- Learn the different ways to purchase gold stocks. Generally speaking, one can invest in gold stocks in three different ways: you can buy stock in gold mining companies directly; ...

- Analyze specific gold-mining companies. The most direct way to invest in gold stock is to buy gold-mining companies directly.

- Invest in gold mutual funds. If you prefer a lower-risk option or simply can't settle on one outstanding company, consider a gold-oriented mutual fund.

- Invest in gold-oriented exchange-traded funds (ETFs). An ETF is similar to a mutual fund in that it offers the investor access to a wide array of stocks and bonds ...

- Purchase gold stocks. Once you have decided on a particular investment method, it is time to buy. ...

Is buying gold stock the same as buying gold?

Investing in Gold . Investing in gold is not like buying stocks or bonds. You can take physical possession of gold by buying either gold coins or gold bullion. Bullion is gold in bar form, with a stamp on it. The stamp contains the purity level and the amount of gold contained in the bar.

Is buying gold a good investment?

Gold is a good investment because it is a store of value and currency, offers diversification benefits, liquidity, has a long track record against geopolitical risks, inflation and deflation. Buying gold bars, coins, jewelry, gold ETFs and mining stocks are some of the ways to invest in gold.

What is the best gold to buy?

Top gold mutual funds and ETFs include:

- iShares Gold Trust (IAU)

- Invesco DB Gold Fund (DGL)

- Franklin Gold and Precious Metals Fund (FKRCX)

How to invest in gold in stock market?

- Get a free copy of the StockNews.com research report on Barrick Gold (GOLD)

- Tyson Foods Flies To New Highs

- Jabil Circuits Stock is a Resilient Electronics Play

- 3 Stocks for Bargain Hunters to Buy Now

- 3 Best Sports Betting Stocks in Light of Next Week’s Super Bowl

- MarketBeat Podcast – Stocks Not to Invest In with Will Rhind

Can you invest directly in gold?

When you think about investing in gold, don't restrict yourself to just buying physical gold, like coins or bullion. Alternatives to invest in gold include buying shares of gold mining companies or gold exchange-traded funds (ETFs). You can also invest in gold by trading options and futures contracts.

What is the safest way to buy gold?

Bullion coins and ingots are a relatively safe way to buy gold, though some investors prefer to invest in gold funds, such as mutual funds or exchange-traded funds (ETFs).

How do beginners buy gold?

Gold Coins Dealers are located in most cities making gold coins easy to come by. For ease of purchase, gold coins are one of the best ways to invest in gold for beginners. Occasionally, you may run into gold coins that are marked up due to their collector's value.

How much is a gold bar worth 2021?

A 100-gram gold bar will spot a price around $6,481. When you get to 10-ounces gold bars the spot price can vary from about $13,245 to $20,301 depending on the above factors. Finally, a kilo gold bar can be worth $64,353.

How to Buy Gold Stocks

The quest for riches that prompted the expansion of empires continues to this day. It’s just easier to access now. In fact, investors can invest in gold without getting out of bed. Today, all you need is an internet connection, a computer or smartphone, and a bank account.

The Bottom Line of Buying Gold Stocks

Gold has captured the imaginations of investors for ages. And it will continue to do so for ages to come. That’s why gold remains one of the most popular investments in the world.

About Matthew Makowski

Matthew Makowski is a senior research analyst and writer at Investment U. He has been studying and writing about the markets for 20 years. Equally comfortable identifying value stocks as he is discounts in the crypto markets, Matthew began mining Bitcoin in 2011 and has since honed his focus on the cryptocurrency markets as a whole.

Why do investors buy gold?

Investors purchase gold stocks and commodities to safeguard against economic crisis and support the value of stocks in general.

What factors affect the price of gold?

There are several factors that tend to affect the price of gold: The Washington Agreement of Gold, originally negotiated in 1999, was a gentleman's agreement among fourteen nations to limit the amount of government-owned gold to be sold in any calendar year.

Why does the price of gold increase with inflation?

This is because as inflation increases investors drive up the price of gold by buying it as an alternative to cash. While gold's merits as an investment are highly debated, it is generally regarded as a good repository of value.

Why is gold important?

It is important when diversifying to hold asset classes whose prices do not move together ( that are "uncorrelated").

