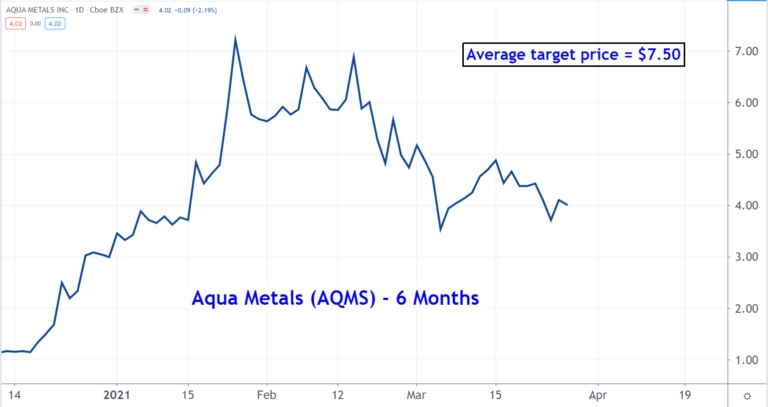

| High | $7.00 |

|---|---|

| Low | $4.00 |

| Average | $5.50 |

| Current Price | $0.9155 |

What is the price of AQMS stock?

One share of AQMS stock can currently be purchased for approximately $0.89. How much money does Aqua Metals make? Aqua Metals has a market capitalization of $61.86 million and generates $110 thousand in revenue each year. The business services provider earns $-25.76 million in net income (profit) each year or ($0.45) on an earnings per share basis.

What are analysts'target prices for Aqua Metals'stock?

2 brokers have issued 12 month target prices for Aqua Metals' shares. Their forecasts range from $2.00 to $2.00. On average, they anticipate Aqua Metals' stock price to reach $2.00 in the next year. This suggests that the stock has a possible downside of 25.7%.

Who holds Aqua Metals'stock?

Only 5.00% of the stock of Aqua Metals is held by insiders. Only 18.69% of the stock of Aqua Metals is held by institutions. Earnings for Aqua Metals are expected to grow in the coming year, from ($0.18) to ($0.16) per share.

Where can I buy Aqua Metals shares?

Shares of AQMS can be purchased through any online brokerage account. Popular online brokerages with access to the U.S. stock market include WeBull, Vanguard Brokerage Services, TD Ameritrade, E*TRADE, Robinhood, Fidelity, and Charles Schwab. Compare Top Brokerages Here. What is Aqua Metals' stock price today?

Is Aqms stock a good buy?

The consensus among 2 Wall Street analysts covering (NASDAQ: AQMS) stock is to Strong Buy AQMS stock.

Will Aqms go up?

Aqua Metals Inc (NASDAQ:AQMS) The 2 analysts offering 12-month price forecasts for Aqua Metals Inc have a median target of 5.50, with a high estimate of 7.00 and a low estimate of 4.00. The median estimate represents a +565.78% increase from the last price of 0.83.

Do MarketBeat users like Aqua Metals more than its competitors?

MarketBeat users like Aqua Metals stock less than the stock of other Business Services companies. 62.13% of MarketBeat users gave Aqua Metals an ou...

Does Aqua Metals's stock price have much upside?

According to analysts, Aqua Metals's stock has a predicted upside of 288.35% based on their 12-month price targets.

What analysts cover Aqua Metals?

Aqua Metals has been rated by HC Wainwright in the past 90 days.

What is Aqua Metals' stock price forecast for 2022?

0 analysts have issued 1 year price objectives for Aqua Metals' shares. Their forecasts range from $4.00 to $4.00. On average, they anticipate Aqua...

How has Aqua Metals' stock performed in 2022?

Aqua Metals' stock was trading at $1.23 on January 1st, 2022. Since then, AQMS shares have decreased by 25.9% and is now trading at $0.9115. View...

When is Aqua Metals' next earnings date?

