What is the CAPM equation?

What are the components of CAPM equation? The capital asset pricing model (CAPM) provides a formula that calculates the expected return on a security based on its level of risk. The formula for the capital asset pricing model is the risk-free rate plus beta times the difference of the return on the market and the risk-free rate.

What is CAPM in finance?

CAPM stands for capital asset pricing model. It’s a formula used to calculate the expected return on an asset in comparison to its systemic risk. The CAPM formula is used in finance when it comes to pricing risky securities, as well as forecasting expected returns on a given asset given the asset’s risk and cost of capital.

What is the formula to calculate stock price?

What is Common Stock Formula?

- Examples of Common Stock Formula (With Excel Template) Let’s take an example to understand the calculation of Common Stock in a better manner. ...

- Explanation. ...

- Relevance and Uses of Common Stock Formula. ...

- Common Stock Formula Calculator

- Recommended Articles. ...

How to calculate CAPM beta?

CAPM Beta Calculation in Excel. Technically speaking, Beta is a measure of stock price variability in relation to the overall stock market (NYSE, NASDAQ, etc.). Beta is calculated by regressing the percentage change in stock prices versus the percentage change in the overall stock market. CAPM Beta calculation can be done very easily on excel.

What is CAPM in stock?

The capital asset pricing model (CAPM) is an idealized portrayal of how financial markets price securities and thereby determine expected returns on capital investments. The model provides a methodology for quantifying risk and translating that risk into estimates of expected return on equity.

How do you know if a stock is overvalued or undervalued using CAPM?

Beta is an input into the CAPM and measures the volatility of a security relative to the overall market. SML is a graphical depiction of the CAPM and plots risks relative to expected returns. A security plotted above the security market line is considered undervalued and one that is below SML is overvalued.

What does a high CAPM mean?

With investing, the higher the risk, the more an investor expects to earn. The capital asset pricing model (CAPM) tries to estimate how much you can expect to earn given the amount of risk.

Why CAPM is widely used?

The CAPM has several advantages over other methods of calculating required return, explaining why it has been popular for more than 40 years: It considers only systematic risk, reflecting a reality in which most investors have diversified portfolios from which unsystematic risk has been essentially eliminated.

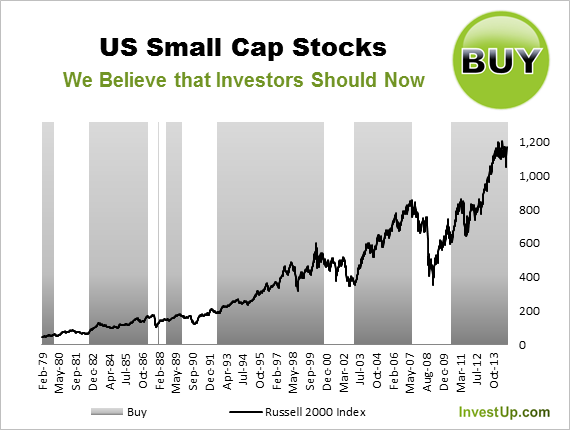

Why does the CAPM imply that investors should trade very rarely?

Why does the CAPM imply that investors should trade very rarely? Investors should trade very rarely because the market portfolio changes very rarely. (The market portfolio is a value-weighted portfolio and thus requires no additional trading when prices change to maintain the value weights).

How do you interpret alpha in CAPM?

Alpha for Portfolio Managers That is generally a higher bar. If the CAPM analysis indicates that the portfolio should have earned 5%, based on risk, economic conditions, and other factors, but instead the portfolio earned just 3%, the alpha of the portfolio would be a discouraging -2%.

What are the assumptions of CAPM?

CAPM assumes the availability of risk-free assets to simplify the complex and paired covariance of Markowitz's theory. The risk-free asset leads to the curved efficient frontier of MPT and makes the linear efficient frontier of the CAPM simple.

What is overvalued and undervalued stocks?

If the value of an investment (i.e., a stock) trades exactly at its intrinsic value, then it's considered fairly valued (within a reasonable margin). However, when an asset trades away from that value, it is then considered undervalued or overvalued.

