Why did the stock market crash in 1929?

The initial decline in U.S. output in the summer of 1929 is widely believed to have stemmed from tight U.S. monetary policy aimed at limiting…. During the mid- to late 1920s, the stock market in the United States underwent rapid expansion.

What was the first stock market crash in history?

The earliest-known market crash was the Dutch Tulip Bulb Market Bubble, also known as Tulipmania, which took place in 1637. 1 The first U.S. stock market crash was the Financial Crisis of 1791 to 1792, an event that was preceded by the Crisis of 1772, which occurred in the 13 colonies. 2

What happened in the year 2000 in the stock market?

The Crash of 2000. A total of 8 trillion dollars of wealth was lost in the crash of 2000. From 1992-2000, the markets and the economy experienced a period of record expansion. On September 1, 2000, the NASDAQ traded at 4234.33.

Can fracking fix the decline rate on the Wells?

While fracking is an amazing technological achievement, one thing that nobody has yet figured out how to fix is the decline rate on the wells. So, once you drill a well. If you drilled a conventional well, it's going to keep producing oil or gas for a lot of years. In the case of fracking, the wells decline at a really steep rate.

What caused the stock market crash of 1920s?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it, during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels.

What happened to the stock market during the 1920s?

Throughout the 1920s a long boom took stock prices to peaks never before seen. From 1920 to 1929 stocks more than quadrupled in value. Many investors became convinced that stocks were a sure thing and borrowed heavily to invest more money in the market.

What mistake in the 1920s did investors make that allowed the stock market crash to lead the US into a major economic depression?

Investors could not repay what they borrowed, and banks could not repay the investors from whom they had borrowed. After the stock market crashed, Americans feared that banks would soon fail. People immediately began to withdraw funds from their accounts, causing thousands of banks to close.

How did the collapse of the stock market impact America?

The stock market crash crippled the American economy because not only had individual investors put their money into stocks, so did businesses. When the stock market crashed, businesses lost their money. Consumers also lost their money because many banks had invested their money without their permission or knowledge.

What two factors caused the stock market crash?

What caused the 1929 stock market crash?Overconfidence and oversupply: Investors and institutions were piling into the stock market during the early 1920s as the economy expanded. ... Buying on margin: Margin is the practice of taking a loan to buy stocks which can amplify gains and losses.More items...•

Who profited from the stock market crash of 1929?

The classic way to profit in a declining market is via a short sale — selling stock you've borrowed (e.g., from a broker) in hopes the price will drop, enabling you to buy cheaper shares to pay off the loan. One famous character who made money this way in the 1929 crash was speculator Jesse Lauriston Livermore.

What two things made the Great Depression so devastating?

It began after the stock market crash of October 1929, which sent Wall Street into a panic and wiped out millions of investors. Over the next several years, consumer spending and investment dropped, causing steep declines in industrial output and employment as failing companies laid off workers.

What caused the stock market crash of 1929 for dummies?

Major Causes of the Crash Wild speculation - The market had grown too fast and stocks were overvalued. The stocks were worth much more than the real value of the companies they represented. The economy - The economy had slowed down considerably and the stock market didn't reflect it.

What were the 5 causes of the Great Depression?

of 05. Stock Market Crash of 1929. Workers flood the streets in a panic following the Black Tuesday stock market crash on Wall Street, New York City, 1929. ... of 05. Bank Failures. ... of 05. Reduction in Purchasing Across the Board. ... of 05. American Economic Policy With Europe. ... of 05. Drought Conditions.

How did agriculture contribute to the stock market crash?

As Food Demand Drops, Farm Prices Collapse Until then, land prices had been rising rapidly as farmers and non-farmers saw buying farms as a good investment. With the collapse of farm prices, the land bubble burst, often dropping the market value of the land well below what the investor owed on it.

Who was most affected by the stock market crash of 1929?

Unsurprisingly, African American men and women experienced unemployment, and the grinding poverty that followed, at double and triple the rates of their white counterparts. By 1932, unemployment among African Americans reached near 50 percent.

What is the famous Day called when the stock market crash of 1929 took place?

October 1929. On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

How long did the 1920-1921 bear market last?

