Is common stock found on an income statement?

This time period is most often a year. Common stock is included on the income statement as well as the balance sheet. The income statement of a business includes the expenditures and general costs related to the company's revenues. On the last line of the statement, the total amount earned or lost by the company over a given time period is given.

What is common stock on the balance sheet?

What is Common Stock Formula?

- Examples of Common Stock Formula (With Excel Template) Let’s take an example to understand the calculation of Common Stock in a better manner. ...

- Explanation. ...

- Relevance and Uses of Common Stock Formula. ...

- Common Stock Formula Calculator

- Recommended Articles. ...

Is a common stock considered an asset?

Common stock is a popular type of financial asset, in which investors buy shares in a publicly traded company. Common stockholders typically receive quarterly dividends and voting rights in major corporate decisions. Common stocks vary greatly in their riskiness and price performance but tend to appreciate in value over the long term.

Is common stock on the income statement or balance sheet?

Common stock is reported on both the balance sheet and the income statement. What happens to the balance sheet when you issue common stock? When stock is issued by a corporation, two accounts must be adjusted on your business’s balance sheet to record the transactions.

What is common stock on the balance sheet?

Common stock on a balance sheet On a company's balance sheet, common stock is recorded in the "stockholders' equity" section. This is where investors can determine the book value, or net worth, of their shares, which is equal to the company's assets minus its liabilities.

What category does common stock go under?

As an investor, common stock is considered an asset. You own the property; the property has value and can be liquidated for cash. As a business owner, stock is something you use to get an influx of capital.

What is common stock in Financial Accounting?

Common stock is an ownership share in a corporation that allows its holders voting rights at shareholder meetings and the opportunity to receive dividends.

Is common stock an asset on a balance sheet?

No, common stock is neither an asset nor a liability. Common stock is an equity.

How do you find common stock in accounting?

Common Stock = Total Equity – Preferred Stock – Additional Paid-in Capital – Retained Earnings + Treasury StockCommon Stock = $1,000,000 – $300,000 – $200,000 – $100,000 + $100,000.Common Stock = $500,000.

Is common stock a current asset?

Yes, marketable securities such as common stock or T bills are current assets for accounting purposes. Current assets are any assets that can be converted into cash within a period of one year.

Is common stock an equity?

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms.

What is the difference between a balance sheet and an income statement?

The balance sheet provides a snapshot of the financial condition of the company on a specific day ( usually December 31), where as the income statement reports the amount of revenue a company earned over a specific time period (usually for a year). Common stock is reported on both the balance sheet and the income statement.

What is income statement?

The income statement is one of the four financial statements used by businesses when reporting the financial condition of their company. The four include: the balance sheet, the income statement, the statement of owner’s equity and the statement of cash flows. The balance sheet provides a snapshot of the financial condition ...

What is the bottom line of an income statement?

The bottom line of the income statement indicates how much the company earned or lost over the period. The equation for an income statement looks like this: Net Income equals revenue minus expenses plus gains minus losses.

What is earnings per share?

Earnings per share represent the amount of earnings related to one share of common stock. There are two types of earnings per share: basic earnings per share and diluted earnings per share (which include the impact of stock options, grants and convertible bonds).

What is common stock?

A common stock is a representation of partial ownership in a company and is the type of stock most people invest in. Common stock comes with voting rights, as well as the possibility of dividends and capital appreciation. In accounting, you can find information about a company's common stock in its balance sheet.

Where is common stock recorded on a balance sheet?

Common stock on a balance sheet. On a company's balance sheet, common stock is recorded in the "stockholders' equity" section. This is where investors can determine the book value, or net worth, of their shares, which is equal to the company's assets minus its liabilities.

What is the difference between preferred and common stock?

The main difference is that preferred stock has a fixed, guaranteed dividend, while common stock dividends can change over time or even be discontinued. For this reason, share prices of preferred stocks generally don't fluctuate as much as common stock.

Why do people invest in common stock?

What is a common stock and why do people invest in it? Simply put, each share of common stock represents a share of ownership in a company. If a company does well , or the value of its assets increases, common stock can go up in value. On the other hand, if a company is doing poorly, a common stock can decrease in value.

Which shareholders have the most potential for profit?

Common shareholders have the most potential for profit, but they are also last in line when things go bad. In the event of bankruptcy, holders of common stock have the lowest-priority claim on a company's assets and are behind secured creditors such as banks, unsecured creditors such as bondholders, and preferred stockholders.

What is common stock?

