Should I buy Duke Energy stock?

Duke Energy Corp. DUK recently inked a partnership deal with Accenture ACN and Microsoft MSFT to co-develop a first-of-its-kind monitoring platform, which will be used to measure actual baseline ...

Is Duke Energy still a buy?

Plus, over the last three years, Duke has increased its dividend by an average of 9.46%. Duke Energy Remains a Buy . Over the next decade, Duke is well-positioned to be part of the country’s transition to renewable energy. And it stands to benefit from a renewed investment in the nation’s energy grid.

Why Duke Energy (Duk) is a top dividend stock?

They are a Dividend Aristocrat, and almost a Dividend King. Duke Energy, on the other hand, has only increased their dividend for 8 consecutive years. Both companies have similar dividend growth rates, with 5 year average dividend growth rates just over 3%.

Why is Duke Energy stock dropping?

Duke Energy Corp. has won qualified support for its proposal to seek 700 megawatts of additional solar contracts in the Carolinas this year. But interested groups generally find it either too small to reduce carbon or too expensive to implement. The new ...

See more

Is Duke stock a buy?

For example, a stock trading at $35 with earnings of $3 would have an earnings yield of 0.0857 or 8.57%. A yield of 8.57% also means 8.57 cents of earnings for $1 of investment....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy24.75%2Buy18.15%3Hold9.70%4Sell5.35%2 more rows

When did Duke Energy stock split?

Duke Energy (DUK) has 4 splits in our Duke Energy stock split history database. The first split for DUK took place on October 01, 1990....DUK Split History TableDateRatio10/01/19902 for 101/29/20012 for 101/03/200710000 for 58111 more row

Is Duke Energy overvalued?

Because Duke Energy is relatively overvalued, the long-term return of its stock is likely to be lower than its business growth, which is estimated to grow 3.92% annually over the next three to five years.

When was the last time Duke Energy Split?

2012DUK Common StockYearSplit Ratio19642 for 119902 for 120012 for 120121 for 32 more rows

Is Duke stock going to split?

Progress Stock Conversion, 1:3 Split In pursuant to the merger, shareholders of Progress Energy now have the right to receive 0.87083 shares of Duke Energy common stock. The company also completed a 1-for-3 stock split, which is designed to reduce the total number of shares outstanding.

How often does Duke Energy pay dividends?

CHARLOTTE, N.C., May 5, 2022 /PRNewswire/ -- Duke Energy (NYSE: DUK) today declared a quarterly cash dividend on its common stock of $0.985 per share. This dividend is payable on June 16, 2022, to shareholders of record at the close of business on May 13, 2022.

Is Duke Energy a good buy now?

DUK is a good stock for both high yield dividend investors and dividend growth investors who want to add some higher yield to their portfolio.

Will Duke Energy stock go up?

Stock Price Forecast The 18 analysts offering 12-month price forecasts for Duke Energy Corp have a median target of 113.00, with a high estimate of 120.00 and a low estimate of 105.00. The median estimate represents a +7.65% increase from the last price of 104.97.

Is Dominion Energy a good stock to buy?

Dominion Energy is a decent utility stock, but that doesn't mean investors can pay a blank-check valuation and expect to do well in the long run. To avoid significantly overpaying, it's important to have an idea of what a stock is worth before investing.

Why are Duke Energy bills so high?

Duke Energy tells Local 12 that electric bills are increasing, but that it's out of the company's control. In Kentucky, where Palmer lives, Duke said prices are up after a plant had to temporarily shut down for maintenance late last year.

How can I lower my Duke Energy Bill?

Increase your home's energy efficiency by setting your air conditioner's thermostat to 78 degrees when you're in and to 80 degrees when you're out during the summer5, and to 68 degrees when you're in and to 69 degrees when you're out during the winter.

Is Duke Energy a Fortune 500 company?

Duke Energy (NYSE: DUK), a Fortune 150 company headquartered in Charlotte, N.C., is one of the largest energy holding companies in the U.S. It employs 30,000 people and has an electric generating capacity of 51,000 megawatts through its regulated utilities, and 3,000 megawatts through its nonregulated Duke Energy ...

Is Duke Energy cutting off power in North Carolina?

CHARLOTTE, N.C. — Duke Energy announced Thursday the company will continue to avoid shutting off electricity for the most at-risk families through March of 2022. The announcement came just a day before Duke Energy's limited disconnection ban was set to end.

Is Duke Energy stock a Buy, Sell or Hold?

Duke Energy stock has received a consensus rating of hold. The average rating score is and is based on 8 buy ratings, 35 hold ratings, and 0 sell r...

What was the 52-week low for Duke Energy stock?

The low in the last 52 weeks of Duke Energy stock was 95.50. According to the current price, Duke Energy is 111.98% away from the 52-week low.

What was the 52-week high for Duke Energy stock?

The high in the last 52 weeks of Duke Energy stock was 116.33. According to the current price, Duke Energy is 91.93% away from the 52-week high.

What are analysts forecasts for Duke Energy stock?

The 43 analysts offering price forecasts for Duke Energy have a median target of 105.02, with a high estimate of 125.00 and a low estimate of 68.00...

How long will Duke power plant run?

When will Duke Energy announce its second quarter results?

