What is the formula to calculate the cost of preferred stock?

You can use the following formula to calculate the cost of preferred stock: Cost of Preferred Stock = Preferred stock dividend / Preferred stock price For the calculation inputs, use a preferred stock price that reflects the current market value, and use the preferred dividend on an annual basis.

How much does preferred stock cost?

Generally, the dividend is fixed as a percentage of the share price or a dollar amount. This is usually a steady, predictable stream of income. If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day.

How to calculate dividend distribution of preferred stocks?

What is Dividend Formula?

- Examples of Dividend Formula (With Excel Template) Let’s take an example to understand the calculation in a better manner. ...

- Explanation. Step 1: Firstly, determine the net income of the company which is easily available as one of the major line items in the income statement.

- Relevance and Uses. ...

- Calculator

- Recommended Articles. ...

What is the par value of preferred stock?

What is the par value of preferred stock? The par value of a share of preferred stock is the amount upon which the associated dividend is calculated. Thus, if the par value of the stock is $1,000 and the dividend is 5%, then the issuing entity must pay $50 per year for as long as the preferred stock is outstanding.

How do you find the market value of preferred stock?

The value of a preferred stock equals the present value of its future dividend payments discounted at the required rate of return of the stock. In most cases the preferred stock is perpetual in nature, hence the price of a share of preferred stock equals the periodic dividend divided by the required rate of return.

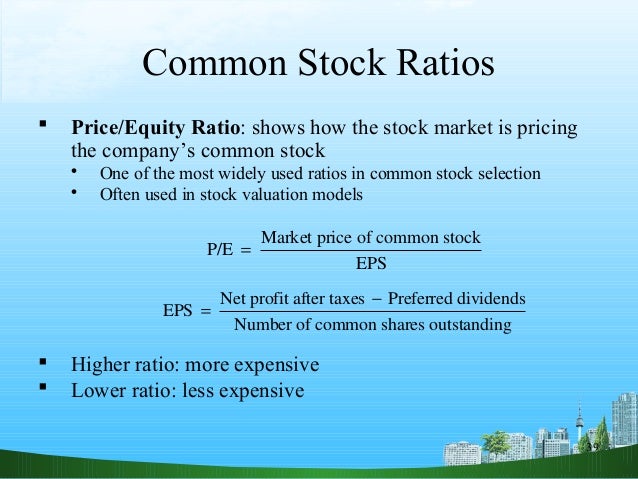

What is the formula for calculating market price per share?

The market price per share is used to determine a company's market capitalization, or "market cap." To calculate it, take the most recent share price of a company and multiply it by the total number of outstanding shares.

What is preferred price and market price?

The preferred share price, or pref price, is what investors paid for one company share during the latest investment round. The pref price does not directly mean anything for your employee equity, but may be interesting to you as a signal of company success or to help you value your company shares.

What is the market price of a 9% share when a person gets 180 by investing?

Expert-verified answer The person gets Rs. 180 by investing Rs. 4000.

How do you calculate preferred stock return?

To figure the raw return on your initial investment of preferred stock, subtract the price you paid for the shares from the current price. Then, add the dividends you received per share you bought. Finally, multiply the result by the number of shares you bought to figure the raw return.

What is an example of market price?

Say a new trader comes in and wants to buy 800 shares at the market price. The market price, in this case, is all the prices and shares it will take to fill the order. This trader has to buy at the offer: 500 shares at $30.01, and 300 at $30.02.

What is the difference between stock price and market price?

The cost price is the price at which you procure the stock while the market price is what the stock is currently quoting at in the current market.

What is market price of a stock?

The market price of a stock is the price that it sells for on the open market at a given point in time. The market price will usually fluctuate throughout the trading day as investors buy and sell stocks. The market price will rise if more people want to buy it and fall as people begin selling more of the stock.

Is it better to buy common or preferred stock?

Preferred stock may be a better investment for short-term investors who can't hold common stock long enough to overcome dips in the share price. This is because preferred stock tends to fluctuate a lot less, though it also has less potential for long-term growth than common stock.

