What does CLM stand for?

Cornerstone Strategic Value Fund, Inc. New (CLM): Price and Financial Metrics Cornerstone Strategic Value Fund, Inc. New (CLM): $14.43 Sign Up to See Ratings...FREE!

Is CLM a good dividend payer?

CLM has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer. View Cornerstone Strategic Value Fund's dividend history. Who are Cornerstone Strategic Value Fund's key executives? Who are some of Cornerstone Strategic Value Fund's key competitors?

What is cornerstone strategic value fund (CLM)?

Cornerstone Strategic Value Fund, Inc. is a closed-end, diversified management investment company and is registered with the U.S. Securities & Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended. Cornerstone Strategic Value Fund, Inc. is traded on the NYSE American under the trading symbol “CLM”.

What is NewNew (CLM) price?

New (CLM): $14.43 Sign Up to See Ratings...FREE! We have 9 different ratings for every stock to help you appreciate its future potential. You can unlock it all now.

Is Clm a good investment?

Investment Thesis CLM isn't a good income investment because it overpays the distribution. Its stock picks are pretty good. And given its very high distribution policy, I am quite impressed at how close it comes to covering it. But in the end, it is just paying out too much.

Is CLM an ETF?

Cornerstone Strategic Value Fund is registered as a diversified, closed-end management investment company. The Fund's investment objective is to seek long-term capital appreciation through investment primarily in equity securities of U.S. and non-U.S. companies....ETFCLMDiv Yield23.76PE Ratio4.88EPS1.8711 more rows

Where can I buy CLM stock?

Shares of CLM can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab.

Is Clm a closed-end fund?

CLM is a diversified, closed-end fund that invests in both U.S. and non-U.S. equities with the goal of long-term capital appreciation. The fund pays a consistently high dividend.

What is the NAV for CLM?

OverviewShare PriceNAVCurrent$8.94$7.5952 Wk Avg$12.64$9.3952 Wk High$14.75$10.5252 Wk Low$7.60$7.38

Is Clm a buy or sell?

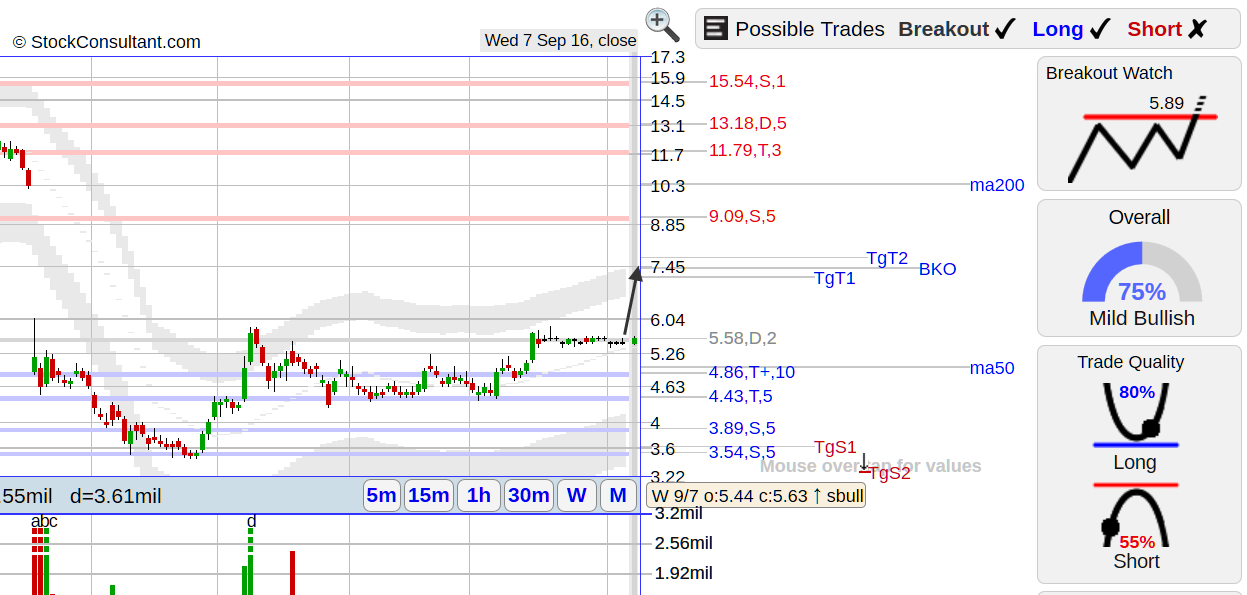

Furthermore, there is a buy signal from the 3 month Moving Average Convergence Divergence (MACD). Some negative signals were issued as well, and these may have some influence on the near short-term development. A sell signal was issued from a pivot top point on Thursday, July 21, 2022, and so far it has fallen -0.43%.

What is CLM invested?

Altogether, CLM's portfolio has 119 stocks, more than 92 percent of which are large-cap stocks. Almost half of the fund is invested in blue-chip stocks from information technology & communication (ITC) and the financial sector.

Who owns Cornerstone Strategic Value Fund?

