I am getting ready to sell common stock in MetLife and Brighthouse financial. This stock was acquired when Metlife Insurance demutualized in the year 2000. According to an article titled "Tax Tips: Demutualized Insurance Companies", the stock basis should be $14.25 per share.

Full Answer

Is Brighthouse Financial and MetLife the same thing?

Registered shareholders: If you are a registered shareholder (meaning you hold physical MetLife, Inc. stock certificates or you own your shares of MetLife, Inc. common stock directly through an account with MetLife, Inc.’s transfer agent, Computershare Inc.), Brighthouse Financial, Inc.’s transfer agent credited the whole shares of Brighthouse Financial, Inc. common stock you …

Did MetLife become Brighthouse?

Jul 20, 2017 · According to the press release, MetLife’s shareholders will receive one share of Brighthouse Financial common stock for every 11 shares of MetLife common stock they own as of the close of business...

Who owns Brighthouse and why did it go into administration?

Find the latest Brighthouse Financial, Inc. (BHF) stock quote, history, news and other vital information to help you with your stock trading and investing.

What is stock price of Brighthouse Financial?

About Brighthouse Financial, Inc. Brighthouse Financial, Inc. (Brighthouse Financial) (Nasdaq: BHF) is on a mission to help people achieve financial security. As one of the largest providers of annuities and life insurance in the U.S., 1 we specialize in products designed to help people protect what they’ve earned and ensure it lasts.

Where did Brighthouse Financial stock come from?

Overview. On August 4, 2017, Brighthouse Financial completed its separation from MetLife and began trading on the Nasdaq stock exchange on August 7, 2017, under the symbol "BHF." Upon completion of the separation, MetLife retained a 19.2% stake in the company.

What is Brighthouse Financial Computershare?

Computershare Trust Company, N.A. (“Computershare”) is Brighthouse Financial's stock transfer agent and registrar.

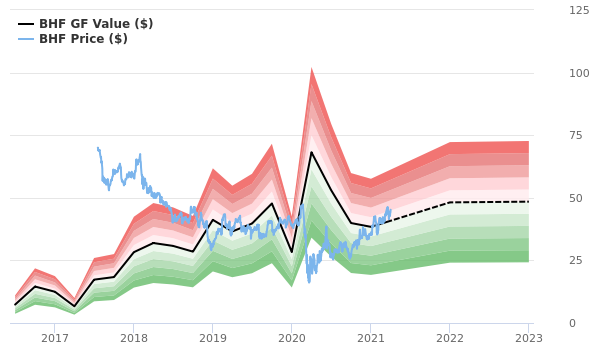

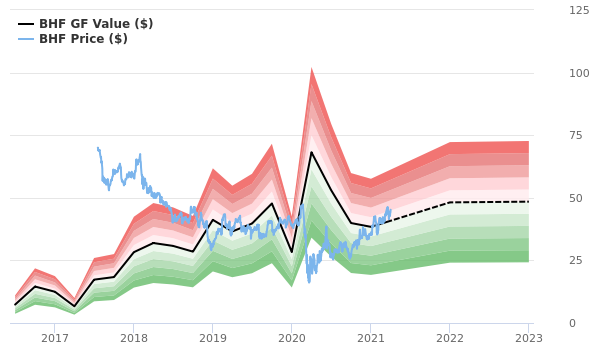

Should I sell Brighthouse Financial stock?

(BHF-Q) Rating. Stockchase rating for Brighthouse Financial Inc. is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

Did MetLife spinoff Brighthouse Financial?

Yes. Brighthouse Financial, Inc. spun off from MetLife, Inc. on August 4, 2017, through the distribution of Brighthouse Financial, Inc.

Who holds Brighthouse stock?

Top 10 Owners of Brighthouse Financial IncStockholderStakeShares ownedThe Vanguard Group, Inc.10.38%8,082,227BlackRock Fund Advisors8.21%6,389,912T. Rowe Price Associates, Inc. (I...5.81%4,520,762Greenlight Capital, Inc.4.86%3,787,6886 more rows

Is Brighthouse Financial the same as MetLife?

On March 6, 2017, MetLife separated its U.S. retail business. The separated business launched Brighthouse Financial, Inc. - an independent company that is no longer a part of MetLife. Click here to learn more about Brighthouse Financial.

Does Brighthouse stock pay dividends?

Is BRIGHTHOUSE FINANCIAL's dividend stable? BRIGHTHOUSE FINANCIAL (NASDAQ: BHF) does not pay a dividend.

Is BHF a buy?

Out of 6 analysts, 0 (0%) are recommending BHF as a Strong Buy, 0 (0%) are recommending BHF as a Buy, 4 (66.67%) are recommending BHF as a Hold, 0 (0%) are recommending BHF as a Sell, and 2 (33.33%) are recommending BHF as a Strong Sell. What is BHF's earnings growth forecast for 2022-2024?

