How to Buy Coinbase (COIN) Stock

- Pick a brokerage. A broker is a financial service company that offers retail investors a trading platform that they can use to buy and sell shares of stock online. ...

- Decide how many shares you want. After you’ve opened your brokerage account, keep track of how the share price of Coinbase moves. ...

- Choose your order type. ...

- Execute your trade. ...

- Company overview.

- Where to buy Coinbase stock.

- Step 1: Pick a stock broker.

- Step 2: Transfer funds to your account.

- Step 3: Decide how much to invest.

- Step 4: Choose between shares of stock or ETFs.

- Step 5: Set up your order type.

- Step 6: Submit the order.

Is Coinbase stock a good investment?

Jul 01, 2021 · How to Buy Coinbase (COIN) Stock Pick a brokerage. A broker is a financial service company that offers retail investors a trading platform that they can... Decide how many shares you want. After you’ve opened your brokerage account, keep track of how the share price of... Choose your order ...

Should you invest in Coinbase?

Buy Coinbase Stock with a Limit Order. In a limit order, you set your upper limit for your investment. For example, you place an order for five shares of Coinbase stock once the price reaches $100 per share. This means your order would only go through if the stock dips to that price. The most you would risk in this investment would be $500.

Why to invest in Coinbase?

Apr 04, 2022 · That’s it, from this point on, you either purchase or decide to wait some more. You also check in on your investment (or potential investment) every now and again. How to buy Coinbase IPO? The short answer is – you can’t! Not anymore, at least. Seeing as how Coinbase went public on April 14, 2021, buying it is no longer an option.

Where to invest in Coinbase?

Nov 10, 2021 · To buy Coinbase stock, investors must have an active brokerage account. Brokerage accounts are usually identified as discount brokerages or full-service brokerages.

How much is Coinbase worth?

Coinbase had a formal valuation in 2018 when the company accepted $300 million in new financing. At that time, the company was estimated to be worth about $8 billion. However, this valuation didn’t take into account the massive success that major cryptocurrencies like Bitcoin and Ethereum have seen since.

Is Coinbase going public?

Coinbase going public was big news for crypto investors. The firm has the largest crypto exchange in the U.S., making crypto investment easier for the masses. Knowing how to tap into Coinbase’s value could help you get the results you want for your portfolio while tapping into a new market you may not have tried.

Is Coinbase a direct listing?

Coinbase chose a direct listing, meaning it passed up the traditional process of allowing investment banks to investigate the company and assign an opening value for the stock’s IPO. Coinbase had a formal valuation in 2018 when the company accepted $300 million in new financing.

How much is Bitcoin worth in 2021?

Bitcoin alone increased in value from about $4,000 per coin in early 2019 to over $57,000 per coin in April 2021. Based on the price of shares that changed hands on the NASDAQ Private Market, experts estimate the company might have been worth nearly $90 billion during price discovery between inside investors.

When was Coinbase founded?

Founded in 2012, Coinbase has maintained its stronghold on the crypto market, continuing to reign as the largest exchange in the United States when measured in terms of users and total market capitalization.

What are the factors to consider when choosing a broker?

Some of the factors you might want to consider when you choose the best broker for your needs may include: • Commissions and fees: Though many brokers now offer commission-free trading, you shouldn’t assume that your broker will allow you to buy and sell stocks with no fees.

What is a broker?

A broker is a financial service company that offers retail investors a trading platform that they can use to buy and sell shares of stock online. Before you can buy or sell stock, you must choose a broker and open your brokerage account.

What is JPMorgan Chase?

JPMorgan Chase & Co. operates as a financial services company worldwide. It operates in four segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM). The CCB segment offers deposit and investment products and services to consumers; lending, deposit, and cash management and payment solutions to small businesses; mortgage origination and servicing activities; residential mortgages and home equity loans; and credit card, auto loan, and leasing services. The CIB segment provides investment banking products and services, including corporate strategy and structure advisory, and equity and debt markets capital-raising services, as well as loan origination and syndication; wholesale payments and cross-border financing; and cash securities and derivative instruments, risk management solutions, prime brokerage, and research. This segment also offers securities services, including custody, fund accounting and administration, and securities lending products for asset managers, insurance companies, and public and private investment funds. The CB segment provides financial solutions, including lending, investment banking, and asset management to small business, large and midsized corporations, local governments, and nonprofit clients; and commercial real estate banking services to investors, developers, and owners of multifamily, as well as to office, retail, industrial, and affordable housing properties. The AWM segment offers multi-asset investment management solutions across equities, fixed income, alternatives, and money market funds to institutional clients and retail investors; and retirement products and services, brokerage, custody, trusts and estates, loans, mortgages, deposits, and investment management products. The company also provides ATM, online and mobile, and telephone banking services. JPMorgan Chase & Co. was founded in 1799 and is headquartered in New York, New York.

