When is the best time to buy Leap stocks?

In a typical value investing mindset, it would seem that the best time to purchase a LEAP is after the underlying security has already fallen substantially in price. But if the stock has recently fallen substantially, then its corresponding implied volatility will most likely have risen.

How many leaps calls should I buy?

Now that you’ve chosen your strike price and month of expiration, you need to decide how many LEAPS calls to buy. You should usually trade the same quantity of options as the number of shares you’re accustomed to trading. If you’d typically buy 100 shares, buy one call.

What are 52 Week lows in stocks?

While some price ranges will be quite wide, others (such as mature, blue-chip stocks) will be contained within a more predictable range. 52 week lows are a list of stocks that are currently trading for a price that is lower than anything they’ve experienced over the course of the past year.

What is a leaps call option?

LEAPS Calls. Equity—another name for stocks—LEAPS call options allows investors to benefit from potential rises in a specific stock while using less capital than purchasing shares with cash upfront. In other words, the cost of the premium for an option is lower than the cash needed to buy 100 shares outright.

When should you buy LEAP calls?

As a starting point, consider a LEAPS call that is at least 20% of the stock price in-the-money. (For example, if the underlying stock costs $100, buy a call with a strike price of $80 or lower.) However, for particularly volatile stocks, you may need to go deeper in-the-money to get the delta you're looking for.

Is it better to buy shares or LEAPs?

The Bottom Line Most buy-and-hold investors and index investors are not aware that LEAP calls can be used as a source of investment debt. Using LEAP call options is more complex than purchasing stock on margin, but the rewards can be a lower cost of capital, higher leverage and no risk of margin calls.

Why is my call option going up when the stock is going down?

As interest rates rise, call option premiums increase. Higher rates increase the underlying stock's forward price (the stock price plus the risk-free interest rate). If the stock's forward price increases, the stock gets closer to your strike price, which we know from above helps increase the value of your call option.

Can you average down on call options?

Averaging down by purchasing a second option with a lower strike price, such as the July 90 call, lowers the breakeven point, but adds considerable additional risk, especially since the price has broken below a key support level of 91.60 (indicated in Figure 1).

Is buying LEAPS safe?

Using long-term equity anticipation securities (LEAPS) with an expiration period of up to three years can be an alternative to buying stocks outright. Using LEAPS can result in huge returns, but they can be risky, and you'll have to roll the dice just right.

Are LEAPS a good strategy?

LEAPS strategies are similar to short-term options strategies but often favor buying strategies over selling strategies because of the slower rate of time decay. LEAPS are bought and sold like their short-term counterparts, and can have American or European-style expirations.

What is the most successful option strategy?

The most successful options strategy is to sell out-of-the-money put and call options. This options strategy has a high probability of profit - you can also use credit spreads to reduce risk. If done correctly, this strategy can yield ~40% annual returns.

Why is my put option down when the stock is down?

Simply put, every day, your option premium is losing money. This results in the phenomenon known as Time Decay. It should be noted that only the premium portion of the option is subject to time decay, and it decays faster the closer you get to expiration.

What is a poor man's covered call?

DEFINITION. A poor man's covered call is a long call diagonal debit spread that is used to replicate a covered call position. The strategy gets its name from the reduced risk and capital requirement relative to a standard covered call.

What percentage of option traders make money?

However, the odds of the options trade being profitable are very much in your favor, at 75%. So would you risk $500, knowing that you have a 75% chance of losing your investment and a 25% chance of making a profit?

How do you get out of a losing call option?

4:0213:24How To SAVE A Losing Options Trade - Options Trade Of The WeekYouTubeStart of suggested clipEnd of suggested clipIf the trade went dead against us the most that we were going to lose was 325. Dollars per spreadMoreIf the trade went dead against us the most that we were going to lose was 325. Dollars per spread all right so. Now we take a look at it the trade has gone against us ideally.

Should you buy when the market is down?

Changes in financial markets are effective at playing with our emotions, but instead of exiting the market, there are ways to take advantage of a market downturn. Buying the dip is a strategy used to buy stocks when their prices are down, betting that the long-term upward trend will eventually win out.

Voyager Therapeutics (VYGR)

Voyager Therapeutics is a Cambridge, MA-based clinical-stage gene therapy company. Its lead gene therapy is in Phase 1 clinical trial for Parkinson’s disease. It is also in the pre-clinical study of gene therapies for Huntington’s disease, Alzheimer’s disease, progressive supranuclear palsy, and frontotemporal dementia.

Playtika Holding Corp (PLTK)

Playtika, which recently went public in mid-January at $27 per share, is an Israel-based company that acquires and develops mobile video games for major mobile platforms. PLTK stock is trading below its IPO price of $27, where it raised about $1.8 billion.

JOANN Inc (JOAN)

The popular sewing-and-fabrics retail chain JoAnn Inc. went public earlier this month at $12, after being private since 2011. JoAnn is one of the oldest U.S. retailers for fabric and sewing goods. It currently operates 867 arts and crafts stores in 49 states and has a fast-growing e-commerce business.

