How much is a share of CBL worth?

One share of CBL stock can currently be purchased for approximately $27.90. How much money does CBL & Associates Properties make? CBL & Associates Properties has a market capitalization of $5.48 billion.

Does CBL&Associates Properties stock pay a dividend?

CBL & Associates Properties does not currently pay a dividend. CBL & Associates Properties does not have a long track record of dividend growth. In the past three months, CBL & Associates Properties insiders have not sold or bought any company stock. 20.12% of the stock of CBL & Associates Properties is held by insiders.

Who is CBL Properties?

Headquartered in Chattanooga, TN, CBL Properties owns and manages a national portfolio of market-dominant properties located in dynamic and growing communities.

How much did CBL sell its self storage for?

CHATTANOOGA, Tenn., November 18, 2021--CBL Properties (NYSE: CBL) today announced the sale of its self-storage portfolio for a gross sales price of $42. 0 million ($22. 0 million at CBL’s share). After repayment of approximately $25. 7 million.

Should I buy CBL stock?

There are currently 1 buy rating for the stock. The consensus among Wall Street equities research analysts is that investors should "buy" CBL & Associates Properties stock.

Why is CBL stock down?

CBL Properties declares bankruptcy as shopping center manager looks to restructure debt. CBL & Associates Properties Inc. said Monday that it has filed for bankruptcy protection, as it looks to implement a plan to recapitalize and restructure parts of its debt. The stock dropped 22% premarket prior to a tradi...

Is CBL a REIT?

CBL & Associates Properties, Inc. is a REIT that manages its portfolio of market-dominant retail suburban town centers to generate lasting value for our shareholders.

How many malls does CBL own?

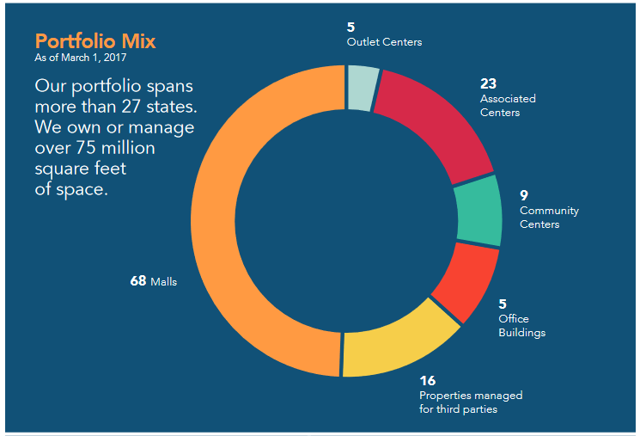

CBL's portfolio is comprised of 105 properties totaling 63.9 million square feet across 24 states, including 63 high-quality enclosed, outlet and open-air retail centers and six properties managed for third parties.

Who is the owner of CBL properties?

Charles B. LebovitzCBL PropertiesTypePublicFounderCharles B. LebovitzHeadquartersChattanooga, Tennessee, U.S.Key peopleCharles B. Lebovitz, Chairman Stephen D. Lebovitz, CEO Michael Lebovitz, President Farzana Khaleel, CFOProductsShopping centers11 more rows

Is CBL a multinational company?

Ceylon Biscuits Limited (branded CBL, commonly called Munchee) is a Sri Lankan food manufacturer, the maker of Munchee biscuits and one of the oldest biscuit makers in Sri Lanka. The company owns 60% of the domestic market share in Sri Lanka....Ceylon Biscuits Limited.FormerlyWilliams Confectionery LimitedParentCBL Investments18 more rows

CBL Properties Announces DEI Partnership With Hinton & Company

EVgo and CBL Properties Partner to Expand Public Fast Charging at Retail Locations, Bringing Convenient Charging Amen..

CHATTANOOGA, Tenn.-- (BUSINESS WIRE)---- $CBL--CBL Properties (NYSE: CBL) today announced that it has partnered with Hinton & Company on its diversity, equity, inclusion, and belonging initiatives. Found...