The 1920-1921 bear market started in November 1919 and lasted for nearly two years with the Dow Industrials dropping around 45% before bottoming out. This bear however was different to the normal bear markets as the entire decline actually occurred during the first four months.

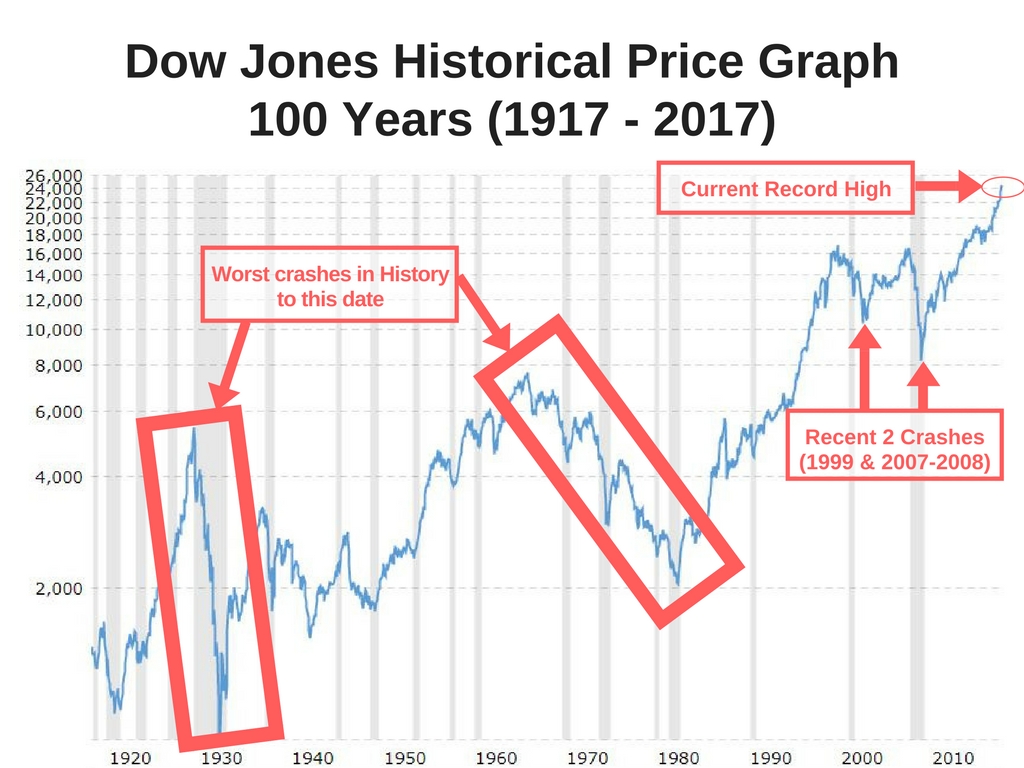

When was the Dow Industrials Average created?

The Dow Industrials Average. The Dow Industrials Average was originally formed in 1896 with just 12 stocks. This was increased to 20 stocks in 1916 and in 1928 was again increased to 30 stocks - which is the number of stocks used today..

How long do bear markets last?

These market corrections can last for many months and the bear markets can last for a year or two and sometimes three. Bull markets and bear markets along with the less severe market corrections are a normal function of the stock market.

What happened to the stock market after the 1929 crash?

After the crash, the stock market mounted a slow comeback. By the summer of 1930, the market was up 30% from the crash low. But by July 1932, the stock market hit a low that made the 1929 crash. By the summer of 1932, the Dow had lost almost 89% of its value and traded more than 50% below the low it had reached on October 29, 1929.

How much wealth was lost in the 1929 stock market crash?

The Crash of 1929. In total, 14 billion dollars of wealth were lost during the market crash. On September 4, 1929, the stock market hit an all-time high. Banks were heavily invested in stocks, and individual investors borrowed on margin to invest in stocks.

How much wealth was lost in the 2000 crash?

The Crash of 2000. A total of 8 trillion dollars of wealth was lost in the crash of 2000. From 1992-2000, the markets and the economy experienced a period of record expansion. On September 1, 2000, the NASDAQ traded at 4234.33. From September 2000 to January 2, 2001, the NASDAQ dropped 45.9%.

