Great Depression

The Great Depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States. The timing of the Great Depression varied across nations; in most countries, it started in 1929 and lasted until the late 1930s. It was the longest, de…

Full Answer

What was the stock market like during the Great Depression?

The great depression not only hugely affected the stock market, but it also affected the clients whose money was already in the markets for investment. In which many banks had done that and that created a huge loss for the clients which, the banks were also forced to close down because they directly depended on the stock market. Get Access

What is the biggest stock market crash?

May 07, 2014 · However, as a singular event, the stock market crash itself did not cause the Great Depression that followed. In fact, only approximately 10 percent of American households held stock investments and speculated in the market; yet nearly a third would lose their lifelong savings and jobs in the ensuing depression.

Why is the stock market crashed in 1929?

May 09, 2010 · The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse of which it was also a symptom. By 1933, nearly half of...

What actually happens during a stock market crash?

Mar 27, 2022 · What were the immediate effects of the Great Depression? The stock market crash in 1929 was swift and severe. It rippled throughout the financial community, and banks started to fail. That slowed economic growth, reduced business activity, and increased the unemployment rate.

How much did the Dow rise in 1933?

On March 15, 1933, the Dow rose 15.34%, a gain of 8.26 points, to close at 62.1. 8. The timeline of the Great Depression tracks critical events leading up to the greatest economic crisis the United States ever had. The Depression devastated the U.S. economy.

What was the Dow down in 1932?

By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-high close of 381.17 on September 3, 1929. It was the worst bear market in terms of percentage loss in modern U.S. history. The largest one-day percentage gain also occurred during that time.

What happened on September 26th 1929?

September 26: The Bank of England also raised its rate to protect the gold standard. September 29, 1929: The Hatry Case threw British markets into panic. 6. October 3: Great Britain's Chancellor of the Exchequer Phillip Snowden called the U.S. stock market a "speculative orgy.".

What happened in 1929?

Updated September 02, 2020. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929. By Oct. 29, 1929, the Dow Jones Industrial Average had dropped 24.8%, marking one of the worst declines in U.S. history. 1 It destroyed confidence in Wall Street markets and led to the Great Depression .

Why did banks honor 10 cents for every dollar?

That's because they had used their depositors' savings, without their knowledge, to buy stocks. November 23, 1954: The Dow finally regained its September 3, 1929, high, closing at 382.74. 8.

Who is Thomas Brock?

Thomas Brock is a well-rounded financial professional, with over 20 years of experience in investments, corporate finance, and accounting. The stock market crash of 1929 was a collapse of stock prices that began on Oct. 24, 1929.

How many times did stock prices go up in 1929?

Until the peak in 1929, stock prices went up by nearly 10 times. In the 1920s, investing in the stock market became somewhat of a national pastime for those who could afford it and even those who could not—the latter borrowed from stockbrokers to finance their investments. The economic growth created an environment in which speculating in stocks ...

Why did the economy stumbled in 1929?

In mid-1929, the economy stumbled due to excess production in many industries, creating an oversupply.

Why did companies acquire money cheaply?

Essentially, companies could acquire money cheaply due to high share prices and invest in their own production with the requisite optimism. This overproduction eventually led to oversupply in many areas of the market, such as farm crops, steel, and iron.

What was the result of the Great War?

The result was a series of legislative measures by the U.S. Congress to increase tariffs on imports from Europe.

What happens when the stock market falls?

However, when markets are falling, the losses in the stock positions are also magnified. If a portfolio loses value too rapidly, the broker will issue a margin call, which is a notice to deposit more money to cover the decline in the portfolio's value.

What happens if a broker doesn't deposit funds?

If the funds are not deposited, the broker is forced to liquidate the portfolio. When the market crashed in 1929, banks issued margin calls. Due to the massive number of shares bought on margin by the general public and the lack of cash on the sidelines, entire portfolios were liquidated.

What was the era of the Roaring Twenties?

Excess Debt. The Aftermath of the Crash. The decade, known as the "Roaring Twenties," was a period of exuberant economic and social growth within the United States. However, the era came to a dramatic and abrupt end in October 1929 when the stock market crashed, paving the way into America's Great Depression of the 1930s.

How did the stock market crash affect people?

Although only a small percentage of Americans had invested in the stock market, the crash affected everyone. Banks lost millions and, in response, foreclosed on business and personal loans, which in turn pressured customers to pay back their loans, whether or not they had the cash.

How much did the stock market lose in 1929?

Between September 1 and November 30, 1929, the stock market lost over one-half its value, dropping from $64 billion to approximately $30 billion. Any effort to stem the tide was, as one historian noted, tantamount to bailing Niagara Falls with a bucket.

