Caredx Inc Share price Caredx Inc (CDNA) USD0.001 Sell: $26.23 Buy: $26.26 $0.34 (1.31%)

Full Answer

What will caredx's share price reach in the next year?

On average, they expect CareDx's share price to reach $47.40 in the next year. This suggests a possible upside of 100.3% from the stock's current price. View Analyst Price Targets for CareDx.

Is caredx a “underperform” stock?

CareDx has received 181 “underperform” votes. (Add your “underperform” vote.) CareDx has received 69.32% “outperform” votes from our community. MarketBeat's community ratings are surveys of what our community members think about CareDx and other stocks.

Where can I buy DX shares?

Shares of DX can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here.

Does caredx have an upside of 166%?

According to analysts' consensus price target of $98.50, CareDx has a forecasted upside of 166.0% from its current price of $37.03. CareDx has only been the subject of 2 research reports in the past 90 days. CareDx has received 409 “outperform” votes. (Add your “outperform” vote.) CareDx has received 181 “underperform” votes.

Is Cdna a buy?

The consensus among 1 Wall Street analyst covering (NASDAQ: CDNA) stock is to Strong Buy CDNA stock.

When did CareDx go public?

Brisbane, CA July 17, 2014 CareDx, Inc. CareDx completed its first day of trading today on The NASDAQ Global Market under the ticker symbol "CDNA." The offering is expected to close on July 22, 2014, subject to customary closing conditions. Piper Jaffray & Co.

Who owns CareDx?

Peter Maag, PhD Maag has served as CareDx President and CEO, Chairman and CEO or Executive Chairman since October 2012 until November 2021, and has over 20 years of executive management experience in the pharmaceutical and diagnostic industry. Prior to joining CareDx, Peter was President of Novartis Diagnostics.

Who is the CEO of CareDx?

Reginald Seeto (Nov 1, 2020–)CareDx / CEO

Should I buy or sell CareDx stock right now?

4 Wall Street analysts have issued "buy," "hold," and "sell" ratings for CareDx in the last twelve months. There are currently 3 buy ratings and 1...

What is CareDx's stock price forecast for 2022?

4 brokers have issued 1-year target prices for CareDx's shares. Their forecasts range from $50.00 to $110.00. On average, they anticipate CareDx's...

How has CareDx's stock performed in 2022?

CareDx's stock was trading at $45.48 on January 1st, 2022. Since then, CDNA stock has decreased by 50.1% and is now trading at $22.70. View the be...

Are investors shorting CareDx?

CareDx saw a decrease in short interest in May. As of May 31st, there was short interest totaling 3,160,000 shares, a decrease of 25.8% from the Ma...

When is CareDx's next earnings date?

CareDx is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings forecast for CareDx .

How were CareDx's earnings last quarter?

CareDx, Inc (NASDAQ:CDNA) issued its quarterly earnings data on Thursday, October, 28th. The company reported $0.07 EPS for the quarter, topping th...

What guidance has CareDx issued on next quarter's earnings?

CareDx issued an update on its FY 2022 earnings guidance on Monday, May, 23rd. The company provided EPS guidance of for the period. The company iss...

Who are CareDx's key executives?

CareDx's management team includes the following people: Dr. Reginald Seeto , Pres, CEO & Director (Age 50, Pay $1.51M) ( LinkedIn Profile ) Ms....

Who are some of CareDx's key competitors?

Some companies that are related to CareDx include Guardant Health (GH) , Natera (NTRA) , Elekta AB (publ) (EKTAY) , Fulgent Genetics (FLGT) ,...

Recently Viewed Tickers

Visit a quote page and your recently viewed tickers will be displayed here.

CareDx Inc

CareDx, Inc. operates as a transplant diagnostics company, which discovers, develops and commercializes diagnostic solutions. Its product includes AlloMap, AlloSure and Laboratory products. The company was founded on December 21, 1998 and is headquartered in South San Francisco, CA.

