Should you Buy Costco stock right now?

Similarly, Costco's stock has delivered exceptional value to shareholders, up 62% in the last year and 548% in the previous decade, before dividends. It's understandable that potential investors would want to know more about this incredible retailer and whether or not the stock is a buy right now.

Is Costco stock a Buy Right Now?

There are currently 5 hold ratings and 21 buy ratings for the stock. The consensus among Wall Street research analysts is that investors should "buy" Costco Wholesale stock. View analyst ratings for Costco Wholesale or view top-rated stocks.

Is it time to Buy Costco stock?

Costco stock is one of the best in the market right now and its recent run to all-time highs shows why. The stock has been in an impressive uptrend, something both traders and investors love to see. “Stick with the trend until it bends,” is a common ...

Is Costco a good investment?

If you are a long-term shareholder of Costco stock, you’ve no doubt seen a nice return on your investment. In fact, since its IPO in 1985, the stock has gone from $1.67 per share to, now, more than $300. In fact, Costco stock (Nasdaq: COST) has been so consistent in its growth, it’s widely considered to be a blue chip stock.

See more

What was Costco's original stock price?

$10.00 per shareWhen was Costco Wholesale's initial public offering and at what price? The Company went public on December 5, 1985 at $10.00 per share (before stock splits). Adjusting for stock splits, the initial price per share was approximately $1.67.

What is the highest price Costco stock has ever been?

The all-time high Costco stock closing price was 608.05 on April 07, 2022.

When was Costco's last stock split?

2000Costco doesn't split its stock very often. The last time was more than two decades ago. Before the 2000 stock split, Costco had a 3-for-2 split in 1992 and a 2-for-1 split in 1991.

What was the book value of Costco equity 2018?

Compare COST With Other StocksCostco Price/Book Ratio Historical DataDateStock PriceBook Value per Share2018-08-31220.27$29.902018-05-31186.84$28.382018-02-28179.40$27.4652 more rows

Is Costco a good stock to buy 2022?

Analysts expect Costco's revenue and earnings per share to rise by 15% and 16%, respectively, in fiscal 2022. Next fiscal year, they expect its revenue to grow 8% and earnings per share to increase 10%. That would be impressive growth, but Costco's stock already trades at more than 30 times next year's earnings.

Will Costco ever split?

Should investors buy Costco stock ahead of a potential split? The short answer is no. For one thing, the company has made no such announcement -- and there's no telling if it will.

How many times did Costco stock split?

How Many Times Has Costco Stock Split Before? COST has split its stock three times before - in 2000, 1992, and 1992 as seen below.

Will Costco stock recover?

Costco stock forecast: Targets for 2022-2025 It expected the stock to plunge to $413.430 on 10 June. However, it predicted that the stock could rebound and end the year at $537.166. As for its baseline Costco stock forecast 2025, Wallet Investor predicted that the price could rise further to $820.937.

Which stock has the highest dividend?

9 highest dividend-paying stocks in the S&P 500:AT&T Inc. (T)Williams Cos. Inc. (WMB)Devon Energy Corp. (DVN)Oneok Inc. (OKE)Simon Property Group Inc. (SPG)Kinder Morgan Inc. (KMI)Vornado Realty Trust (VNO)Altria Group Inc. (MO)More items...•

Is Costco overvalued?

Historically Costco was trading for a premium, with an average P/E of 26. However, the current valuation is much higher even compared to the high average valuation, to begin with. Back in 2017, the share price simply disconnected from its long-term trend. At the moment, shares seem like they are overvalued.

Is Costco a good stock to buy?

Costco's excellent prospects are no secret Costco is trading at a price-to-earnings (P/E) ratio of 36 and a price-to-free cash flow ratio of 50, suggesting a valuation near the higher end of its average over the last five years. Investors are undoubtedly aware of retailer's excellent prospects.

What was the book value of Costco equity?

Book Value Per Share (Annual) Costco Wholesale Corporation (COST) had Book Value Per Share of $40.92 for the most recently reported fiscal year, ending 2021-08-31.

What was Costco stock in 2015?