How to explain the stock market crash?

By the end of this section, you will be able to: 1 Identify the causes of the stock market crash of 1929 2 Assess the underlying weaknesses in the economy that resulted in America’s spiraling from prosperity to depression so quickly 3 Explain how a stock market crash might contribute to a nationwide economic disaster

What was Hoover's agenda?

Upon his inauguration, President Hoover set forth an agenda that he hoped would continue the “Coolidge prosperity ” of the previous administration. While accepting the Republican Party’s presidential nomination in 1928, Hoover commented, “Given the chance to go forward with the policies of the last eight years, we shall soon with the help of God be in sight of the day when poverty will be banished from this nation forever.” In the spirit of normalcy that defined the Republican ascendancy of the 1920s, Hoover planned to immediately overhaul federal regulations with the intention of allowing the nation’s economy to grow unfettered by any controls. The role of the government, he contended, should be to create a partnership with the American people, in which the latter would rise (or fall) on their own merits and abilities. He felt the less government intervention in their lives, the better.

What happened to the stock market on September 20th?

Even the collapse of the London Stock Exchange on September 20 failed to fully curtail the optimism of American investors. However, when the New York Stock Exchange lost 11 percent of its value on October 24—often referred to as “Black Thursday”—key American investors sat up and took notice.

What happened on October 29, 1929?

October 29, 1929, or Black Tuesday, witnessed thousands of people racing to Wall Street discount brokerages and markets to sell their stocks. Prices plummeted throughout the day, eventually leading to a complete stock market crash. The financial outcome of the crash was devastating.

What were the advertisements selling in the 1920s?

In the 1920s, advertisers were selling opportunity and euphoria, further feeding the notions of many Americans that prosperity would never end. In the decade before the Great Depression, the optimism of the American public was seemingly boundless.

What happened to stock market in 1929?

Stock prices began to decline in September and early October 1929, and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded. Investment companies and leading bankers attempted to stabilize the market by buying up great blocks of stock, producing a moderate rally on Friday. On Monday, however, the storm broke anew, and the market went into free fall. Black Monday was followed by Black Tuesday (October 29, 1929), in which stock prices collapsed completely and 16,410,030 shares were traded on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors, and stock tickers ran hours behind because the machinery could not handle the tremendous volume of trading.

What were the causes of the 1929 stock market crash?

Among the other causes of the stock market crash of 1929 were low wages, the proliferation of debt, a struggling agricultural sector and an excess of large bank loans that could not be liquidated.

What happened on October 29, 1929?

On October 29, 1929, Black Tuesday hit Wall Street as investors traded some 16 million shares on the New York Stock Exchange in a single day. Billions of dollars were lost, wiping out thousands of investors. In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), ...

What happened after Black Tuesday?

In the aftermath of Black Tuesday, America and the rest of the industrialized world spiraled downward into the Great Depression (1929-39), the deepest and longest-lasting economic downturn in the history of the Western industrialized world up to that time .

What was the stock market crash of 1929?

The stock market crash of 1929 was not the sole cause of the Great Depression, but it did act to accelerate the global economic collapse ...

When did stock prices drop in 1929?

Stock prices began to decline in September and early October 1929 , and on October 18 the fall began. Panic set in, and on October 24, Black Thursday, a record 12,894,650 shares were traded.

What was the New Deal?

The relief and reform measures in the “ New Deal ” enacted by the administration of President Franklin D. Roosevelt (1882-1945) helped lessen the worst effects of the Great Depression; however, the U.S. economy would not fully turn around until after 1939, when World War II (1939-45) revitalized American industry.

How much did the economy shrink during the Depression?

During the first five years of the depression, the economy shrank 50% . In 1929, economic output was $105 billion, as measured by gross domestic product (GDP). 5 That's equivalent to more than $1 trillion today.

How many banks failed during the Great Depression?

During the Depression, a third of the nation's banks failed. 1 By 1933, 4,000 banks had failed. 11 As a result, depositors lost $140 billion. 12 . People were stunned to find out that banks had used their deposits to invest in the stock market. They rushed to take their money out before it was too late.

What was the unemployment rate in 1928?

Charles Phelps Cushing / ClassicStock / Getty Images. In 1928, the final year of the Roaring Twenties, unemployment was 4.2%. That's less than the natural rate of unemployment. By 1930, it had more than doubled to 8.7%. 10 By 1932, it had increased to 23.6%. It peaked in 1933, reaching up to around 25%.

What happened in 1938?

Unfortunately, the government cut back on New Deal spending in 1938. The depression returned, and the economy shrank 6.3%. Preparations for World War II sent growth up 7% in 1939 and 10% in 1940. The next year, Japan bombed Pearl Harbor, and the United States entered World War II.

