What is the current price of Facebook stock?

The stock’s fifty day moving average price is $207.87 and its two-hundred day moving average price is $278.30. The company has a market cap of $559.99 billion, a PE ratio of 14.91, a P/E/G ratio of 1.15 and a beta of 1.39. Meta Platforms has a fifty-two week low of $169.00 and a fifty-two week high of $384.33.

Should you buy FB stock?

Nevertheless -- and despite his price target cut -- Thill remains of the opinion that investors should "buy" Snap stock. But why? For one thing, at its current share price of less than $30 per share, Snap sells for a 43% discount to Thill's assessment of the stock's intrinsic value.

How much does Facebook stock cost per share?

Key Data

- Open $999.29

- Day Range 982.19 - 1,012.71

- 52 Week Range 546.98 - 1,243.49

- Market Cap $1.06T

- Shares Outstanding 1.03B

- Public Float 843.5M

- Beta 1.43

- Rev. per Employee $542.08K

- P/E Ratio 201.32

- EPS $4.89

What did Facebook stock start at?

The stock has a fifty day simple moving average of $212.56 and a two-hundred day simple moving average of $288.01. Meta Platforms, Inc. has a 1-year low of $185.82 and a 1-year high of $384.33. The firm has a market cap of $572.10 billion, a price-to ...

See more

What is the target price for FB stock?

According to 34 Wall Street analysts that have issued a 1 year META price target, the average META price target is $281.59, with the highest META stock price forecast at $460.00 and the lowest META stock price forecast at $181.00.

When did Facebook become publicly traded?

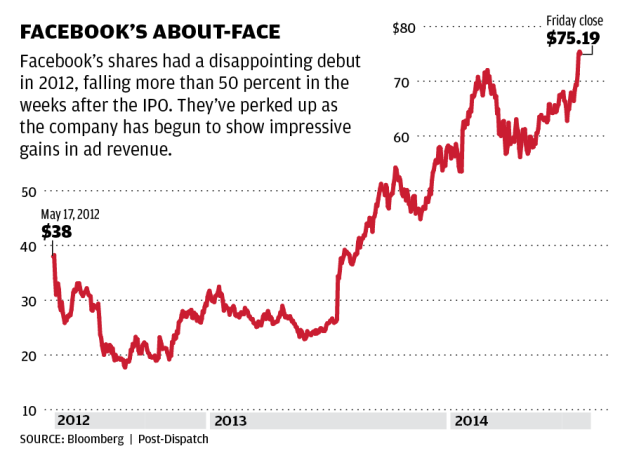

May 18, 2012Facebook held its Nasdaq debut 10 years ago, on May 18, 2012. It remains the largest tech IPO for a U.S. company and third biggest across all sectors, behind only Visa and General Motors. Facebook's stock price is 47% off its high from September as investors question the company's investments in the metaverse.

Does Facebook have a future?

But despite being widely accessible for more than 15 years, Facebook's user base continues to grow at a steady rate as we start 2022. Meta's latest earnings announcement revealed that Facebook's global monthly active users (MAU) had increased by 6.2 percent in the 12 months to October 2021.

How many times has Facebook stock split?

According to our FB stock split history records, FB has had 0 splits.

When did Facebook go public?

Why look at historical data?

Facebook is listed on the Nasdaq exchange under the ticker symbol: FB. The company went public on February 1, 2012 with an IPO price of $38 per share. Facebook historical prices show that there have been no stock splits since the IPO, with the stock price sitting at around $291 as of late March 2021.

Why is historical data important?

Analysing historical data can provide valuable information regarding the past performance of the underlying asset during different economic or political scenarios. For example, by looking at Facebook historical data during significant economic downturns and comparing them you can gain insight into how the underlying cause of a recession will affect the price differently. Analysing Facebook price history is also a valuable tool for traders looking to perform a more thorough comparison of stock price based on qualitative or quantitative analysis.

Is Facebook censoring political parties?

Historical data is also a valuable tool in correlating future revenue growth with stock price. By comparing the Facebook share price history increases to increases in revenue you can gain insight into the share price inflation value. Share price inflation is an indication of how much anticipated future growth is already priced into the stock value. The Facebook stock price history chart is also valuable to compare performance with other companies or indexes. By reviewing the data, a trader can see that Facebook stock outperformed the leading S&P 500 index by more than 64 per cent in 2020.

How long is historical price data available?

Facebook walks a fine line between supporting the right to free speech and preventing hateful content. They have been accused of censoring political parties and allowing extremist views almost in the same breath. It is a difficult position for the company to manage as leaning too far in either direction can have serious implications on the stock price.

How to contact Barchart sales?

Historical daily price data is available for up to two years prior to today's date.