What factors affect a Biotech stock’s price?

Includes daily volume and beta. Stocks in the biotech industry are highly volatile and difficult to analyze. Many biotech companies currently trading on the stock market have one or more drugs still completing the Food and Drug Administration (FDA) approval process. Drugs still in testing can have a big impact on a biotech company’s valuation.

Are biotech stocks heading Lower?

Biotech stocks continue to exhibit signs of weakness and are signaling that they are heading lower. After being up by 11 percent through the end of January, the group has deteriorated, and is presently up about 4 percent using the Nasdaq Biotech ( IBB) as a proxy.

Are biotech stocks a good investment in 2019?

Biotech suffered losses toward the end of 2018 along with the broader stock market but bounced back in early 2019. Biotech stocks provide a tremendous opportunity for gains, but it is also a risky venture for even the most seasoned of investors. Biotech is a notoriously fickle industry.

Why are biotech stocks so volatile?

Stocks in the biotech industry are highly volatile and difficult to analyze. Many biotech companies currently trading on the stock market have one or more drugs still completing the Food and Drug Administration (FDA) approval process. Drugs still in testing can have a big impact on a biotech company’s valuation.

Why are biotech stocks so risky?

Biotech stocks also come with risks due to the potential that some products under development may never make it to market. Biotech firms face many regulations, including from the FDA, adding the risk of uncertainty surrounding developing new drugs.

Should I invest in biotech stocks?

Investing in the biotechnology industry can prove to be overwhelmingly lucrative. Most clinical-stage stocks in this sector trade at prices under $5 per share. However, the successful launch of a new treatment option can send the stock soaring in many multiples.

What are the top 5 biotech stocks to buy?

BioMarin Pharmaceutical Inc. ( ... CRISPR Therapeutics AG (CRSP) ... Exelixis Inc. ( ... Global Blood Therapeutics Inc. ( ... Ionis Pharmaceuticals (IONS) ... Sarepta Therapeutics Inc. ( SRPT) ... Vir Biotechnology Inc. ( VIR) ... 8 best biotech stocks to buy in 2022: Alkermes PLC (ALKS)More items...•

Do biotech stocks go up after FDA approval?

Result: You can see the stock experienced a slight increase after the FDA approval start date in early May. Subsequently the stock continued a steady increase of 17% between the start and end of the approval process.

What happened to biotech stocks?

The SPDR S&P Biotech exchange-traded fund (ticker: XBI) fell 17.9% in April, bringing the total drop for 2022 to 34.1%. Over the past 12 months, the XBI is down 46%, while the S&P 500 is just down 1.2%. The pain remains focused on the small and mid-cap biotechs.

What is the best biotech stock?

Best biotech stocksCompanyMarket CapitalizationNovavax (NASDAQ:NVAX)$8.4 billionRegeneron Pharmaceuticals (NASDAQ:REGN)$66.2 billionVertex Pharmaceuticals (NASDAQ:VRTX)$59.5 billionTwist Bioscience NASDAQ:TWST)$3.03 billion2 more rows

What is the number 1 biotech company?

Largest Biotech companies by Market Cap#Name1d1Johnson & Johnson 1JNJ0.47%2Roche 2ROG.SW0.43%3Eli Lilly 3LLY0.56%4Pfizer 4PFE0.22%56 more rows

Where should I invest right now?

12 best investmentsHigh-yield savings accounts.Certificates of deposit (CDs)Money market funds.Government bonds.Corporate bonds.Mutual funds.Index funds.Exchange-traded funds (ETFs)More items...

What are the best tech stocks to buy now?

Best Tech Stocks to Buy According to Billionaire Ken GriffinAdvanced Micro Devices, Inc. (NASDAQ:AMD) ... Broadcom Inc. (NASDAQ:AVGO) ... Uber Technologies, Inc. (NYSE:UBER) ... Visa Inc. (NYSE:V) ... Tesla, Inc. (NASDAQ:TSLA)

Why is biotech underperforming?

Experts propose a variety of plausible explanations for the recent underperformance of the biotech sector. One of them is simply an undesirable spillover from COVID-19-related efforts, meaning that researchers and capital providers simply diverted their attention towards COVID-19-related developments.