Common stock is a security that represents ownership in a corporation. In a liquidation, common stockholders receive whatever assets remain after creditors, bondholders, and preferred stockholders are paid. There are different varieties of stocks traded in the market. For example, value stocks are stocks that are lower in price in relation ...

Where is common stock reported?

Common stock is reported in the stockholder's equity section of a company's balance sheet.

What is the largest stock exchange in the world?

NYSE had a market capitalization of $28.5 trillion in June 2018, making it the biggest stock exchange in the world by market cap. There are also several international exchanges for foreign stocks, such as the London Stock Exchange and the Tokyo Stock Exchange.

Why are stocks important?

They bear a greater amount of risk when compared to CDs, preferred stock, and bonds. However, with the greater risk comes the greater potential for reward. Over the long term, stocks tend to outperform other investments but are more exposed to volatility over the short term.

What is the difference between growth and value stocks?

There are also several types of stocks. Growth stocks are companies that tend to increase in value due to growing earnings. Value stocks are companies lower in price in relation to their fundamentals. Value stocks offer a dividend, unlike growth stocks.

When was the first common stock invented?

The first-ever common stock was established in 1602 by the Dutch East India Company and introduced on the Amsterdam Stock Exchange. Larger US-based stocks are traded on a public exchange, such as the New York Stock Exchange (NYSE) or NASDAQ.

Is common stock riskier than debt?

This makes common stock riskier than debt or preferred shares. The upside to common shares is they usually outperform bonds and preferred shares in the long run. Many companies issue all three types of securities. For example, Wells Fargo & Company has several bonds available on the secondary market.

What are the three financial statements?

There are three main financial statements investors should be aware of: the income statement, the balance sheet, and the cash flow statement. In this article, we'll look at what each one is and the key information investors should pay attention to.

What is the bottom line of a publicly traded company?

The bottom line is that for all publicly traded companies listed on major U.S. exchanges, financial statements are full of information, updated quarterly, and readily available to help investors like you make informed decisions.

What are the sections of a balance sheet?

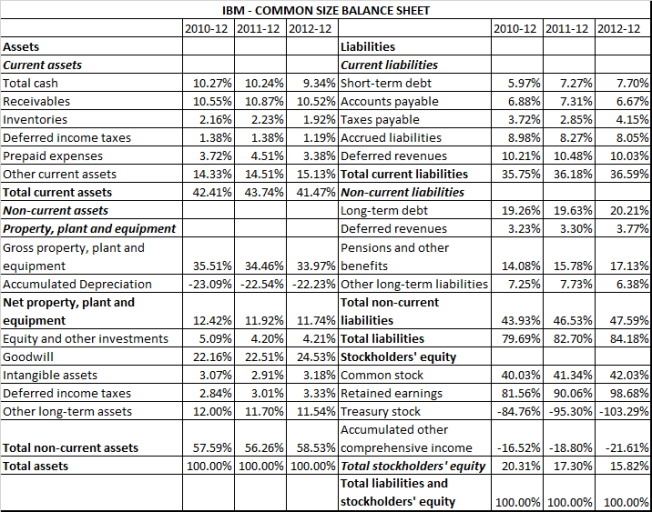

There are three sections on a balance sheet: 1 Assets: What the company owns. This is further broken down into current and noncurrent assets. Current assets include liquid assets and assets that can be expected to become liquid within a year. Examples include cash, short-term Treasuries, accounts receivable, and inventory. Noncurrent assets include long-term investments, real estate, and equipment used in manufacturing, just to name a few. 2 Liabilities: What the company owes. These are also divided into current and noncurrent. Current liabilities include payments a company will have to make within a year, such as accounts payable and short-term debt. Noncurrent liabilities include things like long-term debts. 3 Shareholder's equity: Think of shareholder's equity as what the company would have if it shut down, sold all of its assets, and paid all of its debts. Shareholder’s equity is the difference between assets and liabilities and is the company's net worth.

What does a positive number mean in a cash flow?

A positive number indicates that the company's cash increased during the period, while a negative number shows that the cash decreased. Just under the cash flow number will be a total of the cash and cash equivalents the company currently has. Learn which investments can help grow your money over time.

What are current assets?

Current assets include liquid assets and assets that can be expected to become liquid within a year. Examples include cash, short-term Treasuries, accounts receivable, and inventory. Noncurrent assets include long-term investments, real estate, and equipment used in manufacturing, just to name a few. Liabilities: What the company owes.

What is balance sheet?

Balance sheet. A balance sheet gives you a snapshot of a company's financial condition at a given time (typically the end of a quarter). And as with the income statement, the data is typically presented as a comparison between the current period and the same time a year prior. There are three sections on a balance sheet:

What is an income statement?

