On September 20, 1929, the London Stock Exchange crashed when top British investor Clarence Hatry and many of his associates were jailed for fraud and forgery. The London crash greatly weakened the optimism of American investment in markets overseas, and in the days leading up to the crash, the market was severely unstable.

What exactly caused the stock market to crash in 1929?

Apr 13, 2018 · The stock market crash of 1929—considered the worst economic event in world history—began on Thursday, October 24, 1929, with skittish investors trading a record 12.9 million shares. On October 28,...

Which situation helped cause the stock market crash of 1929?

Nov 22, 2013 · A crowd gathers outside the New York Stock Exchange following the 1929 crash. (Photo: Bettmann/Bettmann/Getty Images) Funds that fled the stock market flowed into New York City’s commercial banks. These banks also assumed millions of dollars in stock-market loans. The sudden surges strained banks.

Which of these factors led to the stock market crash of 1929?

May 07, 2014 · October 29, 1929, when a mass panic caused a crash in the stock market and stockholders divested over sixteen million shares, causing the overall value of the stock market to drop precipitously speculation the practice of investing in risky financial opportunities in the hopes of a fast payout due to market fluctuations

What was the significance of the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year. Over the course of four business days—Black Thursday (October 24) through Black Tuesday (October 29)—the Dow Jones Industrial Average dropped from 305.85 points to 230.07 points, representing a decrease in …

What was the cause of the 1929 stock market crash?

Most economists agree that several, compounding factors led to the stock market crash of 1929. A soaring, overheated economy that was destined to one day fall likely played a large role.

What happened to stocks during the stock market crash?

Some experts argue that at the time of the crash, stocks were wildly overpriced and that a collapse was imminent.

What was the economic climate in the 1920s?

Additionally, the overall economic climate in the United States was healthy in the 1920s. Unemployment was down, and the automobile industry was booming. While the precise cause of the stock market crash of 1929 is often debated among economists, several widely accepted theories exist. 17. Gallery.

Why did the stock market crash make the situation worse?

Public panic in the days after the stock market crash led to hordes of people rushing to banks to withdraw their funds in a number of “bank runs,” and investors were unable to withdraw their money because bank officials had invested the money in the market.

What was the worst economic event in history?

The stock market crash of 1929 was the worst economic event in world history. What exactly caused the stock market crash, and could it have been prevented?

What happened on October 28th?

On October 28, dubbed “Black Monday,” the Dow Jones Industrial Average plunged nearly 13 percent. The market fell another 12 percent the next day, “ Black Tuesday .” While the crisis send shock waves across the financial world, there were numerous signs that a stock market crash was coming. What exactly caused the crash—and could it have been prevented?

Why did people buy stocks in the 1920s?

During the 1920s, there was a rapid growth in bank credit and easily acquired loans. People encouraged by the market’s stability were unafraid of debt.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

How did the stock market crash affect the economy?

While New York’s actions protected commercial banks, the stock-market crash still harmed commerce and manufacturing. The crash frightened investors and consumers. Men and women lost their life savings, feared for their jobs, and worried whether they could pay their bills. Fear and uncertainty reduced purchases of big ticket items, like automobiles, that people bought with credit. Firms – like Ford Motors – saw demand decline, so they slowed production and furloughed workers. Unemployment rose, and the contraction that had begun in the summer of 1929 deepened (Romer 1990; Calomiris 1993). 7

How did the Fed help the banks during the financial crisis?

It assured commercial banks that it would supply the reserves they needed. These actions increased total reserves in the banking system, relaxed the reserve constraint faced by banks in New York City, and enabled financial institutions to remain open for business and satisfy their customers’ demands during the crisis. The actions also kept short term interest rates from rising to disruptive levels, which frequently occurred during financial crises.

What was the financial boom?

The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds. A new industry of brokerage houses, investment trusts, and margin accounts enabled ordinary people to purchase corporate equities with borrowed funds. Purchasers put down a fraction of the price, typically 10 percent, and borrowed the rest. The stocks that they bought served as collateral for the loan. Borrowed money poured into equity markets, and stock prices soared.

When did the Dow drop?

The epic boom ended in a cataclysmic bust. On Black Monday, October 28, 1929, the Dow declined nearly 13 percent. On the following day, Black Tuesday, the market dropped nearly 12 percent. By mid-November, the Dow had lost almost half of its value. The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak. The Dow did not return to its pre-crash heights until November 1954.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

What was the cause of the Great Depression?

While it is misleading to view the stock market crash of 1929 as the sole cause of the Great Depression, the dramatic events of that October did play a role in the downward spiral of the American economy. The crash, which took place less than a year after Hoover was inaugurated, was the most extreme sign of the economy’s weakness. Multiple factors contributed to the crash, which in turn caused a consumer panic that drove the economy even further downhill, in ways that neither Hoover nor the financial industry was able to restrain. Hoover, like many others at the time, thought and hoped that the country would right itself with limited government intervention. This was not the case, however, and millions of Americans sank into grinding poverty.

