Because the fund might sell some of the stock it owns. If the fund does this, the fund incurs a capital gain. And since you are the real owner of the fund, you are the one who has to pay the capital gains tax on the mutual fund.

Where do capital gains come from when you sell mutual funds?

Capital Gains Come From Selling. You would calculate your capital gain or loss for each mutual fund share you sell when you sell shares, and this is where it gets more complicated. If you've invested in a fund over a period of time, you'll have a different cost basis and a different holding period for each share you own.

Do mutual fund investors owe tax on capital gains?

An investor holding mutual fund shares in a taxable account may owe tax on any net capital gains realized from the sale of his fund shares during the calendar year. In addition, he may also have to pay taxes on his proportionate share of the fund's capital gains.

What happens when a mutual fund sells a stock?

If the mutual fund owns stocks and is close to being fully invested, the fund may need to sell shares of those stocks to meet those redemptions. There can be a capital gains taxable event if the fund sells winning positions, which is then passed along to all the remaining shareholders, he says.

How often do mutual funds pay capital gains?

The frequency with which mutual funds pay capital gains varies. However, funds that generate a profit within a given year are required to distribute gains to shareholders at least once annually. 1

How can I avoid paying capital gains tax on mutual funds?

6 quick tips to minimize the tax on mutual fundsWait as long as you can to sell. ... Buy mutual fund shares through your traditional IRA or Roth IRA. ... Buy mutual fund shares through your 401(k) account. ... Know what kinds of investments the fund makes. ... Use tax-loss harvesting. ... See a tax professional.

Do mutual funds pay taxes when they sell stocks?

Generally, yes, taxes must be paid on mutual fund earnings, also referred to as gains. Whenever you profit from the sale or exchange of mutual fund shares in a taxable investment account, you may be subject to capital gains tax on the transaction. You also may owe taxes if your mutual fund pays dividends.

How does capital gains work on mutual funds?

A capital gains distribution is a payment by a mutual fund or an exchange-traded fund (ETF) of a portion of the proceeds from the fund's sales of stocks and other assets from within its portfolio. It is the investor's pro-rata share of the proceeds from the fund's transactions.

What happens when a mutual fund sells a stock?

Mutual fund shares are priced once the market closes every day at 4 p.m. unlike stocks, which trade on an intraday basis. Once the closing bell rings, the net asset value (NAV) of each mutual fund is calculated. With most redemptions, the proceeds are distributed to the investor on the following business day.

Why do mutual funds pay out capital gains?

These distributions are the result of the fund's managers selling shares of one or more of the fund's holdings during the tax year. Capital gains can occur if the fund manager decides to sell stock due to the changing outlook, or even if the fund must simply raise cash for shareholder redemptions.

Are mutual funds taxed twice?

For example, if a stock holding in your mutual fund pays dividends, then the fund manager later sells the stock at a higher value than they paid for it, you'll owe tax on two levels: A dividend tax, which is generally applied at your income-tax rate. A capital gains tax, which will be taxed at capital gains rates.

Do I have to pay tax on mutual funds if I sell and reinvest?

Distributions and your taxes If you hold shares in a taxable account, you are required to pay taxes on mutual fund distributions, whether the distributions are paid out in cash or reinvested in additional shares. The funds report distributions to shareholders on IRS Form 1099-DIV after the end of each calendar year.

Do I pay taxes on capital gains that are reinvested?

Mutual funds must distribute any dividends and net realized capital gains earned on their holdings over the prior 12 months, and these distributions are taxable income even if the money is reinvested in shares in the fund.

Are mutual funds taxable when withdrawn?

If you withdraw from your equity mutual fund units after 12 months of holding, then a long term capital gain will arise. The long term capital gain will be taxed at 10% without the benefit of indexation. Moreover, a long term capital gain on equity mutual funds up to Rs 1 lakh is exempt from tax.

Do you have to pay tax on mutual fund gains?

Short term capital gains (if the units are sold before three years) in debt mutual funds are taxed as per applicable tax rate of the investor. Therefore, if your tax rate is 30% then short term capital gains tax on debt fund is 30% + 4% cess. Long term capital gains of debt fund are taxed at 20% with indexation.

Can I sell mutual funds and buy stocks?

Mutual funds are not traded freely on the open market as stocks and ETFs are. Nevertheless, they are easy to purchase directly from the financial company that manages the fund. They also can be purchased through any online discount brokerage or a full-service broker.

