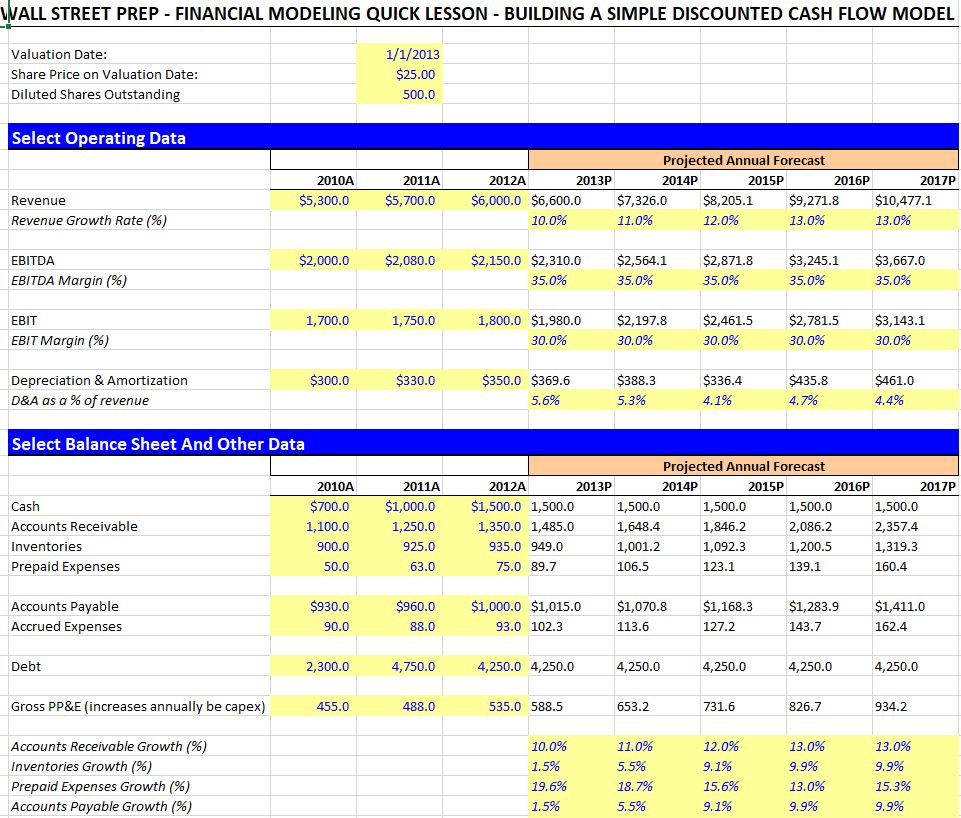

- Discounted cash flow analysis. Some economists think that discounted cash flow (DCF) analysis is the best way to calculate the intrinsic value of a stock.

- Analysis based on a financial metric. A quick and easy way of determining the intrinsic value of a stock is to use a financial metric such as the price-to-earnings (P/E) ...

- Asset-based valuation. The simplest way of calculating the intrinsic value of a stock is to use an asset-based valuation. What is RoboBasketball's intrinsic value using this approach?

How do you calculate intrinsic stock price?

- Market Value - This is how much you would have to pay to purchase the entire company.

- Book Value - This is how much you would get if you sold off all the Assets & cleared all the liabilities of the company

- Instrinsic Value - This is how much the company is actually worth. In technical terms it is : Book Value + Discounted Future Cash Flows

How to find the true value of a stock?

- Dividend yields

- Price-to-book ratios

- Earnings per share

- Price-to-earnings ratios

- Price earnings-to-growth ratios

How to calculate the intrinsic value of a stock [buffet style]?

To find intrinsic value of a stock, you can follow the steps listed below:

- Find all required financial data

- Calculate discount rate and use it to discount the future value of the business

- Perform a discounted free cash flow (DCF) analysis

- Calculate the company's net present value (NPV)

- Calculate the company's terminal value (TV)

- Put the net present value and the terminal value together

How do you calculate the intrinsic value of a company?

- Intrinsic value formula = Value of the company / No. of outstanding shares

- = $2,504.34 Mn / 60 Mn

- = $41.74

How do you calculate intrinsic stock price?

Estimate all of a company's future cash flows. Calculate the present value of each of these future cash flows. Sum up the present values to obtain the intrinsic value of the stock.

What is the easiest way to calculate intrinsic value?

How to Calculate Intrinsic Value of a Stock Using a Multiple-based Intrinsic Value Formula. The P/E is a fairly easy ratio to calculate, take the market price per share of the company, and divide it by the earnings per share (EPS). For example company XYZ has an EPS of $2.61, and a share price of $24.57.

How do you ascertain the intrinsic value of shares?

DCF also is known as the Discounted Cash Flow (DCF) method is the most used approach to arrive at the intrinsic value. In this method, the analyst forecasts the future cash flow of the business and discount it to present value by using the firm's Weighted Average Cost of Captial (WACC).

How do you find the intrinsic value of a stock using DCF?

To calculate the intrinsic value of a stock using the discounted cash flow method, you will have to do the following:Take the free cash flow of year 1 and multiply it with the expected growth rate.Then calculate the NPV of these cash flows by dividing it by the discount rate.More items...

