Should I buy Chipotle stock?

- What would cause people to stop going to Chipotle?

- Are there long-term downsides to Chipotlanes?

- Can Chipotle maintain its quality as it grows and opens more restaurants?

- Does Chipotle have to find a balance between digital and in-person orders?

- Will rising menu prices turn away customers?

What was the lowest Chipotle stock was?

Chipotle Mexican Grill (NYSE:CMG)‘s stock had its “outperform” rating ... Chipotle Mexican Grill has a 52 week low of $1,256.27 and a 52 week high of $1,958.55. The firm has a 50-day moving ...

Is Chipotle worth it?

OTOH Chipotle is still IMO the best value in "fast food" now that your average burger costs like $6 and fries cost $3 at least here in SoCal. And every single time I eat fries I always wonder why I bothered - they have almost zero nutritional value and don't fill you up.

Is it too late to buy Chipotle stock?

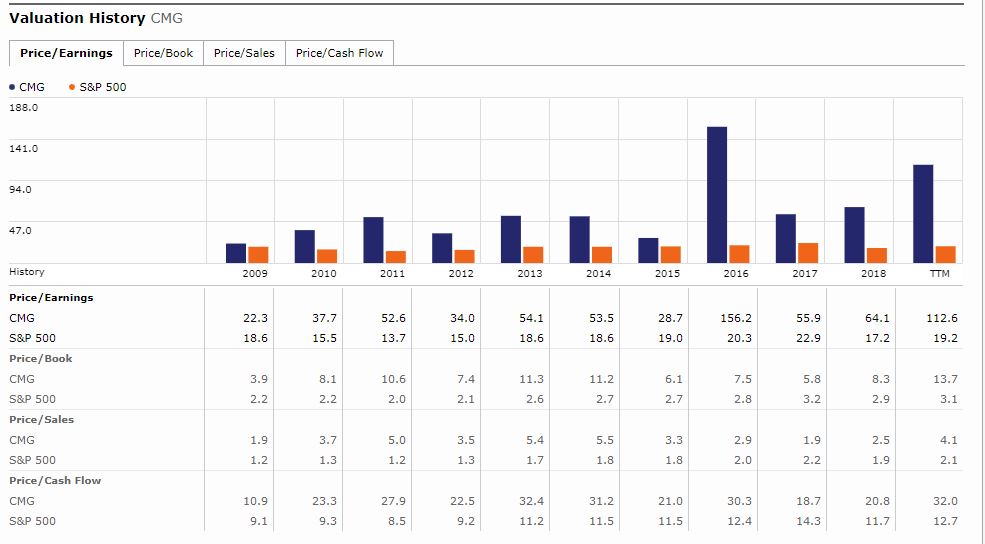

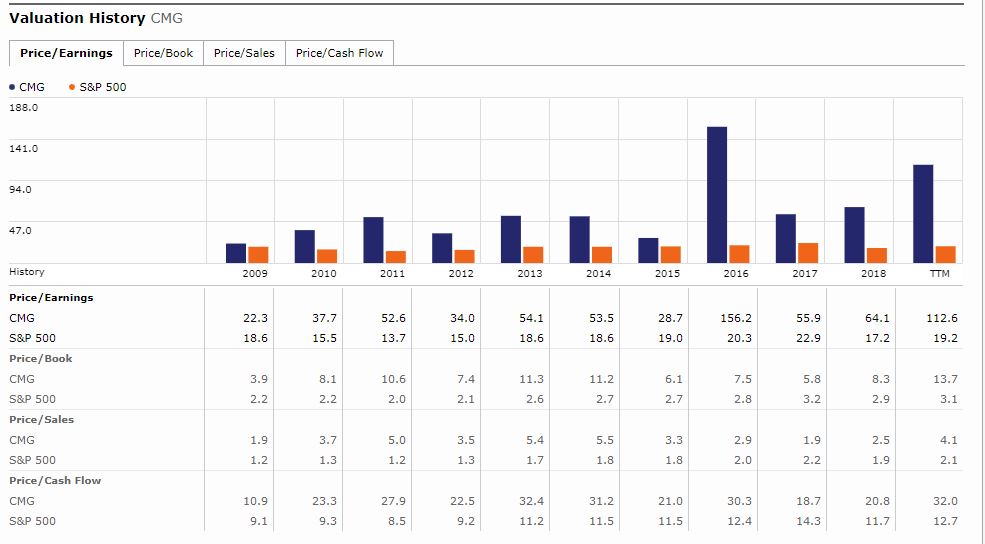

While the shares have done well, Regan said Chipotle is still in a recovery phase, so it isn’t too much of a stretch to think that still more upside can exist. The chain continues to open stores and increase sales at those already operating. Valuation has been one of the biggest knocks against the stock throughout its rally.

What is the highest Chipotle stock has ever been?

The all-time high Chipotle Mexican Grill stock closing price was 1944.05 on September 23, 2021. The Chipotle Mexican Grill 52-week high stock price is 1958.55, which is 55.3% above the current share price.

How long has Chipotle been in the stock market?

On January 26, 2006, Chipotle made its initial public offering (IPO) after increasing the share price twice due to high pre-IPO demand. In its first day as a public company, the stock rose exactly 100%, resulting in the best U.S.-based IPO in six years, and the second-best IPO for a restaurant after Boston Market.

Who owns the most Chipotle stock?

Top 10 Owners of Chipotle Mexican Grill IncStockholderStakeTotal value ($)T. Rowe Price Associates, Inc. (I...9.88%3,610,265,171The Vanguard Group, Inc.8.51%3,110,494,444BlackRock Fund Advisors4.83%1,764,642,822Edgewood Management LLC4.51%1,650,020,9576 more rows

Is Chipotle overvalued?

While the company's P/E ratio or P/S ratio may look high on the current year estimates, if we look at its top and bottom-line growth prospects I don't think it is overvalued. By FY 2025, the company is expected to reach an EPS of $69.35 and will still have a multi-year runway of high growth ahead.

