Is Aphria stock a good investment?

Aphria stock is relatively cheap by the standards of the cannabis sector. And the company is profitable, at least on an EBITDA (earnings before interest, taxes, depreciation and amortization) basis. © Provided by InvestorPlace Marijuana plants growing in a greenhouse. The balance sheet isn’t in bad shape.

Should you invest in Aphria stock or not?

The company will receive 0.8381 shares of Tilray and get about 62% of the ownership of the new entity. Interestingly enough, based on these terms, APHA stock is trading at a discount. This actually presents an arbitrage opportunity, in which an investor can short Tilray and buy Aphria to lock in a gain.

Should Aphria stock investors take the money and run?

When you have years or even decades to let your money grow ... in stock prices, and while many people try to profit from those short-term moves, long-term investors should be laser-focused ...

Is Aphria a buy now?

These rallying stocks are great for buying right now and hold forever ... but it’s a good stock to buy for the long-term. Aphria announced its Q2 of fiscal 2021 results on January 14. During the quarter, its revenue rose by 33% year-over-year.

Will Aphria be delisted?

Aphria's stock also trades on Nasdaq, but it will be delisted from that exchange on May 3. The deal is expected to close by the end of the second quarter of 2021.

Will Tilray buy Aphria?

The two cannabis companies announced in December that they will merge under the Tilray name with Aphria CEO Irwin Simon at the helm and Tilray CEO Brendan Kennedy joining the board. Aphria will lose its name and independent stock symbol on Wednesday.

What happens to my Aphria stocks after the merger?

The company will continue to trade on the Nasdaq Global Select Exchange under the symbol "TLRY" and will commence trading on the Toronto Stock Exchange under the symbol "TLRY" on May 5. Under the terms, Aphria shareholders receive 0.8381 of a Tilray share for each common share of Aphria.

Why is Aphria stock dropping?

Aphria stock plunged Monday after the Canadian cannabis firm missed expectations for third-quarter sales and its net loss widened. Also falling were shares of Canadian peer Tilray , which plans to merge with Aphria.

How many Tilray shares for Aphria?

0.8381 Tilray sharesUnder the deal, structured as a reverse acquisition of Tilray, each Aphria shareholder will receive 0.8381 Tilray shares for each Aphria share held.

Who purchased Aphria?

TilrayIrwin D Simon, formerly Aphria's CEO and chairman, will lead the new Tilray, with Tilray's current CEO Brendan Kennedy joining the board. Tilray shareholders voted in favor of the deal on Friday. Aphria shareholders received 0.8381 of a Tilray share for each Aphria common share owned.

Is APHA a buy or sell?

A P/B of 1 means it's selling at its per share book value....Momentum Scorecard. More Info.Zacks RankDefinitionAnnualized Return1Strong Buy25.08%2Buy18.56%3Hold10.15%4Sell5.79%2 more rows

Why is Aphria delisted?

“In the past, Aphria had substantial holdings in the U.S. But the company was forced by TMX, the operator of the Toronto Stock Exchange, to divest those holdings because, while pot remains illegal under U.S. federal law, it ran the risk of having its stock delisted.” Aphria is listed on the NYSE (NYSE: APHA).

What is Aphria called now?

Last week, Tilray (TLRY) and Aphria formally merged to form a new company. It instantly became the industry leader in the Canadian pot market.

Is Aphria stock a good investment?

Because Aphria is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth, which averaged 125.7% over the past three years and is estimated to grow 26.56% annually over the next three to five years.

Should I sell my Tilray stock?

(TLRY-Q) Rating. Stockchase rating for Tilray Inc. is calculated according to the stock experts' signals. A high score means experts mostly recommend to buy the stock while a low score means experts mostly recommend to sell the stock.

Is Tilray a good buy?

Shares of Tilray are not in a base or in buy range. So TLRY stock is not a buy right now. IBD advises investors to focus on stocks with stronger fundamentals that are moving into buy zones.

How were Aphria's earnings last quarter?

Aphria Inc. (NASDAQ:APHA) released its earnings results on Sunday, April, 11th. The company reported ($1.14) earnings per share (EPS) for the quart...

Who are Aphria's key executives?

Aphria's management team includes the following people: Mr. Irwin D. Simon , CEO & Chairman (Age 62, Pay $5.23M) Mr. Carl A. Merton , Chief Fin...

Who are some of Aphria's key competitors?

Some companies that are related to Aphria include STADA Arzneimittel Aktiengesellschaft (STDAF) , Tilray (TLRY) , Canopy Growth (CGC) , USANA H...

What other stocks do shareholders of Aphria own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Aphria investors own include AbbVie (ABBV) , Alibaba Grou...

What is Aphria's stock symbol?

Aphria trades on the NASDAQ under the ticker symbol "APHA."

What is Aphria's stock price today?

One share of APHA stock can currently be purchased for approximately $15.38.

How much money does Aphria make?

Aphria (NASDAQ:APHA) has a market capitalization of $4.87 billion and generates $405.96 million in revenue each year. The company earns $-63.21 mil...

How many employees does Aphria have?

