Is Dominion Resources a good stock to buy?

USD 78.66 0.59 0.74% Taking into account the 90-day investment horizon and your above-average risk tolerance, our recommendation regarding Dominion Resources is 'Strong Buy'.

Is Dominion Resources a buy sell or hold?

Dominion Energy has received a consensus rating of Hold. The company's average rating score is 2.17, and is based on 2 buy ratings, 3 hold ratings, and 1 sell rating.

Is Dominion Energy a good stock to buy now?

Dominion Energy has produced good operating results through the first three quarters of 2021. The company reported $10.08 billion in operating revenue year-to-date, which is down 5.3% against the year-ago period (data sourced from Dominion Energy's Q3 2021 earnings press release).

Is Dominion Energy a buy or sell?

Dominion Energy's analyst rating consensus is a 'Moderate Buy. This is based on the ratings of 13 Wall Streets Analysts. When is Dominion Energy's upcoming earnings report date? Dominion Energy's upcoming earnings report date is Aug 04, 2022 which is in 23 days.

Will Dominion stock go up?

Stock Price Forecast The 15 analysts offering 12-month price forecasts for Dominion Energy Inc have a median target of 90.00, with a high estimate of 98.00 and a low estimate of 76.00. The median estimate represents a +13.52% increase from the last price of 79.28.

Does D pay a dividend?

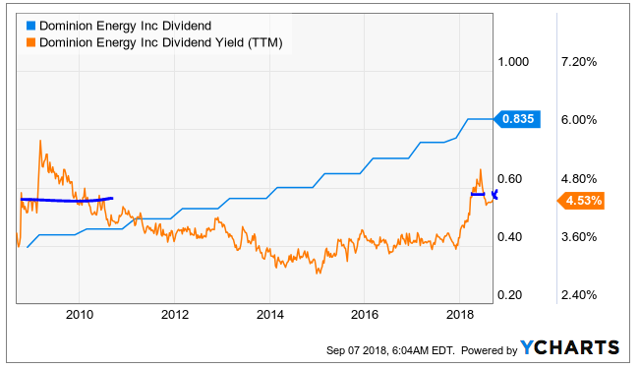

D pays a dividend of $2.60 per share. D's annual dividend yield is 3.27%.

Is Dominion Energy a good long term stock?

Dominion Energy Inc's trailing 12-month revenue is $14.4 billion with a 20.3% profit margin. Year-over-year quarterly sales growth most recently was 10.6%. Analysts expect adjusted earnings to reach $4.117 per share for the current fiscal year. Dominion Energy Inc currently has a 3.3% dividend yield.

Is Dominion Energy a good dividend stock?

Dominion Energy's dividend appears to be safe and positioned for decent growth in the years ahead. This is supported by looking at two different elements. First, the stock's 3.14% dividend yield is slightly lower than the 3.38% diversified utilities industry average dividend yield.

Is Duk a buy?

It's just OK. All in, Duke Energy is far from a screaming buy at current prices. However, if you are trying to generate dividend income in today's low-yield world, it is still worth looking at. You just have to go in knowing that you are paying full fare for a slow and boring dividend payer.

How do I buy stock in Dominion Power?

How to buy shares in Dominion EnergyCompare share trading platforms. Use our comparison table to help you find a platform that fits you.Open your brokerage account. Complete an application with your details.Confirm your payment details. ... Research the stock. ... Purchase now or later. ... Check in on your investment.

What did Dominion Resource Open at today?

Stock Quote (U.S.: NYSE) | MarketWatch....$ 78.98.CloseChgChg %$79.38-0.44-0.55%Jul 8, 2022

Dominion Resources Stock Price History Chart

Dominion Stock Price History Data

There are several ways to analyze Dominion Stock price data. The simplest method is using a basic Dominion candlestick price chart, which shows Dominion Resources price history and the buying and selling dynamics of a specified period.

About Dominion Resources Stock history

The price series of Dominion Resources for the period between Wed, Nov 17, 2021 and Tue, Feb 15, 2022 has a statistical range of 11.1 with a coefficient of variation of 3.41. Under current investment horizon, the daily prices are spread out with arithmetic mean of 77.19. The median price for the last 90 days is 78.1.

Dominion Resources Stock Technical Analysis

Dominion Resources investors dedicate a lot of time and effort to gaining insight into how a market's past behavior relates to its future.

Dominion Resources Technical and Predictive Indicators

Dominion Resources technical stock analysis exercises models and trading practices based on price and volume transformations, such as the moving averages, relative strength index, regressions, price and return correlations, business cycles, stock market cycles, or different charting patterns.

Complementary Tools for Dominion Stock analysis

Predictive indicators are helping investors to find signals for Dominion stock's direction in advance.

What happens when a company splits its shares?

When running Dominion Resources price analysis, check to measure Dominion Resources' market volatility, profitability, liquidity, solvency, efficiency, growth potential, financial leverage, and other vital indicators. We have many different tools that can be utilized to determine how healthy Dominion Resources is operating at the current time.

What is Dominion Energy?

When a company such as Dominion Energy splits its shares, the market capitalization before and after the split takes place remains stable, meaning the shareholder now owns more shares but each are valued at a lower price per share. Often, however, a lower priced stock on a per-share basis can attract a wider range of buyers.

When did the D split?

Dominion Energy is a holding company. Through its subsidiaries , Co. is a provider of electricity, natural gas and related services to customers primarily in the eastern and Rocky Mountain regions.