Which Coca Cola stock to buy?

When thinking about how much money to invest, consider the following factors:

- Price per share: Although some brokers allow you to buy slices of individual shares—referred to as fractional shares—not all have that option. ...

- Overall Portfolio: As a blue-chip stock, Coca-Cola may be a solid investment option. ...

- Goals: Coca-Cola has a proven track record, but it’s unlikely to have the dramatic returns that newer growth stocks provide. ...

How to invest in Coca Cola stocks?

Coca-Cola HBC (OTCMKTS:CCHGY – Get Rating) was downgraded by investment analysts at JPMorgan Chase & Co. from an “overweight” rating to a “neutral” rating in a research report issued on Monday, The Fly reports. They presently have a GBX 1,900 ($ ...

Who are the shareholders of Coca Cola?

Unlimited access to Just Drinks content including in-depth analysis, exclusive blogs, industry executive interviews and management briefings Unbeatable market coverage from wine and beer, to soft drinks Unrivalled apparel industry comment from Olly Wehring ...

Can I Buy Coca Cola stock directly?

What type of stock purchase plans do you have available? | The Coca-Cola Company Shares can be purchased through a Direct Stock Purchase and Dividend Reinvestment Plan sponsored and administered by Computershare Trust Company, N.A. Details about the Computershare Investment Plan, including any fees associated with the Plan, can be viewed and printed from Computershare’s website .

What is the annual return on Coca-Cola stock?

Trailing ReturnsTotal Return %1-Day15-YearKO0.377.64Industry0.239.81Index-1.058.66

Is Coca-Cola undervalued or overvalued?

overvaluedCoca-Cola Co. (KO) shares are overvalued based on current multiples and the recent decline in revenue trends due to socio-demographic shifts in the soft drink market.

What is the highest KO stock has ever been?

CocaCola - 60 Year Stock Price History | KOThe all-time high CocaCola stock closing price was 66.21 on April 21, 2022.The CocaCola 52-week high stock price is 67.20, which is 6.6% above the current share price.The CocaCola 52-week low stock price is 52.28, which is 17% below the current share price.More items...

What is the highest price paid for a share of Coca-Cola stock in the last 52 weeks?

Analysis. Coca-Cola's 52 week high is $67.20.

Is Coca-Cola stock a good investment?

Dividend growth investors have been drawn to KO for a long time due to its impressive dividend growth record of 59 years. Even for the investor looking to only live off the dividends as income, KO shouldn't be seen as a bond proxy, or as a great dividend at any price though.

What is the future of Coca-Cola?

Launched in the United States in early 2021, Coca-Cola with Coffee blends Coca-Cola soda with Brazilian coffee and comes in caramel, dark blend and vanilla varieties. “You'll see a lot more marketing investment in that in 2022,” Mr.

Can KO split again?

From a share price standpoint, there's not a lot of evidence to suggest that Coca-Cola would split its stock again, since the share price remains close to what it was at the end of last year, at just over $50 per share.

When was the last time Coke stock split?

History Of Stock Splits For The Coca-Cola CompanyRecord DateActivityCumulative Shares07/27/20122-for-1 Stock Split9,21605/01/19962-for-1 Stock Split4,60805/01/19922-for-1 Stock Split2,30405/01/19902-for-1 Stock Split1,1528 more rows

How many times has KO stock split?

Our common stock has split 11 times since its listing in 1919.

What is a good price for KO stock?

Stock Price Target KOHigh$76.00Median$70.00Low$63.00Average$69.79Current Price$61.59

How much was a bottle of Coke in 1950?

six centsAs early as 1950, Time reported Coca-Cola prices went up to six cents. In 1951, Coca-Cola stopped placing "five cents" on new advertising material, and Forbes Magazine reported on the "groggy" price of Coca-Cola.

How long has KO paid a dividend?

CocaCola - 58 Year Dividend History | KO.

What is Coca Cola?

How much did Coca Cola lose?

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; water, enhanced water, and sports drinks; juice, dairy, and plant?based beverages; tea and coffee; and energy drinks. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes, ... [Read more...]

How much did Ronaldo wipe out Coca Cola?

Reports were that the stock lost $1.4 billion...

What is the highest inflation rate in 31 years?

Soccer superstar Cristiano Ronaldo may have helped wipe out $4 billion of Coca-Cola's market value when he moved two Coke bottles out of view at a press conference -- and opted for water instead.

Does Berkshire Hathaway own the Dow Jones?

October's inflation reading of 6.2% is the highest level recorded in 31 years. As a result, some investors may understandably feel that protecting their portfolio from a rapidly rising price level has b...

Do dividend paying stocks make money?

While Berkshire Hathaway Inc. (NYSE: BRK-B) doesn't own most of the 30 equities in the Dow Jones Industrial Average, more than half of the eight Dow stocks that Warren Buffett and Berkshire do own are t...

Introduction

Dividend-paying stocks generate easy money -- delivered regularly, with no effort from you.

