What is the downside for Duke Energy's stock?

On average, they anticipate Duke Energy's stock price to reach $92.1250 in the next twelve months. This suggests that the stock has a possible downside of 1.1%. View Analyst Price Targets for Duke Energy.

When will Duke Energy stock pay a dividend?

Duke Energy trades on the New York Stock Exchange (NYSE) under the ticker symbol "DUK.". Duke Energy declared a quarterly dividend on Friday, October 26th. Shareholders of record on Friday, November 16th will be paid a dividend of $0.9275 per share on Monday, December 17th.

What do your marketbeat community ratings say about Duke Energy (Duk)?

MarketBeat's community ratings are surveys of what our community members think about Duke Energy and other stocks. Vote “Outperform” if you believe DUK will outperform the S&P 500 over the long term. Vote “Underperform” if you believe DUK will underperform the S&P 500 over the long term. You may vote once every thirty days.

Will Duke Energy (Duk) outperform the S&P 500 over the long term?

Duke Energy has received 56.29% “outperform” votes from our community. MarketBeat's community ratings are surveys of what our community members think about Duke Energy and other stocks. Vote “Outperform” if you believe DUK will outperform the S&P 500 over the long term.

See more

Will Duke Energy stock go up?

Stock Price Forecast The 18 analysts offering 12-month price forecasts for Duke Energy Corp have a median target of 113.00, with a high estimate of 120.00 and a low estimate of 105.00. The median estimate represents a +8.23% increase from the last price of 104.41.

Is Duk stock a buy or sell?

The consensus among 11 Wall Street analysts covering (NYSE: DUK) stock is to Buy DUK stock.

Is Duke Power a good stock to buy?

DUK is a good stock for both high yield dividend investors and dividend growth investors who want to add some higher yield to their portfolio.

Is Duke Energy overvalued?

Because Duke Energy is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth, which is estimated to grow 3.92% annually over the next three to five years.

When did Duke Energy stock split?

Duke Energy (DUK) has 4 splits in our Duke Energy stock split history database. The first split for DUK took place on October 01, 1990....DUK Split History TableDateRatio10/01/19902 for 101/29/20012 for 101/03/200710000 for 58111 more row

Is Duke Energy a Sell?

Duke Energy has received a consensus rating of Hold. The company's average rating score is 2.36, and is based on 4 buy ratings, 7 hold ratings, and no sell ratings.

Is Duk a buy Zacks?

See rankings and related performance below. The VGM Score are a complementary set of indicators to use alongside the Zacks Rank....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

Who is buying Duke Energy?

Under the previously announced agreement, GIC will acquire a 19.9% indirect minority interest in Duke Energy Indiana for a total purchase price of $2.05 billion in two separate phases.

Is Duke Energy a Fortune 500 company?