Who is Sheri Bechtel?

Sheri Bechtel is the share trading and investments editor at Finder . She is a seasoned journalist who has reported on bonds, stocks, engineering and other topics for more than 20 years. For 12 years, she was a markets reporter for Prospect News, spearheading their coverage of private investments in public equities, high-yield debt, structured products and municipal bonds. Before joining Finder, Sheri was editor-in-chief of Plastics Engineering from Wiley. She has a bachelor’s degree in English from Columbus State University and a side gig as a novelist.

What does a high P/E ratio mean?

The high P/E ratio could mean that investors are optimistic about the outlook for the shares or simply that they're over-valued. However, Coinbase Global's P/E ratio is best considered in relation to those of others within the software-application industry or those of similar companies.

Is Coinbase a legitimate cryptocurrency?

Coinbase has taken cryptocurrency legitimate. At least, that’s the position of many in the cryptocurrency community who see the company’s IPO as proof that digital assets have arrived as mainstream investment products. Investors are excited about crypto, even if many don’t quite know what it is.

Is the SEC regulating crypto?

The SEC has been slow to act on the status of cryptocurrency. While the agency has been clear that it considers some crypto assets securities for the purpose of regulation , it has not created unambiguous categories, black line tests, nor even outlined specifically which major tokens are regulable products.

Should I Buy Coinbase Stock?

Coinbase is a bit different from other publicly traded stocks, primarily because you’re dealing with the enigmatic world of cryptocurrency. The benefits and rewards of cryptocurrency have been hotly debated, with some people concerned about the inherent instability of this new form of digital currency.

How Can I Buy Coinbase Stock?

Now that Coinbase has gone public, it can be publicly traded on the NASDAQ exchange. This means that you can buy Coinbase stock the same way that you would purchase any other stock on the market.

Can I Buy Coinbase Stock Through a Mutual Fund?

You might want to include Coinbase as part of your existing mutual fund. If you rely on a brick-and-mortar brokerage firm, they may be able to do this quite easily. If you choose to rely on a brokerage app or other digital platform, your options may be limited, however.

How to Buy Coinbase Stock Through a Broker

Since Coinbase is now public, you can purchase shares of this stock through any traditional stock market broker.

How to Buy Coinbase Stock Through a Trading Platform

The investing industry has also been revolutionized by the rise in digital investing platforms. These have largely eliminated the need for in-person brokerage firms, though some of these app-based services may be able to offer a robo-advisor to offer personalized guidance.

Can I Buy Coinbase Stock Fractionally?

When Coinbase first went public, it was trading at $328 per share. However, you may also have the option of purchasing fractional shares, which means that you can purchase a portion of a share if you’re unsure about committing too much money to this company.

Can You Day Trade on Coinbase?

Can you day trade on Coinbase? This may sound like a confusing question, because much of what’s been written on this subject has been about trading the cryptocurrency itself.

