What is Gladstone Investment's stock symbol?

What is Gladstone Investment's stock symbol? Gladstone Investment trades on the NASDAQ under the ticker symbol "GAIN." Who are Gladstone Investment's major shareholders?

Will Gladstone Investment (gain) gain on rising earnings prospects?

Gladstone Investment (GAIN) has been upgraded to a Zacks Rank #1 (Strong Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. Tapping the debt market for capital, Gladstone (GAIN) priced a public offering of long-term notes with aggregate principal amount of $117 million.

Who is the CEO of Gladstone Investment Corp?

Today, the CEO of Gladstone Investment Corp (GAIN), David Gladstone, bought shares of GAIN for $246.8K.

Will Gladstone’s (gain) public offering drive stock higher?

This might drive the stock higher in the near term. Tapping the debt market for capital, Gladstone (GAIN) priced a public offering of long-term notes with aggregate principal amount of $117 million.

Is Gladstone investment a good stock to buy?

Valuation metrics show that Gladstone Investment Corporation may be overvalued. Its Value Score of D indicates it would be a bad pick for value investors. The financial health and growth prospects of GAIN, demonstrate its potential to underperform the market.

What does Gladstone investment do?

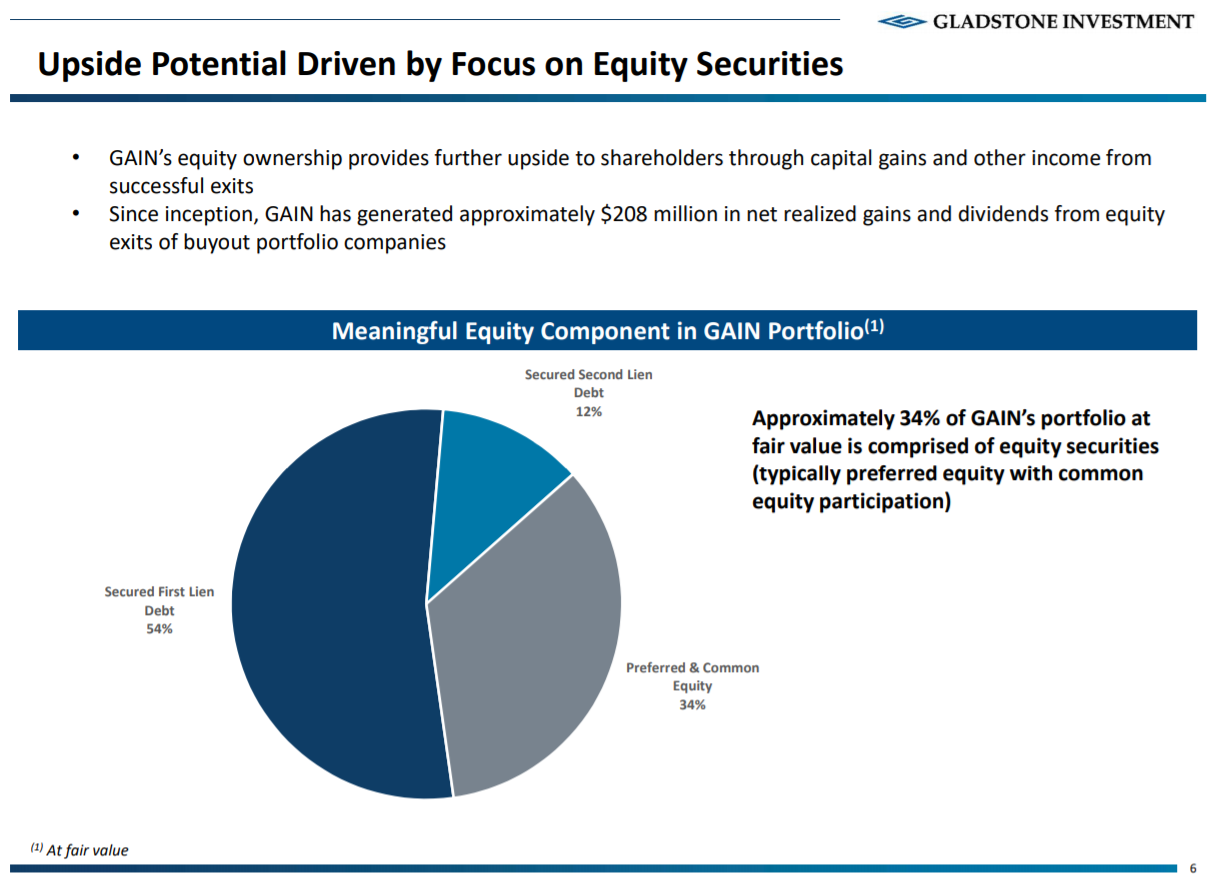

Gladstone Investment Corporation (Nasdaq: GAIN), a business development company, is a private equity fund focused on acquiring mature, lower middle market companies with $20 to $100 million in revenue, attractive fundamentals and strong management teams.

Is Gladstone investment A BDC?

Gladstone Capital Corporation is a BDC that also invests in small and medium sized private businesses in the U.S., historically as a debt fund.

Is GAIN stock a buy?

Today GAIN ranks #1343 as buy candidate.

Is Gladstone investment a REIT?

Gladstone Commercial Corporation (Nasdaq: GOOD) is an equity real estate investment trust (REIT) that invests in single-tenant and anchored multi-tenant net leased industrial and office properties nationwide.

How long has Gladstone been in business?

Our senior management team, under the guidance of David Gladstone and Bob Cutlip, has over 200 years of combined experience investing in real estate and middle market businesses.

Is Gladstone Commercial?

We are a commercial real estate investment company with a track record of success, as exhibited by a history of strong distribution yields, consistent occupancy greater than 95.0% and 10+ years of paying continuous monthly cash distributions.

What stocks pay dividends monthly?

