Is GMS efficiently growing its dividend?

GMS does not have a long track record of dividend growth. In the past three months, GMS insiders have sold more of their company's stock than they have bought. Specifically, they have bought $0.00 in company stock and sold $4,258,262.00 in company stock. Only 1.40% of the stock of GMS is held by insiders.

Do analysts agree on GMS Inc (GMS) stock's price targets?

The company's average rating score is 2.86, and is based on 6 buy ratings, 1 hold rating, and no sell ratings. According to analysts' consensus price target of $64.14, GMS has a forecasted upside of 16.3% from its current price of $55.13.

Where can I buy shares of GMS?

Shares of GMS can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Who is the CEO of GMS Inc?

President and CEO of Gms Inc (30-Year Financial, Insider Trades) John C Jr Turner (insider trades) sold 56,561 shares of GMS on 12/06/2021 at an average price of $58.74 a share.

Should I buy or sell GMS stock right now?

7 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for GMS in the last twelve months. There are currently 1 hold rating...

What is GMS's stock price forecast for 2022?

7 brokers have issued 1 year price objectives for GMS's shares. Their forecasts range from $56.00 to $72.00. On average, they expect GMS's stock pr...

How has GMS's stock price performed in 2022?

GMS's stock was trading at $60.11 on January 1st, 2022. Since then, GMS stock has decreased by 14.9% and is now trading at $51.16. View the best g...

When is GMS's next earnings date?

GMS is scheduled to release its next quarterly earnings announcement on Thursday, June 23rd 2022. View our earnings forecast for GMS .

How were GMS's earnings last quarter?

GMS Inc. (NYSE:GMS) released its earnings results on Thursday, December, 2nd. The company reported $2.00 earnings per share for the quarter, toppin...

Who are GMS's key executives?

GMS's management team includes the following people: Mr. John C. Turner Jr. , Pres, CEO & Director (Age 53, Pay $1.83M) ( LinkedIn Profile ) Mr....

What is Michael Callahan's approval rating as GMS's CEO?

11 employees have rated GMS CEO Michael Callahan on Glassdoor.com . Michael Callahan has an approval rating of 78% among GMS's employees.

Who are some of GMS's key competitors?

Some companies that are related to GMS include Beacon Roofing Supply (BECN) , Boise Cascade (BCC) , Aspen Aerogels (ASPN) , Huttig Building Pro...

What other stocks do shareholders of GMS own?

Based on aggregate information from My MarketBeat watchlists, some companies that other GMS investors own include NVIDIA (NVDA) , Deere & Company...

What is Marketbeat community rating?

How much does GMS make?

MarketBeat's community ratings are surveys of what our community members think about GMS and other stocks. Vote “Outperform” if you believe GMS will outperform the S&P 500 over the long term. Vote “Underperform” if you believe GMS will underperform the S&P 500 over the long term. You may vote once every thirty days.

What is the P/E ratio of GMS?

GMS has a market capitalization of $2.07 billion and generates $3.30 billion in revenue each year. The company earns $105.56 million in net income (profit) each year or $3.54 on an earnings per share basis.

What is the rating of GMS?

The P/E ratio of GMS is 18.43, which means that it is trading at a more expensive P/E ratio than the market average P/E ratio of about 15.20.

What is GMS in construction?

GMS has received a consensus rating of Buy. The company's average rating score is 2.71, and is based on 5 buy ratings, 2 hold ratings, and no sell ratings.

Where does GMS trade?

GMS, Inc. is a holding company, which engages in the distribution of wallboard and suspended ceilings systems and complementary interior construction products. It operates through the following segments: Geographic Divisions, Other, and Corporate. The firm offers ceilings products, including suspended mineral fibers, soft fibers, and metal ceiling systems primarily used in offices, hotels, hospitals, retail facilities, schools, and various other commercial and institutional buildings. It also provides steel framing products, such as steel tracks, studs, and various other steel products used to frame the interior walls of a commercial or institutional building; and insulation, lumber and other wood products, ready-mix joint compound, and various other interior construction products, as well as ancillary products comprising tools, fasteners, and safety products. The company was founded by Richard K. Mueller and Richard A. Whitcomb in 1971 and is headquartered in Tucker, GA.

Who owns GMS stock?

GMS trades on the New York Stock Exchange (NYSE) under the ticker symbol "GMS."

How many branches does GMS have?