Aphria employs 1,200 workers across the globe.

What is Aphria's official website?

The official website for Aphria is aphriainc.com .

Who are Aphria's key executives?

Aphria's management team includes the following people: Mr. Irwin D. Simon , CEO & Chairman (Age 62, Pay $6.54M) Mr. Carl A. Merton , Chief Fin...

Who are some of Aphria's key competitors?

Some companies that are related to Aphria include Valeant Pharmaceuticals International (VRX) , Evotec (EVT) , Bausch Health Companies (BHC) ,...

What other stocks do shareholders of Aphria own?

Based on aggregate information from My MarketBeat watchlists, some companies that other Aphria investors own include Aurora Cannabis (ACB) , Cano...

What is Aphria's stock symbol?

Aphria trades on the Toronto Stock Exchange (TSX) under the ticker symbol "APHA."

How do I buy shares of Aphria?

Shares of APHA and other Canadian stocks can be purchased through an online brokerage account. Popular online brokerages with access to the Canadia...

How much money does Aphria make?

Aphria (TSE:APHA) has a market capitalization of C$0.00 and generates C$611.06 million in revenue each year.

How many employees does Aphria have?

Aphria employs 1,200 workers across the globe.

What is Aphria's official website?

The official website for Aphria is www.aphria.com .

How can I contact Aphria?

Aphria's mailing address is 245 Talbot St W Suite 103, LEAMINGTON, ON N8H 1N8, Canada . The company can be reached via phone at 844-427-4742 .

About Aphria

Aphria Inc. cultivates, processes, produces, markets, distributes, and sells medical cannabis in Canada and internationally. The company offers pharmaceutical-grade medical cannabis, adult-use cannabis, and cannabis-derived extracts and derivative cannabis products under the Solei, RIFF, Good Supply, Aphria, P'tite Pof, and Broken Coast brands.

Headlines

Corporate Cannabis Takeover? Assessing 5 Big Industries Already At The Table - Benzinga - Benzinga

Aphria (TSE:APHA) Frequently Asked Questions

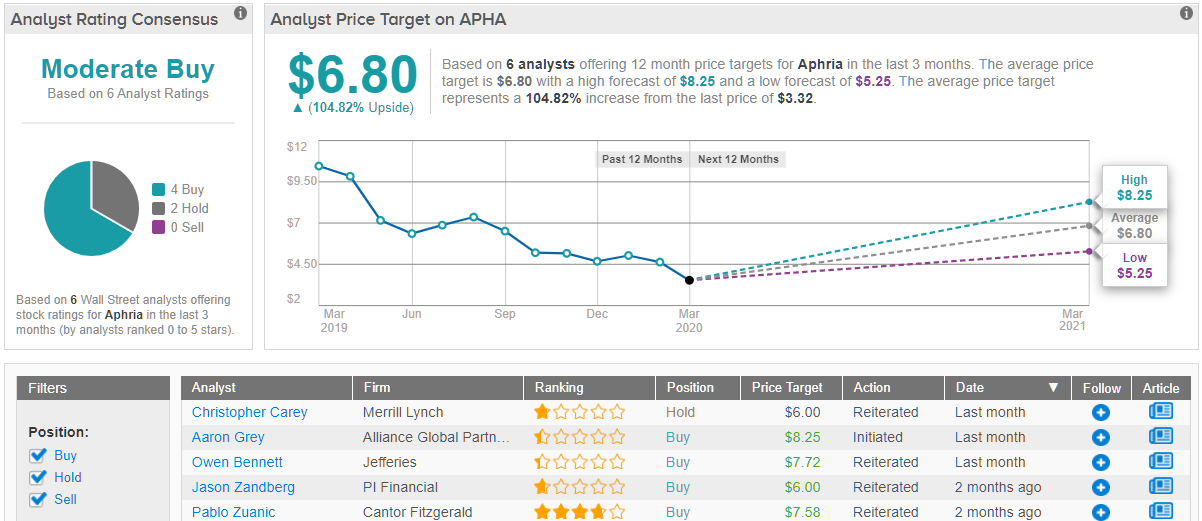

4 Wall Street research analysts have issued "buy," "hold," and "sell" ratings for Aphria in the last twelve months. There are currently 3 hold ratings and 1 buy rating for the stock. The consensus among Wall Street research analysts is that investors should "hold" Aphria stock.

About Aphria

Aphria, Inc. engages in the production and supply of medical cannabis. It operates through the following segments: Cannabis Operations, Distribution Operations, and Business Under Development. The Cannabis Operations segment produces, distributes, and sells both medical and adult-use cannabis.

Headlines

Should You Give Up or Hold Onto Hexo's Stock After Q1 Earnings? - Motley Fool

Who are some of Aphria's key competitors?

Some companies that are related to Aphria include FSD Pharma (FSDDF), Acreage (ACRZF), Core One Labs (CLABD), Costa Group (CTTQF), Feel Foods (FLLLF), First Resources Ltd. (Singapore) (FTROF), Future Farm Technologies (FFRMF), IOI Corp. Bhd.