a portion of ownership in a company, with each unit of stock called a ‘share/shares’. It means that you, as the stockholder, own a portion of the company’s assets and are entitled to a part of the company’s profits, “dividends,” equal to the amount of stock that you own.

Why is the stock market important?

Valued at an incredible $80 trillion, the stock market is an important part of the global economy. Not only is it an important source of capital for businesses, but it also provides investors with the opportunity to share in the profits of publicly-traded companies. When done right, investing in the stock market has the potential ...

What is value stock?

A value stock is a stock that is undervalued when compared to the underlying conditions of the company such as earnings, dividends, sales etc. With value stocks, the investor or trader is looking to capitalise on what they feel is the data not matching the current share price.

How many times can you trade stocks in a day?

If you are using a non-margin account, there is no limit to the number of times you can trade stocks in a day. However, if you trade with margin and have less than $25,000, you must comply with the ‘pattern day trading’ rule’.

What is the key to determining how the stock market moves?

Economics . This is another vital part of determining how stock markets move as generally speaking if the economy is doing well, then company’s will also be able to perform better, therefore helping to increase profitability and its stock price.

How much are penny stocks?

Penny Stocks. Are common shares of small companies usually priced at under $1 per share but can be as large as $5 per share. You will find most penny stocks are traded over the counter (OTC), but some are on large exchanges. They can also be referred to as micro-cap or nano-cap stocks.

What is preferred stock?

Preferred stock lets you get a dividend from the company (a share of the profits), but you don’t get any voting rights. Common stock gives you voting rights in the company, but you’re less likely to receive any dividends. In other words, you’ve got a lot to figure out if you want to be an investor.

Do 401(k)s have money in the stock market?

And even if you’re not interested in actively managing your portfolio, retirement accounts like your 401 (k) and Roth IRA mean you likely have some kind of money on the stock market . But for businesses, the math isn’t so simple. For one, businesses usually have plenty of other ways they can effectively spend money.

Do I need a brokerage account for a business?

Business accounts. As a business investor, you must have a business brokerage account. Many brokers don’t offer these, which will limit your options. But it’s a legal issue, so don’t try to use a personal account for business investing.

Can I invest in stocks?

When you’re starting to invest in stocks, you can invest as much or as little as you want. It all depends on your investment strategy, your goals, and your specific situation. For a more specific number, you should probably talk to a financial advisor about all of those things.

Is it a no brainer to invest in the stock market?

Before you get started trading on the stock exchange, you need to make sure that investing is the best choice for you and your business. For individuals, investing is often a no-brainer. The stock market often gives better returns than simply sticking your money in a savings account, at least in the long term.

How do I buy stock on my own?

You can buy or sell stock on your own by opening a brokerage account with one of the many brokerage firms. After opening your account, connect it with your bank checking account to make deposits, which are then available for you to invest.

Do discount brokers offer investment advice?

Online/discount brokers, on the other hand, do not provide any investment advice and are basically just order takers. They are much less expensive than full-service brokers since there is typically no office to visit and no certified investment advisors to help you.

What is dividend payment?

A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Dividends are typically paid regularly (e.g. quarterly) and made as a fixed amount per share of stock. Read more arrow_forward.

Do investments move in the same direction?

Most investments don’t move in the same direction at the same time. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio.