The monthly announcement indicates the percent change since the previous month in the average prices of the market basket of goods and services tracked by the CPI. Since it shows the direction of prices, it is considered an indicator of inflation and one of the most important economic indicators. Consequently, the CPI affects stock market trading.

How does CPI affect stocks?

Since it shows the direction of prices, it is considered an indicator of inflation and one of the most important economic indicators. Consequently, the CPI affects stock market trading.

What happens to GDP when CPI increases?

5 hours ago · Investors are particularly watching rent and auto prices, which could provide a gauge of whether inflation has topped out. Here are some other things on their radar: The bond …

What is the relationship between GDP and CPI?

9 hours ago · At 8:30 a.m. ET, the CPI report will be released, a closely watched data point to determine how inflation is trending.

What is the relationship between PPI and CPI?

20 hours ago · The CPI report is expected to show headline inflation rose 0.2% in April, or 8.1% year-over-year, according to Dow Jones. That compares to a whopping 1.2% increase in March, …

What does the CPI mean for stocks?

What happens when CPI increases?

How inflation affects the stock market?

As inflation erodes the value of a dollar of earnings, it can make it difficult for the market to gauge the current value of the companies that make up market indexes. Further, higher prices for materials, inventory, and labor can impact earnings as companies adjust.Mar 15, 2022

Is a high CPI good?

What happens when CPI decreases?

Should you buy stocks during inflation?

Is inflation good for Crypto?

How does inflation affect investments?

How does the CPI work?

The CPI is often used to adjust consumer income payments for changes in the dollar's value and to adjust other economic series. Social Security ties the CPI to income eligibility levels; the federal income tax structure relies on the CPI to make adjustments that avoid inflation-induced increases in tax rates and finally, employers use the CPI to make wage adjustments that keep up with the cost of living. Data series on retail sales, hourly and weekly earnings and the national income and product accounts are all tied to the CPI to translate the related indexes into inflation-free terms.

What is the CPI?

The Consumer Price Index (CPI), the principal gauge of the prices of goods and services, indicates whether the economy is experiencing inflation, deflation or stagflation. The CPI's results are widely anticipated and watched; the CPI plays a role in many key financial decisions, including the Federal Reserve interest rate policy and ...

What does CPI mean in economics?

The prices of goods and services fluctuate over time, but when prices change too much and too quickly, the effects can shock an economy. The Consumer Price Index (CPI), the principal gauge of the prices of goods and services, indicates whether the economy is experiencing inflation, deflation or stagflation.

Is deflation a bad thing?

But, deflation can undoubtedly be a bad thing . The best example is the Great Depression when the legions of unemployed people couldn't afford to buy goods and services at any price. When price increases get out of control, inflation is referred to as hyperinflation.

How does inflation affect fixed income?

Movements in the prices of goods and services most directly affect fixed-income securities. If prices are rising, fixed bond payments are worthless, effectively lowering the bonds' yields. Inflation also poses a serious problem to holders of fixed annuities and pension plans, as it erodes the effective value of the fixed payments. Many retirees have watched their pension payment amounts lose buying power over time.

Why are margins squeezed?

Again, the companies' margins are squeezed due to the stickiness of prices for some items and the elasticity of prices for other items.

What are TIPS bonds?

Mutual funds, or banks, concerned about rising inflation might purchase special inflation-protected bonds known as TIPS .

Is the CPI the preferred inflation gauge?

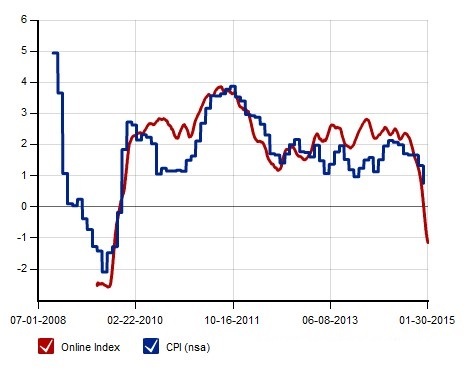

The U.S. CPI is not the Fed’s preferred inflation gauge – the Fed has been framing its inflation forecasts in terms of the personal consumption expenditure (PCE) deflator since 2000. However, it is the market’s preferred inflation gauge.

Who is Marshall Gittler?

Marshall Gittler: Head of Investment Research at BDSwiss Group -- Marshall is a renowned expert in the field of fundamental analysis, with over 30 years’ experience researching the markets. His career spans a range of elite investment banks and international securities firms including UBS, Merrill Lynch, Bank of America and Deutsche Bank. Marshall has established himself as global thought leader, educating and delivering high level FX research, helping traders to make the best trading decisions.