How long do you have to hold a mutual fund before selling?

According to U.S. law, investors have the right to sell the shares of their mutual fund back to the fund itself at any time. Once the share has been redeemed, it is typically incumbent upon the fund to reimburse the former shareholder within seven days, although exceptions to this rule can exist.

When do mutual funds receive capital gains?

Mutual fund shareholders face the possibility of receiving capital gains distributions from their mutual funds each year around November or December. These distributions are the result of management selling shares of one or more of the fund's holdings during the taxable year. Capital gains can occur if the fund manager decides to sell stock due ...

Why do mutual funds sell shares?

These distributions can occur due to changes in the market or because the fund has to raise cash. You could realize a long- or short-term capital gain as a result, bringing taxes due.

What is reinvestment in mutual funds?

The reinvestment of the gains is added to your cost basis, which reduces your taxable gain when the fund is eventually sold. You might want to focus on low-turnover funds, which include index funds, tax-efficient mutual funds, and even some actively managed funds, if you own mutual funds in a taxable account.

When are capital gains distributions taxable?

These distributions are taxable to the fund shareholders unless the fund is owned in a tax-deferred account, such as an IRA or 401 (k).

How long do you have to sell a repurchase fund?

Keep in mind, however, that you'll run afoul of IRS wash sales rules if you repurchase the fund within 30 days, either in your taxable account or in your IRA.

What is capital gain when selling shares?

When you sell some shares, it's assumed that they're sold on a first-in, first-out basis. Your capital gain is calculated using the holding period of the oldest shares being sold, even if you're selling a mixture of long-term and short-term shares.

Can you use cost basis method even if you can't specify shares to sell?

You can still use the actual cost basis method even if you can't specify particular shares to sell. You would keep track of your cost basis for every lot of shares you buy, and assume that the first shares sold were the first shares you bought.

Is capital gains or losses complicated?

The concept of capital gains or losses can be complicated enough when you're dealing with a single, concrete asset . It becomes even more complex when you sell from a mutual fund that you've invested in over an extended period of time. You'll have a different cost basis for your initial investment, for additional investments, ...

Is a reinvestment taxable income?

Each reinvestment counts as both a cash distribution and an additional fund purchase. The dividends and capital gains distributions are included in taxable income. The additional shares purchased in the reinvestment have their own cost basis, which is the purchase price of the shares, and their own holding period.

What is capital gain in mutual funds?

First, an investor incurs a capital gain from selling shares at a higher price than the price you paid for those shares. Second, capital gains also occur when a mutual fund portfolio manager sells shares of a stock held in the portfolio at gain from the price he/she bought them ...

When capital gains are reinvested into a mutual fund, what happens?

When capital gains or income distributions are reinvested into a mutual fund shareholder's account, the payout increases the cost basis on that account. This is because the distribution is part of the shareholder's tax information for the year it is paid.

What is LTCG in mutual funds?

Mutual fund capital gain “distributions” are broken down into two categories: long-term capital gains (LTCG) which occur when a stock is sold after being held in the portfolio for longer than one year; and short-term capital gains (STCG) which occur when a stock is sold after a holding period of one year or less.

How are capital gains determined?

Capital gains are not tied to current market or fund-level performance, they are determined by the sale of securities within a fund. Even when markets are down, the sale of a security can still generate a gain, for example if the gain had appreciated over many years.

How often do mutual funds pay distributions?

The frequency of distributions varies from fund to fund. Most equity mutual funds pay distributions once or twice a year. Fixed income and money market funds often pay on a monthly or quarterly basis.

Is capital gains tax good?

Capital gains are a good thing. Unexpected tax bills are not. But the reality is that capital gains taxes are part of the normal (albeit unwelcome) 'price of admission' for investing. Specifically, it's the price of successful investing.

Do shareholders pay taxes on IRA distributions?

Even when distributions are reinvested, shareholders pay taxes on the amounts they receive (unless their assets are held in a tax-advantaged account, such as a traditional IRA or a Roth IRA). Bond mutual funds also pay distributions.

What is capital gains?

Capital gains can result from rising share values and they can come from mutual fund dividends, which are profits companies share with stockholders. Mutual fund distributions are derived from net capital and can affect your tax cost.

