Who bought Yates?

It is meant to figuratively describe a secure connection or something which can be relied upon. In the 1990s, the American Yated severed its relationship with the Israeli edition over perceived complex religious leanings there. The current publisher is Pinchos Lipschutz, who resides in Lakewood Township, New Jersey.

Who did EOG buy?

Yates PetroleumEOG merges with a historic New Mexico oil and gas company, Yates Petroleum, which adds 260,000 net acres in the core areas of the Delaware Basin and Powder River Basin.

Is EOG a big company?

With more than 2 900 employees, EOG Resources, Inc. is a Fortune 500 company, and it is considered one of the largest crude oil and natural gas exploration and production companies in the United States. According to Forbes, it is considered one of the top 2000 largest public companies in the world.

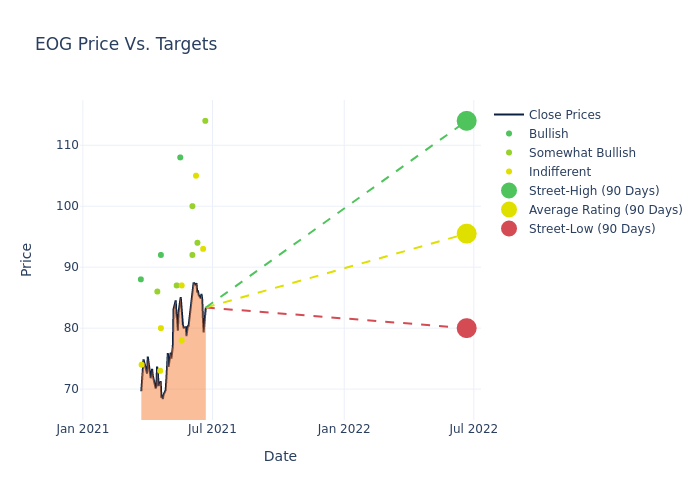

Is EOG a buy right now?

EOG Resources has received a consensus rating of Buy. The company's average rating score is 2.84, and is based on 14 buy ratings, 4 hold ratings, and no sell ratings.

Is EOG a Fortune 500 company?

The company is ranked 186th on the Fortune 500 and 337th on the Forbes Global 2000.

Is EOG a good stock to buy?

The financial health and growth prospects of EOG, demonstrate its potential to outperform the market. It currently has a Growth Score of A. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with a Momentum Score of F.

Is EOG the old Enron?

EOG Resources is the new name for Enron Oil and Gas Company; a Fortune 500 company, it is one of the largest independent oil and natural gas companies in the United States.

How does EOG Resources make money?

Gathering, Processing and Marketing: It includes revenues from transportation services provided to third-party producers. Other: It includes revenues from asset sales, derivative contracts, and other sources.

Is EOG Enron?

EOG Resources is the new name for Enron Oil and Gas Company; a Fortune 500 company, it is one of the largest independent oil and natural gas companies in the United States.

Why should I invest in EOG?

The EOG Resources stock holds buy signals from both short and long-term moving averages giving a positive forecast for the stock, but the stock has a general sell signal from the relation between the two signals where the long-term average is above the short-term average.

What does EOG stand for?

EOGAcronymDefinitionEOGEnd of Grade (tests used in NC)EOGEnron Oil & Gas (stock symbol)EOGExecutive Office of the GovernorEOGEnglish Opera Group (UK)16 more rows

Should I invest in EOG Resources?

EOG Resources, Inc. may be undervalued. Its Value Score of B indicates it would be a good pick for value investors. The financial health and growth prospects of EOG, demonstrate its potential to outperform the market. It currently has a Growth Score of A.

What is the EOG acquisition of Yates?

How many acres does Yates own?

