What is BP’s stock price history?

The BP 52-week high stock price is 34.16, which is 19.9% above the current share price. The BP 52-week low stock price is 22.64, which is 20.5% below the current share price. The average BP stock price for the last 52 weeks is 27.05. For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide.

What is BP’s 52-week low stock price?

The BP 52-week low stock price is 22.64, which is 20.5% below the current share price. The average BP stock price for the last 52 weeks is 27.05. For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide.

What is BP's all-time high and low prices?

The all-time high BP stock closing price was 79.70 on November 06, 2007. The BP 52-week high stock price is 34.16, which is 19.9% above the current share price. The BP 52-week low stock price is 22.64, which is 20.5% below the current share price. The average BP stock price for the last 52 weeks is 27.05.

What is the main business of bpbp?

BP p.l.c. is the holding company of one of the world's largest petroleum and petrochemicals groups. Their main activities are exploration and production of crude oil and natural gas; refining, marketing, supply and transportation; and manufacturing and marketing of petrochemicals.

See more

What was BP highest stock price ever?

BP - 45 Year Stock Price History | BPThe all-time high BP stock closing price was 79.70 on November 06, 2007.The BP 52-week high stock price is 34.30, which is 19.3% above the current share price.The BP 52-week low stock price is 23.39, which is 18.7% below the current share price.More items...

How much did BP stock drop after spill?

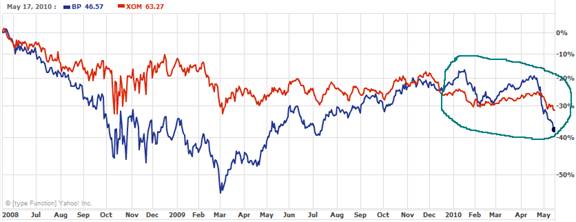

Market value BP's stock fell by 51% in 40 days on the New York Stock Exchange, going from $60.57 on 20 April 2010, to $29.20 on 9 June, its lowest level since August 1996.

How much is BP worth right now?

$ 27.55CloseChgChg %$27.55-0.23-0.83%

Is it a good time to buy BP stock?

The financial health and growth prospects of BLDP, demonstrate its potential to underperform the market. It currently has a Growth Score of F. Recent price changes and earnings estimate revisions indicate this would be a good stock for momentum investors with a Momentum Score of B.

Is BP still paying for Deepwater Horizon?

The vast majority of the tab – about $69 billion – has been picked up by BP. The remainder has been split among Transocean, which owned the Deepwater Horizon, and BP's drilling partners Anadarko and MOEX.

What companies profited from the BP oil spill?

FACTBOX-Companies involved in the U.S. Gulf rig accidentTransocean Ltd RIGN. SRIG. ... BP Plc BP. LBP. ... Anadarko Petroleum Corp APC. ... Cameron International Corp CAM. ... Halliburton Co HAL.N - The oilfield services company, which has headquarters in Dubai and Houston, provided a number of services on the Deepwater Horizon.

Is BP a buy sell or hold?

BP has received a consensus rating of Buy. The company's average rating score is 2.63, and is based on 11 buy ratings, 4 hold ratings, and 1 sell rating.

When did BP last pay a dividend?

Jun 23, 2022BP's last dividend payment date was on Jun 23, 2022, when BP shareholders who owned BP shares before May 11, 2022 received a dividend payment of $0.32 per share. Add BP to your watchlist to be reminded of BP's next dividend payment.

Is BP stock expected to rise?

