Is VanEck junior gold miners ETF gdxj a good dividend stock?

Since then, GDXJ shares have increased by 21.2% and is now trading at $40.57. View which stocks have been most impacted by COVID-19. Is VanEck Junior Gold Miners ETF a good dividend stock? VanEck Junior Gold Miners ETF pays an annual dividend of $0.86 per share and currently has a dividend yield of 2.09%.

What does gdxj stand for?

Artemis Gold Inc. ("Artemis" or the "Company") is pleased to announce that the Company has been added to the VanEck Vectors Junior Gold Miners Exchange Traded Fund (NYSE: GDXJ) ("GDXJ") pursuant to the GDXJ's quarterly rebalancing, with effect starting December 17, 2021.

What is the best price to buy gold and gdxj at?

- Visit 1840-1860$ gold and a double top in GDXJ at 48$ - Move higher to 191x in gold and GDXJ at 52$ and... ... for a 1.12 credit.

What happened to the GDX and gdxj?

Details on the GDX and GDXJ Gold ETFs According to Lam, the GDX has seen about $1.1 billion in outflows during the first quarter so far. Total assets under management in the GDX and GDXJ is down by about 17% quarter-over-quarter. The GDX provides exposure to 51 gold and silver miners.

Is GDXJ a good stock to buy?

GDXJ is in an unsustainable position. With $5.5B in assets, the ETF has to buy a whopping 20% of the junior miners sector. Thus, it can't trade in and out of positions without sending prices to the moon/floor when the index changes and forces it to add or drop a position.

Does GDXJ pay dividend?

VanEck Vectors Junior Gold Miners ETF (GDXJ) GDXJ has a dividend yield of 2.40% and paid $0.75 per share in the past year. The dividend is paid once per year and the last ex-dividend date was Dec 20, 2021.

What companies make up GDXJ?

GDXJ Top 10 Holdings[View All]Yamana Gold Inc. 5.76%Kinross Gold Corporation 5.64%Pan American Silver Corp. 5.43%SSR Mining Inc 4.07%B2Gold Corp. 3.76%Endeavour Mining PLC 3.73%Evolution Mining Limited 3.28%Alamos Gold Inc. 3.28%More items...

What is GDX and GDXJ?

GDX is designed to replicate the performance of the NYSE Arca Gold Miners Index, a benchmark that consists of publicly traded companies involved in gold mining. GDXJ is a relatively new fund. It was established in November 2009. It has become quite popular and its total assets have increased to $800 million.

Does Sil pay a dividend?

SIL Dividend Yield: 1.99% for July 6, 2022.

Does Gdx pay dividend?

VanEck Gold Miners ETF (NYSEARCA:GDX) pays annual dividends to shareholders.

What are gold miners Junior?

A junior gold miner is a junior company that exclusively mines gold. Most of these companies are in the development and exploration phase and are on the lookout for land with a higher chance for uncovering large mineral deposits.

What stocks make up JNUG?

Top 3 HoldingsCompanySymbolTotal Net AssetsDreyfus Government Cash Management Institutional ShsDGCXX58.99%VanEck Junior Gold Miners ETFGDXJ39.86%Financial Square Treasury Instruments Fund FST SharesFTIXX34.49%

Is Gdx a buy or sell?

Barchart Opinions are not a recommendation to buy or sell a security....Barchart Opinion.Composite IndicatorTrendSpotterSell200 Day Moving AverageSell100 - 200 Day MACD OscillatorBuy100 - Day Average Volume: 24,624,049Average: 50% Sell15 more rows•6 days ago

Is Gdxj a leveraged ETF?

On their own, small caps and gold miners can be volatile assets. Combined, the volatility increases. JNUG is the triple-leveraged answer to the VanEck Vectors Junior Gold Miners ETF (GDXJ), an ETF with a three-year standard deviation of just over 50 percent.

What is the difference between GLD and GDX?

GDX has a 0.53% expense ratio, which is higher than GLD's 0.40% expense ratio. Scroll down to visually compare performance, riskiness, drawdowns, and other indicators and decide which one is better suits your portfolio: GDX or GLD....Key characteristics.GDXGLDMax Drawdown-80.57%-45.56%6 more rows

How has VanEck Junior Gold Miners ETF's stock price performed in 2022?