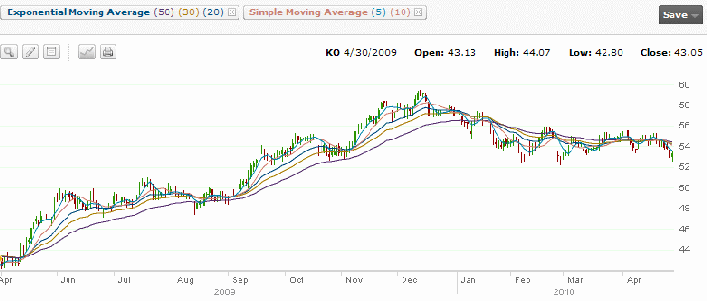

Stock Performance

The financial analysis of Coca Cola is performed in this section, which focuses on the company’s financial performance and its stock price movements in the last five years. The analysis compares the company’s stock performance with three competitors, which also operate in the global market.

Growth Rate and Earnings

Figure 1 shows stock price movements of Coca Cola’s stocks, KO, along with those of its competitors, including PepsiCo, Fevertree Drinks PLC, and Britvic PLC over the last five years.

Sales Distribution

Table 1 indicates the growth rates of different profitability measures and total revenue of Coca Cola in the last five years.

Financial Ratio Analysis

The annual report of Coca Cola indicates that there are six different operating segments, including Europe, Middle East and Africa, Latin America, North America, Asia Pacific, Global Ventures, and Bottling Investments (The Coca Cola Company, 2020). Table 3 provides values of net operating revenues of the company from its six segments.

Projected Financial Statement

The financial ratio analysis conducted in this report calculates and discusses the values of key financial ratios under different categories.

Conclusions

The consolidated income statement of Coca Cola is forecasted based on the following assumptions:

1 Coca Cola Company (The) (KO) Monthly Stock Price Graph For 5 Years

This study is aimed to explore reasons for Coca Cola to make operational improvements for better performance as its financial position was weakening despite its worldwide success. The report focuses on the primary concerns regarding the products of the company, which relate to their harmful effects on human health.

2 KO Weekly Average Graph For 5 Years

Most websites would carry 5-year price charts plotted with daily prices. The daily swings in prices make the graphs less readable. Hence, instead of the conventional daily prices chart, you are about to see the monthly average prices graph. (The data used for this report is within the range of 02-12-2017 and 02-11-2022.)

3 Coca Cola Company (The) (KO) Stock Yearly Returns For Last 5 Years

The graph you saw in the first section has a drawback. The monthly average graph is too smooth to miss large and appreciable fluctuations. On the other hand, a daily price graph is going to look cluttered due to a high frequency of swings. Hence, the below chart tries to provide a balance by displaying weekly average prices.

4 Gains Of KO Investor At Different Exit Points Within 5 Years

Looking at 5-year returns helps you get an idea of how the price and profit have moved year-after-year. This section will give you a feel of the kind of fluctuations and gains in the years to come.

5 KO 5 year performance against the stock market

Many will agree that a medium-term investor is one who invests for a time around 5 years. Assume a medium-term investor has put 10000$ in Coca Cola Company (The) (KO) during the start of 2018.

Conclusion

This section will help you assess the performance of Coca Cola Company (The) (KO) against the stock market. You will know if KO has moved along with or behaved different compared to the composite index. Below is the graph showing KO vs NYSE Composite (NYA) for the last 5 years.

Want to become a smart investor?

Hopefully, the above report helped you. If you want to analyze the recent performance of Coca Cola Company (The) (KO) stock, there are two reports to help you.

How long will it take Coca Cola to reorient its business?

Netcials reports section helps you with deep insights into the performance of various assets over the years. We are constantly upgrading and updating our reports section. Feel free to access them. Do not forget to leave your feedback.

What is Coke's business model?

To be sure, it will likely take years for Coca-Cola to fully reorient its business; turning headwinds into tailwinds takes plenty of adjustment. However, thanks to its unbelievable brand strength, its dominant distribution network, and its exquisitely profitable products, Coke should have the resources necessary to adapt to changing consumer preferences and to continue to drive returns for its investors for years to come.

How many countries did Coca Cola sell in the 1950s?

Coke's business model involves producing the syrups for its various beverages, selling those ingredients to its bottling partners, and heavily marketing their products to consumers. As you might imagine, making and selling some of the most coveted syrups on Earth is a fantastically lucrative business.

How much was Coca Cola worth in 1919?

The 1930s saw further expansion into Australia, Austria, Norway, and South Africa. By the late 1950s, Coca-Cola was sold in over 100 countries, and international sales comprised roughly one-third of the company's gross revenues. Today, an estimated 1.9 billion servings of Coca-Cola products are consumed in over 200 countries.

How many countries use Coca Cola?

Worth just $25 million in 1919, Coca-Cola shares have soared in value to a market capitalization of roughly $180 billion today, and the stock has a powerful legacy of 53 years of consecutive dividend increases. Company Name.

When did Coca Cola start selling syrup?

Today, an estimated 1.9 billion servings of Coca-Cola products are consumed in over 200 countries. Coke owns 20 different Coke brands that each generate at least $1 billion in sales annually. The company is truly everywhere, and its skyrocketing share-price appreciation in recent decades also speaks to Coke's successful recipe for driving investment returns.

When was Coca Cola invented?

Having separated its syrup and bottling operations prior to its IPO -- a business model that remains intact today -- Coca-Cola created its first international arm in 1926 to sell its syrup to bottlers in Belgium, Bermuda, China, Colombia, Germany, Haiti, Italy, Mexico, the Netherlands, and Spain.