What happened in 1987?

The Crash of 1987. During this crash, 1/2 trillion dollars of wealth were erased. The markets hit a new high on August 25, 1987 when the Dow hit a record 2722.44 points. Then, the Dow started to head down. On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day.

How much did the Dow drop in 1987?

On October 19, 1987, the stock market crashed. The Dow dropped 508 points or 22.6% in a single trading day. This was a drop of 36.7% from its high on August 25, 1987.

What is a stock crash?

Stock Market Crash is a strong price decline across majority of stocks on the market which results in the strong decline over short period on the major market indexes (NYSE Composite, Nasdaq Composite DJIA and S&P 500).

When did banks go out of business?

When these banks started to invest heavily in the stock market, the results proved to be devastating, once the market started to crash. By 1932, 40% of all banks in the U.S. had gone out of business.

What was the cause of the 1929 stock market crash?

The primary cause of the 1929 stock market crash was excessive leverage. Many individual investors and investment trusts had begun buying stocks on margin, meaning that they paid only 10% of the value of a stock to acquire it under the terms of a margin loan.

What was the worst stock market crash in history?

The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.

Why did the Dow drop in 1929?

The Dow didn't regain its pre-crash value until 1954. The primary cause of the 1929 stock market crash was excessive leverage. Many individual investors and investment trusts had begun buying stocks on margin, meaning that they paid only 10% of the value of a stock to acquire it under the terms of a margin loan.

Why did the stock market recover from Black Monday?

Because the Black Monday crash was caused primarily by programmatic trading rather than an economic problem, the stock market recovered relatively quickly. The Dow started rebounding in November, 1987, and recouped all its losses by September of 1989.

When did the Dow Jones Industrial Average rise?

The Dow Jones Industrial Average ( DJINDICES:^DJI) rose from 63 points in August, 1921, to 381 points by September of 1929 -- a six-fold increase. It started to descend from its peak on Sept. 3, before accelerating during a two-day crash on Monday, Oct. 28, and Tuesday, Oct. 29.

When did the Dow lose its value?

The stock market was bearish, meaning that its value had declined by more than 20%. The Dow continued to lose value until the summer of 1932, when it bottomed out at 41 points, a stomach-churning 89% below its peak. The Dow didn't regain its pre-crash value until 1954.

What happened on Black Monday 1987?

Black Monday crash of 1987. On Monday, Oct. 19, 1987, the Dow Jones Industrial Average plunged by nearly 22%. Black Monday, as the day is now known, marks the biggest single-day decline in stock market history. The remainder of the month wasn't much better; by the start of November, 1987, most of the major stock market indexes had lost more ...

Why did the Federal Reserve slash interest rates?

The biggest one is that when the Federal Reserve, really, slashed interest rates in the wake of the financial crisis, that's what helped enable the capital for the shale revolution, because all of a sudden you had really, really, really cheap debt.

Did the Permian have oil?

And it's odd, because, you know, the Permian has always been, kind of, the center of U.S. oil production, but people just didn't think to frack there. And once they did, the Permian turned out to just be made for fracking, its geology was tailor-made to be fracked and it became this Permania, people called it.

Does fracking for natural gas have a lot of supply?

One thing is that, because fracking for natural gas unleashed a plethora of supply, which is what you would expect, right; if it worked, we're going to have lots of supply of natural gas. But the natural gas titans, like, McClendon forgot the old role of commodity investing.

What lessons did the Federal Reserve learn from the 1929 stock market crash?

9. First, central banks – like the Federal Reserve – should be careful when acting in response to equity markets. Detecting and deflating financial bubbles is difficult.

What happened in 1929?

Commercial banks continued to loan money to speculators, and other lenders invested increasing sums in loans to brokers. In September 1929, stock prices gyrated, with sudden declines and rapid recoveries.

How much did the Dow drop in 1932?

The slide continued through the summer of 1932, when the Dow closed at 41.22, its lowest value of the twentieth century, 89 percent below its peak.

What happened on Black Monday 1929?

On Black Monday, October 28, 1929, the Dow Jones Industrial Average declined nearly 13 percent. Federal Reserve leaders differed on how to respond to the event and support the financial system.

