Dividends can fluctuate when stock prices change, as businesses can change the dividend amount at any time. However, companies are not required to change the yield when the stock prices go up. Some corporations may need to increase dividends if the stock goes up to match their expected yield rate.

Does the dividend go up when the stock price falls?

The dividend does not go up when the stock price falls. The dividend is a fixed quantity that is announced annually by the company that is so much per share, for example $0.50 per share that you own over the year. You may be thinking of the dividend YIELD instead.

Why do stock prices go up and down?

Essentially, when the collective opinion of investors is positive, stock prices go up. When the general consensus is less than optimistic, prices drop. Despite the seemingly complex nature of the market, most activity truly boils down to the cumulative effect of investors trying to predict what their peers are thinking.

Why do dividends matter when buying stocks?

As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. If a company announces a higher-than-normal dividend, public sentiment tends to soar.

What happens to stock price on ex dividend date?

Stock Price on Ex-Dividend Date. Stock market specialists will mark down the price of a stock on its ex-dividend date by the amount of the dividend. For example, if a stock trades at $50 per share and pays out a $0.25 quarterly dividend, the stock will be marked down to open at $49.75 per share.

Do dividends increase with share price?

Stock Dividends After the declaration of a stock dividend, the stock's price often increases. However, because a stock dividend increases the number of shares outstanding while the value of the company remains stable, it dilutes the book value per common share, and the stock price is reduced accordingly.

What happens to dividend yield when stock price goes up?

While a stock's dividend may hold steady quarter-after-quarter, its dividend yield can change daily, because it is linked to the stock's price. As the stock rises, the yield drops, and vice versa.

Do dividends go down if stock price goes down?

Dividends can go down when the stock price goes down. However, that doesn't mean dividends directly correlate with stock price. Stock prices fluctuate every day, but the dividend yield might not. In other words, the market doesn't impact dividend payments.

What causes dividends to increase?

Dividend Increases If the company is performing well and cash flows are improving, there is more room to pay shareholders higher dividends. In this context, a dividend hike is a positive indicator of company performance.

Are dividends depending on stock price?

The dividend yield is the annual payout divided by the current stock price. Dividends change when stock prices rise and fall. A corporation may also change the size of a dividend. Corporations do not need to change dividend amounts when the common stock price changes.

How long do you have to hold a stock to get the dividend?

Briefly, in order to be eligible for payment of stock dividends, you must buy the stock (or already own it) at least two days before the date of record and still own the shares at the close of trading one business day before the ex-date.

Are dividends profitable?

Dividend is usually a part of the profit that the company shares with its shareholders. Description: After paying its creditors, a company can use part or whole of the residual profits to reward its shareholders as dividends.

What happens to dividends during a bear market?

When you invest during a bear market in a solid company with a history of increasing its dividend payments, you obtain a degree of comfort that you'll receive cash flow while you own that stock. Even if the shares lose value during a bear market, you'll receive income from your dividends.

Which stock has the highest dividend?

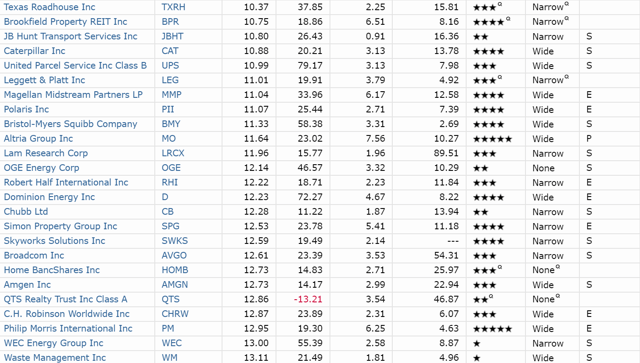

Dividend stocks can be a great choice for investors looking for regular income....25 high-dividend stocks.SymbolCompany NameDividend YieldMOAltria Group Inc.6.66%OKEONEOK Inc.5.68%UVVUniversal Corp.4.96%LAMRLamar Advertising Co4.90%21 more rows

What is a good dividend yield?