Why did Herbert Hoover become president?

Herbert Hoover became president at a time of ongoing prosperity in the country. Americans hoped he would continue to lead the country through still more economic growth, and neither he nor the country was ready for the unraveling that followed. But Hoover’s moderate policies, based upon a strongly held belief in the spirit of American individualism, were not enough to stem the ever-growing problems, and the economy slipped further and further into the Great Depression.

How did the crash affect the economy?

At this time, two industries had the greatest impact on the country’s economic future in terms of investment, potential growth, and employment: automotive and construction. After the crash, both were hit hard. In November 1929, fewer cars were built than in any other month since November 1919. Even before the crash, widespread saturation of the market meant that few Americans bought them, leading to a slowdown. Afterward, very few could afford them. By 1933, Stutz, Locomobile, Durant, Franklin, Deusenberg, and Pierce-Arrow automobiles, all luxury models, were largely unavailable; production had ground to a halt. They would not be made again until 1949. In construction, the drop-off was even more dramatic. It would be another thirty years before a new hotel or theater was built in New York City. The Empire State Building itself stood half empty for years after being completed in 1931.

How much money did the stock market lose on Black Tuesday?

On Black Tuesday, October 29, stock holders traded over sixteen million shares and lost over $14 billion in wealth in a single day. To put this in context, a trading day of three million shares was considered a busy day on the stock market. People unloaded their stock as quickly as they could, never minding the loss. Banks, facing debt and seeking to protect their own assets, demanded payment for the loans they had provided to individual investors. Those individuals who could not afford to pay found their stocks sold immediately and their life savings wiped out in minutes, yet their debt to the bank still remained ( [link] ).

What were the advertisements selling in the 1920s?

In the 1920s, advertisers were selling opportunity and euphoria, further feeding the notions of many Americans that prosperity would never end. In the decade before the Great Depression, the optimism of the American public was seemingly boundless.

What happened in 1929?

Updated September 02, 2020. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

How did the stock market crash affect people?

The crash wiped people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins. They lost faith in Wall Street.

What were the three key trading dates of the Dow crash?

The three key trading dates of the crash were Black Thursday, Black Monday, and Black Tuesday. The latter two days were among the four worst days the Dow has ever seen, by percentage decline.

What happened on September 26th 1929?

September 26: The Bank of England also raised its rate to protect the gold standard. September 29, 1929: The Hatry Case threw British markets into panic. 6. October 3: Great Britain's Chancellor of the Exchequer Phillip Snowden called the U.S. stock market a "speculative orgy.".

How much did the Dow rise in 1933?

On March 15, 1933, the Dow rose 15.34%, a gain of 8.26 points, to close at 62.1. 8. The timeline of the Great Depression tracks critical events leading up to the greatest economic crisis the United States ever had. The Depression devastated the U.S. economy.

Why did banks honor 10 cents for every dollar?

That's because they had used their depositors' savings, without their knowledge, to buy stocks. November 23, 1954: The Dow finally regained its September 3, 1929, high, closing at 382.74. 8.

What was the financial invention that allowed people to borrow money from their broker to buy stocks?

Everyone invested, thanks to a financial invention called buying "on margin." It allowed people to borrow money from their broker to buy stocks. They only needed to put down 10%. 7 Investing this way contributed to the irrational exuberance of the Roaring Twenties.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

What was the stock market like in the 1920s?

During the mid- to late 1920s, the stock market in the United States underwent rapid expansion. It continued for the first six months following President Herbert Hoover ’s inauguration in January 1929. The prices of stocks soared to fantastic heights in the great “Hoover bull market ,” and the public, from banking and industrial magnates to chauffeurs and cooks, rushed to brokers to invest their liquid assets or their savings in securities, which they could sell at a profit. Billions of dollars were drawn from the banks into Wall Street for brokers’ loans to carry margin accounts. The spectacles of the South Sea Bubble and the Mississippi Bubble had returned. People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September. Any warnings of the precarious foundations of this financial house of cards went unheeded.

What was the Great Depression?

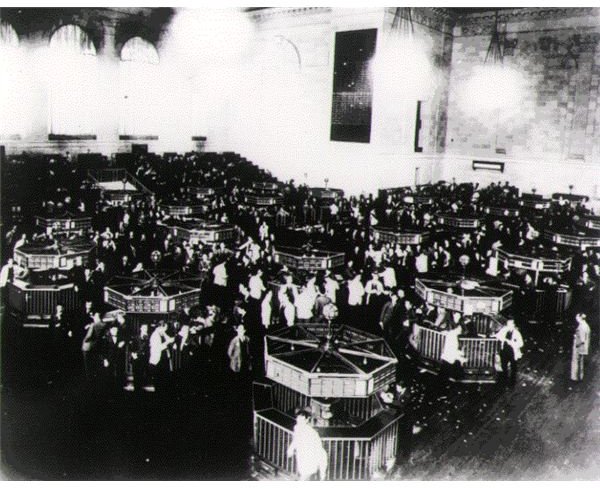

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

What was the cause of the 1929 stock market crash?

