Full Answer

Which Vanguard ETFs can be used to invest in international markets?

Vanguard Total International Bond ETF holds more than 4,500 non-U.S. bonds. Vanguard Total International Stock ETF holds more than 6,000 non-U.S. stocks. You can use just a few ETFs to invest overseas.

What is the vanguard total international stock index fund?

Vanguard Total International Stock Index Fund holds more than 5,500 non-U.S. stocks. Vanguard Total International Bond Index Fund holds about 3,000 non-U.S. bonds. International funds invest only in foreign markets, excluding the United States.

What is the vanguard total stock market ETF (TSM)?

The Vanguard Total Stock Market ETF is a well-diversified exchange-traded fund (ETF) that holds over 3,500 stocks. 3 The ETF’s top sector is technology, with a 21.2% weighting, while Microsoft, Apple, and Amazon are its top three holdings, making up 12.6% of the ETF. 4

Is Dubuque Bank&Trust Co buying Vanguard total stock market ETF?

Dubuque Bank & Trust Co Buys Vanguard Total Stock Market ETF, Vanguard Total International ... Jan. 28, 2022 at 4:38 p.m. ETon GuruFocus.com

Does Vanguard Total Stock Market include International?

Vanguard Total International Stock Index Fund seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in developed and emerging markets, excluding the United States.

Is Vanguard Total World Stock good?

Note that a traditional mutual fund version of the same fund, Vanguard Total World Stock Index (VTWSX), is equally good, except the investor shares of the mutual fund are more expensive—a 0.21% fee versus 0.11% for the ETF. Stocks with large market capitalizations dominate the fund.

Is Vanguard diversified?

Vanguard Diversified Index ETFs provide low-cost broad diversification across multiple asset classes through a transparent and tax efficient portfolio. All four Diversified Index ETFs harness the diversification benefits of Vanguard's index funds to offer exposure to over 10,000 securities in each ETF.

What percentage of portfolio should be international stocks?

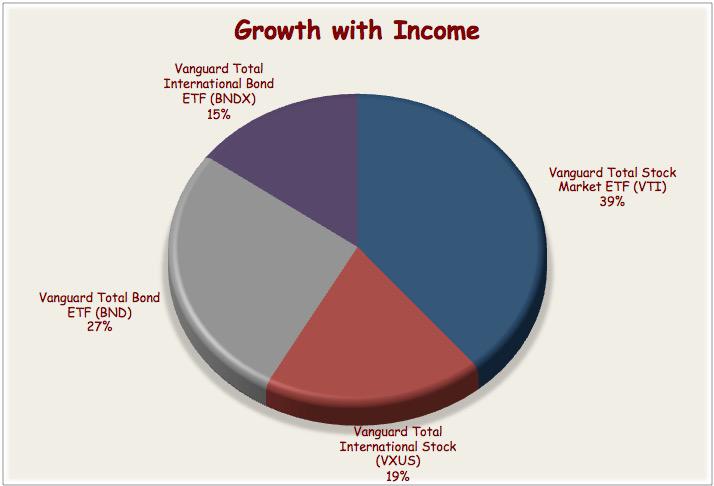

In general, Vanguard recommends that at least 20% of your overall portfolio should be invested in international stocks and bonds. However, to get the full diversification benefits, consider investing about 40% of your stock allocation in international stocks and about 30% of your bond allocation in international bonds.

Should I just invest in VT?

VT is a good low-cost and easy way to invest passively in stocks with a long-term time horizon. Investors that already hold U.S. stocks may find VT offers only limited benefits of portfolio diversification since the fund includes a large allocation to widely held mega-cap companies.

Is VT a good long term investment?

Buy VT Today As far as whether the average retail investor should buy right now, well, yes, absolutely. You'll be in it for the long game. If stocks keep going down, then that's unfortunate, but you'll still be doing better with VT compared to 90% of active funds after 20 years.

Which is the best diversified equity fund?

List of Top 10 Diversified Mutual Funds in 2022Mirae Asset Tax Saver Fund.Canara Robeco Equity Taxsaver fund.DSP Tax Saver Fund.Axis Long Term Equity Fund.ICICI Prudential Long Term Equity Fund Tax Saving.SBI Magnum Long Term Equity Scheme.BNP Paribas Long Term Equity Fun.