What is a good dividend yield? In general, dividend yields of 2% to 4% are considered strong, and anything above 4% can be a great buy—but also a risky one. When comparing stocks, it's important to look at more than just the dividend yield.

What causes dividends to decrease?

Companies usually make drastic dividend cuts because of financial challenges like declining earnings or mounting debts. Sometimes companies may cut dividend payments for more positive reasons, like preparing for a major acquisition or a stock buyback.

Is a high dividend per share good?

Dividends per share (DPS) is an important financial ratio in understanding the financial health and long-term growth prospects of a company. A steady or growing dividend payment by a company can be a signal of stability and growth.

Why do dividends go up?

When dividends go up, the stock becomes more attractive to buyers. That increased demand will cause sellers to raise the price to gain more profits. If you hold this dividend stock, the share price will go up as the dividend rises. Investors generally consider rising dividends a sign of a company's good health.

How does the stock price react to dividends?

The stock price will react before the actual dividend change based on company news. Your stock price will also rise or fall based on profit and sales projections, because these tend to be leading indicators of a coming change in dividends.

How to anticipate dividend changes?

You can anticipate changes in dividends by going on the company's website, reading the annual report, participating in quarterly calls and paying close attention to any press releases issued by the company regarding dividend changes. The stock price will react before the actual dividend change based on company news.

What is the total return on dividends?

Your total return from dividend stocks consists of the rise in your stock prices plus the corporate profits companies pay out as dividends on your shares of their stocks. You profit when stock prices rise and dividends remain steady.

What are the factors that affect stock prices?

Numerous factors affect stock prices. Supply and demand plays a major role in the rise and fall of stock prices. Fear and greed are also driving factors. Something else plays a role when a company pays a dividend, however.

How long do you have to hold a stock to get dividends?

Although most corporate dividends are "qualified" and taxed at a special rate, you have to hold a stock for 61 days or more to earn that status. This means your first couple of dividends will be taxed at your ordinary income tax rate.

Why are payout dates important?

On the record and payout dates, there are no price adjustments made by the stock exchanges. Those dates are mainly administrative markers that don't affect the value of the stock. From an investment perspective, the important date is the ex-dividend date, as that is the date that determines whether you are entitled to a dividend or not. Payout dates are important to investors, as that is the day they actually receive their money. However, it doesn't affect the value of the company on the open market.

How long after the record date is the dividend paid?

The payout date can be days, weeks or even months after the record date. This is the date that the dividend is actually paid out to shareholders.

Can a stock be bid up on the ex-dividend date?

However, the market is guided by many other forces. If a stock is deemed to be undervalued by investors, the stock price may be bid up, even on the ex-dividend date. Similarly, if investor perception of the value of a stock on any given day sours, the stock may sell off much more than the simple drop due to the dividend.

Do dividends have to be recorded on the books?

Dividends are typically paid in cash and given to shareholders quarterly, although some companies pay dividends irregularly or make payouts in the form of shares of stock. Payouts are only made to shareholders that are recorded on the books of the issuing company. A person must be on record as a shareholder by what's known as the record date in order to receive a dividend.

Why do dividend stocks decrease in value?

During a recession or other times of hardship, dividend-paying stocks can quickly decrease in value, because there is a risk that the firm will reduce payouts in the future. If a company says that it's cutting its dividend, the stock price will react right away.

What is dividends?

A dividend is how a firm returns profits directly to its shareholders. 1 Companies aren't required to issue dividends, so there isn't a set rule about which will and which ones won't. Even if a company has issued dividends in the past, it may stop at any time.

What does dividend yield mean?

A stock's dividend yield tells you how much dividend income you receive, compared to the current price of the stock. Buying stocks with a high dividend yield can provide a good source of income, but there are other factors to take into account.

What to do if you don't want to study stocks?

If you don't want to study and purchase individual stocks, you can invest in a dividend income fund instead. These funds allow you to diversify your portfolio while letting experts make the hard choices about which stocks to buy and when to buy them.

Is a company required to pay dividends to the people who own its stock?