How much are long term capital gains taxed?

Long-term capital gains are taxed at either zero, 15% or a maximum rate of 20%.

What does it mean when a portfolio manager leaves a fund?

When a portfolio manager leaves a fund, it can mean a change in strategy. The new fund portfolio manager may sell many of the holdings, triggering capital gains. That's an issue for both current and new fundholders and something to monitor.

Can you buy a mutual fund before taxes are issued?

Investors who buy a mutual fund before capital gains and taxes are issue d to shareholders could be stuck with a tax bill. To avoid this, read the mutual fund company's website, which provides distribution information.

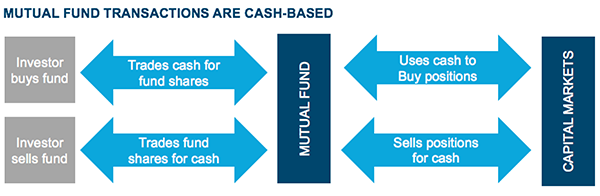

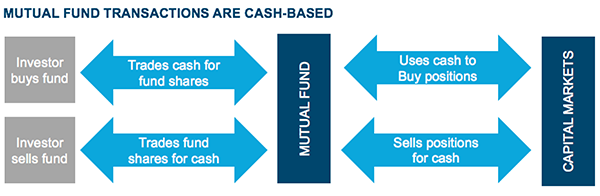

Do mutual funds have all their money together?

Mutual fund investors have all their money together in the fund, says Todd Rosenbluth, director of exchange-traded fund and mutual fund research at CFRA. When some of those investors want their money back, the fund company must return cash to shareholders.

Do mutual funds have capital gains?

Since mutual funds are required to distribute their gains, a fund with high turnover is more likely to create capital gains, says Kevin Dorwin, CEO at wealth management firm Bingham, Osborn & Scarborough. Turnover rates measure how often a fund buys or sells during a year, and that can increase your tax bill, reducing your return ...

Do mutual funds have to include capital gains information?

Investors can research possible capital gains exposure. Mutual funds must include information in their annual report about potential capital gains exposure , Arnott says, and it can give investors a good sense of possible distributions.

Why do mutual funds keep cash?

Mutual funds typically keep cash reserves to cover investor redemptions so that they will not be forced to liquidate portfolio securities at inopportune times. With most mutual fund redemptions, the proceeds are distributed to the investor on the following business day. There are consequences that can be triggered when mutual fund shares are ...

What are the fees for mutual funds?

Shareholder fees include the mutual fund's operating expenses such as investment advisory fees, marketing and distribution 12b-1 fees, and other administrative expenses. The 12b-1 fees are paid out of the fund's assets, which means investors are paying these charges indirectly. The 12b-1 fees cover the expenses for marketing and selling fund shares, including advertising costs, broker compensation, and printing and mailing of prospectuses and sales literature. 2

How much are early redemption fees for mutual funds?

Some mutual funds charge early redemption fees to discourage short-term trading. Generally, these fees take effect for holding periods ranging from 30 days to one year. The early redemption fees are paid to the funds, and are separate from potential back-end load charges, which are paid to the broker. The Securities and Exchange Commission limits redemption fees to a maximum of 2%. 2

What happens when you redeem a mutual fund?

With most mutual fund redemptions, the proceeds are distributed to the investor on the following business day. There are consequences that can be triggered when mutual fund shares are redeemed, yet many investors are not aware of these events. Examples of these consequences include fees, charges, commissions, and expenses ...

Where are fund charges described?

All fund charges are described in a fund's prospectus. It is important that investors read a fund's prospectus to understand all of the financial implications before buying, selling, or exchanging mutual fund shares. 1.

Do mutual funds charge early redemption fees?

When an investor sells mutual fund shares, the redemption process is straightforward, but there might be unexpected charges or fees. Class A shares usually have front-end sales loads, which are fees charged when the investment is made, but Class B shares may impose a charge when shares are sold. Some mutual funds charge early redemption fees ...

Do mutual funds trade intraday?

Mutual fund shares do not trade intraday. Instead, the shares are priced at the close of the market at 4 p.m. EST, when their net asset value (NAV) is calculated. Mutual funds typically keep cash reserves to cover investor redemptions so that they will not be forced to liquidate portfolio securities at inopportune times.