Aqua Metals is scheduled to release its next quarterly earnings announcement on Thursday, August 4th 2022. View our earnings forecast for Aqua Met...

How were Aqua Metals' earnings last quarter?

Aqua Metals, Inc. (NASDAQ:AQMS) released its quarterly earnings results on Thursday, April, 28th. The business services provider reported ($0.06) e...

Who are Aqua Metals' key executives?

Aqua Metals' management team includes the following people: Mr. Stephen Cotton , CEO, Pres & Director (Age 56, Pay $1.01M) ( LinkedIn Profile )...

Who are some of Aqua Metals' key competitors?

Some companies that are related to Aqua Metals include Applied Blockchain (APLD) , AppHarvest (APPH) , Argo Blockchain (ARBK) , Loop Industries...

What other stocks do shareholders of Aqua Metals own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Aqua Metals investors own include CA (CA) , Endologix (EL...

When did Aqua Metals IPO?

(AQMS) raised $33 million in an initial public offering (IPO) on Friday, July 31st 2015. The company issued 6,600,000 shares at $5.00 per share. Na...

What is Aqua Metals' stock symbol?

Aqua Metals trades on the NASDAQ under the ticker symbol "AQMS."

Is Aqua Metals a buy right now?

How has Aqua Metals' stock price been impacted by COVID-19?

1 Wall Street equities research analysts have issued "buy," "hold," and "sell" ratings for Aqua Metals in the last twelve months. There are currently 1 buy rating for the stock. The consensus among Wall Street equities research analysts is that investors should "buy" Aqua Metals stock. View analyst ratings for Aqua Metals or view top-rated stocks.

When is Aqua Metals' next earnings date?

Aqua Metals' stock was trading at $0.6251 on March 11th, 2020 when COVID-19 reached pandemic status according to the World Health Organization. Since then, AQMS stock has increased by 53.4% and is now trading at $0.9590. View which stocks have been most impacted by COVID-19.

How can I listen to Aqua Metals' earnings call?

Aqua Metals is scheduled to release its next quarterly earnings announcement on Thursday, February 24th 2022. View our earnings forecast for Aqua Metals.

How were Aqua Metals' earnings last quarter?

Aqua Metals will be holding an earnings conference call on Thursday, February 24th at 4:30 PM Eastern. Interested parties can register for or listen to the call using this link or dial in at 201-612-7415 with passcode "13727280".

Who are some of Aqua Metals' key competitors?

Aqua Metals, Inc. (NASDAQ:AQMS) announced its earnings results on Thursday, November, 4th. The business services provider reported ($0.02) earnings per share for the quarter, beating the Thomson Reuters' consensus estimate of ($0.06) by $0.04.

What other stocks do shareholders of Aqua Metals own?

Some companies that are related to Aqua Metals include HireQuest (HQI), Bit Digital (BTBT), KLDiscovery (KLDI), iClick Interactive Asia Group (ICLK), Build Acquisition (BGSX), PFSweb (PFSW), Command Center (CCNI), National CineMedia (NCMI), Luokung Technology (LKCO), AdTheorent (ADTH), IDEX Biometrics ASA (IDBA), Digital Media Solutions (DMS), Digihost Technology (DGHI), Luna Innovations (LUNA) and Fathom (FTHM). View all of AQMS's competitors..

Stock Price Forecast

Based on aggregate information from My MarketBeat watchlists, some companies that other Aqua Metals investors own include CA (CA), Endologix (ELGX), Vuzix (VUZI), BlackRock (BLK), Micron Technology (MU), Valhi (VHI), Chipotle Mexican Grill (CMG), NVIDIA (NVDA), TETRA Technologies (TTI) and Advanced Micro Devices (AMD).

Analyst Recommendations

The 2 analysts offering 12-month price forecasts for Aqua Metals Inc have a median target of 7.50, with a high estimate of 8.00 and a low estimate of 7.00. The median estimate represents a +718.42% increase from the last price of 0.92.