Cause. Fears of excessive speculation by the Federal Reserve. The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed.

How did the stock market crash affect the economy?

The decline in stock prices caused bankruptcies and severe macroeconomic difficulties, including contraction of credit, business closures, firing of workers, bank failures, decline of the money supply, and other economically depressing events.

How many points did the Dow Jones Industrial Average recover from the 1929 crash?

The Dow Jones Industrial Average recovered, closing with it down only 6.38 points for the day. The trading floor of the New York Stock Exchange Building in 1930, six months after the crash of 1929.

What was the prediction of the Great Bull Market?

The optimism and the financial gains of the great bull market were shaken after a well-publicized early September prediction from financial expert Roger Babson that "a crash is coming, and it may be terrific". The initial September decline was thus called the "Babson Break" in the press.

What was the most devastating stock market crash in the history of the United States?

It was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its aftereffects. The Great Crash is mostly associated with October 24, 1929, called Black Thursday, the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called Black Tuesday, when investors traded some 16 million shares on the New York Stock Exchange in a single day. The crash, which followed the London Stock Exchange 's crash of September, signaled the beginning of the Great Depression .

Why did the uptick rule fail?

Also, the uptick rule, which allowed short selling only when the last tick in a stock's price was positive, was implemented after the 1929 market crash to prevent short sellers from driving the price of a stock down in a bear raid.

Why did wheat prices fall in August?

In August, the wheat price fell when France and Italy were bragging about a magnificent harvest, and the situation in Australia improved. That sent a shiver through Wall Street and stock prices quickly dropped, but word of cheap stocks brought a fresh rush of "stags", amateur speculators, and investors.

What was the stock market crash of 1929?

The stock market crash of 1929 followed an epic period of economic growth during what's now known as the Roaring Twenties. The Dow Jones Industrial Average ( DJINDICES:^DJI) was at 63 points in August 1921 and increased six-fold over the next eight years, closing at a high of 381.17 points on Sept. 3, 1929. That September day marked the peak of the ...

What happened on Oct 29 1929?

4, 1929, the worst of the crash didn't occur until more than a month later. On Monday, Oct. 29, the Dow Jones Industrial Average plunged by nearly 13%. The next day, the index tumbled by almost another 12%. These devastating two days have since become known as Black Monday and Black Tuesday.

What happens when investment trusts are heavily leveraged?

Some investment trusts, themselves heavily leveraged, also invested in other similarly leveraged investment trusts , which, in turn, invested in other investment trusts employing the same strategy. As a result, each of these trusts became inordinately affected by the movements of others' stock holdings. When the stock market crashed in September ...

What collateral did the banks use to finance the stock buying spree?

In the wake of the crash, the banks and other lenders that financed the stock-buying spree had little means to collect what they were owed. Their only collateral was stocks for which the amount of debt outstanding exceeded the stocks' worth. These institutions had little choice but to begin limiting all other forms of lending, including credit for consumer purchases.

What was the total non-corporate debt in 1929?

By September 1929, total noncorporate debt in the U.S. amounted to 40% of the nation's Gross Domestic Product (GDP). At the same time that readily available credit was fueling consumer spending, the buoyant stock market gave rise to many new brokerage houses and investment trusts, which enabled the average person to buy stocks.

What was the cause of the Great Depression?

The stock market crash of 1929 was a cause, but not the sole driver, of the Great Depression. The 1929 crash served as a critical catalyst that triggered the start of that devastating economic downturn. The bursting of the stock market's bubble unleashed a cascade of market forces that plagued the U.S. economy for years after 1929. The economy likely could have recovered more quickly in those ensuing years had the combined effects of excessive borrowing, business closures, and mass layoffs not exacerbated and prolonged the crisis.

What happened to the economy with less credit?

With less available consumer credit, a lot fewer people were able to purchase big-ticket items, causing consumer spending to decline sharply. Businesses shrank or closed, resulting in millions of people losing their jobs and becoming unable to repay their own debts to the banks. The banks, too, failed by the thousands as many of their borrowers defaulted on their loans.

A Timeline of What Happened

Financial Climate Leading Up to The Crash

- Earlier in the week of the stock market crash, the New York Times and other media outlets may have fanned the panic with articles about violent trading periods, short-selling, and the exit of foreign investors; however many reports downplayed the severity of these changes, comparing the market instead to a similar "spring crash" earlier that year, after which the market bounced b…

Effects of The Crash

- The crash wiped many people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins. They lost faith in Wall Street. By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-h...

Key Events

- March 1929:The Dow dropped, but bankers reassured investors.

- August 8: The Federal Reserve Bank of New York raised the discount rate to 6%.16

- September 3: The Dow peaked at 381.17. That was a 27% increase over the prior year's peak.1

- September 26: The Bank of England also raised its rate to protect the gold standard.17