Do your research- avoid managers that buy and sell incessantly

It’s possible to select funds with low turnover. This means the manager does not buy and sell often within the fund. This information is provided by the fund and stated as the turnover ratio. For example, a turnover ratio of 50% means half of the investments in the fund have been replaced during the year.

Sell your fund before the capital gains distribution takes place

This is definitely an option but remember, you will want to evaluate whether or not you’ve made a profit on your shares. If you’ve made a profit you will have a capital gain that may be subject to taxes. Also, it helps to evaluate from a bigger picture perspective.

Hold mutual funds in a retirement account instead of in an individual account

Remember, if you hold a mutual fund in a retirement account like a 401 (k) or IRA you don’t have to worry about capital gains distributions. These accounts are taxed at ordinary income (not capital gains) rates only when you make withdrawals.

Select different types of investments

Individual stocks, bonds, and some ETFs do not pass through capital gains. When selling these investments the capital gains are based solely on when you sell.

Interested in learning more? Read more about my firm, and check out my service options

The information on this site is provided “AS IS” and without warranties of any kind either express or implied.

What is taxable gain when you sell shares?

The taxable gain or loss when you sell funds is the difference between the amount you receive from the sale and the cost basis of the shares you sold. The first thing to calculate for the shares sold is their cost basis. This will depend on how you received them. If you purchased them, your cost basis is the purchase price.

What happens if a mutual fund doesn't do it for you?

If they don't do it for you, you're forced to do it yourself. And even if they do provide that information, you don't have to have to use the method chosen for you by the mutual fund company. You can use the method that best suits your needs and tax planning. One other caveat.

What is the cost basis of a dividend?

If you got the shares as part of a dividend reinvestment plan, the cost basis is their price at the time of purchase. If you inherited the shares, the cost basis is usually their fair market value (the "net asset value") on the date of death of the decedent.

Do mutual fund companies provide cost basis information?

Most mutual fund companies will provide cost basis information for you when you sell your shares -- averaged according to the Single Category method. That's nice of them to do, and it might take a lot of pressure off you at tax time when you're reporting your mutual fund sales.

Do you have to account for mutual funds?

The answer is no, you don't. But you do have to account for the shares of the mutual fund that you sold during the year. And if you're like many people who regularly buy shares of various funds each month, and you have your dividends reinvested in additional shares, the accounting can begin to seem impossibly complicated.

Is a reinvested mutual fund taxable?

Many people believe that reinvested mutual fund dividends are simply taxable income and don't see them as a purchase of additional shares. Not so. Look at it this way: The mutual fund company gives you a dividend check. And then you turn right around and buy more mutual fund shares with that check.

What happens when you sell shares in a mutual fund?

When you sell mutual fund shares, you trigger a tax event -- a capital gain or loss. Using the sale proceeds to buy shares in a different mutual fund does not affect your tax situation from the sale of shares.

How do mutual funds work?

Every time you buy shares in a mutual fund, the fund company makes a record called a "tax lot." This shows the number of shares, purchase date, price per share and any fees or commissions. When you later sell shares, the fund company matches your sales order to your tax lots to determine your gain or loss. Your cost basis is the amount you paid for the shares. You can have the fund match tax lots on a first-in, first-out basis; by individual identification of lots; or by the average cost of all shares.

What is a tax lot in mutual funds?

Tax Lots. Every time you buy shares in a mutual fund, the fund company makes a record called a "tax lot.". This shows the number of shares, purchase date, price per share and any fees or commissions. When you later sell shares, the fund company matches your sales order to your tax lots to determine your gain or loss.

How do you figure capital gains tax?

You figure your capital gain or loss from the proceeds of the sale minus the shares' cost basis, as identified by the tax lots. Any fees add to your cost basis. For shares you held a year or less, the short-term capital gains tax is your marginal tax rate.

Can you subtract fees from sales?

You can subtract these fees from the sale proceeds, which reduces your taxable income or increases your loss. If you sell all of your shares, any reinvested dividends, interest and capital gains will be included in your proceeds, which may increase your taxable income.

Can you get a new sales fee if you buy shares in the same fund?

You might escape a new sales fee if you exchange shares within the same mutual fund family. This is called a reinvestment right and may limit the tax benefit of sales loads if you sell the shares within 90 days of purchase. When you buy into a new fund, you can expect to receive additional tax forms reporting your dividends ...