How Do Dividends Affect Stock Price?

- When Dividends Go Down. If a company reduces the dividend it pays on its stock, the stock becomes less attractive to...

- When Dividends Go Up. When dividends go up, the stock becomes more attractive to buyers. That increased demand will...

- Company Signals. You can anticipate changes in dividends by going on the company's website,...

Full Answer

What dividends can do to stocks and their prices?

Sep 10, 2015 · After the declaration of a stock dividend, the stock's price often increases. However, because a stock dividend increases the number of shares outstanding while the value of the company remains...

How to tell if a stock pays a dividend?

Cash payouts are made in percentages of the current stock price — if a company pays out 3% dividends on shares priced at $100 each, every shareholder gets $3 per share they own come dividend time. With stock dividends, shareholders just get shares (or fractions of shares) in the company added to their brokerage accounts when dividends are paid out.

How do companies determine stock dividends?

Dividends affect stock price in several ways. In the short term, share prices often drop when a dividend is distributed. New investors aren't getting any of that windfall, and they understandably...

Does a stock have value without a dividend?

Shares generally rise in value once a dividend is declared. But because dividends dilute the book value per common share by distributing more shares, the stock price falls as well, resulting in a lower share price. Smaller stock dividends, like cash dividends, can go unnoticed as readily as smaller cash payments.

Do stock prices go down after dividend?

After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Dividends paid out as stock instead of cash can dilute earnings, which can also have a negative impact on share prices in the short term.

How do Dividends change stock price?

If a company announces a dividend payment, you'd subtract the amount of the dividend from the share price to calculate the adjusted closing price. Let's say a company's closing price is $100 per share and it distributes a dividend of $2 per share. You'd subtract the $2 dividend from the closing price of $100.

Do dividends increase stock price?

One of such methods is based entirely on dividends. This method says that the right price of the share is the present value of all those future dividends. So, if the dividends are higher, one can expect an increase in the share price too.

Are dividends affected by stock price?

The final long-winded answer: You will often see companies cut their dividends when there is a severe economic crash, but not in reaction to a market correction. Since dividends are not a function of stock price, market fluctuations and stock price fluctuations on their own do not affect a company's dividend payments.

Why are stock prices adjusted for dividends?

The reason for the adjustment is that the amount paid out in dividends no longer belongs to the company, and this is reflected by a reduction in the company's market cap. Instead, it belongs to the individual shareholders.

What is a good dividend yield?