How do you know if a security is overvalued?

When a security's current market price is approximately equal to its value estimate, the security is considered to be fairly valued. Conversely, when the market price exceeds the value estimate, the security is overvalued, and so the security is undervalued when the market price is lower than its estimated value.

What is CAPM analysis?

What is capital asset pricing model?

CAPM analysis is the method that empirically helps in assessing the direct relationship between the risk and return. Though the analysis is based on predicting the behavior of investment based on the historical database, it is a simple way to assess the movements in price. Companies mainly use Capital Asset Pricing Model analysis because it not only helps in determining the cost of equity and estimating the required rate of return but also acts as a means to evaluate the performance of stocks in terms of return and cost. Further, by assessing the non-diversifiable risk, Capital Asset Pricing Model analysis provides the method to construct an optimal portfolio with an adequate trade-off of risk and expected return (Rai, 2011).

What is beta in capital asset pricing?

Capital Asset Pricing Model studies the relationship between the systematic risk of investing and the expected return. This model determines the expected return of investment by considering the risk attached to those assets and the cost of capital (CFI, 2020).

What is CAPM in investing?

Beta in the Capital Asset Pricing Model specifies the market volatility. Examining the fluctuations in the prices of the stocks, Beta measures the sensitivity of the stocks to the systematic market risk. A company having higher beta value tends to have more risk but also earn more return (Kenton & Westfall, 2020).

What is market risk premium?

The CAPM formula is used for calculating the expected returns of an asset. It is based on the idea of systematic risk (otherwise known as non-diversifiable risk) that investors need to be compensated for in the form of a risk premium.

What is the beta of a stock?

Market Risk Premium The market risk premium is the additional return an investor expects from holding a risky market portfolio instead of risk-free assets. . A risk premium is a rate of return greater than the risk-free rate. When investing, investors desire a higher risk premium when taking on more risky investments.

What is CAPM in investing?

The beta (denoted as “Ba” in the CAPM formula) is a measure of a stock’s risk (volatility of returns) reflected by measuring the fluctuation of its price changes relative to the overall market. In other words, it is the stock’s sensitivity to market risk.

Why should CAPM not be used to calculate the expected return of equity shares?

With investing, the higher the risk, the more an investor expects to earn. The capital asset pricing model (CAPM) tries to estimate how much you can expect to earn given the amount of risk. The model is often used in conjunction with fundamental analysis, technical analysis and other methods of sizing up securities when making investment decisions. But many investment professionals warn that CAPM should not be used to calculate the expected return of equity shares because it does not account for the real volatility of the stock market. Let’s break down the formula and consider whether investors should use it to determine the risk of an investment.

What is market risk premium?

But many investment professionals warn that CAPM should not be used to calculate the expected return of equity shares because it does not account for the real volatility of the stock market. Let’s break down the formula and consider whether investors should use it to determine the risk of an investment.

Why is capital asset pricing important?

The market risk premium is an added return that can entice investors to put capital into riskier investments. Risky investments can be worthwhile to investors if the return rewards them for their time and risk tolerance. The goal of CAPM is to evaluate whether or not a stock’s value is worth that risk.

Why use CAPM?

Firstly, by helping investors calculate the expected return on an investment, it helps determine how appropriate a particular investment may be. Investors can use the CAPM for gauging their portfolio’s health and rebalancing, if necessary.

How to reduce risk in your portfolio?

Investors can use the CAPM for gauging their portfolio’s health and rebalancing, if necessary. Secondly, it’s a relatively simple formula that’s fairly easy to use. Additionally, the CAPM is an important tool for investors when it comes to accessing both risk and reward.

Who created the CAPM?

If you want to reduce the risk in your portfolio, a financial advisor can help. To find the right one for you, use SmartAsset’s free tool. It will connect you with up to three advisors in your area. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

What is EMP in 2021?

History of CAPM. William Sharpe, an economist and Nobel laureate devised CAPM for his 1970 book “Portfolio Theory and Capital Markets.”. He notes that an individual investment contains two kinds of risk: Systematic Risk: In other words, market risk that portfolio diversification can’t reduce.

What is the wealth report for 2021?