VanEck Junior Gold Miners ETF's stock was trading at $41.93 at the start of the year. Since then, GDXJ shares have decreased by 3.9% and is now tra...

Is VanEck Junior Gold Miners ETF a good dividend stock?

VanEck Junior Gold Miners ETF(NYSEARCA:GDXJ) pays an annual dividend of $0.75 per share and currently has a dividend yield of 1.93%. View VanEck J...

What other stocks do shareholders of VanEck Junior Gold Miners ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other VanEck Junior Gold Miners ETF investors own include VanEck...

What is VanEck Junior Gold Miners ETF's stock symbol?

VanEck Junior Gold Miners ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "GDXJ."

Who are VanEck Junior Gold Miners ETF's major shareholders?

VanEck Junior Gold Miners ETF's stock is owned by many different institutional and retail investors. Top institutional shareholders include Toronto...

Which major investors are selling VanEck Junior Gold Miners ETF stock?

GDXJ stock was sold by a variety of institutional investors in the last quarter, including Alaska Permanent Fund Corp, DAVENPORT & Co LLC, Canada P...

Which major investors are buying VanEck Junior Gold Miners ETF stock?

GDXJ stock was purchased by a variety of institutional investors in the last quarter, including Toronto Dominion Bank, Twin Tree Management LP, UBS...

How do I buy shares of VanEck Junior Gold Miners ETF?

Shares of GDXJ can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBul...

What is VanEck Junior Gold Miners ETF's stock price today?

One share of GDXJ stock can currently be purchased for approximately $40.31.

How has VanEck Junior Gold Miners ETF's stock been impacted by COVID-19 (Coronavirus)?

VanEck Junior Gold Miners ETF's stock was trading at $33.46 on March 11th, 2020 when COVID-19 (Coronavirus) reached pandemic status according to the World Health Organization. Since then, GDXJ shares have increased by 29.9% and is now trading at $43.48. View which stocks have been most impacted by COVID-19.

Is VanEck Junior Gold Miners ETF a good dividend stock?

VanEck Junior Gold Miners ETF pays an annual dividend of $0.75 per share and currently has a dividend yield of 1.76%. View VanEck Junior Gold Miners ETF's dividend history.

What other stocks do shareholders of VanEck Junior Gold Miners ETF own?

Based on aggregate information from My MarketBeat watchlists, some companies that other VanEck Junior Gold Miners ETF investors own include VanEck Gold Miners ETF (GDX), NVIDIA (NVDA), Tencent (TCEHY), SPDR Gold Shares (GLD), iShares Silver Trust (SLV), Advanced Micro Devices (AMD), Alibaba Group (BABA), Wheaton Precious Metals (WPM), Tesla (TSLA) and AbbVie (ABBV)..

What is VanEck Junior Gold Miners ETF's stock symbol?

VanEck Junior Gold Miners ETF trades on the New York Stock Exchange (NYSE)ARCA under the ticker symbol "GDXJ."

Who are VanEck Junior Gold Miners ETF's major shareholders?

VanEck Junior Gold Miners ETF's stock is owned by a variety of institutional and retail investors. Top institutional investors include Rafferty Asset Management LLC (4.05%), Toronto Dominion Bank (2.85%), CMT Capital Markets Trading GmbH (0.00%), Exor Capital LLP (1.97%), Susquehanna International Group LLP (0.00%) and Bank of Montreal Can (1.74%).

Which major investors are selling VanEck Junior Gold Miners ETF stock?

GDXJ stock was sold by a variety of institutional investors in the last quarter, including Toronto Dominion Bank, Alberta Investment Management Corp, Bank of America Corp DE, Susquehanna International Group LLP, JPMorgan Chase & Co., Baird Financial Group Inc., SG Americas Securities LLC, and Credit Suisse AG.

Which major investors are buying VanEck Junior Gold Miners ETF stock?

GDXJ stock was acquired by a variety of institutional investors in the last quarter, including Teacher Retirement System of Texas, CMT Capital Markets Trading GmbH, Marlin Sams Capital Management LLC, BNP Paribas Arbitrage SA, Twin Tree Management LP, Marathon Trading Investment Management LLC, Citadel Advisors LLC, and Desjardins Global Asset Management Inc...