(Bloomberg) -- Duke Energy Corp., one of the biggest power companies in the U.S., is planning to run its fleet of 11 nuclear reactors until they’re 80 years old.The company filed an application with the U.S. Nuclear Regulatory Commission to renew the license for its Oconee power plant for 20 years, Charlotte-based Duke said in statement Monday. The South Carolina facility began producing power in 1973 and the extensions would keep the three reactors in service until 2053 and 2054.The company pla

What is Duke Energy?

Duke Energy to announce second-quarter 2021 financial results on Aug. 5. Duke Energy will announce its second-quarter 2021 financial results at 7 a.m. ET on Thursday, Aug. 5 in a news release to be posted on the company's website at duke-energy.com/investors.

What are the segments of Duke Energy?

Duke Energy Corp. engages in the distribution of natural gas and energy related services. It operates through the following segments: Electric Utilities and Infrastructure; Gas Utilities and Infrastructure; and Commercial Renewables. The Electric Utilities and Infrastructure segment conducts operations in Duke Energy's regulated electric utilities in the Carolinas, Florida and the Midwest. The Gas Utilities and Infrastructure segment focuses on Piedmont, Duke Energy's natural gas local distribution companies in Ohio and Kentucky, and Duke Energy's natural gas storage and midstream pipeline investments. The Commercial Renewables segment acquires, develops, builds, operates, and owns wind and solar renewable generation throughout the continental United States. The company was founded on April 30, 1904 and is headquartered in Charlotte, NC.

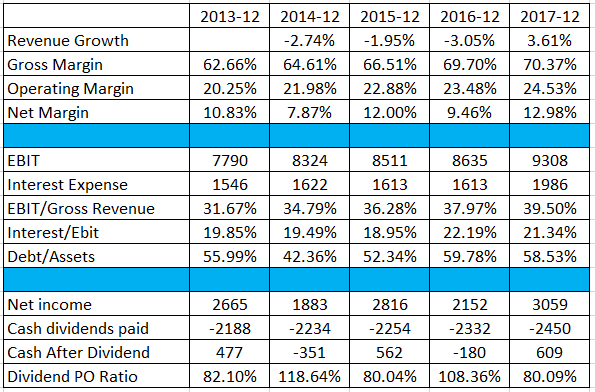

What is Duke Energy's dividend payout ratio?

It operates through the following segments: Electric Utilities and Infrastructure; Gas Utilities and Infrastructure; and Commercial Renewables. The Electric Utilities and Infrastructure segment conducts operations in Duke Energy's regulated electric utilities in the Carolinas, Florida and the Midwest. The Gas Utilities and Infrastructure segment ...

How much does Duke Energy make?

Based on earnings estimates, Duke Energy will have a dividend payout ratio of 70.57% next year. This indicates that Duke Energy will be able to sustain or increase its dividend. View Duke Energy's dividend history.

When will Duke Energy release its earnings?

Duke Energy has a market capitalization of $80.36 billion and generates $23.87 billion in revenue each year. The utilities provider earns $1.38 billion in net income (profit) each year or $5.12 on an earnings per share basis.

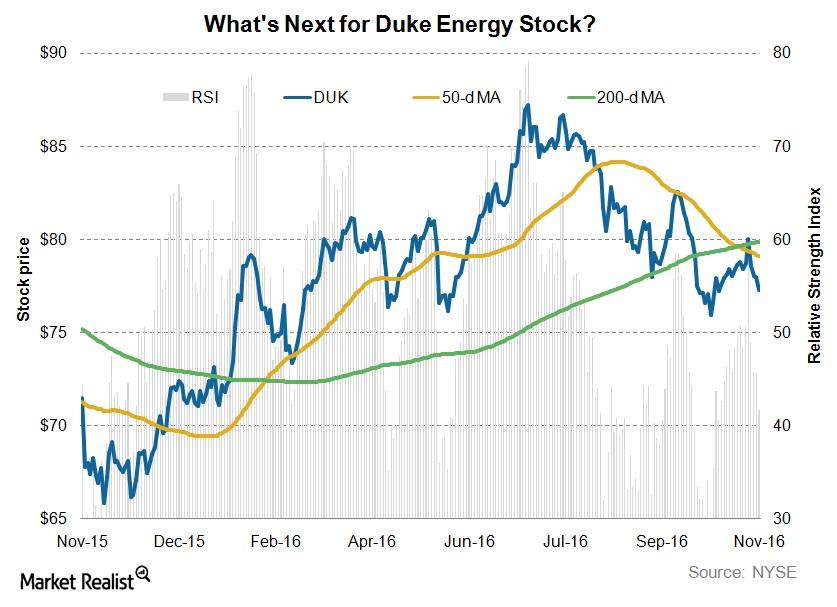

Historical and forecast chart of Duke Energy stock

Duke Energy is scheduled to release its next quarterly earnings announcement on Thursday, August 5th 2021. View our earnings forecast for Duke Energy.

Duke Energy Daily Price Targets

The chart below shows the historical price of Duke Energy stock and a prediction chart for the next month. For convenience, prices are divided by color. Forecast prices include: Optimistic Forecast, Pessimistic Forecast, and Weighted Average Best Forecast. Detailed values for the Duke Energy stock price can be found in the table below.

Duke Energy information and performance

Forecast target price for 02-24-2022: $ 100.43. Positive dynamics for Duke Energy shares will prevail with possible volatility of 3.604%.

Duke Energy (DUK) stock dividend

Duke Energy Corporation is engaged in the distribution of natural gas and energy services. It operates in the following segments: Electricity & Infrastructure, Gas & Infrastructure, and Commercial Renewable Energy.