Should you buy BP stock?

Valuation is also important, so investors should note that BP has a Forward P/E ratio of 6.97 right now. Its industry sports an average Forward P/E of 7.79, so we one might conclude that BP is trading at a discount comparatively. Also, we should mention that BP has a PEG ratio of 0.52.

Should I buy BP shares?

Should I buy, sell or hold BP (LSE: BP) shares? This is a problem I have been trying to figure out for the past year. And it seems unlikely I am alone. Before the pandemic, BP was one of the market’s top income stocks. Rising oil prices were pushing the ...

How much is BP stock?

BP PLC. BP | stock. $32.84-1.98%. $104 B. 4.00%. $1.31-Overview. Home Dividend Stocks Energy Oil Gas Coal Integrated Oils BP PLC (BP) Dividend Data Stock Data Avg ...

How to buy BP shares?

- Get a free copy of the StockNews.com research report on BP (BP)

- 3 High Dividend Stocks to Buy and Hold

- Celestica Stock is a Play on Supply Chain Solutions

- The Bottom Is In For Walmart

- Palantir Tests Investors Patience, But May Still Pay Off Over Time

- Buy The Dip In NVIDIA, Before It’s Too Late

See more

Is BP a buy or sell?

BP has received a consensus rating of Buy. The company's average rating score is 2.59, and is based on 11 buy ratings, 5 hold ratings, and 1 sell rating.

Who owns the most BP stock?

Top 10 Owners of BP PLCStockholderStakeShares ownedArrowstreet Capital LP0.80%25,565,832SSgA Funds Management, Inc.0.77%24,438,815Fisher Asset Management LLC0.45%14,468,179Dimensional Fund Advisors LP0.45%14,284,8686 more rows

What is the highest BP stock has ever been?

The latest closing stock price for BP as of July 19, 2022 is 28.06.The all-time high BP stock closing price was 79.70 on November 06, 2007.The BP 52-week high stock price is 34.30, which is 22.2% above the current share price.The BP 52-week low stock price is 23.39, which is 16.6% below the current share price.More items...

What is the future of BP stock?

Based on 12 Wall Street analysts offering 12 month price targets for BP p.l.c. in the last 3 months. The average price target is 512.25p with a high forecast of 700.00p and a low forecast of 400.00p. The average price target represents a 31.65% change from the last price of 389.10p.

Is BP owned by Russia?

Russia owns 40% of BP's Russian partner, Rosneft; the company's CEO and board chair, Igor Sechin, is Russia's former deputy prime minister and a close Putin ally. Shell's primary partner in Russia is Gazprom, the state-run natural gas giant.

How much of BP is owned by pension funds?

Britain's main pension funds own less than 0.2% of Shell and BP shares, undermining claims that a windfall tax on big oil companies would harm the retirement incomes of UK savers.

Is BP a good investment?

Investors should not overlook BP's progress Its return on average capital employed (ROACE) – the company's preferred measure of operating performance – hit 12.1% in 2021 compared to 9.9% eight years ago.

Will BP share price go up?

The FTSE 100 oil giant BP (LSE: BP) has seen an almost 30% increase in share price over the past year. Since the start of 2022 alone it has risen some 15%. I think this is pretty significant considering the stock market uncertainty we have seen recently.

When did BP last pay a dividend?

The previous BP plc dividend was 4.3556p and it went ex 2 months ago and it was paid 22 days ago....Dividend Summary.SummaryPrevious dividendNext dividendTypeQuarterlyQuarterlyPer share4.356p (5.46c)Sign Up RequiredDeclaration date26 Nov 2021 (Fri)–Ex-div date12 May 2022 (Thu)11 Aug 2022 (Thu)2 more rows

Does BP have a future?

The strong progress bp has made over the past few years has reinforced its confidence in the delivery of its earnings and returns targets for 2025. In addition, it is now aiming to continue to grow EBITDA through to 2030.

Is Shell a buy or sell?

Shell is currently trading on less than six times 2022 forecast earnings. A low price-to-earnings ratio is a traditional value indicator, suggesting the shares could be cheap. If Shell can take advantage of its lower cost base to generate more stable profits, I think there could be an opportunity here.

What are the hot shares to buy?

NSE IPO.Pharmeasy IPO.Boat IPO.Snapdeal IPO.OYO IPO.Droom IPO.Five star IPO.Navi IPO.More items...

What is BP valuation?

Where is BP headquartered?

A valuation method that multiplies the price of a company's stock by the total number of outstanding shares. BP plc is a British multinational oil and gas company headquartered in London, England. It is one of the world's seven oil and gas "supermajors".

How many barrels of oil does BP produce?

Fiscal Q1 2021 ended 3/31/21. Reported on 4/27/21. BP plc is a British multinational oil and gas company headquartered in London, England. It is one of the world's seven oil and gas "supermajors".