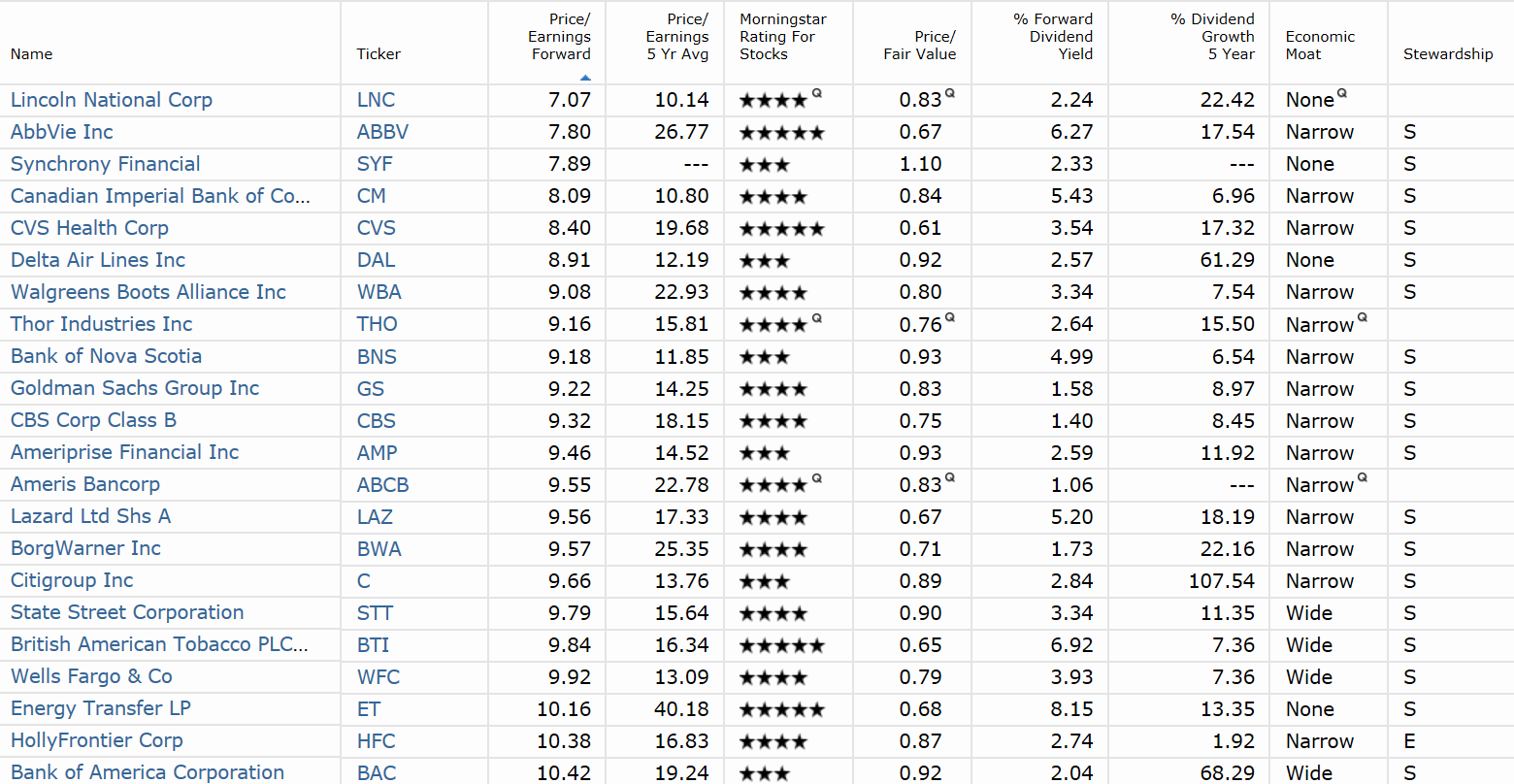

What is a good dividend yield? In general, dividend yields of 2% to 4% are considered strong, and anything above 4% can be a great buy—but also a risky one. When comparing stocks, it's important to look at more than just the dividend yield.

How long do you have to hold a stock to get dividends?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

Why do investors love dividends?

Five of the primary reasons why dividends matter for investors include the fact they substantially increase stock investing profits, provide an extra metric for fundamental analysis, reduce overall portfolio risk, offer tax advantages, and help to preserve the purchasing power of capital.

Do Tesla pay dividends?

Tesla is planning a stock dividend after it gets its shareholders' approval. Stock dividends have much more in common with stock splits than they do with cash dividends. Initial reactions have sent Tesla's shares soaring over 5% in premarket trading.Mar 28, 2022

Do dividends stay the same?

The amount of the dividend will remain $1 regardless of any change in the stock's market price between the time the dividend was declared and the time it was paid.

How does a 5% dividend work?

These stock distributions are generally made as fractions paid per existing share. For example, a company might issue a stock dividend of 5%, which will require it to issue 0.05 shares for every share owned by existing shareholders, so the owner of 100 shares would receive five additional shares.

How do dividends affect stock prices?

How Dividends Affect Stock Prices – A Deeper Look. Dividends add value to a stock by offering investors a cash or stock payout simply for holding shares. Dividends are especially popular among long-term value investors since they provide a relatively stable income source, but they can also increase the value of stocks for day traders. ...

What happens when dividends are paid out in stock?

When dividends are paid out in stock rather than cash, this increases the number of shares outstanding of the company without increasing the company’s value. Thus, all current shares lose a small amount of value , which can drive the price of the stock down to adjust for the new distribution of value. The amount of value loss per share depends on the total number of new shares issued, but the effect is typically small.

Why is the ex dividend date important?