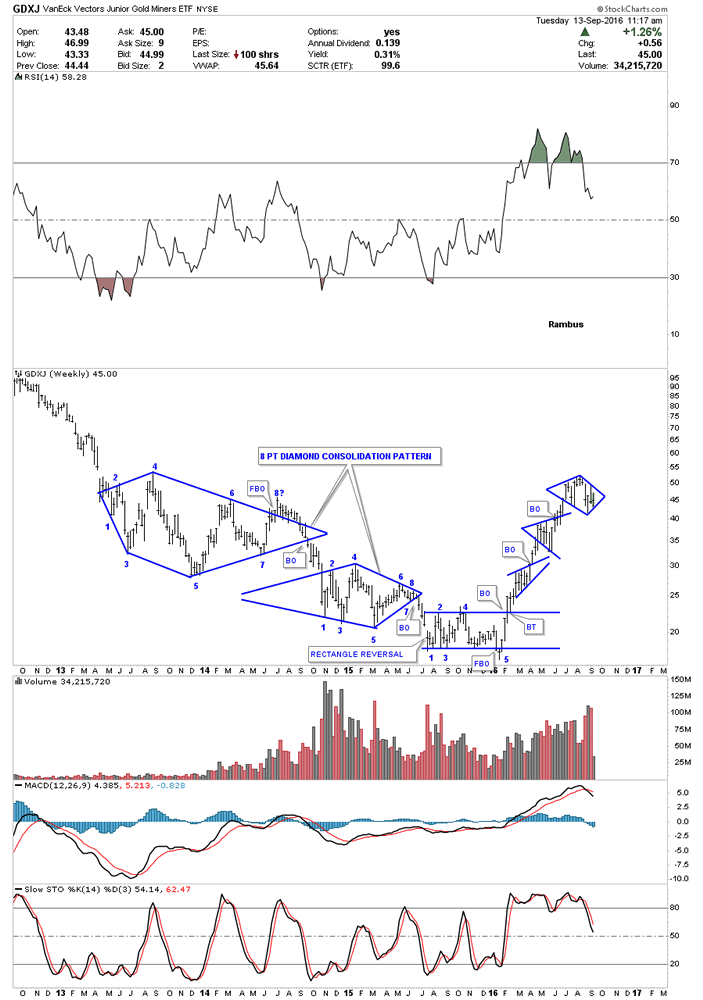

GDXJ Stock Fund Chart

Think there is a high chance GDXJ could visit 50-52 in next next weeks with gold also rising to 1950$ Only with a weak gold and general market going down, GDXJ could move lower in the rest month (red target) Has tested twice a strong support 37$ and rejected. Think gold and GDXJ has legs. Mean while some music I like. www.youtube.com

Ideas

Think there is a high chance GDXJ could visit 50-52 in next next weeks with gold also rising to 1950$ Only with a weak gold and general market going down, GDXJ could move lower in the rest month (red target) Has tested twice a strong support 37$ and rejected. Think gold and GDXJ has legs. Mean while some music I like. www.youtube.com

Signals & Forecast

The VanEck Vectors Junior Gold Miners ETF holds a sell signal from the short-term moving average; at the same time, however, there is a buy signal from the long-term average. Since the short-term average is above the long-term average there is a general buy signal in the ETF giving a positive forecast for the stock.

Support, Risk & Stop-loss

VanEck Vectors Junior Gold Miners finds support from accumulated volume at $41.42 and this level may hold a buying opportunity as an upwards reaction can be expected when the support is being tested.

Is VanEck Vectors Junior Gold Miners ETF ETF A Buy?

Several short-term signals are positive, despite the ETF being in a falling trend, we conclude that the current level may hold a buying opportunity as there is a fair chance for ETF to perform well in the short-term. We have upgraded our analysis conclusion for this ETF since the last evaluation from a Hold/Accumulate to a Buy candidate.

About VanEck Vectors Junior Gold Miners ETF

The investment seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Global Junior Gold Miners Index. The fund normally invests at least 80% of its total assets in securities that comprise the index.

Golden Star Signal

This unique signal uses moving averages and adds special requirements that convert the very good Golden Cross into a Golden Star. This signal is rare and, in most cases, gives substantial returns. From 10 000+ stocks usually only a few will trigger a Golden Star Signal per day!

Top Fintech Company

featured in The Global Fintech Index 2020 as the top Fintech company of the country.