How many service stations does BP have?

As of 31 December 2018, BP had operations in nearly 80 countries worldwide, produced around 3.7 million barrels per day of oil equivalent, and had total proven reserves of 19.945 billion barrels of oil equivalent.

Where is BP located?

The company has around 18,700 service stations worldwide. Its largest division is BP America in the United States. In Russia, BP owns a 19.75% stake in Rosneft, the world's largest publicly traded oil and gas company by hydrocarbon reserves and production. BP has a primary listing on the London Stock Exchange and is a constituent ...

Does BP own Rosneft?

BP plc is a British multinational oil and gas company headquartered in London, England. It is one of the world's seven oil and gas "supermajors". It is a vertically integrated company operating in all areas of the oil and gas industry, including exploration and production, refining, distribution and marketing, power generation, and trading.

What happened to BP in 2010?

In Russia, BP owns a 19.75% stake in Rosneft, the world's largest publicly traded oil and gas company by hydrocarbon reserves and production. BP has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100 Index.

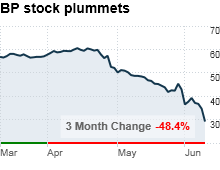

How much did BP lose from the 2010 oil spill?

BP has come a long way since the Gulf of Mexico oil spill incident on Apr 20, 2010, which followed the explosion on the British energy giant’s Deepwater Horizon rig. The largest oil spill incident in America’s history had disrupted the integrated energy player’s financial performance. Notably, BP had taken a pre-tax charge of $32.2 billion related to the disaster, which resulted in the company’s record loss of more than $17 billion in the June quarter of 2010. BP also suspended dividend payments for three quarters, until the firm started paying dividends again ...

When is BP's next dividend payment?

Notably, BP had taken a pre-tax charge of $32.2 billion related to the disaster, which resulted in the company’s record loss of more than $17 billion in the June quarter of 2010.

When was BP's most recent dividend payment?

BP's next quarterly dividend payment of $0.3230 per share will be made to shareholders on Friday, March 25, 2022.

Is BP's dividend growing?

BP's most recent quarterly dividend payment of $0.3276 per share was made to shareholders on Friday, December 17, 2021.

What track record does BP have of raising its dividend?

Over the past three years, BP's dividend has not grown. It has decreased by -47.11%.

When did BP last increase or decrease its dividend?

BP (NYSE:BP) has increased its dividend for the past 2 consecutive years.

What is BP oil?

The most recent change in BP's dividend was a decrease of $0.0046 on Tuesday, February 8, 2022.

What time do you trade in the pre market?

About BP p.l.c. BP is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2019, it produced 2.1 million barrels of liquids and 7.9 billion cubic feet of natural gas per day, including volumes from its 20% ownership interest in Rosneft.

Ownership

- BP trades on the New York Stock Exchange (NYSE) under the ticker symbol \"BP.\" BP's stock is owned by a number of of institutional and retail investors. Top institutional investors include Dimensional Fund Advisors LP (0.45%), BlackRock Inc. (0.36%), Sanders Capital LLC (0.19%), Wells Fargo & Company MN (0.17%), Acadian Asset Management LLC (0.15%) and Federated In…

Release

- BP is scheduled to release their next quarterly earnings announcement on Tuesday, July 30th 2019. View Earnings Estimates for BP.

Example

- 11 Wall Street analysts have issued 1 year price targets for BP's shares. Their forecasts range from $41.00 to $90.00. On average, they expect BP's stock price to reach $58.55 in the next twelve months. This suggests a possible upside of 41.1% from the stock's current price. View Analyst Price Targets for BP.

Ratings

- 11 Wall Street analysts have issued \"buy,\" \"hold,\" and \"sell\" ratings for BP in the last year. There are currently 2 hold ratings, 8 buy ratings and 1 strong buy rating for the stock, resulting in a consensus recommendation of \"Buy.\" View Analyst Ratings for BP.

Reception

- News coverage about BP stock has been trending somewhat positive this week, InfoTrie Sentiment Analysis reports. InfoTrie identifies positive and negative media coverage by monitoring more than six thousand blog and news sources in real time. The firm ranks coverage of companies on a scale of -5 to 5, with scores nearest to five being the most favorable. BP earn…

Business

- BP has a market capitalization of $138.74 billion and generates $303.74 billion in revenue each year. The oil and gas exploration company earns $9.38 billion in net income (profit) each year or $3.80 on an earnings per share basis. BP employs 69,700 workers across the globe.

Transport

- BP's mailing address is 1 ST JAMES`S SQUARE, LONDON X0, SW1Y 4PD. The oil and gas exploration company can be reached via phone at 44-20-7496-4000 or via email at [email protected].