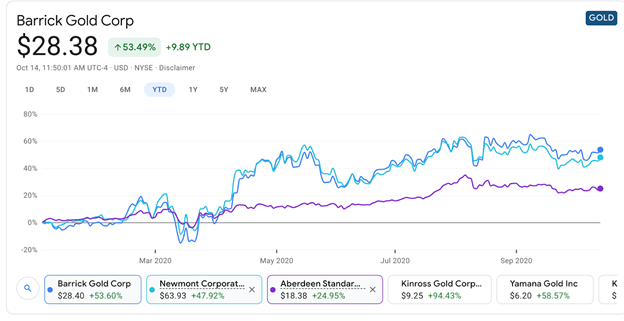

Where does Barrick Gold trade?

This means that Barrick Gold (or ABX) trades on the New York Stock Exchange . To purchase, simply enter a buy order with your brokerage, enter in the ticker of the stock, ETF or mutual fund you want, enter the number of shares you want, and submit the order.

When was gold used as currency?

While not every culture has deemed gold to be the ideal currency, many of them have, resulting in the establishment of the gold standard as the de facto world currency beginning in the 19th century.

Which country cut the gold standard?

Most of the major economies in the world cut their currency ties to the gold standard during the Great Depression. The United States partially cut the cord under Franklin Roosevelt and completely abandoned the gold standard during Richard Nixon's presidency.

How to Buy Physical Gold

Gold bars—more commonly known as bullion—are a popular choice for people looking to buy gold. Bullion is typically sold by gram or ounce, and the purity, manufacturer and weight should be stamped on the face of the bar.

Factors to Consider When Buying Physical Gold

If you decide to buy physical gold, you’ll want to keep a few things in mind:

Other Ways to Buy Gold

If all of that sounds like too much of a hassle, but you still want a little bling in your investment portfolio, consider investing in stocks, mutual funds and ETFs related to the gold industry.

Is Gold a Good Investment?

If you’re looking to strike it rich with a modern-day gold rush, you’re probably in the wrong place. Over the past five years, gold’s price increased by approximately 36% while the S&P 500 increased by 104% during that same period. So why all the hype?

Why invest in gold?

One benefit of gold investments is that they can help diversify your portfolio. Diversification refers to investing in a range of assets across a variety of industries, company sizes and geographic areas. Owning stock in a gold mining company or a gold ETF exposes you to the gold industry, and since gold does not necessarily move in tandem with the stock market, it can help further diversify your holdings. Of course, if your entire portfolio is made up of gold investments, it won’t be diversified at all.

What is gold futures?

Gold futures. A gold futures contract is an agreement to buy or sell a certain amount of gold at a later date. The contract itself is what is traded on an exchange. Gold futures enjoy more liquidity than physical gold and no management fees, though brokerages may charge a trade fee (also called a commission) per contract.

What is gold mutual fund?

Investing in gold mutual funds means you own shares in multiple gold-related assets, like many companies that mine or process gold, but you don’t own the actual gold or individual stocks yourself. Gold exchange-traded funds or mutual funds have more liquidity than owning physical gold and offer a level of diversification that a single stock does not. ETFs and mutual funds also come with certain legal protections. Be aware that some funds will have management fees. Learn more about ETFs and mutual funds.

What is gold bullion?

1. Physical gold. Also called “bullion,” this is what most people picture when they think about investing in gold. Gold bars, gold coins, hunks of pure gold and jewelry: It’s the stuff of treasure chests and bank heists.

How much do you need to invest in mutual funds?

Keep in mind that individual stocks and ETFs are purchased for their share price — which can range from $10 or less to four figures — but mutual funds have a minimum investment requirement, often of $1,000 or more. Learn more about how to invest in stocks and how to invest in mutual funds.

What to do when you are nervous about the stock market?

When the movements of the stock market are making you nervous, try to take a long-term view and remember that market volatility is normal. Often, the best thing you can do for your portfolio is stick to your investment plan, not rush out and buy gold bars.

Why do people bury gold?

People joke about burying gold for a reason: It’s valuable, and because it's a physical commodity, people may try to steal it . It’s important to anticipate storing your gold somewhere safe, whether that is a literal safe or a safety deposit box at a bank. Storing gold safely can get expensive.

5 ways to buy and sell gold

Here are five different ways to own gold and a look at some of the risks that come with each.

1. Gold bullion

One of the more emotionally satisfying ways to own gold is to purchase it in bars or in coins. You’ll have the satisfaction of looking at it and touching it, but ownership has serious drawbacks, too, if you own more than just a little bit. One of the largest drawbacks is the need to safeguard and insure physical gold.

2. Gold futures

Gold futures are a good way to speculate on the price of gold rising (or falling), and you could even take physical delivery of gold, if you wanted, though physical delivery is not what motivates speculators.