Are biotech stocks cyclical?

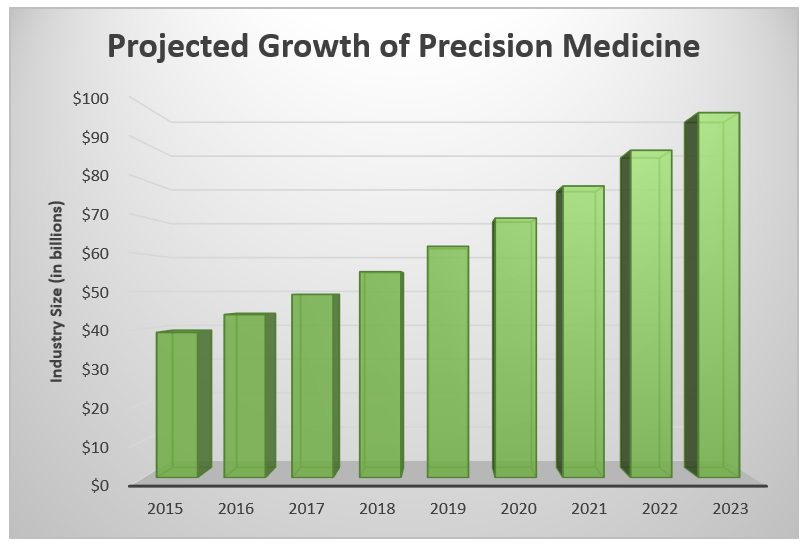

Investing in biotech stocks is cyclical. Companies like Pfizer (PFE) and Moderna now have huge war chests for acquisitions. Some of that deal-making is already underway. Meanwhile, new innovations like messenger RNA vaccines, CRISPR gene editing and precision medicines are making their prime time debuts.

Do stocks always go up after FDA approval?

Answering the question, "Does a Drug Approval Mean a Higher Stock Price?" is fairly straight forward, but there are some caveats that investors need to be aware of. The simple answer is yes, in most cases a new drug approval can lead to a higher share price for the company on the receiving end of that approval.

Is now a good time to buy biotech?

The stock does remain risky, but a little less so after the thumbs-up from the committees convened by the FDA. That's why for those investors with above-average risk tolerance, now is a great time to consider opening a (small) position in this biotech stock.

Is biotech Growth Trust a good investment?

There's no doubt that biotech is a risky business, but Biotech Growth Trust has a good long-term track record with an annualised share price total return of 20 per cent over the decade to 31 July, according to analysts at Edison....Top 10 holdingsImmunoGen2.40%Source: Frostrow Capital, 31 July 20219 more rows•Sep 23, 2021

What is the best biotech company?

Top 10 Biotechnology Companies in the USA1) Novo Nordisk.2) Regeneron Pharmaceuticals.3) Alexion Pharmaceuticals.4) Vertex Pharmaceuticals.5) Jazz Pharmaceuticals.6) Incyte Corporation.7) Biomarin Pharmaceutical.8) United Therapeutics.More items...•

Is biotech in a bear market?

Biotechs rushed to go public in 2021 with inflated stock prices, only to see the market plummet into bear territory a year later, GlobalData Business Fundamentals Analyst Mariam Shwea said. Stock prices have plummeted, and many biotechs are now trading below value.

How were Cellular Biomedicine Group's earnings last quarter?

Cellular Biomedicine Group, Inc. (NASDAQ:CBMG) announced its earnings results on Monday, November, 9th. The biotechnology company reported ($0.88)...

Who are Cellular Biomedicine Group's key executives?

Cellular Biomedicine Group's management team includes the following people: Mr. Bizuo Liu , CEO, CFO & Exec. Director (Age 56, Pay $541.33k) Dr....

Who are some of Cellular Biomedicine Group's key competitors?

Some companies that are related to Cellular Biomedicine Group include Immunocore (IMCR) , Allogene Therapeutics (ALLO) , Revolution Medicines (R...

What other stocks do shareholders of Cellular Biomedicine Group own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Cellular Biomedicine Group investors own include CRISPR Th...

What is Cellular Biomedicine Group's stock symbol?