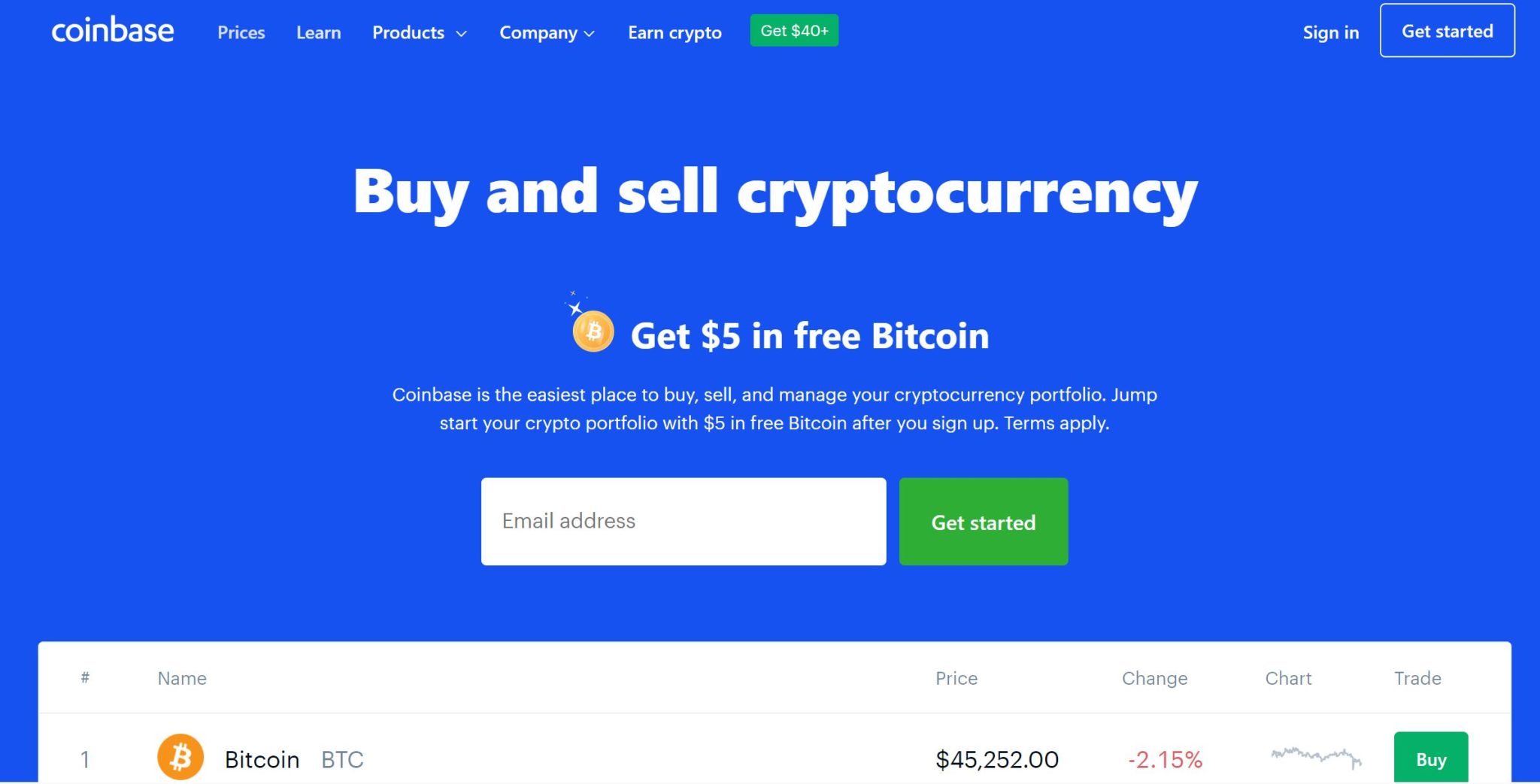

What is Coinbase stock?

Coinbase (NASDAQ: COIN) is the world’s biggest cryptocurrency exchange, supporting dozens of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

What is Coinbase exchange?

Company Overview. Coinbase is a cryptocurrency exchange that was founded in 2012 to help people buy and sell cryptocurrencies like Bitcoin. The company also helps facilitate transactions between traditional currencies like the dollar and cryptocurrencies.

What is a broker company?

Brokerage companies help to facilitate investments in stocks, bonds, ETFs, mutual funds, and other investments. If you want to start investing, the first thing you’ll need to do is open a brokerage account.

What is fundamental analysis?

Many investors use a technique called fundamental analysis. This method looks at things like the company’s cash flows, revenues, profits, and debts to try to arrive at a fair price for a stock. If they think the fair price is higher than the price the stock is trading at, then it may be a good opportunity to buy.

What happens if a company performs poorly?

Risks. Whenever you invest in a company, you’re taking a risk. If that company performs poorly, you could lose some or all of the money you’ve invested. The success of a company relies on a few things, including its ability to produce, maintain, and sell new products and services.

Can you put all your eggs in one basket?

Instead of holding shares in one company, you can hold shares in many companies. Even if one goes bankrupt , you’ll only lose a portion of the money you’ve invested.

How to build a diversified portfolio?

A popular, easy way to build a diversified portfolio is to invest in mutual funds and exchange-traded funds (ETFs). These give you an ownership stake in dozens or hundreds of companies, even though you only have to buy shares in a single fund.

How many users does Coinbase have in 2021?

31, 2021. The company expects verified users of 56 million with $223 billion assets on platform, representing an 11.3% crypto asset market share.

Is Coinbase Global a cryptocurrency?

As the popularity of cryptocurrencies — especially Bitcoin and Ethereum — surges, Coinbase Global ( COIN) is at the forefront of the cryptocurrency industry.