About CareDx

CareDx, Inc. operates as a transplant diagnostics company, which discovers, develops and commercializes diagnostic solutions. Its product includes AlloMap, AlloSure and Laboratory products. The company was founded on December 21, 1998 and is headquartered in South San Francisco, CA.

CareDx (NASDAQ:CDNA) Frequently Asked Questions

4 Wall Street analysts have issued "buy," "hold," and "sell" ratings for CareDx in the last year. There are currently 3 buy ratings and 1 strong buy rating for the stock. The consensus among Wall Street analysts is that investors should "buy" CareDx stock. View analyst ratings for CareDx or view top-rated stocks.

What is CareDX Inc?

CareDx Inc operates as a precision medicine company focused on the discovery, development, and commercialization of clinically differentiated, high-value healthcare solutions for transplant patients and caregivers. It offers testing services, products, and digital solutions along with the pre- and post-transplant patient journey, and is a leading provider of genomics-based information for transplant patients. Its primary operations are in Brisbane, Califor

Does market cap include convertible securities?

It does not include securities convertible into the common equity securities. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable).

60 Biggest Movers From Yesterday

Gainers Bone Biologics Corporation (NASDAQ: BBLG) shares surged 57.1% to close at $5.39 on Monday.

45 Stocks Moving In Monday's Mid-Day Session

Gainers Bone Biologics Corporation (NASDAQ: BBLG) shares climbed 71.5% to $5.88.

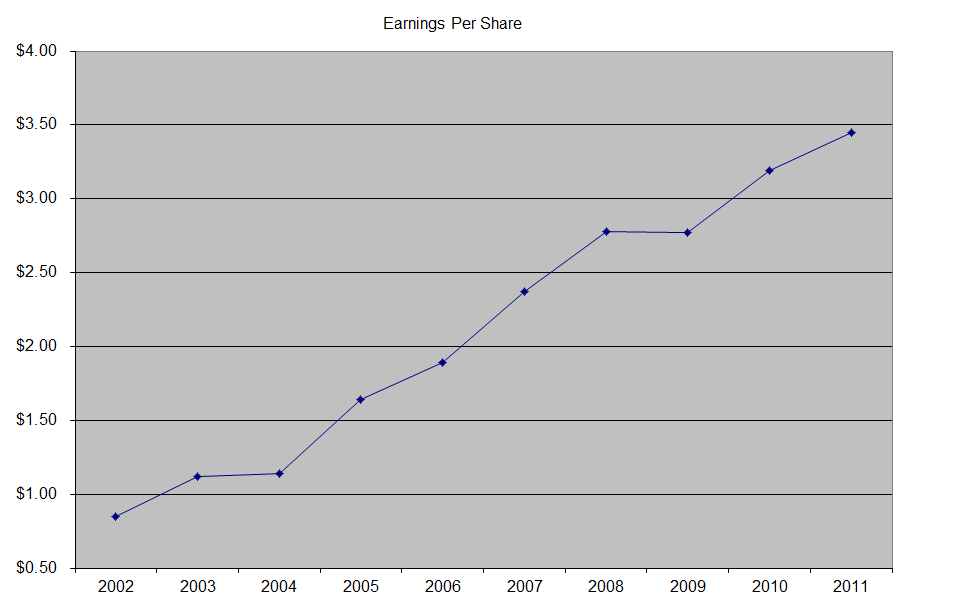

How many shares of Dynex Capital are there after the split?

An investor that had 100 shares of Dynex Capital stock prior to the reverse split would have 33 shares after the split.

Why is Dynex Capital's payout ratio above 75% not desirable?

Payout ratios above 75% are not desirable because they may not be sustainable. Based on EPS estimates, Dynex Capital will have a dividend payout ratio of 81.68% in the coming year. This indicates that Dynex Capital may not be able to sustain their current dividend. View Dynex Capital's dividend history.

Is Dynex a good dividend stock?

DX has a dividend yield higher than 75% of all dividend-paying stocks, making it a leading dividend payer. Dynex Capital does not yet have a strong track record of dividend growth.