On September 6, 2016 EOG Resources (EOG) announced the acquisition of Yates Petroleum (Yates) for approximately $2.4 billion dollars , by our calculations. Yates will receive approximately $2.2 billion in EOG common stock and $37 million in cash. In addition, EOG assumed $114 million (net) in Yates debt. 1 Based on EOG’s disclosures, the assets received by EOG include (1) Wells currently producing 29,600 barrels of oil equivalent per day (BOEPD); (2) proved developed reserves of 44 million barrels of oil equivalent; and (3) 1.624 million in net acreage throughout New Mexico, Wyoming, Colorado, Montana, North Dakota and Utah. Approximately 48% of the current production and proved developed reserves are crude oil. Based upon the consideration given by EOG, here is the implied market value of invested capital (MVIC) for Yates:

How many acres are there in the Delaware basin?

At the time of the transaction, Yates owned acreage rights in several domestic resource plays with the most popular resource play of 186,000 net acres in the Delaware Basin. The below chart shows the implied pricing metrics for Yates versus the market pricing multiples for publicly traded operators in the Delaware Basin.

Where is Yates acreage located?

The highly publicized acreage includes: (1) 186,000 net acres in the Delaware Basin; (2) 138,000 net acres in the Northwest Shelf; (3) 200,000 net acres in the Powder River Basin and (4) other western basins which add up to 1.1 million net acres. The following maps, disclosed by EOG, show the resource plays Yates owned acreage within. These resource plays range from Texas to Canada. Of the eight resource plays named in the map, EOG classifies two as the “best plays”. These are the Delaware Basin and the Powder River Basin.

What is Mercer Capital?

In addition to these two plays, the map shows Yates acreage located in northern Chaves and Lea counties. EOG does not show any acreage in these areas. Our historical transaction data indicates acreage rights transact for $50 to $350 per acre in northern Chaves, Lea, and Roosevelt counties. Compare this to the Delaware Basin and Northwest Shelf areas which have spots that historically transact for $5,000 per acre and above.

Did EOG acquire Yates?

Mercer Capital has significant experience valuing assets and companies in the energy industry, primarily oil and gas, bio fuels, and other minerals. Our oil and gas valuations have been reviewed and relied on by buyers and sellers and Big 4 Auditors. These oil and gas related valuations have been utilized to support valuations for IRS Estate and Gift Tax, GAAP accounting, and litigation purposes. We have performed oil and gas valuations and associated oil and gas reserves domestically throughout the United States and in foreign countries. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Is EOG in the Powder River Basin?

Much of the acquisition details have not been disclosed and we’ll wait for additional filings from EOG to learn more. Regardless, EOG’s acquisition of Yates was one of the largest E&P related transactions of 2016 and analyzing available information can help us to better understand the current marketplace. Based upon our experience involving private companies, we understand that pricing for proven undeveloped, probable and possible reserves have dropped significantly in the previous year, by upwards of 90% in some cases. In addition, due to the nature of the current oil and gas environment, we understand that the historical transactions may have little comparability to today.

What is the EOG acquisition of Yates?

EOG also discusses their interest in the Powder River Basin. As the map shows, EOG has significant acreage positions in the middle of the play. Similarly, Yates has large clumps of acreage rights in the same general area and in some cases, right next to EOG. This tends to indicate efficient drilling benefits may exist in the Powder River Basin too. Similar to the resource plays in New Mexico, acreage rights pricing varies widely by location.

How many acres does Yates own?

This morning EOG announced it is acquiring privately-held Yates Petroleum for $2.5 billion to be funded by a 26.06 million share equity offering (~5% dilutive) and $37 million in cash. The assets include ~1.6 million net acres in the U.S., including ~524K net acres prospective for the Delaware, Northwest Shelf and Powder River Basin, as well as 29.6 Mboepd (48% oil) in current production. The Company appears to have obtained the assets at a favorable price, paying ~$3K/acre (assuming $30K/flowing) when only including acreage prospective for the Delaware, Northwest Shelf and Powder River Basin. The transaction is expected to close in early October, and EOG will be hosting a conference call today at 11 a.m. ET. We remain EW but are putting our price target and estimates under review.

Does Yates increase EOG?

Yates currently holds 1.6 million net acres across the western United States, including 186,000 net acres in the Delaware Basin, 138,000 net acres in the Northwest Shelf, 200,000 acres in the Powder River Basin, and an additional 1.1 million net acres in New Mexico, Wyoming, Colorado, Montana, North Dakota, and Utah.