An income statement starts with the company's sales and shows step by step how it turns them into profit. It's also worth mentioning that there are typically several columns of numbers on an income statement to show how the current period compares to the same period last year.

What is common stock?

Common stock is one of many elements of data that must be reported on quarterly and annual balance sheets. Generally speaking, a company divides their balance sheet into three distinct sections: assets, liabilities and stockholder equity. It is is this third section in which you will look to find more information about the value of the shares ...

How to find the value of common stock?

In order to locate the value of common stock shares, you can use the quarterly or annual balance sheet issued by a company. This information will typically be included in the element of the balance sheet known as stockholder equity. It may be necessary to subtract the value of preferred stock, bonds and other investment options first as part of a common stock formula, however.

Why is it important to compare common stock and preferred stock?

That being said, comparing common and preferred stock is particularly important given the distinct privileges attached to each. Owners of preferred stock are given priority in situations where dividends are issued or when the assets of a company are liquidated during bankruptcy.

Does common stock reflect the true value of the company?

Stockholders' equity and common stock equity may not reflect the true value of the company. Accounting principles require the balance sheet to list the asset values at cost, not the market value if the company sold them off. Ryan Cockerham is a nationally recognized author specializing in all things business and finance.

Do common stockholders have voting rights?

Although common stockholders forsake priority in dividend payouts and asset liquidation, they continue to carry voting rights, a privilege that allows them to exert their own influence on the company in question.

Do preferred stock owners give up voting rights?

In exchange for this degree of priority, however, preferred stock owners typically give up any voting rights they may have had. Many analysts consider preferred stock to represent a hybrid of common stock and bonds.

What is common stock?

Common Stock. If a corporation has issued only one type, or class, of stock it will be common stock. (Preferred stock is discussed later.) While "common" sounds rather ordinary, it is the common stockholders who elect the board of directors, vote on whether to have a merger with another company, and see their shares of stock increase in value ...

What is issued stock?

Issued shares. When a corporation sells some of its authorized shares, the shares are described as issued shares. The number of issued shares is often considerably less than the number of authorized shares.

How to determine number of shares issued?

This required accounting (discussed later) means that you can determine the number of issued shares by dividing the balance in the par value account by the par value per share.

What is outstanding stock?

If a share of stock has been issued and has not been reacquired by the corporation, it is said to be outstanding. For example, if a corporation initially sells 2,000 shares of its stock to investors, and if the corporation did not reacquire any of this stock, this corporation is said to have 2,000 shares of stock outstanding.

What is accounting records?

A corporation's accounting records are involved in stock transactions only when the corporation is the issuer, seller, or buyer of its own stock. For example, if 500,000 shares of Apple Computer stock are traded on the stock exchange today, and if none of those shares is newly issued, sold, or repurchased by Apple Computer, ...

Why is the stockholders' equity section of a corporation's balance sheet more expansive than the owner's

Because of legal requirements , the stockholders' equity section of a corporation's balance sheet is more expansive than the owner's equity section of a sole proprietorship's balance sheet. For example, state laws require that corporations keep the amounts received from investors separate from the amounts earned through business activity.

How to keep track of an investor's stock?

To keep track of each investor's ownership interest, corporations use a unit of measurement referred to as a share (or share of stock ). The number of shares that an investor owns is printed on the investor's stock certificate or digital record. This information is also maintained in the corporate secretary's records, which are separate from the corporation's accounting records.

What Is Common Stock?

Understanding Common Stock

- Common stock represents a residual claim to a company's ongoing and future profits. As such, shareholders are said to be part-owners in a company. This does not mean that shareholders can walk into a company's offices and claim ownership of a portion of the chairs or desks or computers. These things are owned by the corporation itself, which is a l...

Special Considerations

- Corporate Bankruptcy

With common stock, if a company goes bankrupt, the common stockholders do not receive their money until the creditors, bondholders, and preferred shareholders have received their respective share. This makes common stock riskier than debt or preferred shares. The upside to common … - IPOs

For a company to issue stock, it must begin by having an initial public offering(IPO). An IPO is a great way for a company, seeking additional capital, to expand. To begin the IPO process, a company must work with an underwriting investment banking firm, which helps determine both t…

Common Stock and Investors

- Stocks should be considered an important part of any investor’s portfolio. They bear a greater amount of risk when compared to CDs, preferred stock, and bonds. However, with the greater risk comes the greater potential for reward. Over the long term, stocks tend to outperform other investments but are more exposed to volatility over the short term. There are also several types …