No business development companies (BDC), which are a risky segment that often pays monthly dividends....Realty Income (O) ... SL Green (SLG) ... STAG Industrial (STAG) ... AGNC Investment (AGNC) ... Apple Hospitality REIT (APLE) ... EPR Properties (EPR) ... Agree Realty (ADC)

How often does Glad pay dividends?

There are typically 12 dividends per year (excluding specials), and the dividend cover is approximately 1.5.

Is GAIN a monthly dividend?

GAIN is a very attractive stock for dividend investors. It currently pays a monthly dividend of $0.075 per share. On an annualized basis, the $0.90 per-share dividend represents a 5.5% current dividend yield. The company has a long history of consistent dividend payments to shareholders.

Is GAIN a good company?

GAIN has a Quality Grade of B, ranking ahead of 82.83% of graded US stocks.

McCarthy Asset Management, Inc. Buys ARK Innovation ETF, Parker Hannifin Corp, Adient PLC, ..

Gladstone Capital (GLAD) Q1 Earnings and Revenues Top Estimates

Investment company McCarthy Asset Management, Inc.

About GAIN

Gladstone Capital (GLAD) delivered earnings and revenue surprises of 35% and 12.74%, respectively, for the quarter ended December 2021. Do the numbers hold clues to what lies ahead for the stock?

Analyst Forecast

Gladstone Investment Corporation specializes in lower middle market, mature stage, buyouts; refinancing existing debt; senior debt securities such as senior loans, senior term loans, lines of credit, and senior notes; senior subordinated debt securities such as senior subordinated loans and senior subordinated notes; junior subordinated debt securities such as subordinated notes and mezzanine loans; limited liability company interests, and warrants or options.

News

According to 9 analysts, the average rating for GAIN stock is "Sell." The 12-month stock price forecast is 16.32, which is an increase of 8.22% from the latest price.

How much is Gladstone stock worth in 2020?

When markets that have flown so high for so long start to tumble, along with an economy that transitioning, safe stocks are essential. The post 7 Safe Stocks to Rely On When the Market Swerves appeared ...

Is Gladstone a hold stock?

How has Gladstone Investment's stock price been impacted by COVID-19? Gladstone Investment's stock was trading at $9.96 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization (WHO). Since then, GAIN shares have increased by 43.2% and is now trading at $14.26.

Is Gain a dividend payer?

There are currently 1 hold rating for the stock. The consensus among Wall Street analysts is that investors should "hold" Gladstone Investment stock. A hold rating indicates that analysts believe investors should maintain any existing positions they have in GAIN, but not buy additional shares or sell existing shares.