The ex-dividend date, which is the date from which new shareholders are no longer eligible to receive the upcoming dividend payout, is an important short-term driver of a stocks’ price . A stock’s price will typically increase in the days leading up to the ex-dividend date to account for the added value of the dividend itself.

What is dividend yield?

The dividend yield and dividend payout ratio are two metrics used to evaluate the value of anticipated dividends from a company. The dividend yield measures the annual payout in dividends than an investor can expect to receive per share held:

How to calculate dividends per share?

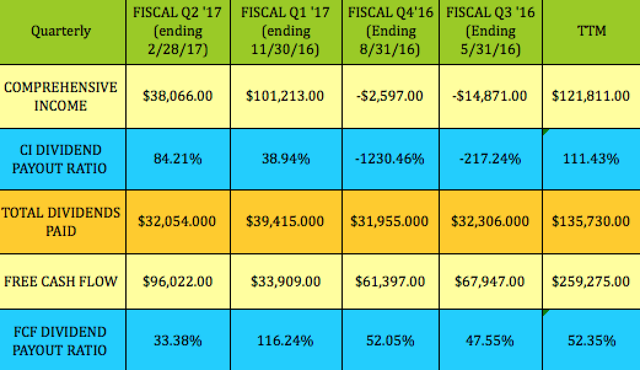

Dividends per Share = (Total Dividends – Special Dividends) / Shares Outstanding. The dividends per share can thus be used to track changes in a company’s dividends over time and can be used in combination with dividend payout to determine how what fraction of the company’s earnings per share is paid out to investors in dividends.

What does dividend per share mean?

Dividends per share indicates the actual value that a company is paying out in dividends each year. Changes in the dividend per share are typically what investors look at to determine whether a company is performing well or poorly based on its dividends.

Do dividends have to be fixed?

There is a lot of variation in how dividends are paid out by different companies, or even by the same company over time. For example, while most dividends are paid in cash, they can also be paid in stock. In addition, dividend amounts are not fixed – companies may decide to raise or lower their dividends at any time, ...

How do dividends affect stock prices?

How Dividends Impact Stock Prices. Dividends affect stock price in several ways. In the short term, share prices often drop when a dividend is distributed. New investors aren't getting any of that windfall, and they understandably don't want to pay a premium for somebody else's recent good fortune.

Why do stocks drop?

Conversely, a stock can drop if investors think a company is paying out too much of its profit in dividends, which could leave less cash for investing in new businesses. But slow and steady prevails often enough that dividend stocks deserve a place in your portfolio. What works for Warren Buffett can work for you, too.

Why do dividends go up?

When dividends go up, the stock becomes more attractive to buyers. That increased demand will cause sellers to raise the price to gain more profits. If you hold this dividend stock, the share price will go up as the dividend rises. Investors generally consider rising dividends a sign of a company's good health.

How to anticipate dividend changes?

You can anticipate changes in dividends by going on the company's website, reading the annual report, participating in quarterly calls and paying close attention to any press releases issued by the company regarding dividend changes. The stock price will react before the actual dividend change based on company news.

Who is Kevin Johnston?

He has written about business, marketing, finance, sales and investing for publications such as "The New York Daily News," "Business Age" and "Nation's Business." He is an instructional designer with credits for companies such as ADP, Standard and Poor's and Bank of America.

What happens if the stock price drops?

If the price drops and the stock's yield jumps to 6% , they may reconsider. This is a reason many high-dividend stocks performed better than their non-dividend counterparts during the financial crisis in 2008.

What does a dividend cut mean?

Similarly, a dividend cut can be interpreted as a sign of trouble and could result in a depressed valuation. Dividends can also help to create a "price floor" in stocks that otherwise may not exist. For example, if a certain stock yields 4%, it may seem not worth the risk to many investors.

Where is Matt from Motley Fool?

Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool since 2012. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

What is dividend discount model?

The dividend discount model. There is one method of valuing stocks based on the dividends they pay, known as the dividend discount model. Simply put, this model uses the idea that a stock is worth the sum of all of its future dividends.