Coupang (CPNG)

Coupang is a South Korean internet retailer that went public through an IPO on March 11 at $35 per share on the NYSE. At $78 billion, the stock trades at 4.7 times $16.46 billion in estimated. sales for 2021. Bill Ackman, of Pershing Square, personally invested in the company pre-IPO and has a big payday as a result.

Multiplan (MPLN)

Multiplan provides data analytics to the healthcare industry. The stock went public via a SPAC merger earlier this year and is now near a 52-week low.

American Well Corp (AMWL)

American Well is a telehealth app that connects insurers with patients and other groups, as well as telemedicine applications. The stock has been falling since its IPO in late September 2020 when its first trade was at $25.51.

Runner Up – Stocks To Buy At 52-Week Low

Another one of the stocks to buy, as a runner-up, is Vinci Partners Intl (NASDAQ: VINP ). This Brazilian private equity firm recently went public in Jan and raised about $100 million. The company will use this to invest in various private firms. It manages about $9 billion as of Dec. 31.

When trading stocks that are near their 52 week low mark, do you need to make a conscious effort to know?

When trading stocks that are near their 52 week low mark, you will need to make a conscious effort to know which stocks are experiencing cyclical lows and which stocks have actually lost a significant portion of their value.

What is the benefit of trading a stock near its 52 week low?

The primary benefit of trading a stock near its 52 week low is obvious: You’ll have plenty of opportunities to make large amounts of money. Suppose that a stock is currently trading for $100 on January 1, and by the end of the year, it is trading for $110.

What is 52 week high?

A 52-week high is the highest price that a stock has traded at in the last year. Likewise, a 52-week low is the lowest price that a stock has traded at in the last year. Many investors use 52-week highs and 52-week lows as a factor in determining a stock's current value and as a predictor of future price movements. As a stock trades within its 52-week price range (the range that exists between the 52-week low and the 52-week high), investors may show increased interest as price nears either the high or the low. How to use 52-week high and low prices for stock selection.

What happens if a stock falls to $70?

If the stock continues to fall to $70, the total position will be a $40 loss, rather than a $30 loss. If you invest in stocks just because they are at their 52 low mark, you will be forced to endure these losing positions on a fairly regular basis.

How often do stocks move?

Some stocks will move between their high points and low points multiple times within a month. These volatile stocks are both risky and rewarding. In other situations, especially in mature markets, stocks will remain towards either the top or the bottom of their price channel for extended periods of time.

Do companies fail and stocks fall?

Companies do fail and stocks continue to fall —sometimes these falls can last for years or even more. As these stocks continue to drop, establishing a new 52 week low with each passing trading period, it can be tempting to double down and increase your position even further.

How long does a leap last?

And since they don't expire for anywhere from nine months to 2 1/2 years, you've got plenty of time for the stock, and consequently your LEAP, to move higher.

Can you make a killing on a stock?

The underlying stock MUST go up by the amount of the time premium for you to at least break even. Yes, you can theoretically make a killing if the stock moves sharply higher, but if the stock finishes where it started, not only will you have wasted up to a year or two of your life, you'll also have lost money.

Is a leap option smarter than a near term option?

Yes, due to longer term expirations, LEAP options are arguably much smarter purchases than comparable near term options. But I still find that LEAP options have enough disadvantages on their own to keep me from ever wanting to buy any as part of a straight, buy and hold leveraged purchase.

When a stock is trading close to its low of the last 12 months, can it be interpreted in one of

When a stock is trading close to its low of the last 12 months, it can be interpreted in one of two ways. Either it deserves to be there and has more downside, or it is oversold and has the fundamentals to stage a turnaround.

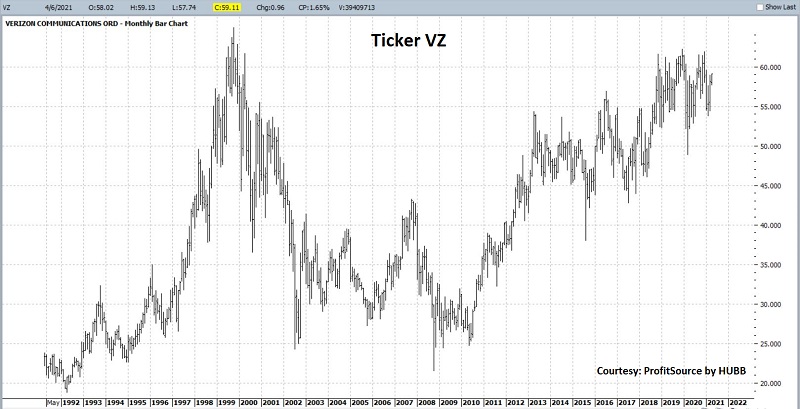

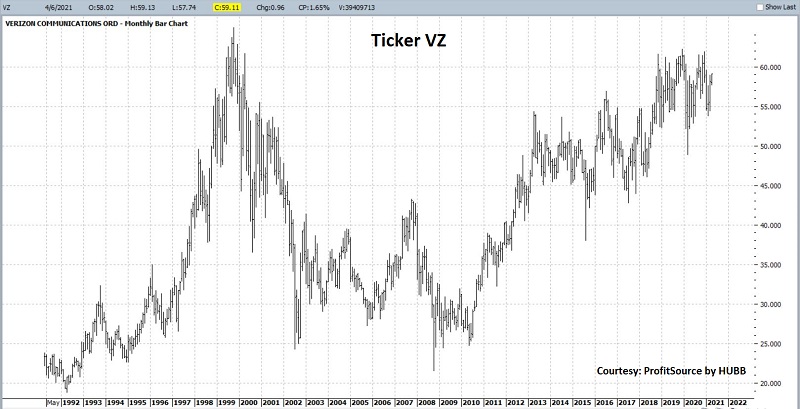

What is Verizon's 52 week low?