Top 10 Owners of Cornerstone Strategic Value FundStockholderStakeShares ownedSecurities America Advisors, Inc.0.19%223,116Raymond James & Associates, Inc. ...0.17%198,827SCF Investment Advisors, Inc.0.14%162,133Commonwealth Equity Services LLC0.11%132,1376 more rows

What is the CLM symbol?

Cornerstone Strategic Value Fund, Inc. is a closed-end, diversified management investment company and is registered with the U.S. Securities & Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended. Cornerstone Strategic Value Fund, Inc. is traded on the NYSE American under the trading symbol “CLM”.

When will the stock market be issued in 2021?

It is anticipated that shares will be issued on or about Thursday, May 20 , 2021.

What is the risk of investing in closed end funds?

An investment in the Fund is subject to certain risks, including market risk . In general, shares of closed-end funds often trade at a discount from their net asset value and at the time of sale may be trading on the exchange at a price that is more or less than the original purchase price or the net asset value.

What is the record date for Cornerstone Total Return Fund?

Securities and Exchange Commission, it has fixed the close of business on April 16, 2021 as the record date (the “Record Date”) for determination of stockholders entitled to participate in the Fund’s 1-for-3 rights offering. The Fund is issuing to its stockholders non-transferable rights entitling the holders to subscribe for an aggregate of 13,751,029 shares of common stock. Each stockholder will receive one non-transferable right for each share of the Fund held as of the Record Date. Fractional Shares will not be issued upon the exercise of the Rights. Accordingly, the number of Rights to be issued to a Stockholder on the Record Date will be rounded up to the nearest whole number of Rights evenly divisible by three. For every three rights a stockholder receives, he or she will be entitled (but not required) to purchase one new share of the Fund at a subscription price equal to the greater of (i) 107% of net asset value per share as calculated at the close of trading on the expiration date of the offering or (ii) 80% of the market price per share at such time. Fractional shares will not be issued. In addition to the shares offered in the primary subscription, the Fund may offer a 100% over-allotment to oversubscribing stockholders. Stockholders who fully subscribe in the primary offering will have the option to oversubscribe for additional shares, to the extent available. The subscription period will commence shortly after the Record Date, and will expire at 5:00 p.m., EDT, on Friday, May 14, 2021, (the “Expiration Date”) unless extended. The actual subscription price per share will be determined on the Expiration Date. Shares will be issued within the 15-day period immediately following the record date of the Fund’s May 2021 monthly distribution to stockholders. Stockholders exercising their rights to purchase shares pursuant to the offering will not be entitled to receive such distribution with respect to the shares issued pursuant to such exercise. This press release is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. The offering is subject to an effective registration statement covering the rights and shares to be issued and to other customary regulatory filings and approvals. Any rights offering conducted by the Fund will be made only by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Cornerstone Total Return Fund, Inc. is a closed-end, diversified management investment company and is registered with the U.S. Securities & Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended. Cornerstone Total Return Fund, Inc. is traded on the NYSE American LLC under the trading symbol “CRF”. The Fund’s investment adviser is Cornerstone Advisors, LLC, which also serves as the investment adviser to another closed-end fund, Cornerstone Strategic Value Fund, Inc. (NYSE American: CLM). For more information regarding Cornerstone Strategic Value Fund, Inc. or Cornerstone Total Return Fund, Inc. please visit www.cornerstonestrategicvaluefund.com, and www.cornerstonetotalreturnfund.com. Past performance is no guarantee of future performance. An investment in the Fund is subject to certain risks, including market risk. In general, shares of closed-end funds often trade at a discount from their net asset value and at the time of sale may be trading on the exchange at a price which is more or less than the original purchase price or the net asset value. An investor should carefully consider the Fund’s investment objective, risks, charges and expenses. Please read the Fund’s disclosure documents before investing. In addition to historical information, this release contains forward-looking statements, which may concern, among other things, domestic and foreign markets, industry and economic trends and developments and government regulation and their potential impact on the Fund’s investment portfolio. These statements are subject to risks and uncertainties, including the factors set forth in the Fund’s disclosure documents, filed with the U.S. Securities and Exchange Commission, and actual trends, developments and regulations in the future, and their impact on the Fund could be materially different from those projected, anticipated or implied. The Fund has no obligation to update or revise forward-looking statements. Contact: (866) 668-6558

Who bought CLM stock?

CLM stock was bought by a variety of institutional investors in the last quarter, including Pure Financial Advisors Inc.. Company insiders that have bought Cornerstone Strategic Value Fund stock in the last two years include Matthew Morris, and Ralph W Bradshaw.

What is Cornerstone Strategic Value Fund's stock symbol?

Cornerstone Strategic Value Fund trades on the New York Stock Exchange (NYSE)AMERICAN under the ticker symbol "CLM."

Is CLM a dividend payer?

CLM has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer. View Cornerstone Strategic Value Fund's dividend history.

Component Grades

We have 9 different ratings for every stock to help you appreciate its future potential. You can unlock it all now.

Cornerstone Strategic Value Fund, Inc. New (CLM) Company Bio

Cornerstone Strategic Value Fund, Inc. is a closed-ended equity mutual fund launched and managed by Cornerstone Advisors, Inc. The fund invests in public equity markets across the globe. It seeks to invest in stocks of companies operating across diversified sectors. The fund primarily invests in value and growth stocks of companies.