Cellular Biomedicine Group trades on the NASDAQ under the ticker symbol "CBMG."

What is Cellular Biomedicine Group's stock price today?

One share of CBMG stock can currently be purchased for approximately $19.75.

How much money does Cellular Biomedicine Group make?

Cellular Biomedicine Group (NASDAQ:CBMG) has a market capitalization of $384.69 million and generates $340 thousand in revenue each year.

How many employees does Cellular Biomedicine Group have?

Cellular Biomedicine Group employs 217 workers across the globe.

What is Cellular Biomedicine Group's official website?

The official website for Cellular Biomedicine Group is www.cellbiomedgroup.com .

Are investors shorting Premier Biomedical?

Premier Biomedical saw a decrease in short interest in the month of April. As of April 15th, there was short interest totaling 18,400 shares, a dec...

Who are Premier Biomedical's key executives?

Premier Biomedical's management team includes the following people: Mr. David Caplan , Pres, Chairman of Directors, Sec. & Treasurer Mr. Carl Ell...

Who are some of Premier Biomedical's key competitors?

Some companies that are related to Premier Biomedical include Abacus Health Products (ABAHF) , Acreage (ACRGF) , Alliance Growers (ACGWF) , Alt...

What other stocks do shareholders of Premier Biomedical own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Premier Biomedical investors own include Co-Diagnostics (C...

What is Premier Biomedical's stock symbol?

Premier Biomedical trades on the OTCMKTS under the ticker symbol "BIEI."

How do I buy shares of Premier Biomedical?

Shares of BIEI can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBul...

What is Premier Biomedical's stock price today?

One share of BIEI stock can currently be purchased for approximately $0.00.

What is Premier Biomedical's official website?

The official website for Premier Biomedical is www.premierbiomedical.com .

How can I contact Premier Biomedical?

Premier Biomedical's mailing address is PO Box 31374, EL PASO, TX 79931-0374, United States . The company can be reached via phone at 724 633 7033 .

What are the best biotech stocks?

Best Value Biotech Stocks 1 Agios Pharmaceuticals Inc.: Agios is a pharmaceutical company developing drug treatments for genetically defined diseases such as hemolytic anemias and sickle cell disease. The company reported net income of $1.9 billion for Q1 2021 versus a loss in Q1 2020. This figure was impacted by the sale of Agios' oncology portfolio to Servier Pharmaceuticals LLC in Q1 2021. 2 2 Sage Therapeutics Inc.: Sage Therapeutics creates treatments for central nervous system disorders including schizophrenia and major depressive disorder. In Q1 2021, the company reported positive trial developments in its SAGE-718, a drug with the potential to be used in the treatment of Huntington disease. 3 3 Innoviva Inc.: Innoviva is a healthcare-focused asset management company that holds a portfolio of royalties from a variety of pharmaceuticals.

What is biotechnology industry?

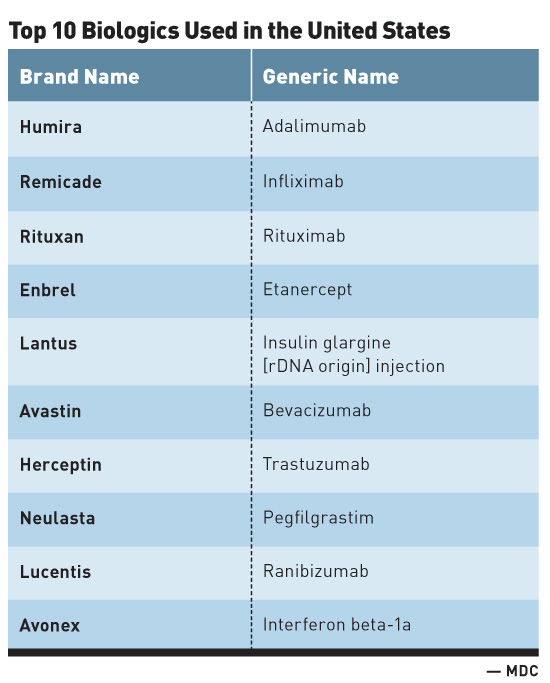

The biotechnology industry includes companies that develop drugs and diagnostic technologies for the treatment of diseases and medical conditions. These products must go through rigorous, costly, and time-consuming trials before potentially obtaining approval from the U.S. Food and Drug Administration (FDA).