4 On the other hand, a company is not required to pay a dividend to the people who own its stock.

When do companies distribute dividends?

Companies typically distribute dividends only when they produce surplus cash. But in lean times, less cash might be coming in the door, or the company may require cash for capital expenditure, expansion, or mergers and acquisitions, in which case it may be forced to reduce or eliminate its dividends.

Why does dividend yield change daily?

While a stock's dividend may hold steady quarter-after-quarter, its dividend yield can change daily, because it is linked to the stock's price. As the stock rises, the yield drops, and vice versa. If JKL shares were to suddenly double in value, from $16.55 to $33.10, the yield would be cut in half to 3.9%.

What to look for in high yield stocks?

What to Look for in High Yield. As always, don't rely on dividend yield alone to determine suitable stock candidates. There are other criteria that you need to keep in mind when you invest in high-dividend-yield stocks. First and foremost, look at the stock's history.

What is dividend yield?

The dividend yield gives investors an idea of the cash dividend return they can expect from the money that they have put at risk in the stock. Determining the dividend yield takes a bit of math, but it can make (or save) a fortune. Take, for instance, the hypothetical stock of a drug manufacturer: Company JKL.

Why are DJIA stocks laggards?

According to O'Higgins, this is because high dividend-yielding stocks of the DJIA will typically be the laggards. By purchasing when the stocks are "cheap" and producing dividends, you can potentially beat other strategies and the market on average in a down market.

Is high dividend yielding stock good?

What's more, regardless of how the stock performs, the yield produces a nice recurring rate of investment return. As a result, high dividend-yielding stocks can be a good place to put your money when markets are falling.

Can you make money on stocks during a downturn?

A downturn in the market doesn't necessarily mean that your money is going to fly out of the window. Even when markets are in turmoil, it's still possible to make money on stocks. For investors facing a falling market, stocks with a high dividend yield can be a good investment. In many cases, stocks that offer a high yield are often ...

How Dividends Can Impact Stock Prices?

Dividends can impact stocks in many ways, although stock values don’t always affect dividends. Many investors check a stock’s dividend history before purchasing it. They can use this information to determine whether or not the stock offers a good, consistent yield over time.

Why Do Stock Prices Fall After Dividends Are Paid?

The stock value drops after the company pays the dividend. This occurrence stems from the company using its money to pay out the dividends and the taxes that come with it. The business’s profit goes down from this.

Reasons Dividends Go Down

According to Investopedia, dividend cuts are likely a bad sign for a company’s financial well-being. Businesses tend to cut back on dividends when they face financial struggles, including dropping profits, high debts, and other issues.

Reasons Stock Prices Go Down

Stock prices are constantly fluctuating and are independent of the dividend value. Whether they go up or down has to do with the supply and demand of the share. When the demand is higher, more people buy, and the stock prices go up.

Conclusion

Dividends and stock prices affect each other, although dividends won’t always drop when stocks drop. If this does happen at the same time, it’s usually because the ex-dividend date passed and shareholders want to make the stock appealing to others.

Understand Dividend Terminology

Stock Price on Ex-Dividend Date

- Stock market specialists will mark down the price of a stock on its ex-dividend date by the amount of the dividend. For example, if a stock trades at $50 per share and pays out a $0.25 quarterly dividend, the stock will be marked down to open at $49.75 per share. However, the market is guided by many other forces. If a stock is deemed to be underva...

Record and Payout Dates

- On the record and payout dates, there are no price adjustments made by the stock exchanges. Those dates are mainly administrative markers that don't affect the value of the stock. From an investment perspective, the important date is the ex-dividend date, as that is the date that determines whether you are entitled to a dividend or not. Payout dates are important to investor…

Taxation of Dividends

- Taxation is another concern for dividend investors. Although most corporate dividends are "qualified" and taxed at a special rate, you have to hold a stock for 61 days or more to earn that status. This means your first couple of dividends will be taxed at your ordinary income tax rate. If you intend to buy and sell stocks immediately before and after their ex-dividend dates simply to …