How Warren Buffett calculates intrinsic value?

Buffett follows the Benjamin Graham school of value investing. Value investors look for securities with prices that are unjustifiably low based on their intrinsic worth. There isn't a universally accepted way to determine intrinsic worth, but it's most often estimated by analyzing a company's fundamentals.

What is intrinsic value example?

For example, if a call option's strike price is $19 and the underlying stock's market price is $30, then the call option's intrinsic value is $11. You will hardly ever find an option that is worth less than what an option holder can receive if the option is exercised.

How do you find undervalued stocks in ticker tape?

P/E ratio = Current Market Price/Earnings Per Share If the P/E ratio is less than 15, then analysts usually consider the stock undervalued. A lower P/E ratio indicates that investors are willing to accept a lower return from the stock in exchange for holding on to it.

How do you calculate intrinsic value and time value of an option?

Time value is calculated by taking the difference between the option's premium and the intrinsic value, and this means that an option's premium is the sum of the intrinsic value and time value: Time Value = Option Premium - Intrinsic Value. Option Premium = Intrinsic Value + Time Value.

Does Warren Buffett use DCF?

While Buffett accepts the principle of discounting cash flows, Charlie Munger says that he has never seen him perform a formal DCF analysis. Munger: Warren often talks about these discounted cash flows, but I've never seen him do one.

Is DCF and intrinsic value same?

The discounted cash flow (DCF) model is a commonly used valuation method to determine a company's intrinsic value. The DCF model uses a company's free cash flow and the weighted average cost of capital (WACC). WACC accounts for the time value of money and then discounts all its future cash flow back to the present day.

How do you calculate intrinsic value in Excel?

To determine the intrinsic value, plug the values from the example above into Excel as follows:Enter $0.60 into cell B3.Enter 6% into cell B5.Enter 22% into cell B6.Now, you need to find the expected dividend in one year. ... Finally, you can now find the value of the intrinsic price of the stock.

How do you calculate intrinsic value in WACC?

Step 1: Find All Needed Financial Figures. ... Step 2: Calculate Discount Rate (WACC) ... Step 3: Calculate Discounted Free Cash Flows (DCF) ... Step 4: Calculate Net Present Value (NPV) ... Step 5: Calculate Perpetuity Value (Terminal Value) ... Step 6: Sum The NPV and Terminal Value.

How do you find the intrinsic value of a bond?

Determining Intrinsic Value: The intrinsic value of an asset (the perceived value by an individual investor) is determined by discounting all of the future cash flows back to the present at the investor's required rate of return (i.e., Given the Ct's and k, calculate V).

What is intrinsic value?

Intrinsic value refers to some fundamental, objective value contained in an object, asset, or financial contract. If the market price is below that value it may be a good buy—if above a good sale. When evaluating stocks, there are several methods for arriving at a fair assessment of a share's intrinsic value.

Why does intrinsic value matter?

Why Intrinsic Value Matters. The Bottom Line. Intrinsic value is a philosophical concept wherein the worth of an object or endeavor is derived in and of itself—or, in layman's terms, independently of other extraneous factors.

Is intrinsic value a guarantee?

Though calculating intrinsic value may not be a guaranteed way of mitigating all losses to your portfolio, it does provide a clearer indication of a company's financial health .

How to calculate intrinsic value?

2. Discounted Cash Flow Model – How Warren Buffett calculates Intrinsic Value. 1 Project the cash flows ten years into the future, and repeat steps one and two for all those years. 2 Add up all the NPV’s of the free cash flows. 3 Multiply the 10th year with 12 to get the sell-off value. 4 Add up the values from steps four, five, and Cash & short-term investments to arrive at the intrinsic value for the entire company. 5 Divide this number with the number of shares outstanding to arrive at the intrinsic value per share.

What is intrinsic value per share?

Now that you know what the intrinsic value is per share, you can compare that to the actual share price. If the intrinsic value is more than the actual share price, that will constitute a value investment.

What does Warren Buffett base his intrinsic value on?

Interestingly, Warren Buffett bases his Intrinsic Value calculations on future free cash flows. To explain, Buffett thinks cash is a company’s most important asset, so he tries to project how much future cash a business will generate.

What is dividend discount model?

The Dividend Discount Model’s problem is that a company’s management can end the dividend; or change it at any time. For instance, a company that pays a quarterly dividend could switch to annual dividends. Moreover, some companies will occasionally issue big bonus dividends.

Why do you need to pay attention to the P/E ratio?

You must pay attention to the P/E Ratio because it is the most popular stock analysis formula. However, the P/E Ratio is a short-term analysis tool that has little effect on Intrinsic Value. On the other hand, speculators watch the P/E Ratio because it can affect short-term market prices.

What is book value?

The Book Value of a company is the value of all its physical, financial, and legal assets. For example, the money in the company’s accounts, accounts receivable, inventory, real estate, patents, assets, equipment, etc.

Is intrinsic value labor intensive?