What was Chipotle's original IPO price?

$22.00Chipotle Mexican Grill is registered under the ticker NYSE:CMG . Their stock opened with $22.00 in its Jan 26, 2006 IPO.

When did Chipotle stock split?

A high stock price Chipotle is in the same neighborhood at 257%. At $1,600, Chipotle shares have also reached a point where one share costs a sizable chunk of change. And management has never split the stock.

Why is Chipotle stock so high?

Chipotle has always had a knack for growth, despite operating in a market with heavy competition. While other restaurants large and small struggled to adapt to the coronavirus lockdown, Chipotle was already in the right place at the right time to properly serve a need for sanitary food.

What percentage of Chipotle does McDonald's own?

Meanwhile, McDonald's became its largest investor, holding a 90% stake in Chipotle.

Why did McDonald's sell its shareholding in Chipotle?

"Company executives wanted everyone to put 100 percent of their efforts into the McDonald's brand, so they sold the company's shares." Clearly, that wasn't the best strategy. Chipotle's same-store sales grew more than 16% in 2014, while McDonald's declined 1% during the same period.

Is Chipotle a good stock to buy?

Chipotle is performing well despite higher supply-chain costs. The company's digital business is fueling improvement in its profit margin. Management still sees plenty of opportunity to open more restaurants.

Is Chipotle a profitable company?

Net income for 2021 was $653.0 million, or $22.90 per diluted share, compared to net income of $355.8 million, or $12.52 per diluted share for 2020.

Does Chick Fil A have stock?

Chick-fil-A is a private, family-owned company and does not offer stock options to the public. If you are interested in investing in Chick-fil-A by applying to become a franchised Owner/Operator, check our franchise page to learn more about opportunities in the U.S., Canada and Puerto Rico.

How much does chipotle pay in Canada?

Does chipotle accept TikTok?

Chipotle Mexican Grill (NYSE: CMG) today announced it is increasing restaurant wages in Canada resulting in a $15 CAD minimum hourly rate in Ontario restaurants and $16 CAD minimum hourly rate in British Columbia restaurants.

Is chipotle raising the stakes?