How do corporations calculate the cost of preferred stock?

They calculate the cost of preferred stock by dividing the annual preferred dividend by the market price per share. Once they have determined that rate, ...

What is Preferred Stock?

Preferred stock is a form of equity that may be used to fund expansion projects or developments that firms seek to engage in. Like other equity capital, selling preferred stock enables companies to raise funds. Preferred stock has the benefit of not diluting the ownership stake of common shareholders, as preferred shares do not hold the same voting rights that common shares do.

What is the term for the first cash flow payment after a liquidation?

Because of the nature of preferred stock dividends, it is also sometimes known as a perpetuity. Perpetuity Perpetuity is a cash flow payment which continues indefinitely.

What is perpetuity in finance?

Perpetuity Perpetuity is a cash flow payment which continues indefinitely. An example of a perpetuity is the UK’s government bond called a Consol. . For this reason, the cost of preferred stock formula mimics the perpetuity formula closely.

Does common equity have a par value?

However, preferred stock also shares a few characteristics of bonds, such as having a par value. Common equity does not have a par value.

Is preferred stock more valuable than common stock?

In theory, preferred stock may be seen as more valuable than common stock, as it has a greater likelihood of paying a dividend and offers a greater amount of security if the company folds.

How to find value of preferred stock?

If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock.

What is preferred stock?

The owners of preferred shares are part owners of the company in proportion to the held stocks, just like common shareholders. Preferred shares are hybrid securities that combine some of the features of common stock with that of corporate bonds.

What happens to preferred shares when interest rate rises?

When the market interest rate rises, then the value of preferred shares will fall. This is to account for other investment opportunities and is reflected in the discount rate used.

What is call provision in preferred stock?

Something else to note is whether shares have a call provision, which essentially allows a company to take the shares off the market at a predetermined price. If the preferred shares are callable, then purchasers should pay less than they would if there was no call provision. That's because it's a benefit to the issuing company because they can essentially issue new shares at a lower dividend payment.

How do preferred shares differ from common shares?

Preferred shares differ from common shares in that they have a preferential claim on the assets of the company. That means in the event of a bankruptcy, the preferred shareholders get paid before common shareholders. 1

What is preferred shareholder?

In addition, preferred shareholders receive a fixed payment that's similar to a bond issued by the company. The payment is in the form of a quarterly, monthly, or yearly dividend, depending on the company's policy, and is the basis of the valuation method for a preferred share.

What is call provision in stock market?

Something else to note is whether shares have a call provision, which essentially allows a company to take the shares off the market at a predetermined price. If the preferred shares are callable, then purchasers should pay less than they would if there was no call provision.

How to calculate preferred stock value?

Here’s an easy formula for calculating the value of preferred stock: Cost of Preferred Stock = Preferred Stock Dividend (D) / Preferred Stock Price (P).

How to Calculate Par Value of Preferred Stock?

Par value of one share of preferred stock equals the amount upon which the dividend is calculated. In other words, par value is the face value of one share of stock.

What is Startup Preferred Stock?

Stock, or equity, is often one of the most critical assets in a startup. Equity can help a startup attract top talent as well as early-stage investors. In a new business, two types of stock are typically offered: common and preferred. Common stock is a share of ownership in the startup, typically accompanied by voting rights. Although preferred stock also represents ownership, it differs from common stock in two significant ways: no voting rights and preferential claims.

What is the Difference Between Common Stock and Preferred Stock?

As stated above, a common stock owner has purchased ownership in the startup along with voting rights, enabling them to vote on issues such as who will serve on the board of directors or on specific management decisions. The more ownership you have, the more significant impact your vote holds.

Why is preferred stock preferred?

Because preferred stock creates a more advantageous position for investors as it mitigates their investment risk by giving them a greater claim to the startup's assets. Investors today typically will not invest in your startup in exchange for common share ownership. They insist on preferred shares.

How does preferred stock differ from common stock?

Although preferred stock also represents ownership, it differs from common stock in two significant ways: no voting rights and preferential claims.