When will Aqua Metals report results?

The current consensus among 2 polled investment analysts is to Buy stock in Aqua Metals Inc. This rating has held steady since March, when it was unchanged from a Buy rating. Move your mouse over past months for detail

How much insurance did Aqua Metals receive in 2021?

(NASDAQ:AQMS) ("Aqua Metals" or the "Company"), which is reinventing metals recycling with its AquaRefining™ technology, will report financial results for the first quarter ended March 31, 2021 after the United States financial markets close on Thursday, April 29, 2021. The Company will conduct a conference call to discuss results the same day at 4:30 p.m. Eastern Daylight Time. The conference call may be accessed by dialing: (833) 579-0902 or (778) 560-2608 for international callers and referencing conference ID: 1979603. A simultaneous webcast of the conference call, that will include presentation slides, will be available at: https://onlinexperiences.com/Launch/QReg/ShowUUID=123B7457-7347-402B-8B72-063CCC4AB283. In addition, the live webcast or a replay of the conference call will be available via the Company website at: https://ir.aquametals.com/ir-calendar. A telephone replay of the conference call will be available until May 29, 2021 by dialing (800) 585-8367 (toll free) or (416) 621-4642 and using conference ID: 1979603. About Aqua Metals Aqua Metals, Inc. (NASDAQ: AQMS) is reinventing metals recycling with its patented hydrometallurgical AquaRefining™ technology. Unlike smelting, AquaRefining is a room temperature, water-based process that emits less pollution. The modular Aqualyzers™ cleanly generates ultra-pure metal one atom at a time, closing the sustainability loop for the rapidly growing energy storage economy. The Company’s offerings include equipment supply, services, and licensing of the AquaRefining technology to recyclers across the globe. Aqua Metals is based in McCarran, Nevada. To learn more, please visit: www.aquametals.com. Contact: Glen Akselrod, Bristol Capital (905) 326-1888, Ext. [email protected]

How much will Aqua Metals lose in 2021?

Aqua Metals received insurance proceeds of $231,000 during the first quarter of 2021 related to the 2019 fire. Subsequent to the end of the quarter, the Company received an additional insurance payment of $1.4 million, the first payment related to its business interruption claim.

When will Aqua Metals join Russell Microcap?

In the first quarter of 2021, Aqua Metals reported a net loss of $4.1 million, coming to 6 cents per share, compared to the $4.4 million, 7-cent per share, net loss reported in the year-ago quarter.

When is Aqua Metals Q2 2021?

(NASDAQ: AQMS) ("Aqua Metals" or the "Company"), which is reinventing metals recycling with its AquaRefining™ technology, announced that it will join the Russell Microcap® Index effective June 28, 2021, at the conclusion of the 2021 Russell Microcap® Index’s annual reconstitution. Aqua Metals was identified on the preliminary list of additions that were posted on June 4, 2021. Inclusion in the Russell Microcap® Index provides Aq

When did Aqua Metals lease to buy?

Aqua Metals (AQMS) Q2 2021 Earnings Call Transcript. Earlier today Aqua Metals released financial results for the quarter ended June 30, 2021. Joining us for today's call from management is Steve Cotton, president and CEO; as well as Judd Merrill, the company's chief financial officer. GlobeNewswire • 21 days ago.

Is Aqua Metals generating revenue?

As a triple-net lease, the agreement will significantly reduce Aqua Metals' cash outflow related to the plant. The lease-to-buy agreement commenced on April 1, 2021. The Company utilized its at-the-market share sales agreements during the quarter.

AQMS earnings per share forecast

As Aqua Metals has been refining its product offering for future license and equipment supply partners , the Company did not generate revenue during the first quarter of 2021. The minimal revenue recognized during the first quarter of 2020 was the result of the sale of existing inventory.

AQMS revenue forecast

What is AQMS 's earnings per share in the next 3 years based on estimates from 2 analyst s?