GMS's stock is owned by a variety of retail and institutional investors. Top institutional shareholders include State of Alaska Department of Revenue (0.07%) and Marotta Asset Management (0.02%).

Where is GMS Inc located?

As of April 30, 2021, the company operated 268 branches across 44 states and the District of Columbia, as well as 6 provinces in Canada. It also operates a network of approximately 265 distribution centers. The company was formerly known as GYP Holdings I Corp. and changed its name to GMS Inc. in July 2015.

What is GMS ceilings?

and changed its name to GMS Inc. in July 2015. GMS Inc. was founded in 1971 and is headquartered in Tucker, Georgia. More... Sector. Industrials. Industry. Trading Companies and Distributors. Employees.

Is GMS bullish or bearish?

GMS Inc. distributes wallboards, suspended ceilings systems, and complementary building products in the United States and Canada. The company offers ceilings products, including suspended mineral fibers, soft fibers, and metal ceiling systems primarily used in offices, hotels, hospitals, retail facilities, schools, and various other commercial and institutional buildings. It also provides steel framing products, such as steel tracks, studs, and various other steel products used to frame the interior walls of a commercial or institutional building; and insulation, lumber and other wood products, ready-mix joint compound, and various other interior construction products, as well as ancillary products comprising tools, fasteners, and safety products. In addition, the company distributes acoustical ceilings, insulation, and related building products, as well as commercial and residential building materials. It serves wallboard and ceilings contractors and homebuilders, general contractors, and individuals. As of April 30, 2021, the company operated 268 branches across 44 states and the District of Columbia, as well as 6 provinces in Canada. It also operates a network of approximately 265 distribution centers. The company was formerly known as GYP Holdings I Corp. and changed its name to GMS Inc. in July 2015. GMS Inc. was founded in 1971 and is headquartered in Tucker, Georgia.

Does GMS pay dividends?

Currently, 4 Wall Street analysts rated GMS as Bullish, while 0 were Bearish, and 3 rated it Neutral. This suggests a consensus of GMS going up. View GMS’s ratings here. 1 Seeking Alpha authors also rated the stock, and their ratings often outperform those of Wall Street analysts. Here are their ratings on GMS

Is GMS stock on the NYSE?

GMS does not currently pay a dividend.

How to calculate money flow?

GMS Inc. is currently listed on NYSE under GMS. One share of GMS stock can currently be purchased for approximately $ 60.18.

How long are futures trading delayed?

Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an "uptick" in price and the value of trades made on a "downtick" in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes.

How often do exchanges report short interest?

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Source: FactSet

What is trailing twelve month net income?

Percentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.

How to calculate P/E?

A company's net income for the trailing twelve month period expressed as a dollar amount per fully diluted shares outstanding.

When are actual numbers added to the table?

The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock's most recent closing price by the sum of the diluted earnings per share from continuing operations for the trailing 12 month period.

Is index time real time?

Calendars and Economy: 'Actual' numbers are added to the table after economic reports are released. Source: Kantar Media

What are the different grades for stocks?

Indexes: Index quotes may be real-time or delayed as per exchange requirements; refer to time stamps for information on any delays. Source: FactSet

How many sectors are there in Zacks?

Within each Score, stocks are graded into five groups: A, B, C, D and F. As you might remember from your school days, an A, is better than a B; a B is better than a C; a C is better than a D; and a D is better than an F.

How many brands does GM have?

The Zacks Sector Rank assigns a rating to each of the 16 Sectors based on their average Zacks Rank.

What is Warren Buffett known for?