Understanding Intrinsic Value is important for all value investors, but calcula ting it manually is labor-intensive and counter-productive. Using our Screener Review Winning Stock Screener, Stock Rover will enable you to find the most undervalued companies on the NYSE, or NASDAQ exchanges, simply and effectively.

What is Value?

Value in investing is about finding the benefit or desired result in pursing an action. Value is typically regarded as something of monetary worth and expressed various different ways. For securities, intrinsic value is what a company is worth, but there are other types of value to consider.

Book value or asset-based valuation

The book value or shareholder’s equity contained in the balance sheet of a company’s financial statements is perhaps the only way to calculate the fair value of a portfolio. Book value, also known as asset-based valuation, is calculated by deducting a company’s liabilities from its assets.

Benjamin Graham Method

Benjamin Graham is widely recognized as the father of value investing. He wrote the books on value investing, Security Analysis and The Intelligent Investor. He employed and mentored Warren Buffett and taught for years at Columbia University.

Discounted cash flow analysis

And now, for probably the most complex of the valuation models suggested by analysts for determining a stock’s intrinsic value. The discounted cash flow or DCF formula evaluates the value of common stock based on projected potential cash flows or how much they will earn over time.

How to calculate intrinsic value of a stock?

The calculation of the intrinsic value formula of the stock is done by dividing the value of the business by the number of outstanding shares of the company in the market. The value of stock derived in this way is then compared with the market price#N#Market Price Market price refers to the current price prevailing in the market at which goods, services, or assets are purchased or sold. The price point at which the supply of a commodity matches its demand in the market becomes its market price. read more#N#of the stock to check if the stock is trading above / at par / below its intrinsic value.

Why does the stock market return to its fair value?

It happens due to various reasons such as declining macro-economic factors, intense pessimism across the economy, securities specific factors, over-inflation in the markets, and so on. read more will happen such that the stock price on an average will return to the fair value.

What determines intrinsic value?

Internal factors like a firm's products, its management, and the strength of its brands in the marketplace determine intrinsic value . Investors are interested in cash available to stockholders. The internal factors above determine how much cash a company can expect to generate.

What is intrinsic value?

The intrinsic value of a stock is a price for the stock based solely on factors inside the company. It eliminates the external noise involved in market prices. A quick and easy way to calculate intrinsic value is the dividend discount method (DDM). It works best for large and stable companies.

What influences the value of a stock?

The market value of stocks is influenced by many external factors. The condition of the economy and the latest numbers for GDP and unemployment move market prices. So do political things like pending legislation, and presidential tweets! The intrinsic value of a stock, on the other hand, attempts to boil out the externals ...

What is the dividend discount method?

The dividend discount method (DDM) is a quick and easy way to evaluate intrinsic value. It is especially useful for large, stable companies. The commonly used formula for the Gordon Growth version of the DDM is focused on dividends, which are cash paid to stock holders and their future growth. It is:

What is intrinsic valuation?

Intrinsic valuation is often used for long-term investment strategies, but there are many other approaches to valuation and investing. Alternatives include t echnical analysis, r elative valuation, and c ost approach.

Who is the founder of value investing?

Benjamin Graham and Warrant Buffett are widely considered the forefathers of value investing, which is based on the intrinsic valuation method. Graham’s book, The Intelligent Investor, laid the groundwork for Warren Buffett and the entire school of thought on the topic.

What is cost approach?

In the cost approach, an investor looks at what the cost to build or create something would be and assumes that is what it’s worth. They may look at what it costs others to build a similar business and take into account how costs have changed since then (inflation, deflation, input costs, etc.).

Intrinsic Value Calcluation, Formula and Example

Intrinsic value is often calculated using a discounted cash flow (DCF) model.

Graham Formula: Step-by-Step Guide

A stock’s intrinsic value is generally defined as the value of the future cash flows of a company, discounted back to present value.

Updating the Intrinsic Value Calculator

The intrinsic value formula used in our calculator was defined by Graham many years ago.

What is intrinsic value?

Intrinsic value is the focus here, and unlike other methods, it does not look at the larger market, or current trading prices, or past patterns; nor does it attempt to predict future prices. Instead, it bases a stock's value on what an investor will pay for it.

What are the two types of stocks?

If you're new to investing, you might not be aware that not all stocks are the same form. The two main types of stocks are common stock and preferred stock . The biggest difference between the two has to do with the rights and perks they bestow upon their owners. When you buy shares of stock, you are also buying a small piece of ownership in a company, and the type of stock you buy will dictate your role, mostly with regard to voting rights and dividend payments. 1

What happens to preferred stock when it goes bankrupt?

The basic tenet of preferred stock is that it will receive dividend payments before common stock. If the company declares bankruptcy, and has to liquidate all of its assets, holders of preferred stock will receive payouts before holders of common stock see a dime.

Why is perpetuity infinite?

That's because a perpetuity is expected to last forever—from now until the end of time— and the math will back it up. If the rate of growth exceeds the required rate of return, the value of the investment is, in theory, infinite.

What does the equation not account for?

What the equation doesn't account for is the human lifespan, and whether the timeline for reaching the required rate of return is feasible. Other than that one small quirk, this equation is all you need to calculate the intrinsic value of a simple preferred stock.