NEW YORK, July 06, 2021--Capgemini today announced its e-commerce transformation engagement with Emergency Medical Products (EMP), an online provider that specializes in the distribution of medical and safety supplies to businesses, first responders and other healthcare professionals. The site, BuyEMP.com, was delivered in six months to meet increased safety and preparedness concerns. In addition to a lift in conversions, the average order value (AOV) is up by almost 30 percent since launch.

Understanding The Capital Asset Pricing Model

- The formula for calculating the expected return of an asset given its risk is as follows: ERi=Rf+βi(ERm−Rf)where:ERi=expected return of investmentRf=risk-free rateβi=beta of the investment(ERm−Rf)=market risk premium\begin{aligned} &ER_i = R_f + \…

Problems with The CAPM

- There are several assumptions behind the CAPM formula that have been shown not to hold in reality. Modern financial theory rests on two assumptions: One, securities markets are very competitive and efficient (that is, relevant information about the companies is quickly and universally distributed and absorbed) and two, these markets are dominated by rational, risk-ave…

The CAPM and The Efficient Frontier

- Using the CAPM to build a portfolio is supposed to help an investor manage their risk. If an investor were able to use the CAPM to perfectly optimize a portfolio’s return relative to risk, it would exist on a curve called the efficient frontier, as shown in the following graph. The graph shows how greater expected returns (y-axis) require greater expected risk (x-axis). Modern Portf…

Practical Value of The CAPM

- Considering the critiques of the CAPM and the assumptions behind its use in portfolio construction, it might be difficult to see how it could be useful. However, using the CAPM as a tool to evaluate the reasonableness of future expectations or to conduct comparisons can still have some value. Imagine an advisor who has proposed adding a stock to a portfolio with a $100 sha…

The Bottom Line

- The CAPM uses the principles of Modern Portfolio Theory to determine if a security is fairly valued. It relies on assumptions about investor behaviors, risk and return distributions, and market fundamentals that don’t match reality. However, the underlying concepts of CAPM and the associated efficient frontier can help investors understand the relationship between expected ri…

Understanding The Concept of The Capital Asset Pricing Model

Terminologies Related to Capital Asset Pricing Model

- William Sharpe, the financial economist, while explaining the concept of CAPMhas explained in his book Portfolio Theory and Capital Markets (1970) that investors have to face two types of risk (Chan, 2010; Mcclure, 2019) i.e.

Some of The Challenges in Using The Capital Asset Pricing Model Analysis

- Despite having the simple procedure of computation and providing the specification on the past performance of the stocks, CAPManalysis still faces some the problems in its implementation (Rai, 2011) i.e. 1. Unrealistic assumptions existence: CAPManalysis is based on examining the investors’ behaviour over a single time horizon by considering that time does not have relevanc…

Importance of Capital Asset Pricing Model For Determining The Stock Value

- CAPManalysis is the method that empirically helps in assessing the direct relationship between the risk and return. Though the analysis is based on predicting the behaviour of investment based on the historical database, it is a simple way to assess the movements in price. Companies mainly use Capital Asset Pricing Model analysis because it not onl...

CAPM Formula and Calculation

Expected Return

Risk-Free Rate

Beta

Market Risk Premium

Video Explanation of CAPM

Why CAPM Is Important

CAPM Example – Calculation of Expected Return

- Let’s calculate the expected return on a stock, using the Capital Asset Pricing Model (CAPM) formula. Suppose the following information about a stock is known: 1. It trades on the NYSE and its operations are based in the United States 2. Current yield on a U.S. 10-year treasury is 2.5% 3. The average excess historical annual return for U.S. stocks ...

More Resources

Understanding The Capital Asset Pricing Model

Key Terms For The Capital Asset Pricing Model

What Is The CAPM Formula?

Why Is The CAPM Important?

- The CAPM plays a key role in financial modeling and asset valuation. When a financial analyst values a stock, they use the weighted average cost of capital (WACC) to find the net present value (NPV) of future cash flows. The WACC equation uses the expected value calculated from the CAPM as the cost of equity. The company value is divided by the num...

Advantages and Disadvantages of The CAPM