How do I buy Brighthouse stock?

How to buy shares in Brighthouse FinancialCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. Complete an application with your details.Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

Who owns Brighthouse Financial?

Brighthouse Financial is currently an operating segment of MetLife, Inc. (NYSE: MET), and a leading annuity and life insurance provider in the U.S. with approximately 2.8 million insurance policies and annuity contracts in-force.

When was Brighthouse Financial stock issued?

Brighthouse Financial, Inc. common stock begins "regular-way" trading under the symbol "BHF" on the NASDAQ Stock Market today, Aug. 7, 2017, when markets open.Aug 7, 2017

Where is Brighthouse Financial headquarters?

Charlotte, NCBrighthouse Financial / Headquarters

Summary

MetLife affirmed a plan of the spin-off of Brighthouse Financial, its U.S. retail business.

Final thoughts

We believe our valuation analysis could serve as a good starting point for MetLife’s shareholders, who will receive Brighthouse Financial’s shares on August 4. Notably, MetLife has already launched a “when-issued” market in the shares under the symbol BHFWV.

What Type Of Shareholders Own The Most Number of Brighthouse Financial, Inc. (NASDAQ:BHF) Shares?

A look at the shareholders of Brighthouse Financial, Inc. ( NASDAQ:BHF ) can tell us which group is most powerful...

Brighthouse Financial Announces Preferred Stock Dividends and Related Depositary Share Distributions

CHARLOTTE, N.C., August 16, 2021--Brighthouse Financial, Inc.

Brighthouse Financial, inc (BHF) Q2 2021 Earnings Call Transcript

Image source: The Motley Fool. Brighthouse Financial, inc (NASDAQ: BHF)Q2 2021 Earnings CallAug 6, 2021, 8:00 a.m. ETContents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks: OperatorGood morning, ladies and gentlemen, and welcome to the Brighthouse Financial's Second Quarter 2021 Earnings Conference Call.

Brighthouse Financial (BHF) Surpasses Q2 Earnings and Revenue Estimates

Brighthouse Financial (BHF) delivered earnings and revenue surprises of 70.51% and 10.58%, respectively, for the quarter ended June 2021. Do the numbers hold clues to what lies ahead for the stock?

Brighthouse Financial Announces Second Quarter 2021 Results

CHARLOTTE, N.C., August 05, 2021--Brighthouse Financial, Inc. ("Brighthouse Financial" or the "company") (Nasdaq: BHF) announced today its financial results for the second quarter ended June 30, 2021.

Brighthouse Financial (BHF): Strong Industry, Solid Earnings Estimate Revisions

Brighthouse Financial (BHF) has seen solid earnings estimate revision activity over the past month, and belongs to a strong industry as well.

Signals & Forecast

The Brighthouse Financial Inc stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock. Also, there is a general buy signal from the relation between the two signals where the short-term average is above the long-term average.

Support, Risk & Stop-loss

On the downside, the stock finds support just below today's level from accumulated volume at $45.36 and $43.52. There is natural risk involved when a stock is testing a support level, since if this is broken, the stock then may fall to the next support level. In this case, Brighthouse Financial Inc finds support just below today's level at $45.36.

Is Brighthouse Financial Inc stock A Buy?

Several short-term signals are positive and we conclude that the current level may hold a buying opportunity, as there is a fair chance for Brighthouse Financial Inc stock to perform well in the short-term period. We have upgraded our analysis conclusion for this stock since the last evaluation from a Hold/Accumulate to a Buy candidate.

METLIFE COMPLETES SPIN-OFF OF BRIGHTHOUSE FINANCIAL

MetLife, Inc. (NYSE: MET) today announced it has completed the spin-off of Brighthouse Financial, Inc. (NASDAQ: BHF), creating two independent, publicly-traded companies. Today marks the first day of post-separation trading for each company’s common stock on its respective stock exchange.

NEW YORK, August 07, 2017

MetLife, Inc. (NYSE: MET) today announced it has completed the spin-off of Brighthouse Financial, Inc. (NASDAQ: BHF), creating two independent, publicly-traded companies. Today marks the first day of post-separation trading for each company’s common stock on its respective stock exchange.

What is the purpose of MetLife?

The purpose of MetLife establishing Brighthouse Financial was so that the insurance provider could focus solely on selling life insurance, as well as annuities, to individuals.

Is MetLife still around?

MetLife still continues to exist, but they only focus on selling their products to companies that can be used as employee benefits. The insurance policies that are sold through Brighthouse Financial, on the other hand, are only sold via financial professionals. In other words, Brighthouse Financial is a spin-off of MetLife.

What is Brighthouse Financial?

Brighthouse Financial is a new company that was established by MetLife. It is a major provider of life insurance and annuity products, with an estimated worth of $223 billion in assets, and an estimated 2.7 million life insurance policies and annuity contracts currently in force.