How do I diversify my Vanguard portfolio?

Diversification can be achieved in many ways, including spreading your investments across:Multiple asset classes, by buying a combination of cash, bonds, and stocks.Multiple holdings, by buying many bonds and stocks (which you can do through a single ETF) instead of just one or a few.More items...

What does a diverse stock portfolio look like?

A diversified portfolio is a collection of different investments that combine to reduce an investor's overall risk profile. Diversification includes owning stocks from several different industries, countries, and risk profiles, as well as other investments such as bonds, commodities, and real estate.

Which Vanguard International fund is best?

The following Vanguard international funds are good places to start for those who are looking to invest in international markets:Vanguard Developed Markets Index (VTMGX)Vanguard Emerging Markets Select Stock (VMMSX)Vanguard Emerging Markets Stock Index (VEMAX)Vanguard European Stock Index (VEUSX)

Does Warren Buffett invest in international stocks?

Buffett's mandated portfolio notably excludes assets such as U.S. small cap stocks, international stocks, corporate bonds, municipal bonds and other investments commonly held in contemporary institutional and individual investors' portfolios.

Is it worth investing in international stocks?

The answer is Yes. Now is not the time to give up on international investing. If anything, it is time to increase allocation to international stocks and international funds. International stocks are due to provide superior returns compared to U. S. stocks.

What is VXUS ETF?

What is Vanguard VXUS ETF? Vanguard VXUS is an ETF that tracks the performance of a benchmark index that measures the investment return of stocks issued by companies located in international markets, outside the US. The index that VXUS tracks is FTSE Global All Cap ex US Index, which is market-cap weighted. The index includes over 6,100 stocks of ...

What does EAFE mean in Vanguard?

EAFE stands for Europe, Australasia and Far East, and Min-Vol stands for minimum volatility (meaning lower beta and lower risk). But be careful–do your diligence before investing in those funds. The Vanguard Total International Stock ETF ( NASDAQ:VXUS) was unchanged in premarket trading Tuesday.

Is VXUS a good investment?

Index funds such as VXUS are ideal for individual investors wanting to get a broad exposure to international markets, including both developed and emerging. VXUS is a good fit for long-term investors, for whom money’s growth over a longer period of time is essential.

Can you deduct VXUS from your bank account?

In fact, you can even choose an option to automatically deduct from your bank account every month. VXUS, on the other hand, trades similar to stocks. Investors have the option of manual additions to their existing investments. But, the particular amount of shares is usually based on the current share price.

ETF vs. Mutual Fund

The Vanguard Total International Stock Index mutual fund and ETF share the same underlying index, but they involve different levels of commissions, trading costs, tax implications, and other matters.

Digging Into the Portfolio

The Vanguard Total International Stock Index Fund provides 40.9% exposure to Europe, 26.7% to the Asia-Pacific, 24.7% to emerging markets, 7.2% to North America, and 0.5% to the Middle East, as of December 31, 2021.

Expenses and Risk Factors

The Vanguard Total International Stock Index funds have much lower expense ratios than funds with many of the same holdings. The mutual fund version of the index offers an expense ratio that may be able to save you upwards of $2,000 for every $10,000 invested over a 10-year period, as compared to competing funds.

Alternatives to Consider

There are many types of funds that provide exposure to international markets, including international funds (which exclude the U.S.) and all-world funds (which include the U.S.). If you are looking to diversify a domestic portfolio, you may want to think about international funds.

In Review

With over 7,742 holdings, the index provides diversified exposure to mid- and large-cap equities around the world, with an expense ratio that’s much lower than many others in the industry. As you invest you should keep in mind that there are many options to choose from, and select the ETF or mutual fund that’s right for your own needs and goals.

What is Vanguard European stock index?

Vanguard European Stock Index (VEURX) VEURX is a passively-managed index fund that focuses on European stocks. With this international stock fund, you'll get low-cost broad exposure to companies in European countries like Italy, France, Germany, Spain, Portugal, Germany, Finland, Switzerland, Norway, and the United Kingdom.

