What is the offer price for Genentech shares?

GENENTECH : Roche Increases Offer Price for Genentech Shares to US$ 93.00 per Share and Ex.. News in other languages on GENENTECH, INC. GENENTECH : Roche détient 93,2% du capital. Analyst Recommendations on GENENTECH, INC.

Is Genentech still traded under the gene symbol?

Genentech is no longer traded under the GENE symbol and the statements in this story do not describe the company’s current stock market presence under the Roche Group. U.S. investors interested in investing in the Roche Group or Genentech can learn more here.

When did Roche acquire Genentech?

In 2009, Swiss pharmaceutical company Roche acquired Genentech, keeping its local identity but offering international reach. How do you build a company when the science-minded want to publish their work and the business-focused want to protect their inventions?

What happened to Genentech in the late 1990s?

Genentech reached new heights in the late 1990s, with revenues surpassing the $1 billion mark for the first time in 1997 before reaching $1.15 billion the year after. The reemphasis on research revitalized the company's product pipeline, leading to a substantial increase in the sales of products Genentech marketed itself.

See more

What happened Genentech stock?

Following its purchase of all the outstanding stock of Genentech lastmonth, Roche has publicly offered 20 million of the latter's common stock at a price of $97 per share, thus raising a gross $1.94 billion.

What is Genentech stock price?

Stock market history ROCHE HOLDING (GENENTECH)XPriceJun 2, 2022323.35Jun 1, 2022322.7May 31, 2022326.4May 30, 2022330.7214 more rows

Does Genentech have a stock?

The Roche Group (of which Genentech is a wholly-owned member) is traded in the United States as a U.S.-dollar denominated American Depositary Receipt (“ADR”) on the OTCQX International Premier market under the stock symbol: RHHBY.

When did Genentech ipo?

Genentech IPO soars - Jul. 20, 1999. NEW YORK (CNNfn) - Shares of biotechnology company Genentech Inc. soared more than 30 points above its initial public offering price Tuesday, as investors bet heavily on a top company in a popular sector.

What happened to Genentech stock on the first day it was offered?

The Los Angeles Times called trading that Tuesday “a frenzy the likes of which hasn't been seen on Wall Street since the go-go days of the 1960s.” That morning, Genentech issued a million shares of stock in its Initial Public Offering (IPO), at an opening price of $35 each.

Is Roche a good investment?

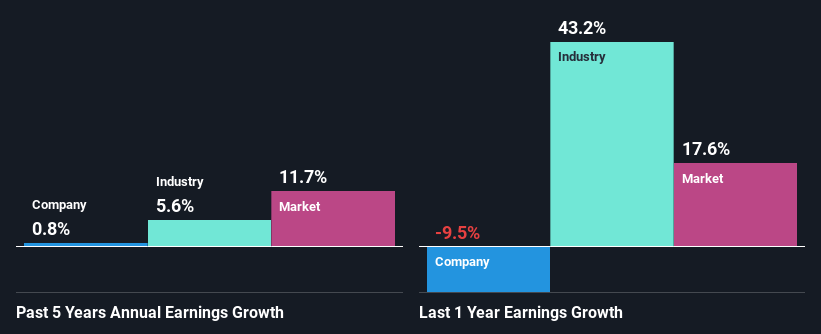

Roche Holding AG (RHHBY) could be a solid choice for investors given its recent upgrade to a Zacks Rank #1 (Strong Buy). This upgrade primarily reflects an upward trend in earnings estimates, which is one of the most powerful forces impacting stock prices.

Is Genentech stock a good buy?

Wei says Genentech remains "one of" the best high-quality biotech stocks, rates it a "buy" and has a $117 one-year target price for the stock (symbol DNA). The shares traded at $81 Thursday.

Did Roche buy Genentech?

When Roche leadership bought 56% of Genentech for $2.1 billion in 1990, “it was a highly controversial move back in Switzerland,” according to Krognes. “A lot of people thought it was a waste of money [to buy] a young biotechnology company for $2 billion.

Who owns Genentech?

Roche Holding AGGenentech / Parent organizationConsidered the founder of the industry, Genentech, now a member of the Roche Group, has been delivering on the promise of biotechnology for more than 40 years.

Does Pfizer own Genentech?

Roche Holding's agreement on Thursday to acquire full ownership of Genentech for $46.8 billion is the third big drug industry merger this year. But it is different from the other two — Pfizer's $68 billion proposal to acquire Wyeth and Merck's $41 billion deal with Schering-Plough — in crucial ways.

Is Genentech a Fortune 500?

RANK78. The South San Francisco–based biotech giant has earned a place on Fortune's Best Companies list for 24 consecutive years.

When did Genentech go private?