CBL Properties Opens More Than 1.7 Million Square Feet of New Retail, Dining, Entertainment, and Other Uses in 2021 W..

LOS ANGELES-- (BUSINESS WIRE)--EVgo and CBL Properties announced a partnership to add EVgo fast charging to select retail locations, including the first EVgo station in Kansas.

CBL Properties and Volta Partner to Bring EV Charging Stations to Select Properties

CHATTANOOGA, Tenn.-- (BUSINESS WIRE)---- $CBL--CBL Properties (NYSE: CBL) today announced that more than 1.7 million square feet of new retail, dining, entertainment, and other uses have opened across it...

CBL Properties Completes Sale of JV Storage Portfolio

CHATTANOOGA, Tenn.-- (BUSINESS WIRE)---- $CBL--CBL Properties (NYSE: CBL) and Volta Inc. (“Volta”), an industry leader in commerce-centric electric vehicle (“EV”) charging networks, have partnered to off...

CBL Properties Reports Results for Third Quarter 2021

CHATTANOOGA, Tenn.-- (BUSINESS WIRE)---- $CBL--CBL Properties (NYSE: CBL) today announced the sale of its self-storage portfolio for a gross sales price of $42.0 million ($22.0 million at CBL's share). A...

Marks' Oaktree Gains CBL & Associates Properties Stake Following Reorganization

CHATTANOOGA, Tenn.-- (BUSINESS WIRE)---- $CBL--CBL Properties (NYSE: CBL) announced results for the third quarter ended September 30, 2021. A description of each supplemental non-GAAP financial measure a...

What is CBL real estate?

Oaktree Capital Management disclosed a stake in CBL & Associates Properties Inc. ( CBL , Financial) earlier this week.

Is CBL a long term downtrend?

CBL & Associates Properties, Inc. is a real estate investment trust, which owns and operates retail properties. The firm engages in owning, developing, acquiring, leasing, managing and operating regional shopping malls, open-air centers, community centers and office properties. It operates through Malls and All Other segments. Its properties include Malls, Associated Centers, Community Centers, Office Buildings, Construction Properties and Mortgages. The company was founded on July 13, 1993 and is headquartered in Chattanooga, TN.

Is CBL ready for wave 4?

CBL and Associates Properties, Inc. has been in a long-term downtrend, and I don't think I'd want to own this stock long-term. Analysts are fairly bearish, and the stock has a history of missing earnings estimates. For the last month, however, it's been in an uptrend. It broke a downward trendline, and most recently it's formed what looks like a double bottom....

Where is CBL located?

CBL is ready for a wave 4 bounce. Could be a 4~5 bagger

What is Marketbeat community ratings?

Headquartered in Chattanooga, TN, CBL Properties owns and manages a national portfolio of market-dominant properties located in dynamic and growing communities. CBL's portfolio is comprised of 108 properties totaling 68.2 million square feet across 26 states, including 68 high-quality enclosed, outlet and open-air retail centers and 9 properties managed for third parties. CBL seeks to continuously strengthen its company and portfolio through active management, aggressive leasing and profitable reinvestment in its properties.

Does CBL pay dividends?

MarketBeat's community ratings are surveys of what our community members think about CBL & Associates Properties and other stocks. Vote “Outperform” if you believe CBL will outperform the S&P 500 over the long term. Vote “Underperform” if you believe CBL will underperform the S&P 500 over the long term. You may vote once every thirty days.

What is CBL and Associates?

CBL & Associates Properties does not currently pay a dividend.

Is CBL & Associates Properties Inc stock A Buy?

CBL & Associates Properties, Inc. is a public real estate investment trust. It engages in acquisition, development, and management of properties. The fund invests in the real estate markets of United States. Its portfolio consists of enclosed malls and open-air centers. CBL & Associates Properties is based in Oak Brook, Illinois. CBL & Associates Properties was founded in 1978 and is based in Chattanooga, Tennessee with additional offices in Walt... Read more