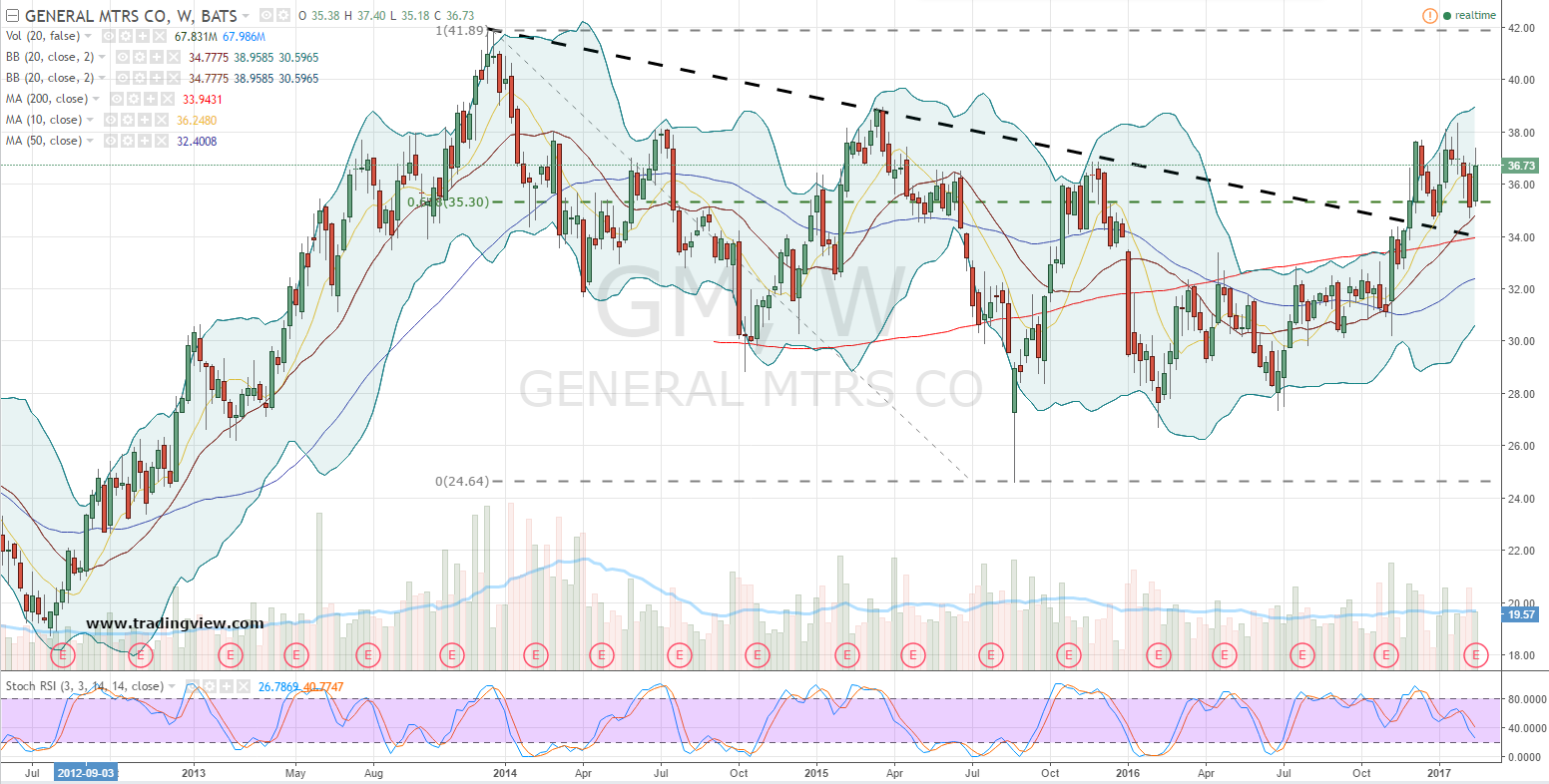

Analyst Report: General Motors Company General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company remains the market leader in the U.S. with 17.3% share in 2020. GM Financial became the company's captive finance arm in October 2010 via the purchase of AmeriCredit.

What is fair value in accounting?

Warren Buffett is best known for his investing prowess, and the numbers prove why. The Oracle of Omaha's Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) has clocked compound annual growth of 20% between 1965 and 2020, doubling S&P 500 returns over the same period, and that trend has continued into 2021. Berkshire Hathaway currently owns nearly 45 stocks, most of which are established companies that have already proved their mettle over the years.

Why was the Chevrolet Bolt recalled?

Fair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected.

Is Rivian Automotive going public?

GM recalled the Chevrolet Bolt EV in 2020 over battery issues. Some vehicles are still catching on fire—and the batteries are made by the same manufacturer that caused Hyundai to recall 76,000 vehicles. Investor's Business Daily • 2 days ago.

Who makes Ocean EV?

Rivian Automotive just went public, surprising many investors after a multi-billion dollar premier, and it looks like Wall Street couldn’t be happier

Did GM workers in Mexico defeat union?

Founded and run by legendary automotive designer Henrik Fisker, unveiled the production version of its Ocean EV SUV.