When did the Dow Jones Industrial Average increase?

The Dow Jones Industrial Average increased six-fold from sixty-three in August 1921 to 381 in September 1929 . After prices peaked, economist Irving Fisher proclaimed, “stock prices have reached ‘what looks like a permanently high plateau.’” 2. The epic boom ended in a cataclysmic bust.

Who published a monetary history of the United States in 1963?

Consensus coalesced around the time of the publication of Milton Friedman and Anna Schwartz’ s A Monetary History of the United States in 1963.

Who created the Dow Jones Industrial Average?

Dow Jones Industrial Average (Created by: Sam Marshall, Federal Reserve Bank of Richmond) Enlarge. The financial boom occurred during an era of optimism. Families prospered. Automobiles, telephones, and other new technologies proliferated. Ordinary men and women invested growing sums in stocks and bonds.

What was the 1929 stock market crash?

The Wall Street crash of 1929, also called the Great Crash, was a sudden and steep decline in stock prices in the United States in late October of that year.

What caused the stock market to go down in 1929?

Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier that summer, both of which contributed to gradual declines in stock prices in September and October, eventually leading investors to panic. During the mid- to late 1920s, the stock market in the United States underwent rapid ...

What was the Great Depression?

Stock market crash of 1929, also called the Great Crash, a sharp decline in U.S. stock market values in 1929 that contributed to the Great Depression of the 1930s. The Great Depression lasted approximately 10 years and affected both industrialized and nonindustrialized countries in many parts of the world. Crowds gathering outside the New York ...

How many points did the Dow close down?

Still, the Dow closed down only six points after a number of major banks and investment companies bought up great blocks of stock in a successful effort to stem the panic that day. Their attempts, however, ultimately failed to shore up the market. The panic began again on Black Monday (October 28), with the market closing down 12.8 percent.

What was the cause of the 1929 Wall Street crash?

The main cause of the Wall Street crash of 1929 was the long period of speculation that preceded it , during which millions of people invested their savings or borrowed money to buy stocks, pushing prices to unsustainable levels. Other causes included an increase in interest rates by the Federal Reserve in August 1929 and a mild recession earlier ...

Why did people sell their Liberty bonds?

People sold their Liberty Bonds and mortgaged their homes to pour their cash into the stock market. In the midsummer of 1929 some 300 million shares of stock were being carried on margin, pushing the Dow Jones Industrial Average to a peak of 381 points in September.

Stock Market Crash Basics

Early U.S. Stock Market Crashes

- The first U.S. stock market crash took place in March of 1792.2 Prior to the Financial Crisis of 1791 to 1792, the Bank of the United States over-expanded its credit creation, which led to a speculative rise in the securities market. When a number of speculators ultimately defaulted on their loans, it set off panic selling of securities. In response, then-Secretary of the Treasury Alexa…

Contemporary Us Crashes

- Wall Street crash of 1929

Prior to the Wall Street crash of 1929, share prices had risen to unprecedented levels. TheDow Jones Industrial Average (DJIA)had increased six-fold from 64 in August 1921 to 381 in September 1929.9 However, at the end of the market day on Oct. 24, 1929, which became know… - Recession of 1937 to 1938

The third-worst downturn in the 20th century, the Recession of 1937 to 1938 hit as the U.S. was in the midst of recovering from the Great Depression. The primary causes of this recession are believed to be Federal Reserve and Treasury Department policies that caused a contraction in th…

Other Crashes That Affected The U.S.

- Below is a list of other notable crashes that affected the U.S. but didn't originate within the country itself, were too global to be considered U.S. stock market crashes, and/or only affected a specific asset/company's stock (i.e., not one of the major indices): 1. Crisis of 1772: The first financial crisis in what became the U.S. occurred when the East Coast was still referred to as the 13 colo…

The Bottom Line

- As a result of market cycles, stock market crashes are an inherent risk of investing. No matter how high an index rises, there's only so much it can grow before sellers take action. However, market downtrends don't have to result in a crash, so long as cooler heads prevail. While 2020's crash certainly won't be the last one the U.S. will experience, it's not clear how long it will be befo…