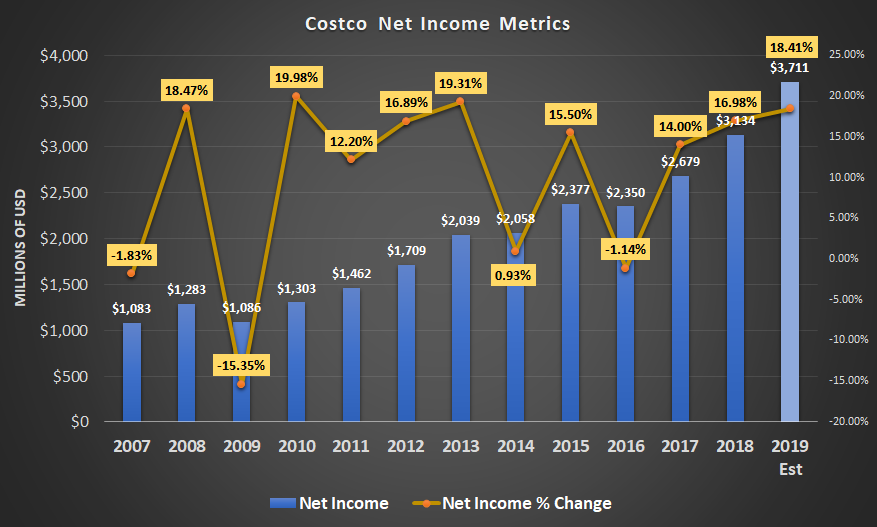

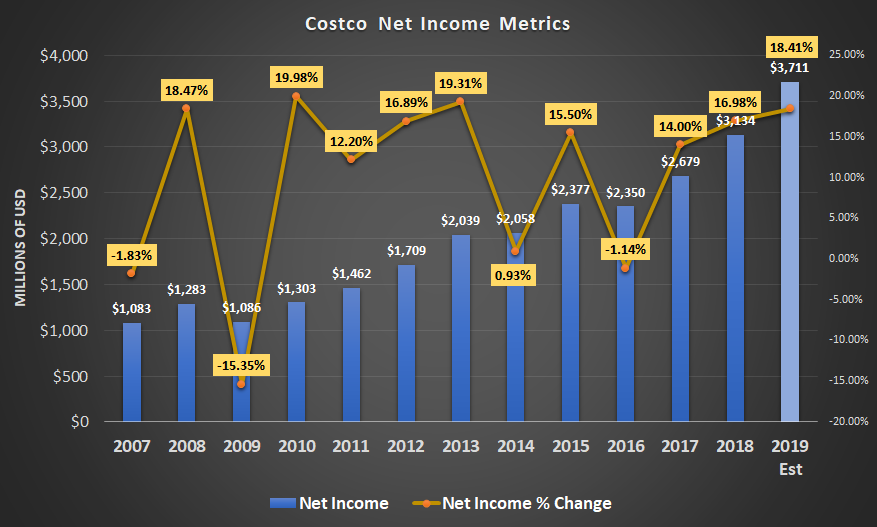

Costco's (NASDAQ: COST) stock price has increased nearly 2x from $140/share in August 2015 to $274/share in August 2019.

Where is Costco stock 5 years?

As for its baseline Costco stock forecast 2025, Wallet Investor predicted that the price could rise further to $820.937. Although it didn't provide price targets for 2030, its 5 year price prediction expected COST to hit $940.943 in May 2027.

Why has Costco stock gone up so much?

Costco (COST) is up 7.1% year-to-date (YTD) but could rise significantly from here based on its huge sales growth. Costco's March sales were up 17.1% on a comp basis, with U.S. sales up 19.1% YoY.

What are analyst price targets for Costco?

Based on analyst ratings, Costco's 12-month average price target is $560.21.

What was the closing price of Costco in 2021?

What is Costco Wholesale?

The all-time high Costco stock closing price was 529.37 on November 18, 2021.

The warehouse retailer has posted modest gains so far this year, but has lagged rivals Amazon and Wal-Mart in both performance and innovation

Costco Wholesale Corporation operates an international chain of membership warehouses, mainly under the `Costco Wholesale` name, that carry quality, brand name merchandise at substantially lower prices than are typically found at conventional wholesale or retail sources. The warehouses are designed to help small-to-medium-sized businesses reduce costs in purchasing for resale and for everyday business use. Individuals may also purchase for their personal needs. Costco's warehouses present one of the largest and most exclusive product category selections to be found under a single roof. Categories include groceries, candy, appliances, television and media, automotive supplies, tires, toys, hardware, sporting goods, jewelry, watches, cameras, books, housewares, apparel, health and beauty aids, tobacco, furniture, and office equipment. Costco is known for carrying top quality national and regional brands, with 100% satisfaction guaranteed, at prices consistently below traditional wholesale or retail outlets.

Bucking the retail apocalypse

Coming into 2017, Costco Wholesale ( COST 2.36% ) investors were looking for hints that the warehouse retailer would update its business model to adapt to online competitors like Amazon.com ( AMZN 1.61% ).

The e-commerce battle

While much of the retail sector has floundered this year, Costco has been able to post strong comparable sales growth as its unique membership model and rock-bottom prices give it a cushion from the changing consumer habits that are buffeting many of its peers.

Premium Investing Services

After Galanti told analysts last year that the company wanted to make every effort to bring customers into the store, Costco is finally making efforts to step up its e-commerce game, seeing strong growth in segments like appliances, apparel, and nonperishable foods.

The company showed it can compete in the digital space

Invest better with the Motley Fool. Get stock recommendations, portfolio guidance, and more from the Motley Fool's premium services.

Costco turned a digital corner

Daniel B. Kline is an accomplished writer and editor who has worked for Microsoft on its Finance app and The Boston Globe, where he wrote for the paper and ran the Boston.com business desk. His latest book, "Worst Ideas Ever," (Skyhorse) can be purchased at bookstores everywhere. Follow @tworstideas

Membership and renewals look good

For a long time, the membership-based warehouse club more or less ignored the internet. That has slowly changed over the last few years, and the company's digital evolution took hold in 2017.

What's next for Costco?

While comparable-store sales and digital growth are important, the key metric for Costco is membership growth. The chain hovered around its standard 90% renewal rate all year. It also saw total households with memberships climb from 49.4 million at the end of Q4 to 49.9 million at the close of Q1.

How much has Costco stock increased in 2021?

Because of its membership model, Costco does not have to be a first mover -- it proved that with digital and delivery. The company can afford to sit back and let other companies experiment. Then, when a trend takes hold, it can make its move and enter the space.

Has Walmart stock rallied in 2021?

Costco Stock Has Risen Nearly 37% in 2021, Outperforming Competitors — Is It Worth an Investment?