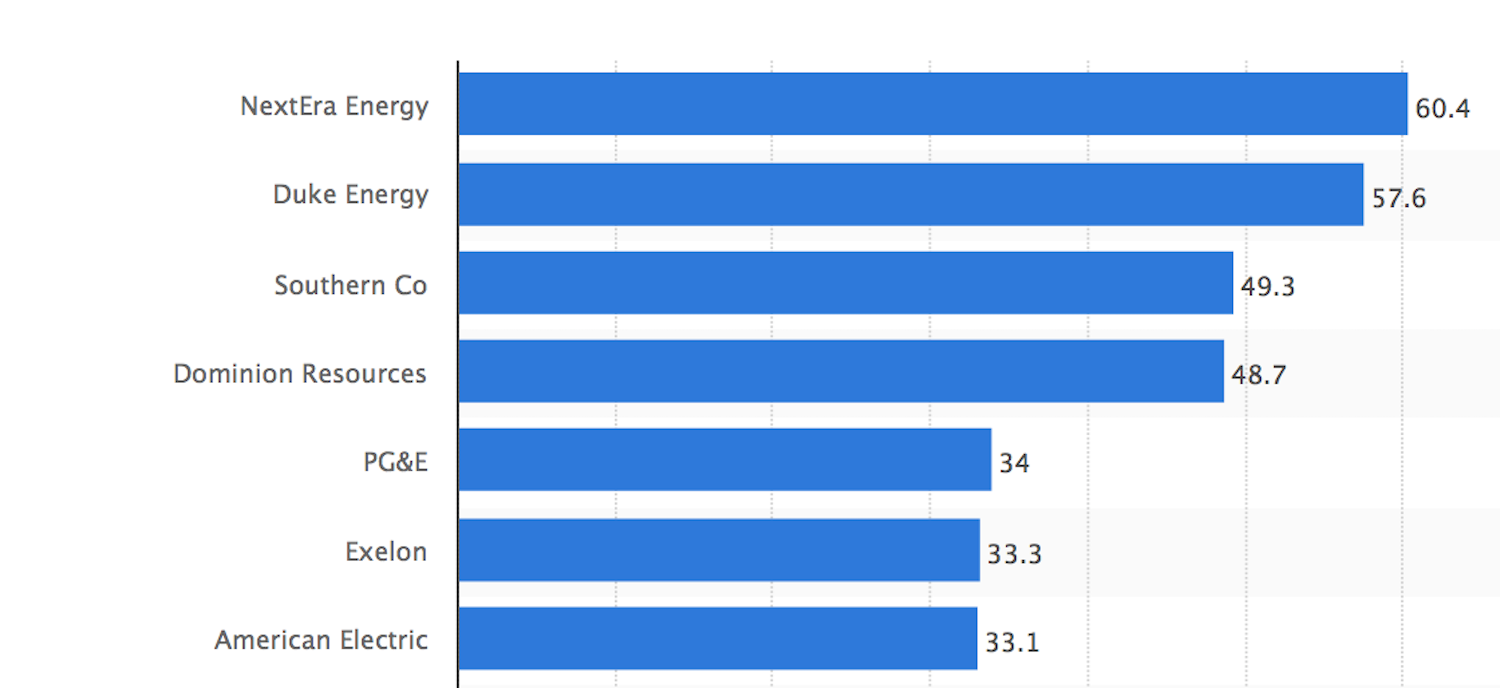

Duke Energy (NYSE: DUK), a Fortune 150 company headquartered in Charlotte, N.C., is one of America's largest energy holding companies. Its electric utilities serve 7.9 million customers in North Carolina, South Carolina, Florida, Indiana, Ohio and Kentucky, and collectively own 51,000 megawatts of energy capacity.

Is Dominion Energy a buy?

Dominion Energy's analyst rating consensus is a 'Moderate Buy. This is based on the ratings of 13 Wall Streets Analysts. Dominion Energy's upcoming earnings report date is Aug 07, 2022 which is in 22 days. Dominion Energy released its earnings results on May 04, 2022.

Is Dominion Resources a buy sell or hold stock?

Dominion Energy has received a consensus rating of Hold. The company's average rating score is 2.17, and is based on 2 buy ratings, 3 hold ratings, and 1 sell rating.

Is Southern Company a good stock to buy?

Valuation metrics show that Southern Company The may be fairly valued. Its Value Score of C indicates it would be a neutral pick for value investors. The financial health and growth prospects of SO, demonstrate its potential to perform inline with the market. It currently has a Growth Score of C.

Is Duke Energy stock a Buy, Sell or Hold?

Duke Energy stock has received a consensus rating of hold. The average rating score is and is based on 8 buy ratings, 35 hold ratings, and 0 sell r...

What was the 52-week low for Duke Energy stock?

The low in the last 52 weeks of Duke Energy stock was 95.50. According to the current price, Duke Energy is 111.98% away from the 52-week low.

What was the 52-week high for Duke Energy stock?

The high in the last 52 weeks of Duke Energy stock was 116.33. According to the current price, Duke Energy is 91.93% away from the 52-week high.

What are analysts forecasts for Duke Energy stock?

The 43 analysts offering price forecasts for Duke Energy have a median target of 105.02, with a high estimate of 125.00 and a low estimate of 68.00...

How long are futures trading delayed?

How to calculate P/E?

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle.

New York Stock Exchange

The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock's most recent closing price by the sum of the diluted earnings per share from continuing operations for the trailing 12 month period.

Environmental, Social, and Governance Rating

An energy company with an integrated network of energy assets. The company manages a portfolio of natural gas and electric supply, delivery and trading businesses.

Business Summary

"A" score indicates excellent relative ESG performance and a high degree of transparency in reporting material ESG data publicly and privately. Scores range from AAA to D.

When will Duke Energy announce its second quarter results?

An energy company with an integrated network of energy assets. The company manages a portfolio of natural gas and electric supply, delivery and trading businesses.

How long will Duke power plant run?

Duke Energy to announce second-quarter 2021 financial results on Aug. 5. Duke Energy will announce its second-quarter 2021 financial results at 7 a.m. ET on Thursday, Aug. 5 in a news release to be posted on the company's website at duke-energy.com/investors.