How did the Depression affect politics?

The Depression affected politics by shaking confidence in unfettered capitalism. That type of laissez-faire economics is what President Herbert Hoover advocated, and it had failed. As a result, people voted for Franklin Roosevelt. His Keynesian economics promised that government spending would end the Depression.

How much was the economy in 1929?

In 1929, economic output was $105 billion, as measured by gross domestic product (GDP). 5 That's equivalent to more than $1 trillion today. The economy began shrinking in August 1929. By the end of the year, 650 banks had failed. 6 In 1930, the economy shrank another 8.5%, according to the Bureau of Economic Analysis.

How much did the New Deal reduce unemployment?

New Deal programs helped reduce unemployment to 21.7% in 1934, 20.1% in 1935, 16.9% in 1936, and 14.3% in 1937. But less robust government spending in 1938 sent unemployment back up to 19%. It remained above 10% until 1941, according to a review of the unemployment rate by year.

What were the economic shocks of the late 1920s and early 1930s?

The economic shock of the late 1920s and early 1930s presented two types of opportunities for investors: they could get more in sync with the new, inherent volatility of the stock market, which accompanies all periods of economic turmoil. Or, they could just buy-and-hold-and-hope.

When did the Great Depression start?

That played out OK, until 1931. Many people think the Great Depression started in 1929 . As you will see, the events of 1931 were more of what pushed the global economy into that era.

How much did the Dow fall in 1931?

investors. The positive start to the 1931 stock market quickly faded. From late February until early June, the Dow fell 37%. Then, it rallied by over 25% in just a month’s time, and got within 9% of where it had started the year.

What was the Dow's return in 1931?

The Dow’s return for the full year 1931 was a loss of 54%. After all of the sharp drops and faith-restoring rallies that occurred that year, an index investor (not that it was a “thing” back then) would have seen their portfolio more than cut in half.

Why did the Fed make credit easy?

The Fed and other central banks made credit too easy for too long, and drove too much capital toward the stock market. That made everyone think it was easy. Modern financial engineering pulled years of future stock market and bond market returns forward. That’s the bottom line.

Did the Yankees win the World Series?

The Yankees didn’t win the World Series (it was the Babe Ruth / Lou Gehrig era, but the Philadelphia A’s beat them out) The U.S. economy was heading into the Great Depression. But all of this recent talk of the 1930s made me take a closer look at that era. In particular, I zeroed in on 1931.

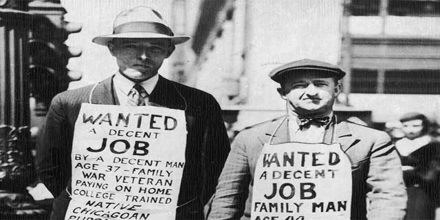

What was the impact of the Great Depression on the economy?

economy. Half of all banks failed. Unemployment rose to 25% and homelessness increased. Housing prices plummeted 30%, international trade collapsed by 65%, and prices fell 10% per year.

How did the Great Depression spread?

to Europe and the rest of the world as a result of the close interconnection between the United States and European economies after World War I. It caused it to be spread throughout the North when the Great Depression was occurring.

A Timeline of What Happened

Financial Climate Leading Up to The Crash

- Earlier in the week of the stock market crash, the New York Times and other media outlets may have fanned the panic with articles about violent trading periods, short-selling, and the exit of foreign investors; however many reports downplayed the severity of these changes, comparing the market instead to a similar "spring crash" earlier that year, after which the market bounced b…

Effects of The Crash

- The crash wiped many people out. They were forced to sell businesses and cash in their life savings. Brokers called in their loans when the stock market started falling. People scrambled to find enough money to pay for their margins. They lost faith in Wall Street. By July 8, 1932, the Dow was down to 41.22. That was an 89.2% loss from its record-h...

Key Events

- March 1929:The Dow dropped, but bankers reassured investors.

- August 8: The Federal Reserve Bank of New York raised the discount rate to 6%.16

- September 3: The Dow peaked at 381.17. That was a 27% increase over the prior year's peak.1

- September 26: The Bank of England also raised its rate to protect the gold standard.17

Black Thursday

Before The Crash: A Period of Phenomenal Growth

Overproduction and Oversupply in Markets

Global Trade and Tariffs

Excess Debt

The Aftermath of The Crash

- The stock market crash and the ensuing Great Depression (1929-1939) directly impacted nearly every segment of society and altered an entire generation's perspective and relationship to the financial markets. In a sense, the time frame after the market crash was a total reversal of the attitude of the Roaring Twenties, which had been a time of great...