How does series seed financing differ from venture capital financing?

Essentially, “series seed financings differ from venture capital financings in that the special negotiated rights attached to the preferred stock sold are usually scaled back, and the documentation involved is condensed into fewer agreements.” These distinctions are important for founders to understand and use to their advantage when funding their startup.

What is the Cost of Preferred Stock?

The Cost of Preferred Stock represents the rate of return required by preferred shareholders and is calculated as the annual preferred dividend paid out (DPS) divided by the current market price.

Cost of Preferred Stock Overview

The recommended modeling best practice for hybrid securities such as preferred stock is to treat it as a separate component of the capital structure.

Cost of Preferred Stock Formula

The cost of preferred stock represents the dividend yield on the preferred equity securities issued.

Nuances to the Cost of Preferred Stock

Sometimes, preferred stock is issued with additional features that ultimately impact its yield and the cost of the financing.

Cost of Preferred Stock Excel Template

Now that we’ve defined the concept behind the cost of preferred equity, we can move on to an example modeling exercise in Excel. To access the model template, fill out the form below:

Cost of Preferred Stock Example Calculation

In our modeling exercise, we’ll be calculating the cost of preferred stock for two different dividend growth profiles:

Why do companies have to examine the cost of preferred stock?

Companies must examine the cost of preferred stock, or any source of funds because it represents the cost of raising money. For example, a bank loan might cost 9 percent interest, while borrowing money in the form of bonds sold to investors could cost 5 percent.

How much does it cost to raise money by selling preferred stock?

Raising money by selling preferred stock could cost the company 10 percent, paid in the form of dividends to shareholders. Various factors drive the actual cost of preferred stock.

What percentage of dividends can be excluded from preferred stock?

As a side note, most preferred stock is held by other companies instead of individuals. If a company holds preferred stock, it can exclude 70 percent of the dividends it receives from the preferred from taxation, so this actually increases the after-tax return of the preferred shares.

What is weighted average cost of capital?

A company's weighted average cost of capital represents the average interest rate a company must pay to finance its operations, asset purchases or other needs. It also signifies the minimum average rate of return the company must earn on its current assets to satisfy its shareholders or owners, investors, and creditors.

What is public stock?

Publicly-held companies sell shares of stock to raise money for use in financing operations, funding business improvements and supporting various other projects. They typically offer two different types of stock, common and preferred, and each type has its own characteristics.

Is preferred stock higher than debt?

The cost of preferred stock will likely be higher than the cost of debt, as debt usually represents the least-risky component of a company's cost of capital. If a firm uses preferred stock as a source of financing, then it should include the cost of the preferred stock, with dividends, in its weighted average cost of capital formula. ...

Do preferred shareholders get paid before common shareholders?

In certain ways, it outranks common stock, meaning that if a company has limited funds to pay out as dividends, preferred shareholders get paid before common shareholders. Likewise, if a company has to liquidate its assets, bondholders get paid first, then preferred shareholders, then common shareholders. However, common shareholders get voting ...

What is preferred stock?

A preferred stock is a type of stock that provides dividends prior to any dividend paid to common stocks. Apart from having preference for dividend payouts, preferred stocks generally will have preference of asset allocation upon insolvency of the company, compared to common stocks. Because of these preferences, ...

Do preferred stocks have dividends?

As previously stated, preferred stocks in most circumstances receive their dividends prior to any dividend s paid to common stocks and the dividends tend to be fixed. With this, its value can be calculated using the perpetuity formula.

How to calculate preferred stock?

The following formula can be used to calculate the cost of preferred stock: Rps = Dps/Pnet. Where: Rps = cost of preferred stock. Dps = preferred dividends.

What is preferred stock?

Preferred stock may also be callable or convertible, which means that the issuing company is given the option to purchase its shares back from holders (typically at a premium) or convert the shares to common stock. Calculating the cost of preferred stock. Preferred stocks are issued with a fixed par value, and they pay dividends to shareholders ...

Why do companies issue preferred stock?