Verizon Communications ( NYSE:VZ) is trading about 9% above it's 52-week low at $57. This week the stock has been under pressure after T-Mobile launched its new 5G home internet service in 49 U.S. states. The high-speed service will go for $60 a month and pit the company head-to-head against Verizon and other competitors.

When did Clorox reach $240?

In hindsight, the stock was overdue for a pullback after going on a 9-month winning streak and reaching a record high of almost $240 in August 2020. A worldwide cavalry of germophobic consumers have driven some incredible results at Clorox during the pandemic.

What is dividend earning stock?

Dividend-earning stocks are a diversification source for a consumer’s portfolio, particularly if the dividend gets reinvested. It’s literally like paying yourself for owning the stock. And the stocks in this presentation look ready also to deliver some additional stock price growth that can increase your total return.

The Experiment - The 52-Week-Low Strategy

To evaluate the 52-Week-Low strategy, we compare the results of a simple trading strategy using only the 52-Week-Low indicator against a random strategy (the control).

About the Data

This data ranges from 1-Jan-2000 to 30-Dec-2010 using approximately 100K trades for each buy and hold time period, evenly distributed over each time period. Eleven years seemed like a long enough time to confirm or reject the 52-week low idea.

Results

If buying stocks at their lows is a good idea, then one would expect the returns from the 52-Week-Low strategy to be higher as a group ( shifted to the right on the histogram charts ). Or perhaps, one might expect a 'fat tail' on the 52-week low distribution; perhaps greater variance. This seems to be the case.

Conclusion

There is definitely something going on here with the 52-Week-Low strategy. It is distinctly different than the control group. If one could eliminate the downside a bit, and still capture the fat tail to the right, then this might be the beginnings of a trading strategy.

Detailed Yearly Results for the 20 Day Strategy

We've selected a few charts to display that looked interesting. Note the skew or fat tails on the distributions. These pull the mean to the right, but generally, the mass of the 52-Week-Low distribution is further to the right than the control group. This suggests a consistent, meaningful trend in the data. However, this is not true every year.

Detailed Yearly Results for 60 day holding period

We've selected a few charts to display that looked interesting. Note the skew or fat tails on the distributions. These pull the mean to the right, but generally, the mass of the 52-Week-Low distribution is further to the right than the control group. This suggests a consistent, meaningful trend in the data. However, this is not true every year.

How long do leap options last?

LEAPS are long-term exchange-traded options with an expiration period of up to three years. 1 Acquiring them allows you to use less capital than you would if you were purchasing stock, and they can deliver outsized returns if you bet right on the direction of the shares. 2.

How much capital loss does a stock have when the option expires?

You'll suffer some loss of capital if the stock trades between $17.51 and $19 per share when the option expires in two years, and you'll have a 100% loss of capital if it trades below your $17.50 call strike price. You could call your broker and close out your position if the stock does rise substantially.

Can you buy stocks on margin?

You can purchase the stock outright, buy it on margin, or use LEAPS. Buying on margin involves borrowing money from your broker and pledging your shares as collateral for the loan. It might sound convenient, but you could ultimately lose more money than you've invested. 3.

Is it risky to use a leap?

Using LEAPS can result in huge returns, but they can be risky, and you’ll have to roll the dice just right. This investment position makes sense if you believe that the stock will be worth much more than the current market price before your options expire.

How long do leaps last?

Short-term options have a maximum expiration date of one year.

What is a leap put?

LEAPS puts provide investors with a long-term hedge if they own the underlying stock. Put options gain in value as an underlying stock's price declines, potentially offsetting the losses incurred for owning shares of the stock. In essence, the put can help cushion the blow of falling asset prices.

How long are long term equity options?

Long-term equity anticipation securities (LEAPS) are publicly traded options contracts with expiration dates that are longer than one year, and typically up to three years from issue. They are functionally identical to most other listed options, except with longer times until expiration. They were first introduced by the Chicago Board Options ...

When do you exercise a $25 option?

The investor will exercise the $25 option if the market price is higher than the strike price. Should it be less, the investor will allow the option to expire and will lose the price paid for the premium. Also, remember each options contract—put or call—equates to 100 shares of the underlying asset.

What is premium in options?

Premiums are the non-refundable cost associated with an options contract. The premiums for LEAPS are higher than those for standard options in the same stock because the further out expiration date gives the underlying asset more time to make a substantial move and for the investor to make a healthy profit. Known as the time value, option marketplaces use this lengthy timeframe and the intrinsic value of the contract to determine the value of the option.