Do dividends affect stock valuation?

Dividends don 't directly affect the valuation of stock investments, as they aren't included in the calculation of most valuation metrics. However, a company's dividend activity or its dividend yield can certainly affect investor sentiment and move the price of the stock, thereby changing its valuation.

What is the dividend discount model?

There is one method of valuing stocks based on the dividends they pay, known as the dividend discount model . Simply put, this model uses the idea that a stock is worth the sum of all of its future dividends.

Who is the Motley Fool?

Founded in 1993 in Alexandria, VA., by brothers David and Tom Gardner, The Motley Fool is a multimedia financial-services company dedicated to building the world's greatest investment community .

How much is the Social Security bonus?

The $16,122 Social Security bonus most retirees completely overlook. If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

Do dividends affect stock price?

Dividends don't affect the valuation of stocks directly, with the exception of significantly flawed valuation methods like the dividend discount model. However, a company's dividend activity can certainly be the cause of movements in a stock's price, which can cause its P/E, P/B, and other valuation metrics to change.

What is the record date for dividends?

The record date is the cut-off day, set by the company, for receipt of a dividend. An investor must own the stock by that date to be eligible for the dividend. However, other rules also apply. If an investor buys the stock on the record date, the investor does not receive the dividend.

Why are put options so expensive?

Put options become more expensive since the price will drop by the amount of the dividend (all else being equal). Call options become cheaper due to the anticipated drop in the price of the stock, although for options this could start to be priced in weeks leading up to the ex-dividend.

How do put options work?

Put options gain value as the price of a stock goes down. A put option on a stock is a financial contract where the holder has the right to sell 100 shares of stock at the specified strike price up until the expiration of the option.

What is call option?

A call option on a stock is a contract whereby the buyer has the right to buy 100 shares of the stock at a specified strike price up until the expiration date. Since the price of the stock drops on the ex-dividend date, the value of call options also drops in the time leading up to the ex-dividend date.

Do you have to own stock before the ex dividend date?

It takes time for the exchange to process the paperwork to settle the transaction. Therefore, the investor must own the stock before the ex-dividend date. The ex-dividend date is, therefore, a crucial date. On the ex-dividend date, all else being equal, the price of the stock should drop by the amount of the dividend.

What is the Black Scholes formula?

The Black-Scholes Formula. The Black-Scholes formula is a method used to price options. However, the Black-Scholes formula only reflects the value of European style options that cannot be exercised before the expiration date and where the underlying stock does not pay a dividend.

Can you exercise an American option early?

Thus, the formula has limitations when used to value American options on dividend-paying stocks that can be exercised early. As a practical matter, stock options are rarely exercised early due to the forfeiture of the remaining time value of the option.

How Are Dividends paid?

Dividends and Short-Term Price Movements

- Investor Sentiment

One of the benefits and perils of a company issuing dividends is that dividends can have a significant effect on investor sentiment about that company. A company that is known for issuing consistent dividends over many years is likely to appeal to long-term value investors and to be s… - Ex-dividend Date

The ex-dividend date, which is the date from which new shareholders are no longer eligible to receive the upcoming dividend payout, is an important short-term driver of a stocks’ price. A stock’s price will typically increase in the days leading up to the ex-dividend date to account for t…

Dividends and Long-Term valuation

- Dividend Yield and Dividend Payout Ratio

The dividend yield and dividend payout ratio are two metrics used to evaluate the value of anticipated dividends from a company. The dividend yield measures the annual payout in dividends than an investor can expect to receive per share held: Dividend Yield = Annual Dividen… - Dividends per Share

Dividends per share indicates the actual value that a company is paying out in dividends each year. Changes in the dividend per share are typically what investors look at to determine whether a company is performing well or poorly based on its dividends. Dividends per Share = (Total Divide…

Conclusion

- Dividends are an important part of stocks as they can affect both short- and long-term price movements. Dividends have a significant effect on investor sentiment and actual share value. In addition, long-term investors often look at dividends as a primary component of the fair price of a company’s shares, while short-term investors can incorporate ...