What is Vanguard fund?

Vanguard funds cover the entire spectrum of stocks, including almost every conceivable slice of the international stock market you can imagine. They offer exposure to developed markets, emerging markets, European stock, global real estate, and specialized international fund types.

What is Vanguard Pacific?

Vanguard Pacific Stock Index (VPACX) The international stock fund from Vanguard focuses on stocks of countries in the Pacific region, primarily in Japan, which makes up approximately 25% of the international market. VPACX passively tracks the FTSE Developed Asia Pacific All Cap Index, which covers 2,347 stocks in the Pacific region.

What is VTMGX investment?

VTMGX is an Admiral share class fund, which means the minimum initial investments are $3,000 for most index funds and $50,000 for actively managed funds. The expense ratio is 0.07%. 1 2 .

What is the best allocation for international stocks?

Depending upon several factors, such as risk tolerance and time horizon , a good allocation to international stocks in a portfolio is in the range of 10–20%.

Why invest in international stocks?

The primary reason to invest in international stocks is to gain access to markets outside of the U.S., which is a fundamental aspect of diversification. U.S. and foreign markets do not always move together; the U.S. may outperform foreign stocks for years at a time, and vice versa. Investing in international stocks also helps to hedge ...

Which countries are included in the International Stock Fund?

This international stock fund, which includes 286 stocks, focuses on stocks of emerging market countries, such as India, China, Russia, and Brazil. While emerging markets can be riskier than U.S. and developed foreign markets, the potential for higher returns is also there.

In a hurry? Here are the highlights

VT and VTI are two completely different funds. Both are from Vanguard.

VT vs. VTI – Methodology, Composition, and Reasoning

First and foremost, understand that even though their tickers only differ by the addition of a single letter, VT and VTI are two completely different funds, and one should not be considered a replacement for the other.

VT vs. VTI – Historical Performance

Here’s the global stock market (VT) vs. the U.S. stock market (VTI) from 1986 through June, 2021:

VT vs. VTI – Reasoning Behind Global Diversification

So again, a decision between just these two funds comes down to betting entirely on the U.S. (VTI) or getting global diversification with markets outside the U.S. (VT).

VT vs. VTI – AUM and Fees

Though both funds are highly liquid and extremely popular, VTI is much more popular with over $250 billion in assets under management. VT has about 1/10 of that at $23 billion. There are probably a couple reasons for this. First, VTI was launched much earlier in 2001, while VT launched in 2008.

Conclusion

While they’re both very popular, have low fees, and reliably track their respective indexes, Vanguard’s VT and VTI are two completely different funds. The former is the entire global stock market, while the latter is just the U.S. stock market. I’m a huge fan of diversification across geographies. In any case, don’t use VTI alone.

ETF vs. Mutual Fund

Digging Into The Portfolio

- The Vanguard Total International Stock Index Fund provided 40.9% exposure to Europe, 26.7% to the Asia-Pacific, 24.7% to emerging markets, 7.2% to North America, and 0.5% to the Middle East, as of December 31, 2021. In terms of industry exposure, the index is focused on financial services, industrials, consumer staples, consumer discretionary, tech...

Expenses and Risk Factors

- The Vanguard Total International Stock Index funds have much lower expense ratiosthan funds with many of the same holdings. The mutual fund version of the index offers an expense ratio that may be able to save you upwards of $2,000 for every $10,000 invested over a 10-year period, as compared to competing funds. As you invest, you'll want to do your best to minimize fees, becau…

Alternatives to Consider

- There are many types of funds that provide exposure to international markets, including international funds (which exclude the U.S.) and all-world funds (which include the U.S.). If you are looking to diversify a domestic portfolio, you may want to think about international funds. On the other hand, those who are looking for an all-in-one fund should take a look at all-world funds. Th…

in Review

- With over 7,742 holdings, the index provides diversified exposure to mid- and large-cap equities around the world, with an expense ratio that’s much lower than many others in the industry. As you invest, you should keep in mind that there are many options to choose from. Select the ETF or mutual fund that’s right for your own needs and goals.