Is fMet over-valued?

That is way over valued FMET is only gonna be 1-2% higher than PSEI max. 2019 is pre pandemic and prices were at an all time high using that as the basis may be the reason why you have over inflated the CAGR of FMETF Has inflations been accounted for?

Is fmetf a good investment in the current market?

All in all, FMETF is a GOOD investment as I've valued it to give investors a return of about 18% (if you bought at its current Net Asset value) Post Pandemic, It's a really good percentage for an investment that you won't be worried of since the portfolio allocated based on the PSE Index.

What is the objective of first metro ETF?

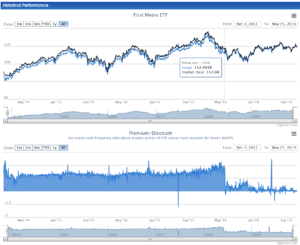

See Interactive Data Terms and condition of use. First Metro ETF aims to provide returns which would reflect the performance of the Philippine equities market by investing in a basket of securities included in the Philippine Stock Exchange Index (PSEi).

Is Fmetf a stock?

(FMETF) is a domestic corporation engaged primarily in investing, reinvesting, trading in, and issuing and redeeming its shares of stock in creation units in exchange for a basket of securities representing an index.

Does Fmetf give dividends?

Dividends of FMETF In 2018, FMETF announced that they'd give away stock dividends representing 3%. That means for every 100 stocks you own, you get 3 more stocks.

How do you make money with Fmetf?

So how do you make money with FMETF? Investors earn by buying the FMETF and selling at a price that's more than they bought it for — a typical case of buying low and selling high. We're essentially betting on long-term economic growth.

Is Fmetf a mutual fund?

First Metro Philippine Equity Exchange Traded Fund, Inc. (FMETF) was incorporated on January 15, 2013 as an open-ended investment company....Company Information.SectorETFFund ManagerFirst Metro Asset Management, Inc.13 more rows

What are the companies in Fmetf?

Underlying Securities as of 07/28/2022Security NamePSEi WeightFMETF WeightMETRO PACIFIC INVESTMENTS CORPORATION1.241.12METROPOLITAN BANK & TRUST COMPANY3.103.05MONDE NISSIN CORPORATION2.892.91PHILIPPINE LONG DISTANCE TELEPHONE COMPANY "COMMON"4.084.2610 more rows

What are ETFS in the Philippines?

In the Philippines, there's currently only one ETF in the market, First Metro Philippine Equity Exchange Traded Fund. An ETF's value, as indicated by the Net Asset Value Per Share (NAVPS), means its price can be volatile, making it a unique investment.

What is 8k rule?

The 8k Rule says that to optimize fees (i.e., to make the most fees paid), invest at least 8,000 pesos. Online brokers charge commissions of “0.25% of the amount invested or 20 pesos, whichever is higher.” We get the equivalence by 20 pesos divided by 0.25%, which is 8,000 pesos.

What is the good investment in Philippines?

📈 Long-Term Bonds These are securities that usually come with a 20 to 30-year term. They can be in the form of corporate bonds, government bonds, and even international bonds. Long-term bonds are considered one of the best investments in the Philippines because of the potentially high-interest yields.

Where can I invest in Philippines?

5 ways for an OFW to invest in the PhilippinesMutual funds. Investing in a mutual fund appears to be the simplest of the options. ... Stock investments. Investing in publicly traded stocks requires a certain kind of aggression and some research. ... Unit Investment Trust Fund (UITF) ... Bonds. ... Real estate.

Is Metrobank a good stock to buy?

Metrobank stock Among the top three largest banks in the country, Metrobank (PSE: MBT) appears to be most promising to recover strongly, being the most undervalued fundamentally.

Whats the difference between an index fund and ETF?

What Is the Difference Between an ETF and Index Fund? The main difference between an ETF and an index fund is ETFs can be traded (bought and sold) during the day and index funds can only be traded at the set price point at the end of the trading day.

What is ETF stand for?

exchange-traded fundsETFs or "exchange-traded funds" are exactly as the name implies: funds that trade on exchanges, generally tracking a specific index. When you invest in an ETF, you get a bundle of assets you can buy and sell during market hours—potentially lowering your risk and exposure, while helping to diversify your portfolio.

How do I buy an ETF in the Philippines?

How to Invest in First Metro ETF in the Philippines? You can start investing and trading FMETF on your online broker accredited by the PSE using the ticker FMETF. Yes, if you have an online trading platform like First Metro Sec Pro, BDO Securities, BPI Trade, and COL Financial, you can trade this ETF.

What is index fund in the Philippines?

The Philippine Stock Index Fund is a long-term investment outlet that allows you to diversify your money in a mix of domestic stocks. The Fund aims to mirror the performance of the Philippine Stock Exchange Index (PSEi).

WHAT ARE ETFs?

Exchange Traded Funds are a hybrid of index mutual funds and shares of stocks. With ETFs, you are given an investment option which features a more cost-efficient way of diversifying your portfolio.

What is a first metro ETF?

First Metro ETF aims to provide returns which would reflect the performance of the Philippine equities market by investing in a basket of securities included in the Philippine Stock Exchange Index (PSEi). The Final Prospectus contains all the information you need to know about the Fund, its management and the price of the securities.

What is the first Metro Philippine equity exchange?

First Metro Philippine Equity Exchange Traded Fund, Inc. is a domestic corporation engaged primarily in the business of investing, reinvesting, and trading in , and issuing and redeeming its shares of stock in Creation Units in exchange for a basket of securities representing an index.