How much did EOG buy Yates?

The Yates acquisition increases EOG’s position in the Delaware Basin by 78% , the company said in its press release.

What is the largest oil field in the US?

(Reuters) - EOG Resources Inc said on Tuesday it would buy privately held Yates Petroleum Corp for $2.5 billion in stock and cash, in the latest move by a U.S. energy company to acquire acreage in the Permian Basin, one of the country’s most cost-effective oil fields.

Where does Yates oil come from?

The Permian is the largest U.S. oil field, with 189 of the country’s 481 total active rigs in early August, according to the latest data from energy services firm Baker Hughes Inc. With the acquisition, EOG would shift its focus away from the Eagle Ford shale, a more expensive Texas field that had helped the company grow into ...

How much does EOG pay to Yates?

Yates, which holds 1.6 million net acres across the western United States, mainly operates in the Permian Basin and the Powder River Basin in northeast Wyoming and produces 29,600 barrels of crude oil equivalent per day.

Where is Yates oil drilling?

Under the terms of the definitive agreement entered by the two companies, EOG will issue 26.06 million shares worth $2.3 billion and pay $37 million in cash to the shareholders of Yates, subject to certain closing adjustments and lock-up provisions. Further, the US-based oil and gas producer will assume and repay Yates’ outstanding debt of $245 million, which will be partially offset by Yates’ anticipated cash of roughly $131 million. EOG expects to close the deal by early October, and plans to commence drilling on the Yates acreage in late 2016 with additional rigs added in 2017. Post the closure of the transaction, EOG intends to maintain Yates’ office in Artesia, to support the combined operations.

Who owns Yates Petroleum?

Yates, the New Mexico-based company, holds 1.6 million net acres mainly in the Permian Basin and the Powder River Basin in Northeast Wyoming, which are some of the sweetest oil drilling prospects in the US. Since much of Yates’ acreage is adjacent to EOG’s existing leases in these basins, it makes economical sense for EOG to invest in these assets even during the weak oil price environment. This is because in order to enhance the productivity of a well or region, oil and gas companies need to drill vertically as well as horizontally for more than a mile, which requires a large area of land to be clubbed together. Having a large acreage in the same region, along with the use of the latest and innovative technology, EOG will be able to drill longer horizontal wells, resulting in higher well productivity, and in turn, higher returns.

Is Yates oil low?

EOG Resources Inc. , one of the most prolific shale drillers in the U.S., agreed to acquire privately owned Yates Petroleum Corp. for roughly $2.34 billion in a deal that expands its presence from Texas and New Mexico to Colorado and Wyoming.

valuation Metrics

- Based upon these ratios, we have the following observations:3 1. EOG is approximately 25x larger than Yates; 2. Of the six public companies, Yates is very close in size to Matador Resources Company (MTDR); 3. Based on per day production, the Yates transaction was priced at the lowest indicated value except for Apache Corp (APA); 4. Based upon net a...

Assets Purchased

- Earlier, we displayed the high level categories for an allocation of purchase price. Three of these categories are oil and gas related assets: (1) Wells currently producing 29,600 barrels of oil equivalent per day; (2) proved developed reserves of 44 million barrels of oil equivalent; and (3) 1.624 million in net acreage. The valuation for current production and proved developed reserve…

Acreage Owned by Yates

- The highly publicized acreage includes: (1) 186,000 net acres in the Delaware Basin; (2) 138,000 net acres in the Northwest Shelf; (3) 200,000 net acres in the Powder River Basin and (4) other western basins which add up to 1.1 million net acres. The following maps, disclosed by EOG, show the resource plays Yates owned acreage within. These resource plays range from Texas t…

Drilling Deeper

- More information is needed to drill down into the specifics and valuation of each of the acquired oil and gas assets. Interested parties may want to consider the following information areas: 1. Reserve Reports. Specifically, we would like to understand the amount of acreage in each of the maps above that have been drilled versus what areas are included in the drilling plan, PV 10 indi…