2009Genentech, Inc., is an American biotechnology corporation which became a subsidiary of Roche in 2009. Genentech Research and Early Development operates as an independent center within Roche....Genentech.TypePrivate ( Independent subsidiary)HeadquartersSouth San Francisco, California, United States9 more rows

Is Genentech stock a good buy?

Wei says Genentech remains "one of" the best high-quality biotech stocks, rates it a "buy" and has a $117 one-year target price for the stock (symbol DNA). The shares traded at $81 Thursday.

What company owns Genentech?

Roche Holding AGGenentech / Parent organizationConsidered the founder of the industry, Genentech, now a member of the Roche Group, has been delivering on the promise of biotechnology for more than 40 years.

Is Genentech a Fortune 500 company?

RANK78. The South San Francisco–based biotech giant has earned a place on Fortune's Best Companies list for 24 consecutive years.

Did Roche buy Genentech?

When Roche leadership bought 56% of Genentech for $2.1 billion in 1990, “it was a highly controversial move back in Switzerland,” according to Krognes. “A lot of people thought it was a waste of money [to buy] a young biotechnology company for $2 billion.

What was the first biotech company to go public?

What is Genentech postdoc?

The Wall Street Journal called it “one of the most spectacular market debuts in recent history.”. Genentech —trading then under the symbol GENE—was the first biotechnology company to go public, and set the pace for a series of heady biotech IPOs that defined the era.

What happened on October 14th 1980?

Inspired by academia, Genentech’s postdoc program fosters curiosity and creative thinking.

How long after breast cancer treatment was approved?