What is Sage Therapeutics?

Sage Therapeutics Inc.: Sage Therapeutics creates treatments for central nervous system disorders including schizophrenia and major depressive disorder. In Q1 2021, the company reported positive trial developments in its SAGE-718, a drug with the potential to be used in the treatment of Huntington disease. 3.

0.0 Analyst's Opinion

Cellular Biomedicine Group has received 191 “outperform” votes. (Add your “outperform” vote.)

How were Cellular Biomedicine Group's earnings last quarter?

Cellular Biomedicine Group, Inc. (NASDAQ:CBMG) released its quarterly earnings data on Monday, November, 9th. The biotechnology company reported ($0.88) earnings per share (EPS) for the quarter, missing the Thomson Reuters' consensus estimate of ($0.63) by $0.25.

Who are some of Cellular Biomedicine Group's key competitors?

Some companies that are related to Cellular Biomedicine Group include Revolution Medicines (RVMD), NanoString Technologies (NSTG), Instil Bio (TIL), Krystal Biotech (KRYS), Alector (ALEC), Allogene Therapeutics (ALLO), iTeos Therapeutics (ITOS), Atara Biotherapeutics (ATRA), Sana Biotechnology (SANA), Vaxcyte (PCVX), REGENXBIO (RGNX), Editas Medicine (EDIT), Immunocore (IMCR), C4 Therapeutics (CCCC) and Coherus BioSciences (CHRS). View all of CBMG's competitors..

What other stocks do shareholders of Cellular Biomedicine Group own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Cellular Biomedicine Group investors own include CRISPR Therapeutics (CRSP), Aduro Biotech (ADRO), Amarin (AMRN), Anavex Life Sciences (AVXL), Adaptimmune Therapeutics (ADAP), Exelixis (EXEL), Fate Therapeutics (FATE), ImmunoGen (IMGN), AT&T (T) and Iovance Biotherapeutics (IOVA)..

What is Cellular Biomedicine Group's stock symbol?

Cellular Biomedicine Group trades on the NASDAQ under the ticker symbol "CBMG."

What is Cellular Biomedicine Group's stock price today?

One share of CBMG stock can currently be purchased for approximately $19.75.

How much money does Cellular Biomedicine Group make?

Cellular Biomedicine Group has a market capitalization of $384.69 million and generates $340 thousand in revenue each year.

About Premier Biomedical

Premier Biomedical, Inc. is a research-based company, which engages in the development and discovery of medical products. It focuses on the development and distribution of hemp oil based topical pain relief products. The company was founded by Mitchell S. Felder on May 10, 2010 and is headquartered in Jackson Center, PA.

Premier Biomedical (OTCMKTS:BIEI) Frequently Asked Questions

Premier Biomedical's stock was trading at $0.0004 on March 11th, 2020 when Coronavirus reached pandemic status according to the World Health Organization. Since then, BIEI stock has increased by 425.0% and is now trading at $0.0021. View which stocks have been most impacted by COVID-19.

When will Axsome be approved for smoking cessation?

Food and Drug Administration (FDA) approval during the second quarter of 2021.

What is biotech company?

What exactly is a biotech? It’s a company that uses living organisms (for example, bacteria or enzymes) to make drugs. This use of living organisms differentiates biotechs from pharmaceutical companies, which use chemicals to develop drugs.

What is the difference between a biotech and a biotech?

In addition, a biotech with more experimental drugs in its pipeline (the term used to refer to all a company’s drugs that are in development) will tend to have less risk than a biotech with only one or a very few drug candidates. Another important thing to watch with biotechs is their financial positions.

What is Axsome 05?

Axsome Therapeutics. Axsome's lead candidate drug, which it calls AXS-05, targets depression and Alzheimer’s disease-related agitation. In early 2021, the company formally filed for U.S. regulatory approval for the drug to treat depression. It’s also evaluating AXS-05 in a phase 2 study for smoking cessation.

How much is AXS 05 worth?