Chipotle Mexican Grill Inc. said Thursday that it will accept job applications via TikTok through July 31. Applicants can submit videos of job-related content to the fast-casual chain through the TikTok app or via a TikTok resumes site. Chipotle says it's using the new platform to reach prospective Gen Z hires at a time when the labor market is tight. "Given the current hiring climate and our strong growth trajectory, it's essential to find new platforms to directly engage in meaningful career c

Is chipotle hiring Gen Z?

Chipotle Mexican Grill (NYSE: CMG) today announced it is raising the stakes on the 2021 Men' s Professional Basketball Championship Series and hiding up to one million dollars (or even more) of free burritos in its TV ads.

Does chipotle give free burritos?

Chipotle Mexican Grill (NYSE: CMG) today announced it is among the first brands to leverage TikTok Resumes to recruit purpose-driven Gen-Z applicants and grow its workforce. Moreover, the company will host its second "Coast To Coast Career Day" on July 15 with the goal of hiring an additional 15,000 employees to meet current demand and accommodate future growth.

Chipotle Mexican Stock Price History Chart

The incentives for people to get the COVID-19 vaccine are piling up. Chipotle (CMG) has announced it will give free burritos and other entrees to customers who have been vaccinated in the latest example of companies trying to boost vaccine rates. Chipotle joins Krispy Kreme (DNUT) Anheuser-Busch, Taco Bell (YUM) and many others who are trying to entice people to get a COVID vaccine with various incentives.

Chipotle Stock Price History Data

There are several ways to analyze Chipotle Stock price data. The simplest method is using a basic Chipotle candlestick price chart, which shows Chipotle Mexican price history and the buying and selling dynamics of a specified period.

About Chipotle Mexican Stock history

The price series of Chipotle Mexican for the period between Mon, Oct 18, 2021 and Sun, Jan 16, 2022 has a statistical range of 364.87 with a coefficient of variation of 5.2. The prices are distributed with arithmetic mean of 1726.87. The median price for the last 90 days is 1748.25. The company had 10:10 stock split on September 20, 2011.

Chipotle Mexican Stock Technical Analysis

Chipotle Mexican investors dedicate a lot of time and effort to gaining insight into how a market's past behavior relates to its future.

Chipotle Mexican Technical and Predictive Indicators

Chipotle Mexican technical stock analysis exercises models and trading practices based on price and volume transformations, such as the moving averages, relative strength index, regressions, price and return correlations, business cycles, stock market cycles, or different charting patterns.

Complementary Tools for Chipotle Stock analysis

Predictive indicators are helping investors to find signals for Chipotle stock's direction in advance.

Chipotle's share-price history

When running Chipotle Mexican Grill price analysis, check to measure Chipotle Mexican's market volatility, profitability, liquidity, solvency, efficiency, growth potential, financial leverage, and other vital indicators. We have many different tools that can be utilized to determine how healthy Chipotle Mexican is operating at the current time.

Chipotle's rise and fall

As you can see in the chart above, Chipotle has posted strong returns for long-term shareholders, even if the stock has given back much of its overall gains over the past year. Its rise since its 2006 spinoff from McDonald's amounts to more than 800%, giving investors who put $1,000 into the stock a position worth more than $9,000 today.

Where will Chipotle go from here?

In response, Chipotle started looking at new ways to grow. The introduction of the ShopHouse Southeast Asian Kitchen concept introduced Chipotle shareholders to the idea that the restaurant chain could grow by branching out in a number of different directions, taking its high-quality food experience into different genres of food.

How much is a $1,000 investment in 2009 worth?

To recover, Chipotle has taken several actions. A rewards program has tried to give loyal customers an incentive to keep coming to the restaurant chain, and an expansion to its menu to add chorizo was also designed to boost interest. Yet the fast-casual giant hasn't provided much guidance on how well those initiatives have worked recently.

Is chipotle gaining momentum?

If you invested in the company 10 years ago, that decision would have paid off big time: According to CNBC calculations, a $1,000 investment in 2009 would be worth more than $10,000 as of March 29, 2019, a total return of over 900 percent. In the same time frame, by comparison, the S&P 500 was up 240 percent.