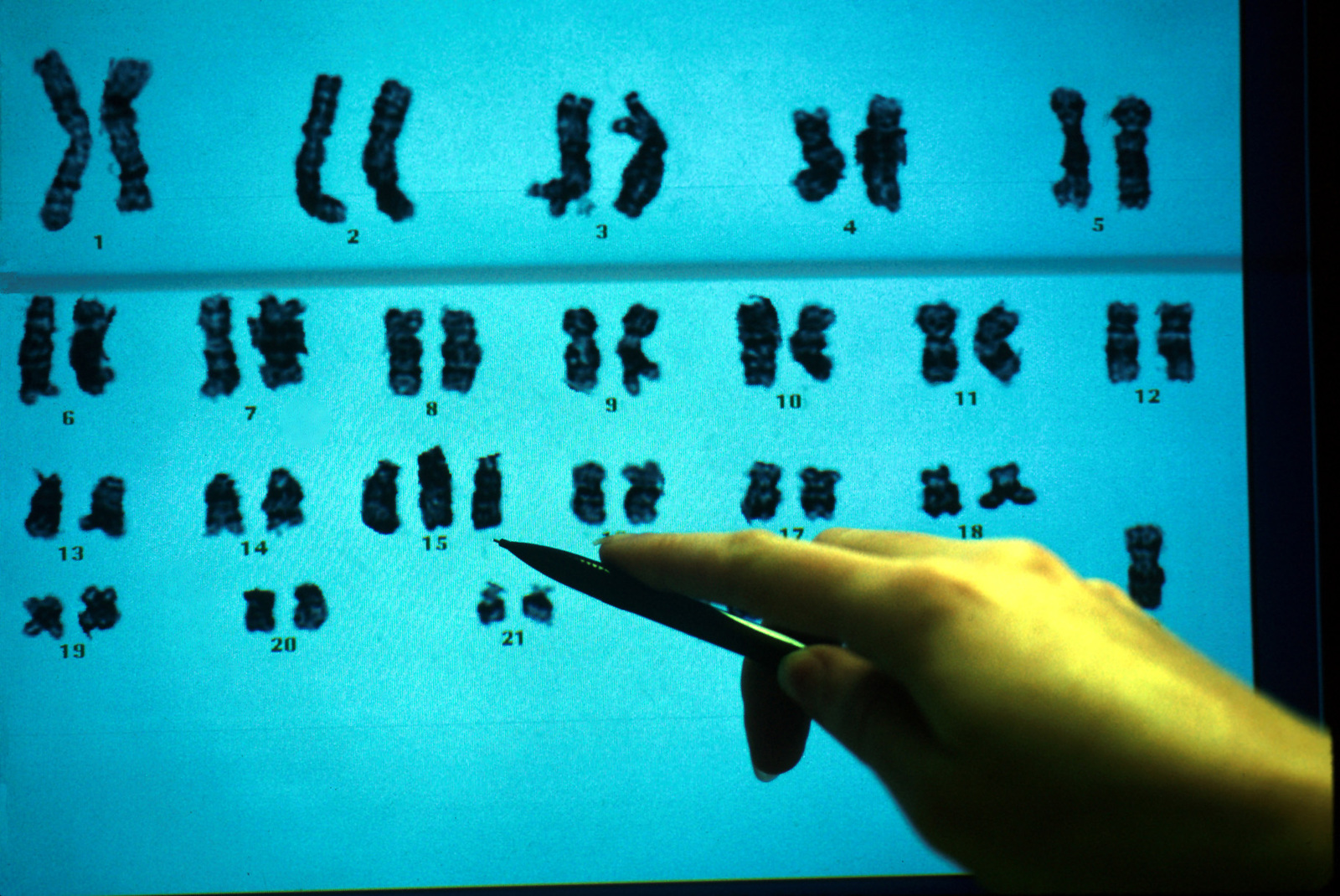

October 14, 1980 was a wild day at the stock market. The Los Angeles Times called trading that Tuesday “a frenzy the likes of which hasn’t been seen on Wall Street since the go-go days of the 1960s.” That morning, Genentech issued a million shares of stock in its Initial Public Offering (IPO), at an opening price of $35 each. Within an hour, the stock—for those who got their hands on it—leapt to $88 a share, closing at $71.25. The Wall Street Journal called it “one of the most spectacular market debuts in recent history.”

What is a new hire in cystic fibrosis?

Just 11 hours after a medicine for metastatic breast cancer was FDA-approved, it was on the way to a patient who needed it.

Is Genentech a long term commitment?

A new hire pursues an idea, from musty journals to clinical trials, eventually changing the way cystic fibrosis is treated.

Is Genentech still trading?

With the FDA approval of its very first medicine, Genentech makes a long-term commitment to patient access.

What companies bought Activase?

Genentech is no longer traded under the GENE symbol and the statements in this story do not describe the company’s current stock market presence under the Roche Group. U.S. investors interested in investing in the Roche Group or Genentech can learn more here.

Why did Genentech sue the FDA?

The regulatory, legal, and clinical roadblocks that stymied Genentech's introduction of Activase, combined with competition from large pharmaceutical and chemical companies that bought into biotechnology in the late 1980s, culminated in Genentech's 60 percent acquisition by Switzerland's Roche Holding Ltd. The merger was one of many in 1989 and 1990, which resulted in such pharmaceutical giants as SmithKline Beecham plc and Bristol-Myers Squibb Company. Genentech used the $2.1 billion influx of capital to fund research, finance patent disputes, and invest in cooperative ventures to develop synthetic drugs using biotechnological discoveries. Also in 1990, G. Kirk Raab, whom the Wall Street Journal described as a 'master marketer,' was named CEO of Genentech. That year, the company launched the first commercial life sciences experiment in space when it sponsored research aboard the space shuttle Discovery, and it received FDA approval to expand the marketing of Activase to include the treatment of acute massive pulmonary embolism (blood clots in the lungs).

What was the first product of Genentech?

To counter this potential threat to their market, Genentech sued the FDA to force the agency to determine which company held exclusive rights to the product. At the end of 1991, Genentech's Protropin maintained an impressive 75 percent share of the HGH market.

How much did Hoffmann La Roche pay Genentech?

The first product independently marketed by Genentech, human growth hormone (HGH) or Protropin, generated $43.6 million in sales in 1986. Demand for HGH increased as the medical profession learned more about the drug's capabilities and diagnosed hormone inadequacy more frequently. Protropin enjoyed record-setting sales over the next six years, topping $155 million by 1991. Approved by the FDA in 1985, Protropin helped prevent dwarfism in children. Genentech's entry into the market was facilitated by an FDA decision to ban the drug's predecessor because it was contaminated with a virus. By the end of the 1980s a 'new and improved' version of HGH patented by Eli Lilly also had received approval from the FDA. Lilly's drug, unlike Genentech's version, actually replicated the growth hormone found in the human body. To counter this potential threat to their market, Genentech sued the FDA to force the agency to determine which company held exclusive rights to the product. At the end of 1991, Genentech's Protropin maintained an impressive 75 percent share of the HGH market.

Why did Genentech enter the market?

Hoffmann-La Roche purchased the rights to Interferon--which it marketed as Roferon-A--and paid approximately $5 million in royalties to Genentech in 1987.

How much did Roche raise in 1999?

Genentech's entry into the market was facilitated by an FDA decision to ban the drug's predecessor because it was contaminated with a virus. By the end of the 1980s a 'new and improved' version of HGH patented by Eli Lilly also had received approval from the FDA.

When did Nutropin AQ become FDA approved?

In October 1999 Roche made a secondary offering of 20 million Genentech shares at $143.50, raising $2.87 billion in the largest secondary offering in U.S. history. Following the offerings, Roche held a 66 percent stake in Genentech, which retained the operational autonomy through which it had thrived.