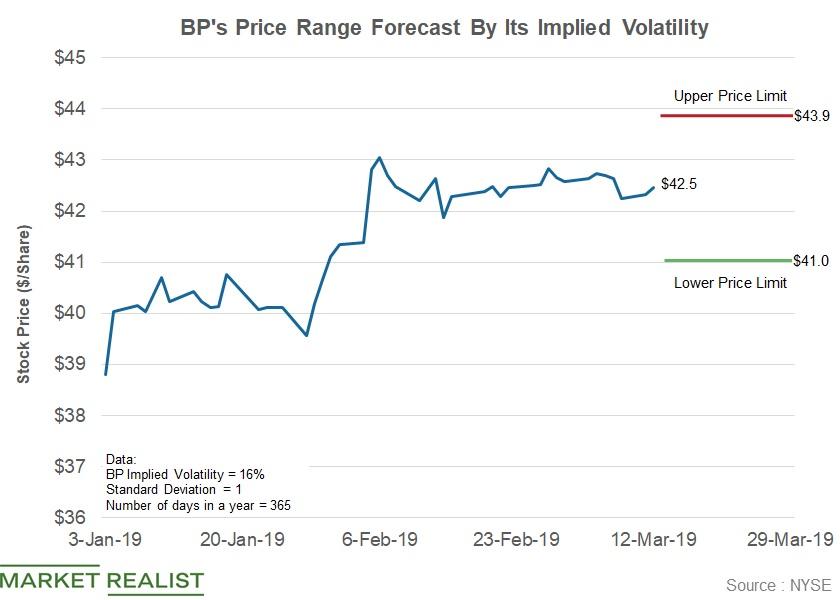

Stock Price Forecast The 26 analysts offering 12-month price forecasts for BP PLC have a median target of 36.06, with a high estimate of 50.89 and a low estimate of 30.11. The median estimate represents a +26.62% increase from the last price of 28.48.

Is BLDP overvalued?

In short, Ballard Power Systems (NAS:BLDP, 30-year Financials) stock is believed to be significantly overvalued. The company's financial condition is strong and its profitability is poor.

Is Ballard Power a good buy?

Is Ballard Power Systems a buy or a sell? In the last year, 8 stock analysts published opinions about BLDP-T. 2 analysts recommended to BUY the stock. 5 analysts recommended to SELL the stock.

Is Ballard Power Systems stock good to buy?

Out of 11 analysts, 1 (9.09%) are recommending BLDP as a Strong Buy, 0 (0%) are recommending BLDP as a Buy, 8 (72.73%) are recommending BLDP as a Hold, 1 (9.09%) are recommending BLDP as a Sell, and 1 (9.09%) are recommending BLDP as a Strong Sell.

How much was BP worth before the oil spill?

$180 billionBP was worth more than $180 billion at the time of the Gulf oil spill and is still one of the largest companies in the world. But it was on the brink of collapse after the spill, and few other companies could afford the costs BP incurred.

How did BP oil spill affect shareholders?

We investigate whether the British Petroleum, PLC oil spill affected the shareholder wealth of oil and gas firms (other than BP). While we find no evidence of a share price reaction for the whole industry, we find share price declines for firms with offshore drilling operations in United States waters.

Has BP recovered from the oil spill?

While the harrowing images of oil-soaked wildlife and beaches have subsided, science has revealed that the impacts of the spill are ongoing and significant. BP agreed to settle out of court and pay more than $20 billion. A judge approved the settlement on April 4, 2016.

How did the BP oil spill affect oil prices?

According to the Houston Chronicle shares of, " BP have fallen 40 percent since the explosion of the Deepwater Horizon drilling rig on April 20, to $36.52, its lowest in more than a year.

What was the all time high for BP?

What is BP oil?

The all-time high BP stock closing price was 79.70 on November 06, 2007.

Related content

BP p.l.c. is the holding company of one of the world's largest petroleum and petrochemicals groups. Their main activities are exploration and production of crude oil and natural gas; refining, marketing, supply and transportation; and manufacturing and marketing of petrochemicals. They have a growing activity in gas and power and in solar power generation. BP has well-established operations in Europe, North and South America, Australasia and Africa.

Annual report

An overview of the key activities, events and results in 2020, together with commentary on bp’s performance and our priorities as we move forward

How much did BP stock trade in 2021?

An overview of the key activities, events and results in 2020, together with commentary on bp’s performance and our priorities as we move forward

What is BP energy?

Looking back at BP historical stock prices for the last five trading days, on July 02, 2021, BP opened at $26.96, traded as high as $27.05 and as low as $26.71, and closed at $26.98. Trading volume was a total of 5.75M shares.

Why did BP spin off operations in Iraq?

BP is a global energy business with operations in Europe, North and South America, Australasia, Asia and Africa. Co. is engaged in: finding, developing and extracting oil and gas; transporting and trading products including oil, natural gas, liquefied natural gas, power and carbon products as well as derivatives and currencies;

How much oil will be released from the Strategic Petroleum Reserve?

BP's plan to spin off operations in Iraq is likely to provide the oil giant with more flexibility to invest in low-carbon energy and reduce its spending on oil and gas.

Which companies are buying oil and gas in the Gulf of Mexico?

The Energy Department will release 50 million barrels of oil from the Strategic Petroleum Reserve as part of efforts to lower gasoline prices.

Is BP going to spin off in Iraq?

Energy companies, including Shell (RDS.A), BP, Chevron (CVX), Exxon (XOM) and Occidental (OXY), sign up for the lease sale to buy drilling rights on federal oil and gas reserves in the Gulf of Mexico.