If approved, AXS-05 as a depression treatment could be a blockbuster drug, with peak annual sales -- the highest dollar-volume of sales per year analysts project -- estimated at $2.6 billion.

What is the importance of biotech?

Another important thing to watch with biotechs is their financial positions. Most biotechs don’t achieve profitability until they successfully launch one or more drugs in the market. They require significant amounts of cash to fund operations and advance their pipeline candidates.

What is phase 1 of a drug?

Phase 1, which involves small studies designed to find a safe dose for the drug candidate and determine how it affects humans. Phase 2, which involves studies that can include around 100 or more patients and focus on safety, short-term side effects, and determining the optimal dose for the drug.

Medical - Biomedical and Genetics

Year to Date (YTD) Return shows the median percentage price change for the respective equally-weighted Industry since the beginning of the year.

Industry Rank for Medical - Biomedical and Genetics

The Medical - Biomedical and Genetics Industry, part of the Medical Sector, is currently ranked in the bottom 41% of industries. Specifically, it is ranked number 150 of 253 industries. Because it is ranked in the bottom half of Zacks Ranked Industries, we expect it to underperform the market over the next 3 to 6 months.

Industry Description

This industry includes biopharmaceutical and biotech stocks like Amgen, Inc. (AMGN).

When did Zacks discover earnings estimate revisions?

In 1978, our founder discovered the power of earnings estimate revisions to enable profitable investment decisions. Today, that discovery is still the heart of the Zacks Rank. A wealth of resources for individual investors is available at www.zacks.com. Learn More.

What is Enzo Biochem?

Enzo Biochem develops, manufactures and markets health care products based on molecular biology and genetic engineering techniques. Enzo has beaten its earnings estimates in each of the past five operational quarters by an average of 51.33%.

What is Regeneron Pharmaceuticals?

Regeneron Pharmaceuticals is a biopharmaceutical company that develops and intends to commercialize drugs for the treatment of serious medical conditions. Regeneron touts a RoE of 22.99% and Net Margin of 19.34, both of which compare favorably to the industry.

Will the FDA stop drug development?

However, President Donald Trump has stated on multiple occasions that he plans to eliminate restrictions on drug development for the FDA. This policy would positively affect biomedical companies, as their products would reach the open market more easily and frequently.

What is noteworthy about biotech?

What's noteworthy about the biotech space is that these companies should prove to be largely immune to any economic downturn. People aren't going to stop taking their prescription medicines. after all.

How much is the Amicus market cap?

To put these revenue projections into context, Amicus' market cap currently sits at $2.2 billion.

How much will Firdapse cost in 2020?

Per the company's latest quarterly update, for instance, Firdapse is on track to haul in between $135 million to $155 million in sales in 2020.

When will Inovio start testing INO-4800?

As things stand now, Inovio expects to have INO-4800 in a human trial by April, with top-line data available by early fall. By the end of the year, the company plans to have approximately 1 million doses available for additional trials, or for emergency purposes.

Is bicycle therapeutics a biotech company?

Bicycle Therapeutics: An underappreciated novel cancer play. Bicycle Therapeutics isn't a particularly well-known name among biotech investors, given that its IPO was only last year. However, this novel immunoncology company is poised to potentially take the field by storm over the next few years.

Is Amicus Therapeutics a rare disease?

Amicus Therapeutics: A leader in the field of rare diseases. Amicus is a rare-disease drugmaker that's held up fairly well against the wave of panic-selling this year. So far in 2020, for instance, the company's shares have lost only about 11% of their value, compared with the nearly 30% losses posted by some of the broader market indices.

Why is it difficult to analyze biotech stocks?

Because there are many biotech companies that do not generate revenue, or their revenue is minimal, it is difficult to analyze these companies based on their fundamentals. A simple screen based on current earnings, revenue, or any other financial figure would not show the whole value of a biotech company. Biotech stocks require a unique form of ...

Is biotech stock volatile?

Stocks in the biotech industry are highly volatile and difficult to analyze. Many biotech companies currently trading on the stock market have one or more drugs still completing the Food and Drug Administration (FDA) approval process. Drugs still in testing can have a big impact on a biotech company’s valuation.