3. ETFs that own gold

If you don’t want the hassle of owning physical gold or dealing with the fast pace and margin requirements of the futures market, then a great alternative is to buy an exchange-traded fund (ETF) that tracks the commodity.

4. Mining stocks

Another way to take advantage of rising gold prices is to own the mining businesses that produce the stuff.

5. ETFs that own mining stocks

Don’t want to dig much into individual gold companies? Then buying an ETF could make a lot of sense. Gold miner ETFs will give you exposure to the biggest gold miners in the market. Since these funds are diversified across the sector, you won’t be hurt much from the underperformance of any single miner.

Bottom line

Investing in gold is not for everyone, and some investors stick with placing their bets on cash-flowing businesses rather than relying on someone else to pay more for the shiny metal. That’s one reason legendary investors such as Warren Buffett caution against investing in gold and instead advocate buying cash-flowing businesses.

What are the best investments to invest in gold?

The three main options to invest in physical gold are bullion, coins and jewelry.

How much of your portfolio should be invested in gold?

Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it.

How much is gold worth in 2020?

Given that the current gold price is around $1,900 per ounce (as of September 2020), this makes investing in gold bullion an expensive proposition. And unlike stocks, there’s really no way to get a fractional share of a gold bar.

How much is gold bullion?

Gold bullion comes in bars ranging from a few grams to 400 ounces, but it’s most commonly available as one- and 10-ounce bars. Given that the current gold price is around $1,900 per ounce (as of September 2020), ...

How much gold is in a 24 karat gold necklace?

You’ll also want to be aware of your jewelry’s purity, or what percentage gold it is. Gold purity is calculated based on karats, with 24 karats being 100% gold.

How much is a gold eagle coin worth in 2020?

In-demand collectable coins frequently trade at a premium. A one-ounce American Gold Eagle coin, for example, retails for just over $2,000 in mid-September 2020. That’s almost a 5% markup over a comparable amount of gold bullion.

What is the most widely available gold coin?

Collectible coins, such as South African Krugerrands, Canadian Maple Leafs and American Gold Eagles, are the most widely available type of gold coins. Some dealers even sell blanks and damaged or worn coins. Gold coin prices may not entirely align with their gold content, though.

Where are gold futures traded?

In the US, gold futures are traded in the New York Mercantile Exchange (NYM EX).

How much does a gold bullion bar cost?

These can be purchased in different weights, from just a few grams to 400 ounces for around $700,000 ...

What is gold ETF?

Gold ETFs. An ETF (exchange-traded fund) is a financial instrument, or security, that typically tracks an index, (though some may track a sector, commodi ty, collection of securities, or the value of an underlying asset).

What is gold mutual fund?

Gold Mutual Funds. Gold mutual funds typically invest in gold mining or refining companies’ stock, though some own small amounts of bullion. Their value fluctuates according to the gold market and the value of said companies, in the manner of gold miner ETFs, and can therefore be similarly volatile.

What is the highest karat gold?

Make sure you know the ‘caratage’ of the gold you’re acquiring, that is, the actual gold content in the piece. The highest karat you can buy is 24 karat or 999 gold, which by all measures is considered pure gold. The lower the karat, the less gold per part.

What is the World Gold Council?

In 2019, the World Gold Council took steps to implement guidelines for member companies, as did the International Council on Mining and Metals. Both require that participating mining companies publish information on their progress publicly, making it easier for consumers to find.

How much is gold worth in 2021?

As of March 30, 2021, the price of gold is $1,684.48 per ounce. Be aware that you won’t be able to buy physical gold at the spot price, since there are premiums involved due to manufacturing, procuring and selling the product.

Why is gold important in the stock market?

As a diversification tool, gold is important not only as a way to hedge falling stock s ...

Why is gold important?

As a diversification tool, gold is important not only as a way to hedge falling stocks but also as a potential protection against inflation. In these two respects learning to invest in gold is a great way to add a powerful tool to your investing portfolio.

Why is gold considered a hedge against inflation?

As an investment, gold is considered a hedge against inflation because it is inversely correlated to the value of the dollar. That means that if the dollar falls in value through inflation, gold prices will rise because it takes more, weaker dollars to buy an ounce. Conversely, if the dollar is rising in value gold prices will fall ...

Is GLD an ETF?

GLD is one of the largest ETFs on the market in terms of asset value because the fund actually holds positions in gold bullion itself. As of this writing, the fund holds over 34K ounces of gold bullion. Because GLD is an ETF you can trade it like a stock.