Companies issue preferred stock to fund initiatives such as product development and expansion. Preferred stock is an attractive option for companies because it allows them to raise capital while limiting the control they give their shareholders.

What is stock ownership?

Stocks represent a share of ownership in a company and a right to part of the company's earnings. Companies can issue two types of stock: common stock and preferred stock.

Why is it important to understand the cost of preferred stock?

Understanding the cost of preferred stock helps companies make strategic decisions for raising capital. For example, if a company can raise money by issuing preferred stock and bonds with respective costs of 2.2% and 4.2%, then it might favor the preferred stock, which comes at a lower cost.

Do preferred stockholders get voting rights?

Unlike common stockholders, holders of preferred stock do not get voting rights, which means they have less influence over company decisions and activities. While preferred stockholders do get consistent dividend payments, companies have the right to defer those payments if they encounter financial hardships and find themselves cash-restricted.

How much dividend do you get from preferred stock?

Suppose that you buy 1,000 shares of preferred stock at $100 per share for a total investment of $100,000. Each share of preferred stock pays a $5 dividend, resulting in a 5% dividend yield (you get this percentage by dividing the $5 dividend by the $100 stock price). That means that you collect $5,000 in dividend income on your $100,000 investment every year. For this example, assume that this is a simple form of preferred stock and not one of the subtypes.

What is the difference between common stock and preferred stock?

The biggest difference between the two has to do with the rights and perks they bestow upon their owners. When you buy shares of stock, you are also buying a small piece of ownership in a company, and the type of stock you buy will dictate your role, mostly with regard to voting rights and dividend payments. 1

What happens to preferred stock when it goes bankrupt?

The basic tenet of preferred stock is that it will receive dividend payments before common stock. If the company declares bankruptcy, and has to liquidate all of its assets, holders of preferred stock will receive payouts before holders of common stock see a dime.

What are the two types of stocks?

If you're new to investing, you might not be aware that not all stocks are the same form. The two main types of stocks are common stock and preferred stock . The biggest difference between the two has to do with the rights and perks they bestow upon their owners. When you buy shares of stock, you are also buying a small piece of ownership in a company, and the type of stock you buy will dictate your role, mostly with regard to voting rights and dividend payments. 1

What is a perpetuity stock?

Since the example involves a simple form of preferred stock, you own what is known as a "perpetuity," which is a stream of equal payments paid at regular intervals without an end date. There is a simple formula for valuing perpetuities and basic growth stocks called the Gordon Growth model, or the Gordon dividend discount model .

What is intrinsic value of preferred stock?

Intrinsic value calculations for preferred stock are based on your annual dividend, the growth rate, and your required rate of return.

What is the formula for k (i - g)?

The formula is "k ÷ (i - g) = v." 2 In this equation:

Unique Features of Preferred Shares

valuation Models

- If preferred stocks have a fixed dividend, then we can calculate the value by discounting each of these payments to the present day. This fixed dividend is not guaranteed in common shares. If you take these payments and calculate the sum of the present values into perpetuity, you will find the value of the stock. For example, if ABC Company pays a ...

Growing Dividends

- If the dividend has a history of predictable growth, or the company states a constant growth will occur, you need to account for this. The calculation is known as the Gordon Growth Model. V=D(r−g)V=\frac{D}{(r-g)}V=(r−g)D By subtracting the growth number, the cash flows are discounted by a lower number, which results in a higher value.

Considerations

- Although preferred shares offer a dividend, which is usually guaranteed, the payment can be cut if there are not enough earnings to accommodate a distribution; you need to account for this risk. The risk increases as the payout ratio (dividend payment compared to earnings) increases. Also, if the dividend has a chance of growing, then the value of the shares will be higher than the result …

The Bottom Line

- Preferred shares are a type of equityinvestment that provides a steady stream of income and potential appreciation. Both of these features need to be taken into account when attempting to determine their value. Calculations using the dividend discount model are difficult because of the assumptions involved, such as the required rate of return, growth, or length of higher returns. Th…